.jpg&w=3840&q=100)

Under the Spotlight Wall St: Deere & Company (DE)

Deere is a farming equipment and heavy machinery giant. Can it continue to harvest big profits? Let’s put it Under the Spotlight.

A titan in the agricultural equipment industry, Deere’s ($DE) iconic green machines have tilled fields, harvested crops and shaped landscapes for nearly two centuries. Even though the company is now known for its tractors and other kinds of heavy machinery, Deere’s history began way before combustion engines took over the world.

In 1837, John Deere, a blacksmith in Grand Detour, a small town in Illinois, noticed the struggles of farmers using cast-iron ploughs in the region's sticky soil. Inspired, he crafted a self-scouring plough made of steel that was able to slice through the earth with ease. This simple innovation sparked a revolution. Demand soared, and Deere's business quickly grew.

Gaining traction

Though the company fared well in the 19th century, the 20th century ushered in a new era for Deere. In 1914, it created a financial division to give loans to its customers to buy their equipment – profiting not only through product sales, but also from interest payments. The invention of the internal combustion engine also paved the way for farm tractors, a game-changer in agricultural mechanisation. Initially hesitant, the farming equipment manufacturer entered the tractor market in 1918 with the acquisition of the Waterloo Gasoline Engine Company. This marked a pivotal moment, propelling Deere to the forefront of the tractor revolution.

The roaring 1920s were extremely important for the firm, as the decade saw the introduction of the Model D tractor, which sold tens of thousands of units from 1923 to 1953, and also the John Deere No. 2, the firm’s first combine harvester. And though the 1929 Great Depression inevitably hurt sales, the period cemented the brand’s popularity as Deere famously refused to repossess machinery from those unable to pay all of their financing instalments.

Diversifying

After producing different kinds of machinery for the war effort in the 1940s, the 1950s marked Deere’s move into industries outside of agriculture. The company began to make construction vehicles, with forklifts, excavators and bulldozers becoming an integral part of the firm’s product portfolio. And in the 1960s, Deere also expanded into forestry and turf products, manufacturing items like lawn mowers.

