Under the Spotlight Wall St: Crocs, Inc. (CROX)

Crocs has built a footwear empire. But can it continue to grow? Let’s put it Under the Spotlight.

In the world of footwear, few brands have garnered as much attention and controversy as Crocs ($CROX). The firm’s rounded, often bright-coloured clogs with holes in them are loved by some and loathed by others. TIME magazine even went as far as ranking the shoes among the world’s worst inventions ever in 2010. But judging by the company’s huge sales numbers, it’s fair to say that in spite of the haters, the brand has amassed a significant amount of loyal customers.

The Crocs business was founded by three Canadian friends who initially targeted the shoes at gardeners and yachters, due to their practicality, their ease of cleaning and the fact they could be worn in both dry and wet environments.

But the shoes quickly became popular among others due to their distinctive look and extreme comfort. Made from a proprietary material called Croslite, the shoes adapt to a wearer’s soles. Celebrities like Ben Affleck and Matt Damon, and even former U.S. president George W. Bush, were spotted sporting the shoes, igniting a quirky fashion trend. Suddenly, everyone, from kids to doctors, wanted a pair of those clogs.

Hitting the ground running

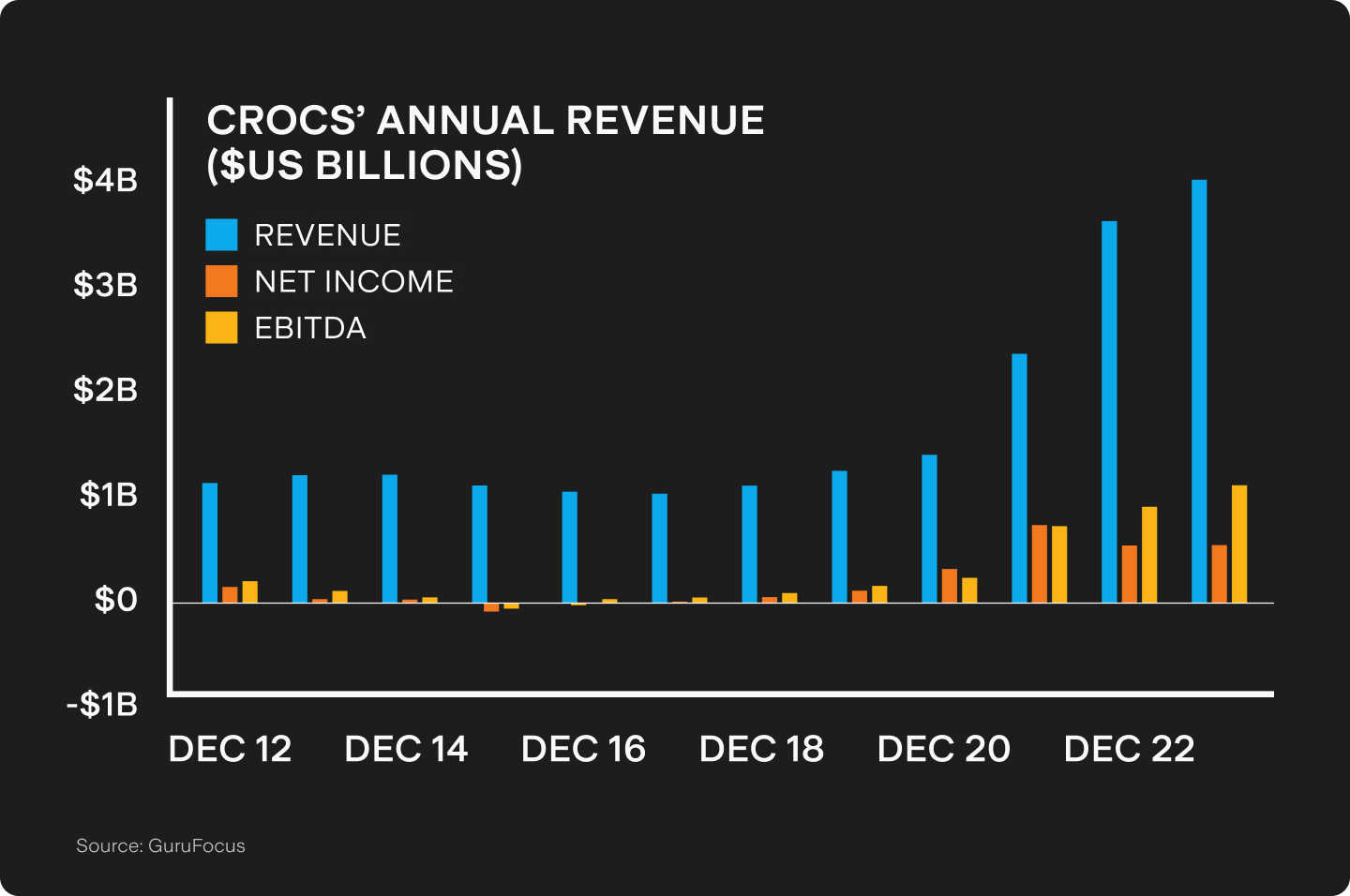

The fame quickly propelled Crocs to explosive growth. Revenue soared from US$108m in 2005 to US$847m in 2007, an almost eight-fold increase in just two years. Public adoration translated to an IPO in February 2006, with shares more than quadrupling in price by October 2007. It seemed Crocs had stumbled upon a golden formula: a unique product, celebrity appeal and an insatiable market for comfort.

But in 2008 the GFC disrupted economies worldwide and Crocs took a serious hit. To make matters worse, overzealous expansion, coupled with a reliance on the Classic Clog, led to overstocked retailers and waning consumer interest. In 2009, revenue plunged 23% from its previous high of 2007.

