.jpg&w=3840&q=100)

Under the Spotlight (AUS): DroneShield Limited (DRO)

Nikola Tesla prophesied about many uses for remote-controlled machines in an 1889 patent for an RC boat. It took 130 years for the technology to give us modern drones – for better or worse. Today, we’re putting ASX-listed DroneShield Under the Spotlight.

This article is sponsored by DroneShield Limited. Stake Connect aims to bring interesting business stories to our customer base. Although this is a paid partnership, the Stake Connect team have written this article independently and adopt a balanced, informative stance, prioritising making content that is valuable to our community. This is for your general, informational purposes only - it is factual and does not contain financial advice. We do not consider or research the potential future performance of any company’s securities. Stake does not endorse or recommend investing in the company discussed below.

Today’s drones are a far cry from the earliest unmanned aerial vehicles. The concept goes back to 1849, when Austrian soldiers launched over 200 explosive-filled balloons without pilots on Venice. Things didn’t go exactly as planned when the wind blew many back to the source. As the technology progressed, it largely remained too expensive and unreliable for commercial applications, only recently becoming a consumer gadget, as RC helicopters evolved into what we now call drones

The ability to move through areas too difficult or dangerous for humans is arguably the greatest strength of drones, but this means almost anything can become a target. With their popularity as novel toys in the early 2010s, some academics became very concerned that people could misuse the devices. This included scientist Dr Brian Hearing, from Johns Hopkins, and physicist Dr John Franklin, from the Defense Advanced Research Projects Agency (DARPA) in the U.S. So, they founded DroneShield ($DRO) in 2014 with the aim of using technology to mitigate against drones that may pose a threat.

During a crowdfunded campaign to develop a system for detecting drones, their initial driver was privacy. The result was sensors with microphones to record ambient noise, that provide data to be processed via an AI model and alert users if any threats are found. DroneShield CEO Oleg Vornik explains the importance of accuracy in a comparison with a fire alarm: it’s key to eliminate or minimise false warnings with reliable detection and tracking. Today this is done using a variety of radiofrequency, radar and camera sensors which can detect and track a drone over long distances.

.jpg&w=3840&q=100)

