Under the Spotlight Wall St: Toyota Motor Corporation (TM)

Toyota is one of the world’s biggest automakers. But can it fend off its electric vehicle competitors? Let’s put it Under the Spotlight.

.jpg&w=3840&q=100)

One of the most distinguished names in the automotive industry, Toyota ($TM) manufactures iconic cars that are sold across the planet. The firm’s story is intermingled with the reindustrialisation of Japan post-World War II, but begins in the early twentieth century with a machine much like the one that kickstarted the original industrial revolution centuries before: the loom.

In 1907, Sakichi Toyoda, a Japanese inventor and entrepreneur, founded Toyoda Loom Works. The business went through numerous iterations, but with capital raised from selling an automatic loom patent, the company diversified its operations into the automotive industry. The firm first experimented with manufacturing a car in 1933, culminating in the creation of the Toyota AA in 1936. The automotive division would soon be spun off and began trading under the name Toyota Motor Company in 1937.

World War II slowed Toyota’s progress, with the automaker forced to focus on producing trucks for the Japanese army. As Japan’s economy dwindled, the business faced serious problems and needed a bailout from the Bank of Japan.

But the tide would turn for Toyota thanks to another war - the Cold War. The U.S. wanted to secure Japan as a key ally in the Pacific and provided significant financial aid to the country as a result. Toyota began manufacturing cars again in 1949, while it also provided trucks to the U.S. army for the war in Korea in the early 1950s.

The Toyota Way

Around this time, Toyota also began to develop its now-famous Toyota Production System (TPS), immortalised in managerial books like The Toyota Way. TPS was founded on the principles of the elimination of waste, continuous improvement and respect for people. The philosophy focused on reducing costs and improving efficiency, and revolutionised car manufacturing for Toyota.

With a much more efficient production structure taking shape, the firm was able to produce its first mainstream passenger car, the Toyopet Crown, in 1955. The 1950s also saw the automaker’s expansion into foreign markets, selling vehicles to Saudi Arabia, Brazil and the U.S.

Toyota’s entrance to the U.S. market didn’t come without its hiccups. Despite being praised for its reliability, the Crown was deemed too slow and inefficient for U.S. highways as it had been optimised for the muddy, unpaved roads of Japan at that time.

Full throttle

The setback in the U.S. provided significant motivation for Toyota, which continued to fine-tune its products to better cater to the American public. In 1966, the iconic Toyota Corolla was released. The sedan would be a game changer for Toyota, with more than 50 million units sold around the world throughout the car’s history.

American cars at the time, such as the Chevy Bel Air and the Ford Galaxie, were known for their engines that consumed large quantities of petrol. In contrast, the original Corolla was a slimmer sedan that boasted higher fuel efficiency. So when fuel prices skyrocketed worldwide in the 1970s as conflict erupted in the Middle East and oil embargoes came into force, the Corolla became much more popular as U.S. consumers tightened their belts.