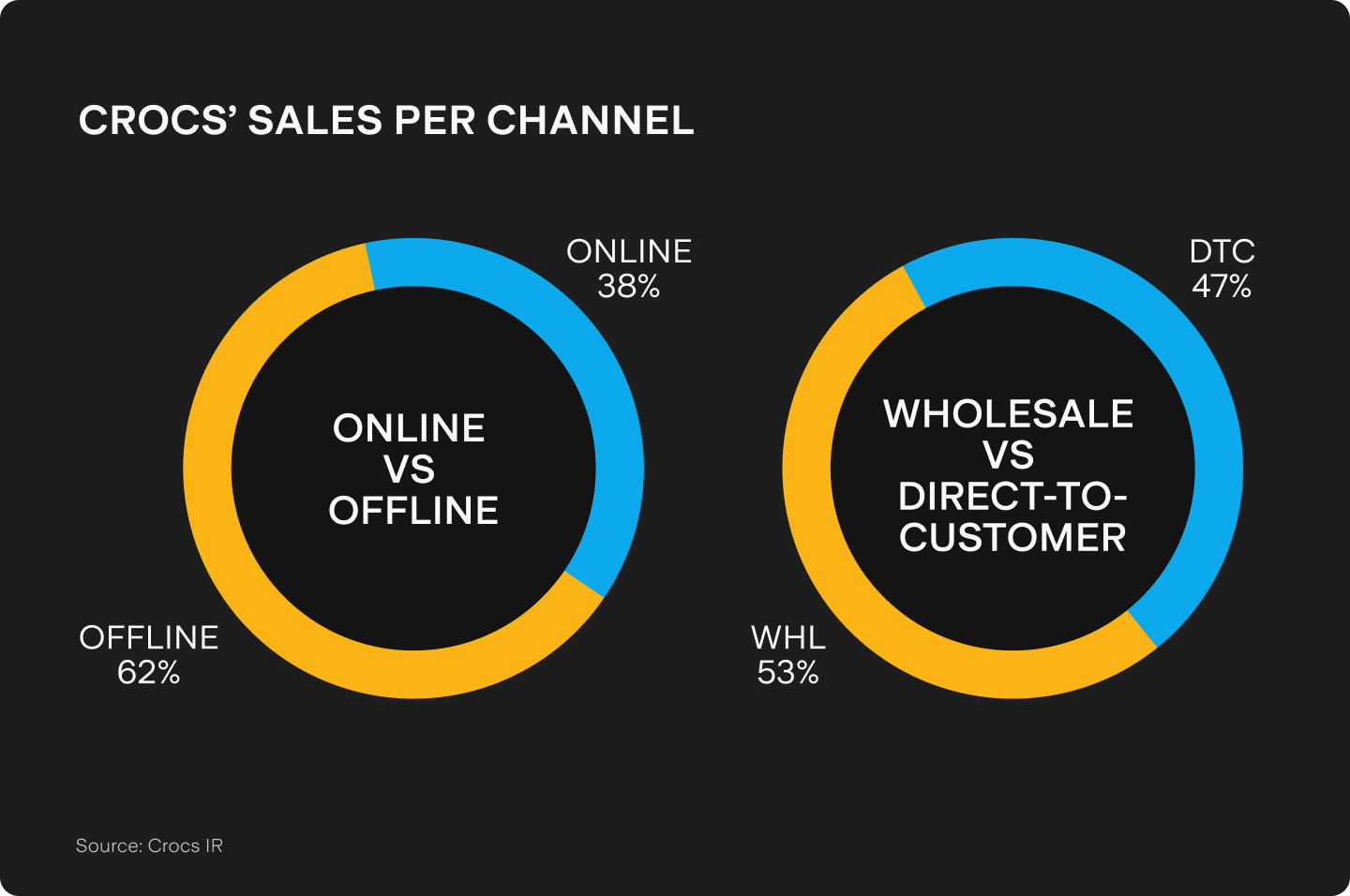

However, Crocs refused to fade away. The firm decided to transform its distribution strategy, opting for a direct-to-consumer approach. By investing significantly in e-commerce, the company not only harnessed the power of online retail, but also established a direct connection with its customers.

This shift allowed the company to control its brand narrative, engage with consumers on a more personal level and tailor its offerings to the evolving preferences of its customer base. By 2023, 47% of Crocs’ sales were direct-to-consumer, with 38% being digital.

Crocs also evolved its product strategy, expanding its repertoire beyond its signature clogs and venturing into sandals, boots, flats, slippers and even sneakers. This deliberate diversification allowed Crocs to cast a wider net and resonate with a more extensive and varied audience. By blending its commitment to comfort with a diverse array of styles, Crocs successfully positioned itself as a versatile and trend-conscious footwear brand.

Embracing uniqueness

One often-overlooked element of Crocs' successful resurgence lies in the company's decision to embrace its unconventional image. The brand launched successful viral marketing campaigns that celebrated its uniqueness, collaborating with influential celebrities like Justin Bieber and Post Malone.

And it wasn’t just artists. The company partnered with luxury fashion brands like Balenciaga and fashion designer Christopher Kane, as well as companies unrelated to fashion, like General Mills ($GIS), McDonald’s ($MCD) and perhaps most memorably, KFC – where each shoe came with a chicken drumstick-shaped charm.

Crocs sells a huge variety of such charms, known as Jibbitz, which customers can pin onto their clogs, allowing them to customise and add a personalised touch to their footwear. By weaving this kind of eccentricity into its product and marketing strategy, Crocs has managed to stay relevant and appeal to a new generation of consumers seeking authenticity and self-expression.