Counter Strike

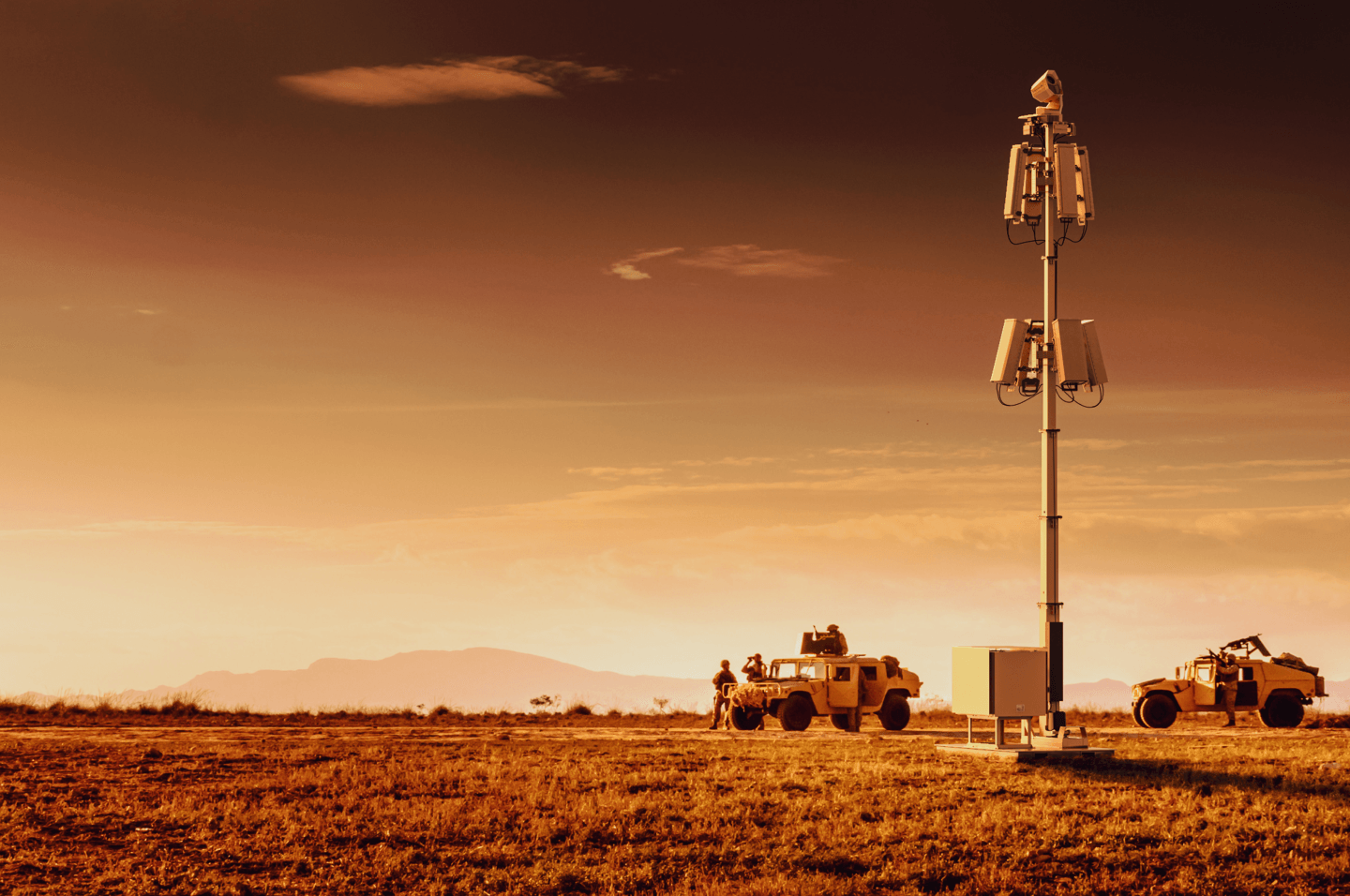

Then the team moved onto the challenge of stopping small, fast-moving drones. DroneShield uses a ‘smart jamming’ method, sending a burst of radio frequency that overwhelms the drone and forces a landing or return to the controller. These devices operate at a dense part of the radio frequency spectrum, having to sort through the noise from Wi-Fi, bluetooth, cell towers and antennas. The drone remains intact, making a forensic investigation possible.

DroneShield’s first major multi-million deal came in 2019, in Saudi Arabia. Their products have since been used with intelligence agencies, border protection, at airports, at critical infrastructure, in prisons, ships, large venues and at events. They’ve even made it to the Olympics, IRONMAN and Davos.

But DroneShield is under constant pressure to improve performance, as bad actors continue to make extensive efforts to evade their technology’s capabilities. With 55 out of total 70 employees being engineers, R&D is still at the core of the company and has received most of the $60m that’s been raised since the 2016 ASX listing. The segment provides income through collaborations, such as a two-year electronic warfare project with the Australian Department of Defence.

The rest of revenues come from hardware and software sales, usually as a combined offering. The software-as-a-service (SaaS) subscriptions currently account for under 10% of revenues. Management speculate this could increase to around 50%, providing a welcome buffer against the lump payments from deals.

Growing demand may come from tackling organised crime, protecting jails and significant occasions like Presidential inaugurations for example, and the anti-drone industry could be worth US$10.5b by 2030. But DroneShield is ultimately dependent on signing deals. The company only started regularly making multi-million dollar sales in 2021.

.jpg&w=3840&q=100)

Navigating Headwinds

There are strict laws about the use of their products in many countries, so potential clients are generally restricted to government agencies. Establishing contracts tends to be a lengthy process – in one case, Vornik says it has taken around two years from initial contact to final handshake. An extensive vetting process takes place due to the nature of the industry. The names of clients aren’t always publicly disclosed and they’ve had to turn away many enquiries for sales.

It’s hard to skirt around a very common, but controversial application for drones – war. A significant reason for growing interest in DroneShield is the deployment of their products on the Ukrainian side since February 2022, to help take down Russian drones. This situation has raised a complicated conversation about the ethics of investing in the sector. Unlike many conflicts in the recent decades, there’s clear popular support for one side in Australia. Still, defence companies remain a taboo for many, while others have reconsidered their positions.

Controlled Landing

The high R&D budgets required by these types of businesses give larger players an advantage. Further consolidation in the industry is likely to be steered by big international firms. In this respect, the ASX might seem an unlikely home for a company like DroneShield, but the low costs compared to many international exchanges do benefit microcaps. Besides, the bulk of work takes place in Sydney, with a handful of sales staff in the U.S. Vornik also mentions the advantages of generous R&D tax incentives in Australia, plus not having to compete with Silicon Valley for talent.

After receiving two company record $11m contracts in recent months, DroneShield has been receiving some attention. Its share price is currently close to the previous highs reached in 2017 and 2019, but it’s not clear whether the gains will be sustained this time. However, revenues were up 59% to $16.9m over 2022 and there’s a backlog of $25m committed in contracts for this year.

On the other hand, investors will have to wait to know whether turning a profit for the first time is enough. DroneShield’s fortunes were greatly impacted by events beyond its control over the last year, which could happen again in the future. It could help or hinder Vornik’s next near-term goal of striking a $20m+ contract.

This article was published by Stakeshop Pty Ltd (‘Stake’) as part of a paid partnership. Stake is not endorsing DroneShield Limited or recommending their securities. Stake does not conduct due diligence or research on the potential future performance of the company’s securities. The article is for information purposes only and is not a recommendation to invest in the company discussed, nor does it reflect an opinion about it. It does not constitute financial product advice. We recommend that you do your own research and consider your own personal financial needs, objectives and circumstances before making any investment decision. It may be appropriate to speak with a licensed financial adviser. Past performance is not a reliable indicator of future performance.

The author of this article and/or other employees of Stake may have, or are likely in the future to have, investments in the featured company DroneShield. Stake has a Conflicts Management Policy which, amongst other things, prohibits certain employees of Stake trading the securities discussed in this article for a period of time. Stake received compensation from the company featured to write and publish this article, who also provided background information and materials about the company to assist Stake in writing the article. The company also had the opportunity to review this article prior to publication for the sole purpose of correcting factual inaccuracies. Stake does not have any other association or relationship with the featured company.