Under the Spotlight AUS: Reliance Worldwide Corporation (RWC)

There are few challenges Mario and Luigi can’t face as the world’s most famous plumbers. But even they could struggle without the right gear, and that’s what Reliance Worldwide Corporation provides. Let’s put it Under the Spotlight.

Controlling the flows and temperatures of water is key to enabling daily comforts in our homes. While most of us wince at the thought of an icy cold shower, early innovations in plumbing were largely driven by safety considerations.

In 1936, Henry George Fredline struck out on his own to improve specialist components with new designs in a small Brisbane workshop. The focus was on valves and taps that could make water heating systems more reliable. He later recruited engineer Marc Schoenheimer as a partner and, in 1949, Reliance Manufacturing Company Pty Ltd was born.

The business evolved over the decades through various owners and acquisitions. It eventually became Reliance Worldwide Corporation ($RWC) and listed on the ASX in 2016. But ‘behind the wall’, plumbing is still at their core. This focuses on the pipes and components of the system that moves water to and from the supply mains, rather than those visible to the person in the room.

Blocked streams

Reliance has become a leading supplier in a number of countries of brass and plastic ‘push to connect’ (PTC) fittings, that attach two ends of a pipe. Installing PTCs requires no special tools, less labour than the traditional crimp or soldering systems, plus they work with different kinds of piping. This makes them attractive to individuals as well as businesses.

Their PTC SharkBrite brand accounts for about 15% of the fittings market in the U.S. by volume. It’s been a significant source of profits and commands a premium over competitors. While Reliance has built up a global business with several product lines, it hasn’t been a smooth ride over the past few years. Even though everyone wants to fix a burst pipe ASAP, the company isn’t completely insulated from the general state of the economy.

With the majority of sales going to the repair and renovation (R&R) segment, the housing market affects the firm’s fortunes. Around 64% of Reliance’s sales occur in North America and about half of the volumes are in the retail sector. American regulations allow a much greater degree of DIY activity than Australia, and home improvement levels historically correlate with rising house values. With higher interest rates now taking up more of the budget, many of these projects could be put on hold.