Diversification

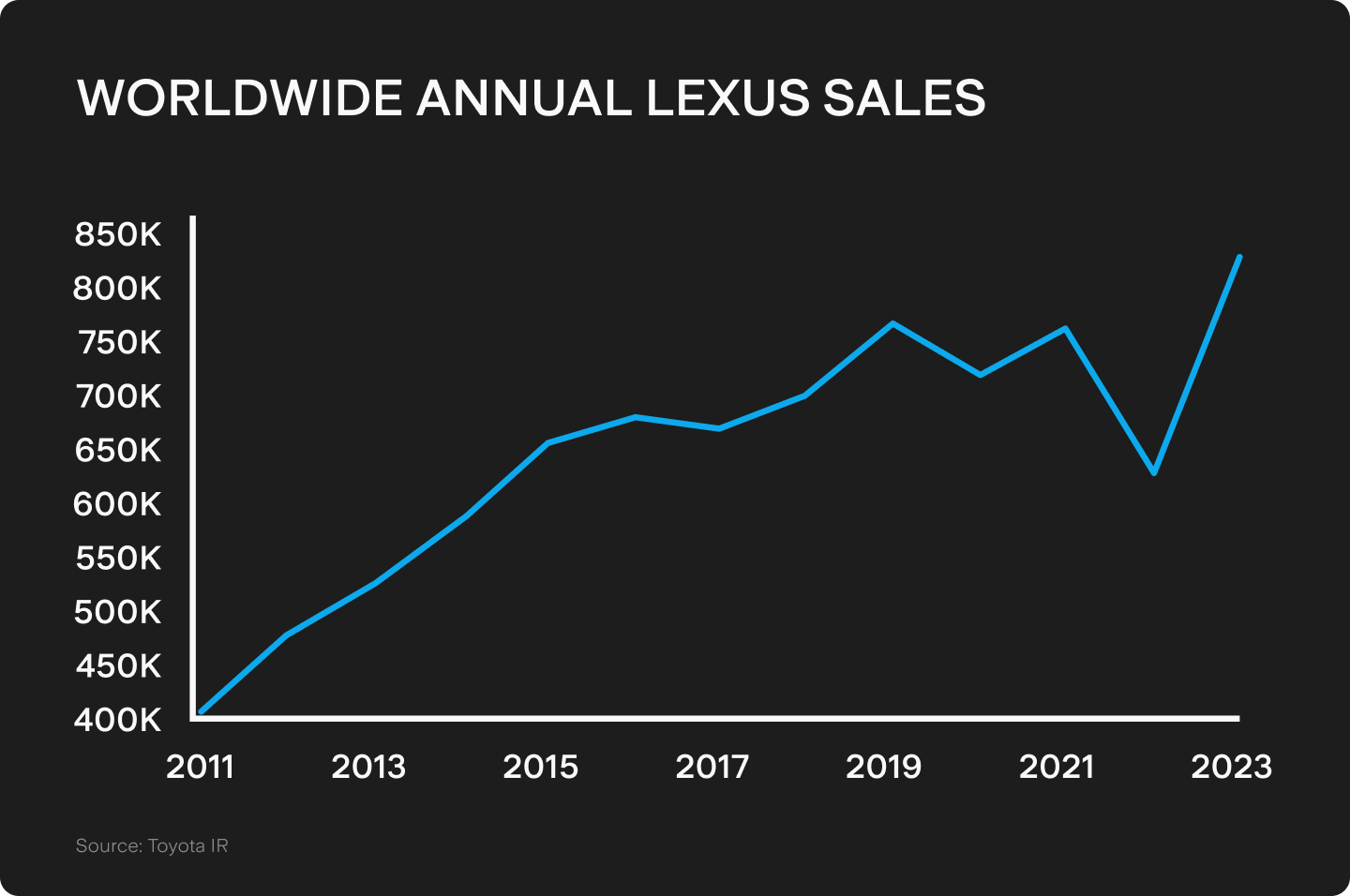

In the 1980s, Toyota continued to expand, with the firm introducing another best-selling sedan, the Camry. It also created an upmarket car brand, Lexus, to better compete with other premium manufacturers. Lexus has grown to become a well-known name in its own right, selling more than 800,000 units in 2023 alone.

The 1990s were marked by two major innovations from Toyota: the firm’s creation of its first compact crossover SUV, the RAV4, and also the launch of a hybrid electric vehicle, the Prius, which was the first one in the world to be mass produced. Both models have proved to be smash hits, selling tens of millions of units.

Slowing growth

Toyota continued to show growth into the 2000s, but the company was hit hard by the 2008 Global Financial Crisis, which sent shockwaves across economies worldwide. To make matters worse, Toyota was forced to recall nearly eight million vehicles in 2009 and 2010 due to “unintended acceleration”, where accelerator pedals were sticking under floor mats, causing cars to continue to go quicker against a driver’s will. The issue allegedly contributed to numerous deaths, with Toyota ultimately ordered to pay US$1.2b in a settlement in the U.S.

