Under the Spotlight Wall St: The Home Depot, Inc. (HD)

A one-stop shop for DIY enthusiasts and professional contractors alike, Home Depot is a multibillion-dollar empire. But can it fend off its main competitor? Let’s put it Under the Spotlight.

Renovating, remodelling, repainting – think about pretty much anything related to home improvement and the tools and materials necessary for the job can most likely be found in a Home Depot store. Its aisles, overflowing with hammers, paint cans and lumber planks, have become the stage for countless DIY dreams and weekend warrior projects.

Home Depot's ($HD) journey began in Atlanta, Georgia, in 1978. The founders, all veterans of the home improvement industry, envisioned a unique retail concept that would cater to both homeowners and professional contractors. The idea was to create a one-stop shop where customers could find a comprehensive range of quality products, competitive prices and expert advice.

Breaking away from the traditional model of small, specialised hardware stores, Home Depot's founders believed in the potential of a large, warehouse-style store that could offer an extensive selection of products, ample parking and a focus on customer service. This approach set the stage for the company's rapid expansion and eventual dominance in the North American home improvement market.

Professionally built

Currently operating more than 2,300 stores in the U.S., Canada and Mexico, Home Depot is not only the leader in its industry in the U.S., but also the fifth biggest US retailer overall in terms of global sales. But its bricks and mortar shops aren’t the only revenue driver for the business. Online sales make up 15% of its volume, making the company the fifth biggest online retailer in America, behind only Amazon ($AMZN), Walmart ($WMT), Apple ($AAPL) and eBAY ($EBAY).

The home improvement colossus, with stores that carry up to 40,000 different items, gives its customers the opportunity to choose where they wish to receive or collect their purchased goods: at home, at a store or at a project site, with almost all goods available with same-day or next-day delivery, thanks to the retailer’s fleet of more than 2,000 trucks.

Such convenience comes at a price. Home Depot’s customers are usually wealthier than the broader population, with a median income of US$100,000, 30% greater than that of the average American. Higher prices charged for wealthier customers results in higher margins, and the company also leads in that regard, with 10.22% net income margins vs 8.39% for its biggest competitor, Lowe’s ($LOW).

Store opening hours usually range from 6am to 10pm, thus making it easier to either drop in to a store before going on a job, or to pay a visit in the evening after work is done. This flexibility is particularly important for professionals in the home improvement and renovations industry, who are some of the company’s best customers, accounting for almost 45% of Home Depot’s sales.