Filtering down

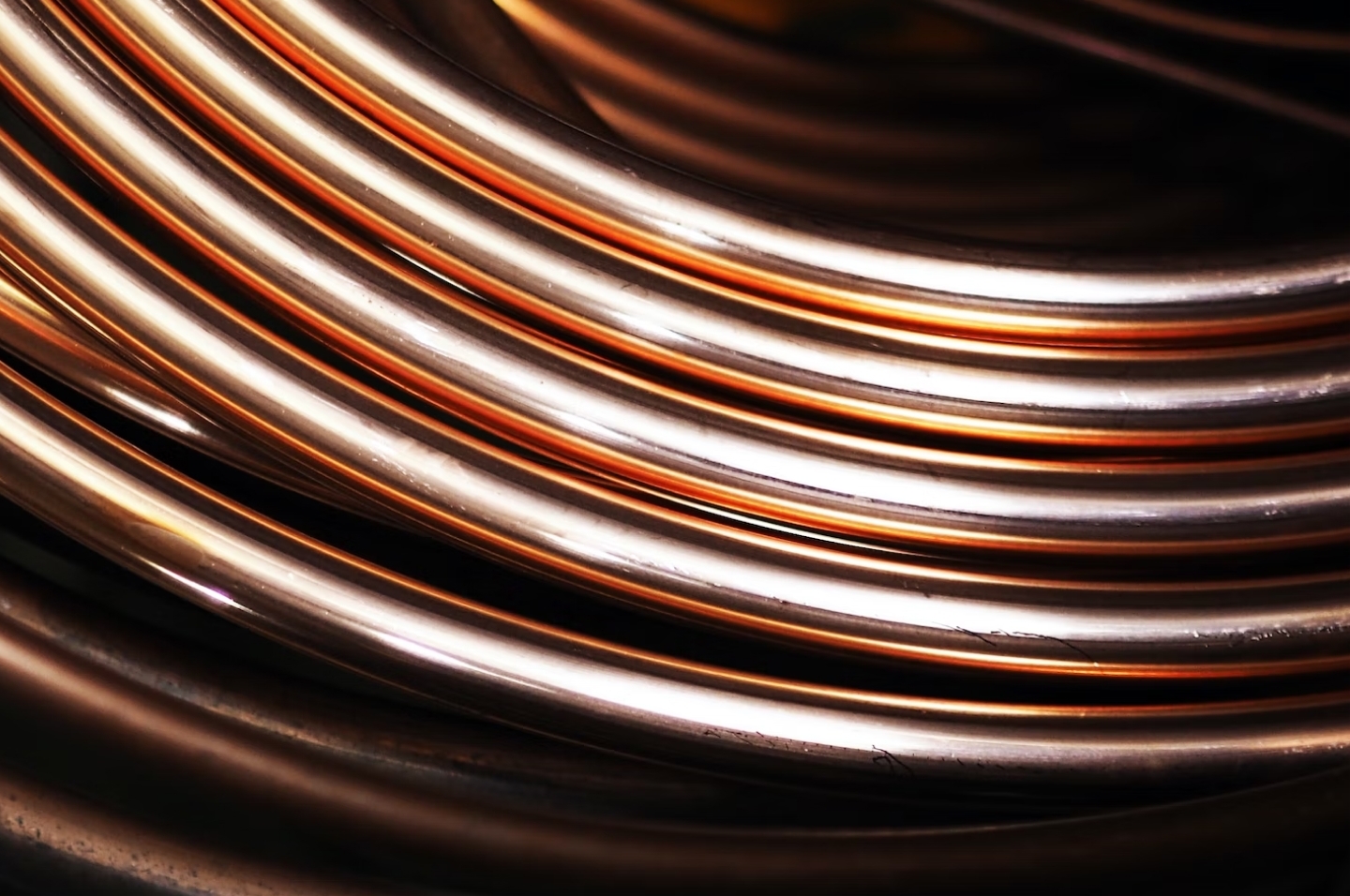

Reliance keeps its trade secrets close to its chest, and manufactures over 80% of its products sold. The team is constantly hedging costs for raw material inputs like copper and steel, with inflation leading to an average 8.5% price increase over HY23. This provided stability and a cushion against flatlining volumes in some markets. Cash flow from operations increased by 57% to US$94.3m over HY22, but adjusted net profits fell 10% to US$66.3m over the same period.

The firm is preparing for leaner times ahead, as indicated by cost reduction activities that saved US$8m in 2023 and another US$15m identified in potential annual savings. They’ve also upgraded inventory levels to reduce delivery delays ahead of new product launches later this year. The next goal is maximising sales, but the latest results have been mixed across categories and areas.

Over HY23, sales growth for the Americas was 28%. This figure would have only been 6% without the EZ-FLO plumbing line, revealing the successful integration of the brand after its 2021 acquisition by Reliance. As the post-pandemic reopening rush settled, demand from the commercial and hospitality sectors for its FluidTech category of products like water filtration and drinks dispensers slowed.

Tapping out

Reliance reports in U.S. dollars and the currency’s strength in 2023 depreciated sales numbers elsewhere. Wholesale clients in the UK absorbed higher prices with a 10% sales increase, but the greater region only saw a 3% change. Continental Europe’s large equipment manufacturing firms also made fewer orders for the FluidTech segment. Demand was similarly depressed in South Korea and China.

The Asia Pacific division eked out a 1% gain in sales, but saw margins shrink. Construction activity in Australia was the main positive driver in this region. Demand across product categories is relatively varied, with a comparatively lower proportion for FluidTech goods. New builds account for over half of the total end market, so news of declining approvals suggests the next six months could be much tougher. On the other hand, it’s a business that could benefit from North America’s freezing start to 2023.

Reliance is a diversified company that sells products essential to everyday life, yet its future could be shaped by matters far beyond its control. Forecasting weather patterns and property prices aren’t simple tasks for the team or investors. Mistakes could land them in hot water.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.jpg&w=3840&q=100)