Under the Spotlight Wall St: Abercrombie & Fitch Co. (ANF)

One of America’s most famous fashion brands, Abercrombie & Fitch has gone through ups and downs for decades. Could it be making a big comeback? Let’s put it Under the Spotlight.

Abercrombie & Fitch ($ANF) has been a staple across the American retail landscape for more than 130 years. But its journey has been a rollercoaster ride, marked by periods of explosive growth followed by significant declines.

Founded as Abercrombie Co. in 1892 by David T. Abercrombie, the company was a sporting goods and outdoor equipment retailer located in downtown Manhattan, New York. The store quickly gained a reputation for its high-quality merchandise and expert craftsmanship. One of its regular customers, Ezra Fitch, liked it so much that in 1900 he joined as a partner, resulting in a rebranding to Abercrombie & Fitch.

Golden years

The two partners later disagreed over the path they wanted the company to take. Abercrombie wanted to stay true to the core business, focusing on outdoor goods for professional explorers, while Fitch wanted to expand the firm’s product lines to entice a broader customer base. Eventually, Fitch won the tug of war. Abercrombie sold his stake to his partner and departed the business in 1907.

The company went from strength to strength, with the early 20th century marking a golden era for the retailer. Abercrombie & Fitch became synonymous with adventure, exploration and luxury, and the firm solidified its position as the premier outfitter for outdoor enthusiasts.

The retailer attracted a prestigious clientele, including renowned explorers and celebrities, like Charles Lindbergh and Ernest Hemingway, and even U.S. presidents Theodore Roosevelt and William Taft. Importantly, the brand remained appealing to society’s A-list through the decades, with presidents Dwight D. Eisenhower and John F. Kennedy sporting the high-end brand’s clothes in the 1950s and 60s.

Out of fashion

The company’s fortunes changed in the 1970s, and an increase in overheads, accompanied by a failure to fend off competition from lower-cost competitors, led to its demise. With sales erratic and the firm’s once hefty earnings turning into losses, Abercrombie & Fitch filed for bankruptcy in 1976.

The brand survived, though, acquired by Oshman's Sporting Goods, a Texas-based chain. Abercrombie & Fitch’s new owner focused on big stores featuring unique products and also on mail orders. But it failed to modernise the retailer and sold its stake in 1988 to Limited Brands, a company known for its success in popularising names like Express and Victoria’s Secret.

Strategic shift

Under the leadership of marketing guru Mike Jeffries, Abercrombie & Fitch underwent a radical transformation in the 1990s. Jeffries aimed to create a youth-focused brand characterised by exclusivity and a focus on physical attractiveness. Abercrombie & Fitch stores became known for their dim lighting, pulsating music and overpowering cologne scents. Under Jeffries, Abercrombie & Fitch went from strength to strength and was listed as a publicly traded company in 1996.

In 2000, Abercrombie & Fitch launched its subsidiary company, Hollister, which focused on T-shirts, polo shirts, low-rise jeans, miniskirts and other trendy garments. Aimed at making teenagers the coolest-looking kids in high school, Hollister eventually grew to become bigger than its parent company, with the brand having higher revenues than the Abercrombie & Fitch brand until a couple of years ago. While its strategy “to go after the attractive all-American kid” initially paid off for Abercrombie & Fitch, its exclusivity and focus on a certain market would contribute to its downfall as consumer preferences shifted. Furthermore, the company was hit with a wave of negativity surrounding accusations of discrimination, with the firm even labelled by some as America’s most hated. With sales rapidly declining, the company's stock price plummeted by more than 80% between 2011 and 2017 and it closed numerous stores globally.

Fresh start

Faced with huge financial pressures and a tarnished brand image, Abercrombie & Fitch embarked on a significant turnaround strategy. In 2014, Jeffries stepped down, paving the way for a new leadership team. The company prioritised inclusivity, expanding its sizing options, featuring diverse models in advertising campaigns and toning down the in-store experience.

Under Jeffries’ administration, there was significant overlap between Abercrombie & Fitch’s and Hollister’s product lines. However, that has since changed, and while Hollister is still focusing on teens and young adults aged 13-21, Abercrombie & Fitch has had its sights locked in on millennials who had previously purchased the brand during their teens, but who now need smart-casual business attire.