Through the roof

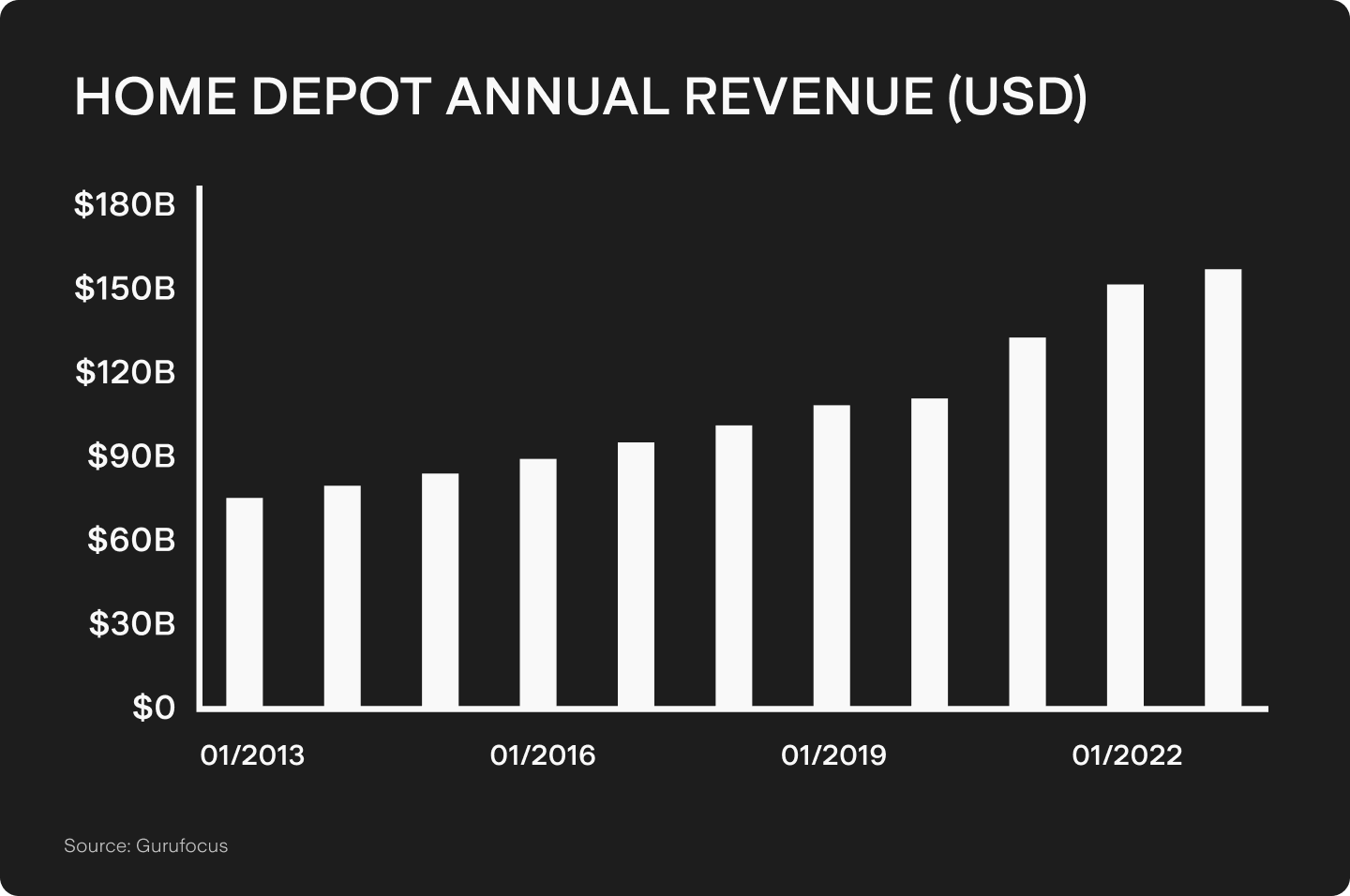

Home Depot has been able to successfully scale up its revenues, thanks to its efforts in expanding and perfecting its logistics, as well as improving its omnichannel sales strategy. As a result, revenues jumped from US$74b in 2013 to more than US$157b in 2023.

Those sums might be impressive, but the board believes the numbers can grow much higher. Despite already being the leader in its segment, Home Depot only holds 17% of its total addressable market, believed to sit around US$950b. Hence, acquiring just a small percentage of market share could lead to a substantial increase in revenues.

Fundamental to its plans for growth is Home Depot’s determination to provide more convenience and better services to its professional customers. This includes offering even bigger inventories, sales people focused specifically on the needs of professional contractors, and trade credit, allowing customers to take on even bigger projects. In its most mature market, located in Dallas, Texas, this model is already being used and store sales have been growing 3.5% more than other locations.

Hammering home

That’s not to say further growth will be effortless for the renovation titan. In fact, Home Depot tried to expand to several countries, such as China, Peru, Chile and Argentina, and failed in all of them. While the setback in China has been attributed to the lack of a DIY culture, the expansion into South America ultimately faltered due to the company’s inability to compete with well-established local home improvement companies.

Home Depot has a relatively firm foothold in Canada and Mexico, but the company’s presence in those two countries is fairly small compared to the U.S. Of its more than 2,300 stores, only 182 are located in Canada and 133 in Mexico. Consequently, the U.S. market makes up a mammoth 92% of the company’s global revenues. As such, Home Depot’s performance remains directly tied to the U.S. economy and the firm is still unable to rely on geographical diversification as a risk hedge.