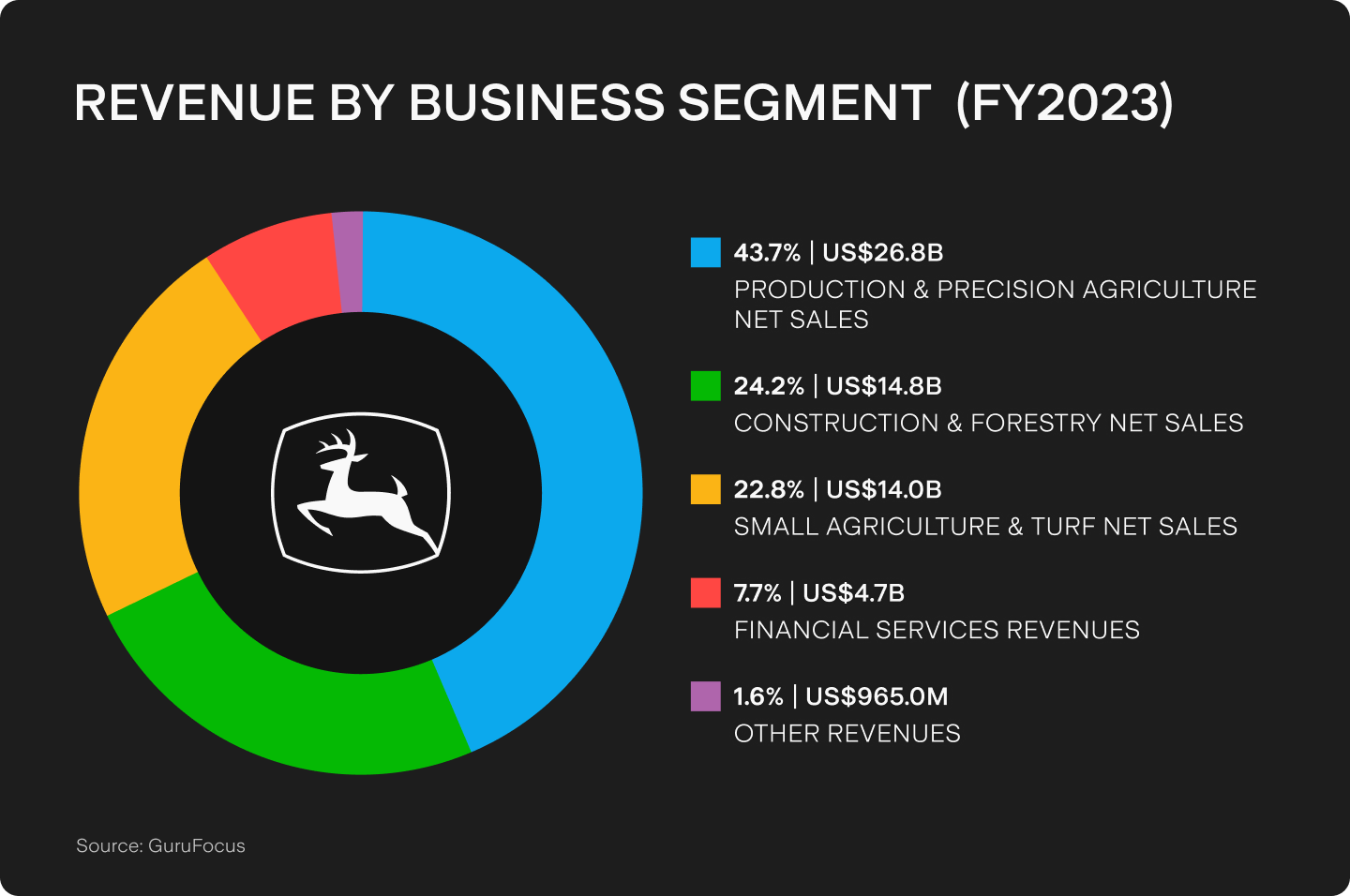

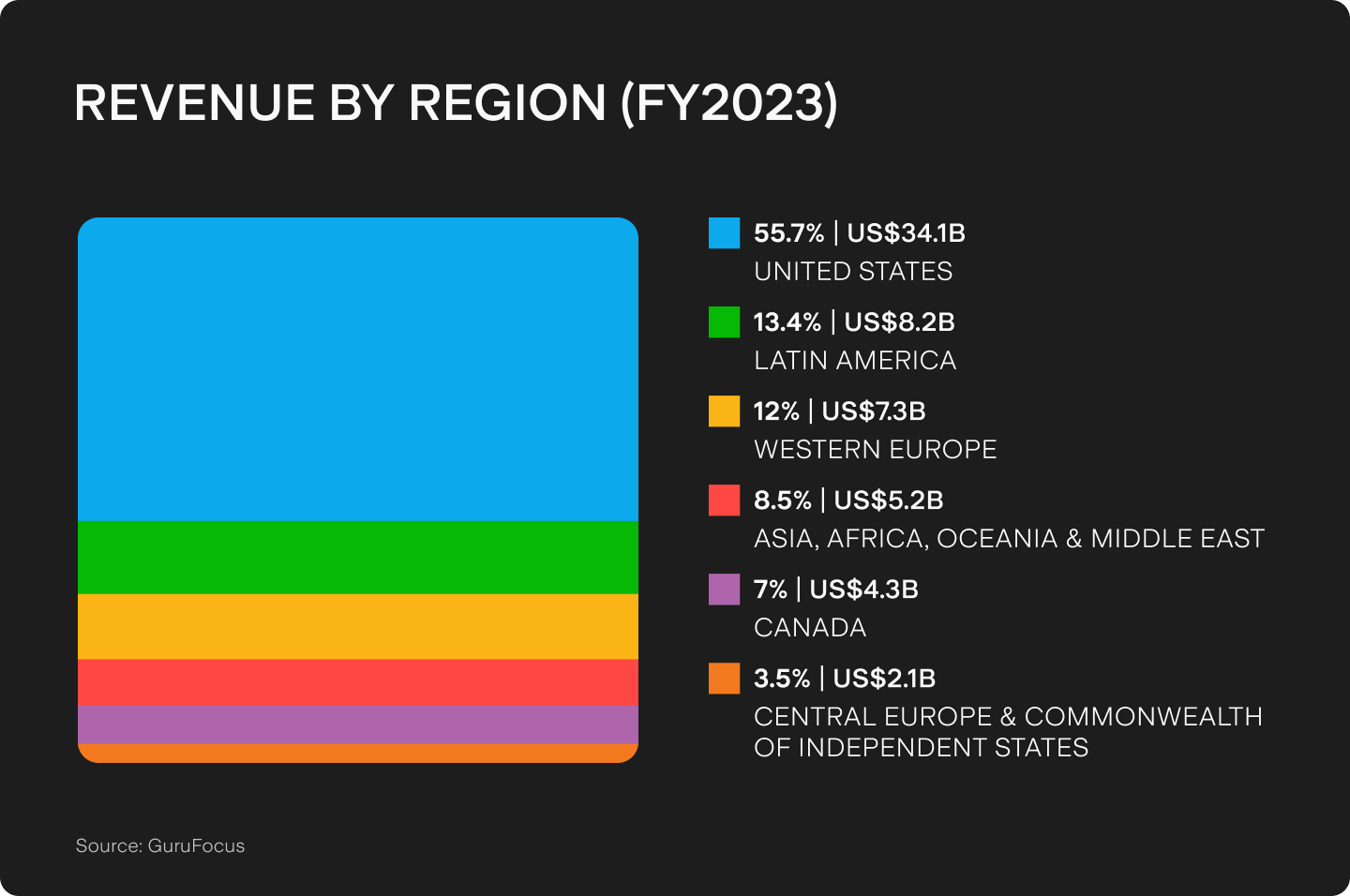

Though Deere has managed to get a strong foothold in these industries, agriculture still makes up the lion’s share of its revenue. In FY2023, farming equipment represented 43.7% of Deere’s US$61.25b sales. And in spite of the firm being an international powerhouse, the U.S. still accounts for 55.7% of its revenue, making the company vulnerable to economic and climatic headwinds that the country might face.

Machinery repairs

From the days of iron ploughs to today’s precision agriculture tools, Deere’s machinery has dramatically changed. While its first product still required horsepower, nowadays the company produces AI-powered sprayers that specifically target weeds and use up to 77% fewer herbicides than other machines. But these technological advances come with a price: complexity.

Traditionally, many farmers have repaired their own machines, particularly in an industry where setbacks of just a day or two can potentially mean the loss of an entire harvest. But as vehicles and tools have evolved significantly, it has become harder and harder for the average farmer to fix their own equipment, with a trip to a local authorised Deere mechanic becoming increasingly necessary.

In fact, many farmers around the world have been left with no choice but to take their equipment to a local Deere dealership, with the firm restricting farmers’ access to specific tools and documentation to repair some of its products. Deere introduced a series of software locks that disables some equipment if an unauthorised person tries to fix it.

Such practice has proved extremely profitable for Deere, with machinery repairs generating 3x-6x the profit margin of equipment sales. However, it caught the eye of US regulators, and in 2023 a lawsuit filed against the company ultimately granted US farmers the right to repair their own machines.