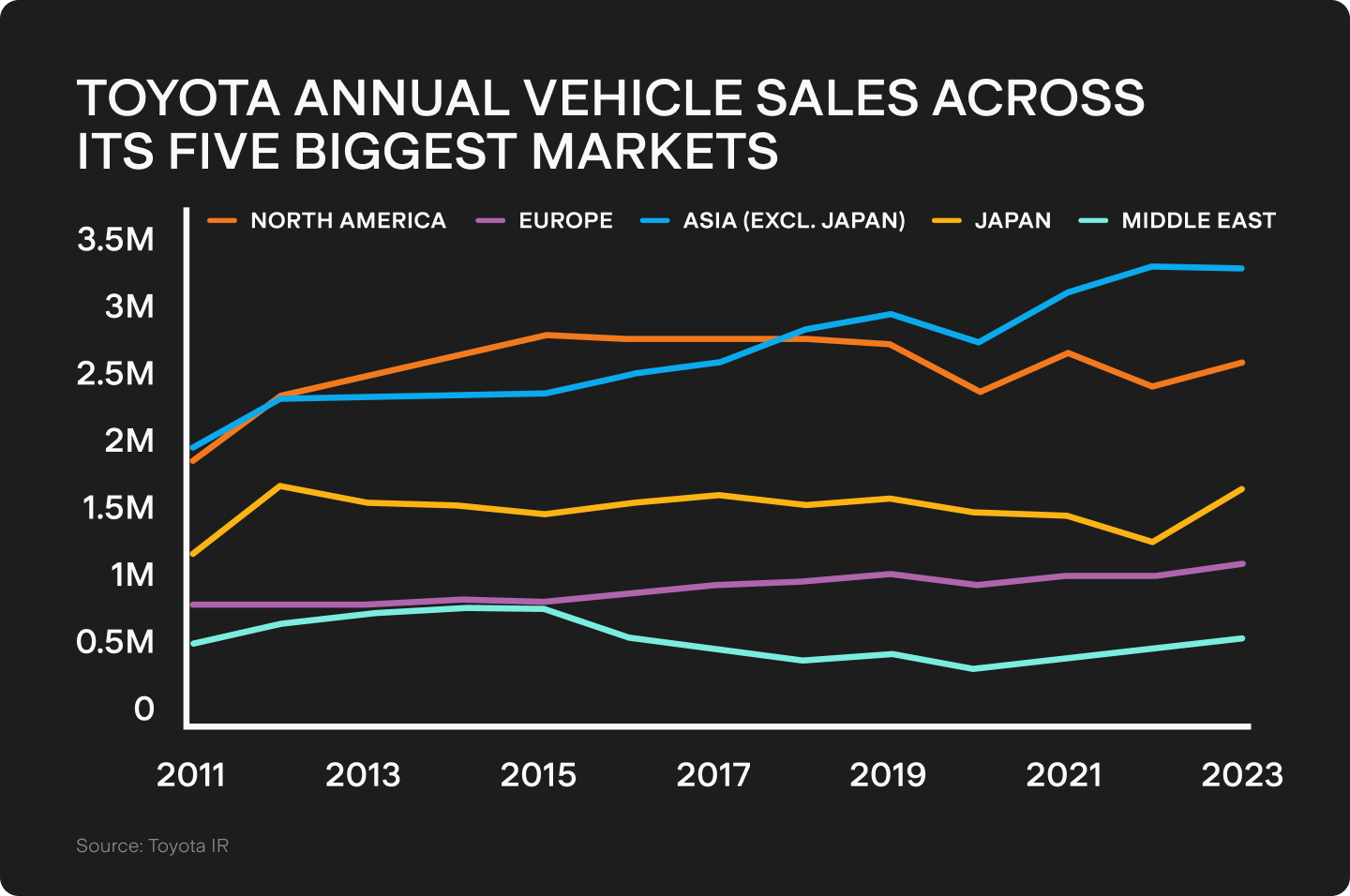

Traditionally Toyota’s two biggest markets, growth stalled in Japan and North America in the 2010s. In Japan, an ageing population, urbanisation and the expansion of public transport slowed demand. In North America and, most importantly, the U.S., Toyota failed to get a firm grip on the utility truck market. By the time the Tundra, Toyota’s flagship model in the category, hit the market, Ford’s ($F) F-150, Chevrolet’s ($GM) Silverado and Dodge’s ($STLA) Ram were already dominating the segment. And even though Toyota’s sedans and hatchbacks are still popular in the U.S., tax incentives made the popularity of utility trucks skyrocket, cementing the F-150 as the country’s best-selling vehicle.

North America and Japan are still extremely relevant for the company though, with 2023 sales reaching 2.6 million vehicles in North America and 1.6 million in Japan. But the biggest growth rates for Toyota are being seen in Asia (excluding Japan) and Europe, where the firm’s sales reached 3.3 million and 1.1 million units respectively in 2023. This was fuelled by the growth of the Chinese economy and the growing market share of hybrid electric vehicles in Europe.