Building resilience

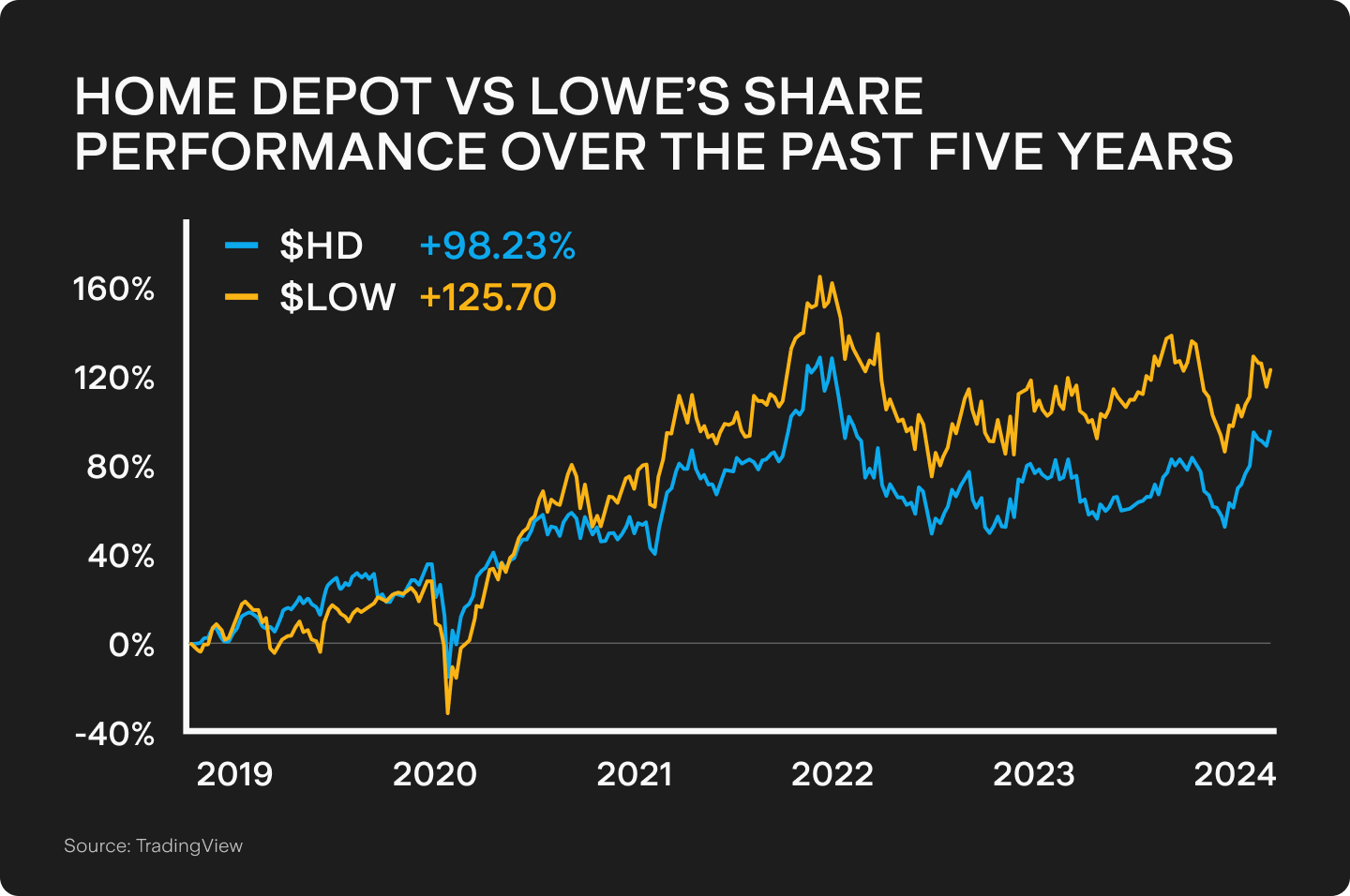

Even though Home Depot has higher sales, higher profit margins and a higher market share, the firm’s stock has still underperformed relative to its rival Lowe’s in the past five years. Though there are many reasons for this, such as Lowe’s having a higher growth rate and Lowe’s being perceived as riskier in a period that was generous for risky assets, one undeniable fact is that Lowe’s went through a more aggressive share buyback program recently, while Home Depot used its cash to brace for any macroeconomic headwinds that might come its way.

So far fears of a global recession or persistent inflation seem to have eased. But there are still risks Home Depot investors should be wary of, such as overpaying for shares. Home Depot currently trades at 22x its price to earnings ratio, while the current ratio for Lowe’s is 16. Certainly the argument could be made that Home Depot’s higher revenue and margins might justify a higher valuation, but it’s a gap to be mindful of.

The biggest risk however is not company-specific, but rather systemic. Hardware stores (and pretty much the whole industry of home improvement and renovations) are exposed to the housing market and, therefore, business can be extremely cyclical. Home prices in the U.S. took a hit in the first half of 2023, bottoming out by the end of Q2. However, if a major housing crisis takes place, it would take a lot more than a simple business remodelling or renovation to be able to push back against the tough market conditions. But having been able to withstand 2008’s GFC, it’s hard to believe that any of Home Depot’s nails could be used for its coffin.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)