Future outlook

As the COVID-19 pandemic took place and billions of people stayed indoors, the search for comfy shoes skyrocketed and Crocs was well-positioned to take advantage of this. Revenue soared, reaching US$1.4b in 2020, an increase of 13% year-on-year. Crocs has been focused on maintaining that growth rate, with revenue continuing to surge.

In late 2021, Crocs announced it was acquiring the comfort footwear company HEYDUDE for US$2.5b, hoping to capitalise on synergies between the two brands. However, this acquisition, coupled with Crocs’ significant marketing expenses, caused Crocs’ debt to equity ratio to explode.

Yet, so far, the acquisition seems to be going well: out of Crocs’ revenue of US$1.04b in Q3 2023, HEYDUDE accounted for US$246m, nearly 25%. And leverage is coming down, dropping from 2.25x at the time the purchase took place, to 1.7x in Q3 2023.

The challenge the company faces is its geographical concentration. Though Crocs is an international brand, 67% of the firm’s revenue comes from North America. Europe, Middle East, Africa and Latin America combined provide 17% of Crocs’ revenue, while 16% comes from the Asia-Pacific (APAC) region. But while North America’s revenue grew 8% in Q3 2023, APAC surged an astounding 29%, with sales rising more than 90% in China alone, signalling that there could be significant growth opportunities in the region.

The biggest risks for the company are changes in consumer preferences and fashion trends. Despite already being an established brand with an iconic look, there’s no firm that’s immune to these factors, like sneaker manufacturer Reebok has come to know. Fortunately, Crocs can find hope in youth, since Gen Z has a more favourable view of the brand than Millennials. And that's no surprise: many of them grew up wearing its clogs.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)