Going electric

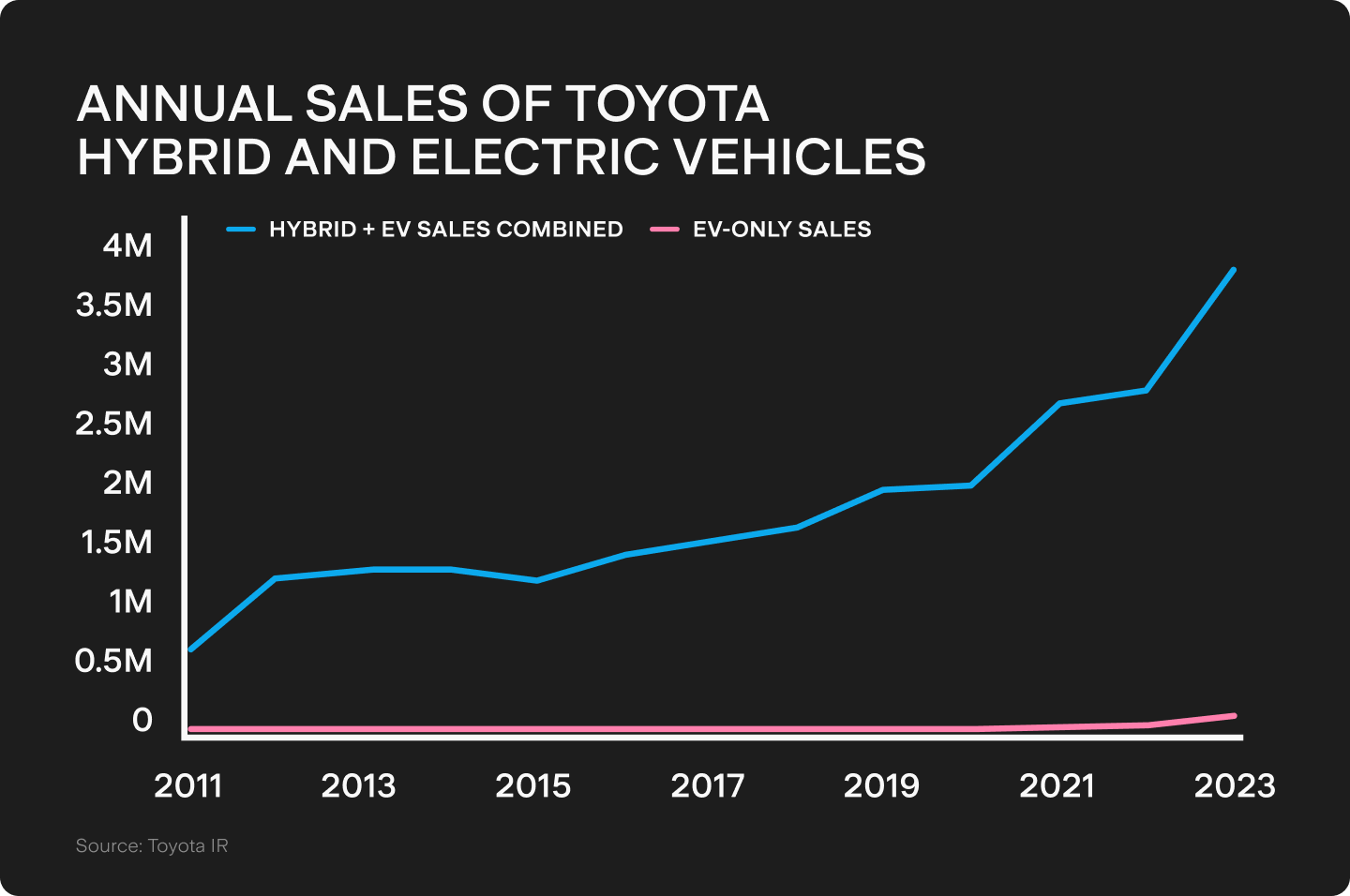

As the world moves away from fossil fuels, electric vehicles have gained popularity as an eco-friendly alternative, with manufacturers like Tesla ($TSLA), Rivian ($RIVN) and NIO ($NIO) gaining prominence. Traditional automakers like Ford, GM and Honda ($HMC) have taken notice, introducing electric models to their product suites. However, despite Toyota being the biggest player in the hybrids segment, the company has remained cautious when it comes to electric vehicles, citing high prices, infrastructure issues and future shortages of lithium and battery grade nickel as reasons to remain circumspect.

Instead, Toyota has focused on hydrogen fuel-cell vehicles (HFCVs). HFCVs typically offer a longer driving range and allow for fast refuelling. However, they are extremely dependent on an existing network of refuelling stations and as a result have yet to become popular. Toyota even went as far as giving a US$40,000 discount on its hydrogen-fuelled Mirai in a bid to enhance its popularity.

Toyota launched its first battery electric vehicle, the bZ4X, in 2022, and in 2023 sold more than 104,000 electric-only vehicles. However, that accounts for less than 1% of its total sales, and the automaker still appears to have a conservative outlook. Toyota’s chairman, Akio Toyoda, recently said he believes electric vehicle adoption will peak soon, at a rate of just 30% of market share.

Price of stability

Due to its lean production system and operational efficiency, Toyota has traditionally been able to boast a bigger net income margin than its peers. This still holds true, with the company maintaining a five-year average of 7.62% vs. a sector median of 4.72%.

However, the company’s shares are currently trading at a forward price-to-earnings ratio of 10.60 times compared to a sector median of 16.28. This signals the market is potentially nervous that Toyota could lose market share if the electric vehicle market grows and the company is left trailing.

Nonetheless, business appears to be booming for Toyota. In 2023, Toyota had a total revenue of US$277b, a new all-time high. Revenue is estimated to grow 8.31% in 2024, more than twice the 3.96% prediction for the overall automotive sector. The company also raised its guidance for this fiscal year’s profit, up from US$27b to US$30b.

Ultimately, Toyota seems to be making the most of its combustion engine vehicle business, while playing it safe among the electric vehicle craze. Whether that decision will prove to be right or wrong remains to be seen. But as Toyota navigates the complex landscape of the automotive industry, its commitment to quality and efficiency ensures its unlikely to be left running on empty.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)

.jpg&w=3840&q=100)