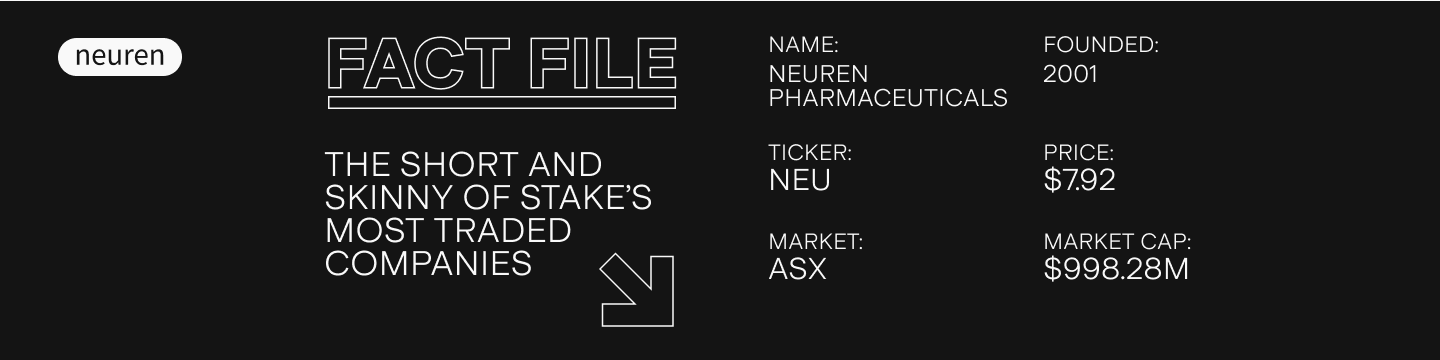

Under the Spotlight AUS: Neuren Pharmaceuticals (NEU)

Modern medicine is constantly working on treatments and cures to improve our lives. But the journey to final approvals is often long and costly. Let’s see how that’s going for biopharmaceutical firm Neuren Pharmaceuticals, as we put it Under the Spotlight.

The human brain is extremely complex and scientists are putting huge efforts into researching exactly how it functions. Normally, the number of synapses – the links between brain cells – increases rapidly during early childhood to create a giant network that gives us consciousness. Sadly there’s sometimes a mishap in the process, leading to impaired connections and signalling in the brain.

Neuren Pharmaceuticals ($NEU) is developing treatments for this common characteristic amongst neurodevelopmental disorders, even though they’re caused by different genetic mutations. Neuren’s two patented drugs, trofinetide and NNZ-2591, provide synthetic equivalents of naturally occurring molecules in the brain that aim to improve those linkages.

The U.S. Food and Drug Administration (FDA) has put trofinetide into a development pipeline of treatments to treat Rett syndrome and Fragile X syndrome. Meanwhile, NNZ-2591 has received the equivalent for Phelan-McDermid syndrome, Angelman syndrome, Pitt Hopkins syndrome and Prader-Willi syndrome. These are all syndromes that stem from problems in the brain’s development, which can lead to various disabilities, impairments and irregularities that seriously affect quality of life.

Medications are usually submitted to either the FDA or the European Medicines Agency (EMA), before the Australian equivalent known as the Therapeutic Goods Agency. Population size, regulatory agency funding and drug pricing rules usually impact biotech companies’ decisions in this respect. FDA approval is key to deciding which drugs can access the lucrative healthcare market in the U.S. and the outcome can make or break a biotech company’s future.

Litmus test

Neuren should hear about the FDA’s decision on trofinetide for Rett syndrome in March. This could trigger a payment worth $46m from the FDA if positive, and projected revenues could reach $115m by the end of the year. They’re entitled to additional royalties and milestone payments under a licensing agreement with their partner Acadia Pharmaceuticals Inc. ($ACAD), such as $55m for business after the first commercial sale for the business. Acadia funded the development and commercialisation in North America.

Trofinetide would be the first drug for the treatment of the rare neurological disorder. Its review period was streamlined due to its special status as an ‘orphan drug’ that treats rare diseases or conditions. This also allows periods of marketing exclusivity to protect the product against generics, lasting 7.5 years in the U.S., 12 years in the EU and 10 years in Japan.

On the other hand, it’s important to remember that Neuren has been working on this specific drug since 2012 and has yet to produce a profit. Pharmaceutical companies tend to have fragmented cash flows, which are contingent on the drugs and stages of product development. Consider that the NEU share price attracted limited interest before positive Phase 3 trial results arrived in November 2021.

There’s potential the business could reach a breakeven point in 2023, with the FY22 net loss being only $7.0m for the first half of 2022. Having $31m in cash and being debt-free at this point puts the team in a strong position.

Trial and error

It seems like all the ingredients for success are already in place for Neuren, but there’s no guarantee the FDA will actually approve the drug. They also still need to establish partnerships to commercialise the treatment outside of North America. With the share price rising from $3.80 to $7.95 in the second half of 2022, some might think all the good news has already been priced in and future gains could be muted.

In a scenario where Neuren soon receives all these funds, they’ve been earmarked to accelerate the development of NNZ-2591. This drug can also be taken orally as a liquid and has more potential applications across markets estimated at five times the size of Rett syndrome. Results from Phase 2 trials are expected to arrive this year for its four main categories. The successful ones would then go on to Phase 3 before becoming eligible for the FDA’s registration process. Investors will be eager to find out whether the team can replicate their trofinetide success.

The next 12 months will bring Neuren key results from their R&D of two drugs that could improve the quality of life for many children and their families affected by neurological disorders. The team’s put in the work over a long time and will soon know whether their efforts will pay off.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.