Future forecast

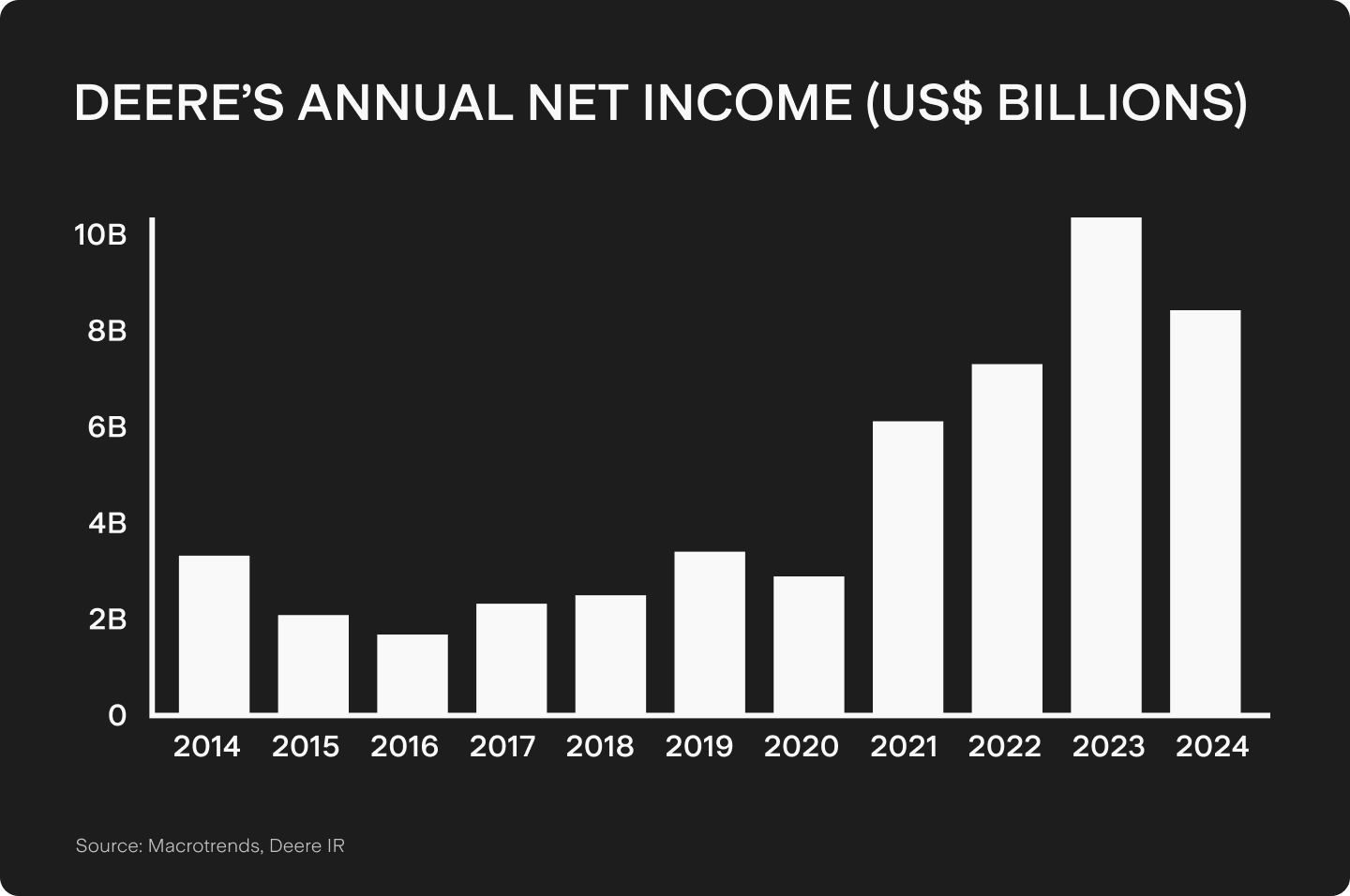

Though the right to repair adjudication lowered profit margins in Deere’s U.S. business, and such a ruling could be granted in other countries too, the business is still very profitable. In FY2023, the firm registered a record net income of US$10.16b, with profit margins still astonishingly high, sitting at 16% vs a sector median of 6%. It could be argued that due to the post-pandemic commodities surge, demand for agricultural machines rose and led to higher margins, but Deere’s 11% five-year average net income margin still dwarfs the competition.

But for FY2024, the machinery giant is forecasting a hefty drop in its profits, down from that US$10.16b figure to the US$7.75b – US$8.25b range. Deere has gathered too much inventory, while the company predicts that big harvests that occurred in 2023 make it more likely that equipment sales will drop in the next financial year. Counterintuitive as it sounds, record harvests are not good for farming equipment manufacturers. That’s because overproduction leads to lower produce prices, and lower prices reduce the likelihood of farmers reinvesting in their machinery.

Competitors CNH Industrial ($CNH) and Corteva ($CTVA) are also forecasting lower sales and even cutting down on personnel. And though that’s part of the cyclicality inherent to the farming industry, this downbeat forecast could be particularly worrisome for companies with a high debt to equity ratio, such as Deere, whose debt to equity ratio is currently 2.92, higher than 95% of its industry counterparts. Historically, such leverage has been used to produce great returns to shareholders, but in trying times, it could be something that many are not willing to bet the farm on.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.