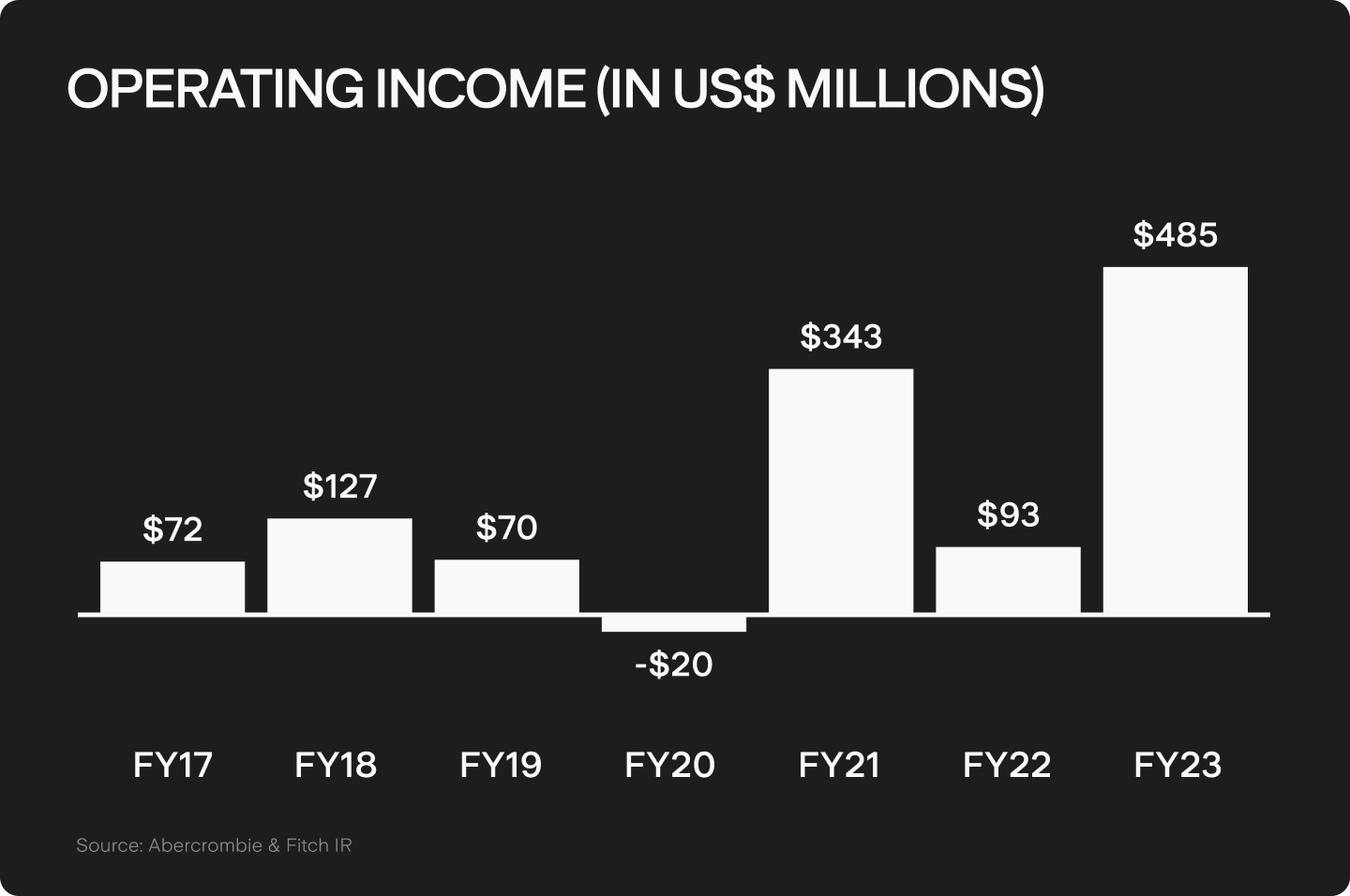

The shift has led to higher income margins, with fancier clothing for an older generation unsurprisingly selling for higher prices than jeans for teens. In FY2023, the company’s operating income was US$485m. For the first time in more than a decade operating income margins were above 10%, with the board expecting numbers to stay within the 8%-10% range in the near term.

Diverse channels

Abercrombie & Fitch has also embraced the omnichannel retail approach, investing in e-commerce and mobile platforms. However, while 60% of the Abercrombie & Fitch brand’s sales were digital in FY2023, the Hollister brand still relies on physical stores for the lion’s share of its sales. Only 30% of sales come through its e-commerce platform, with many teens shopping at stores alongside their parents.

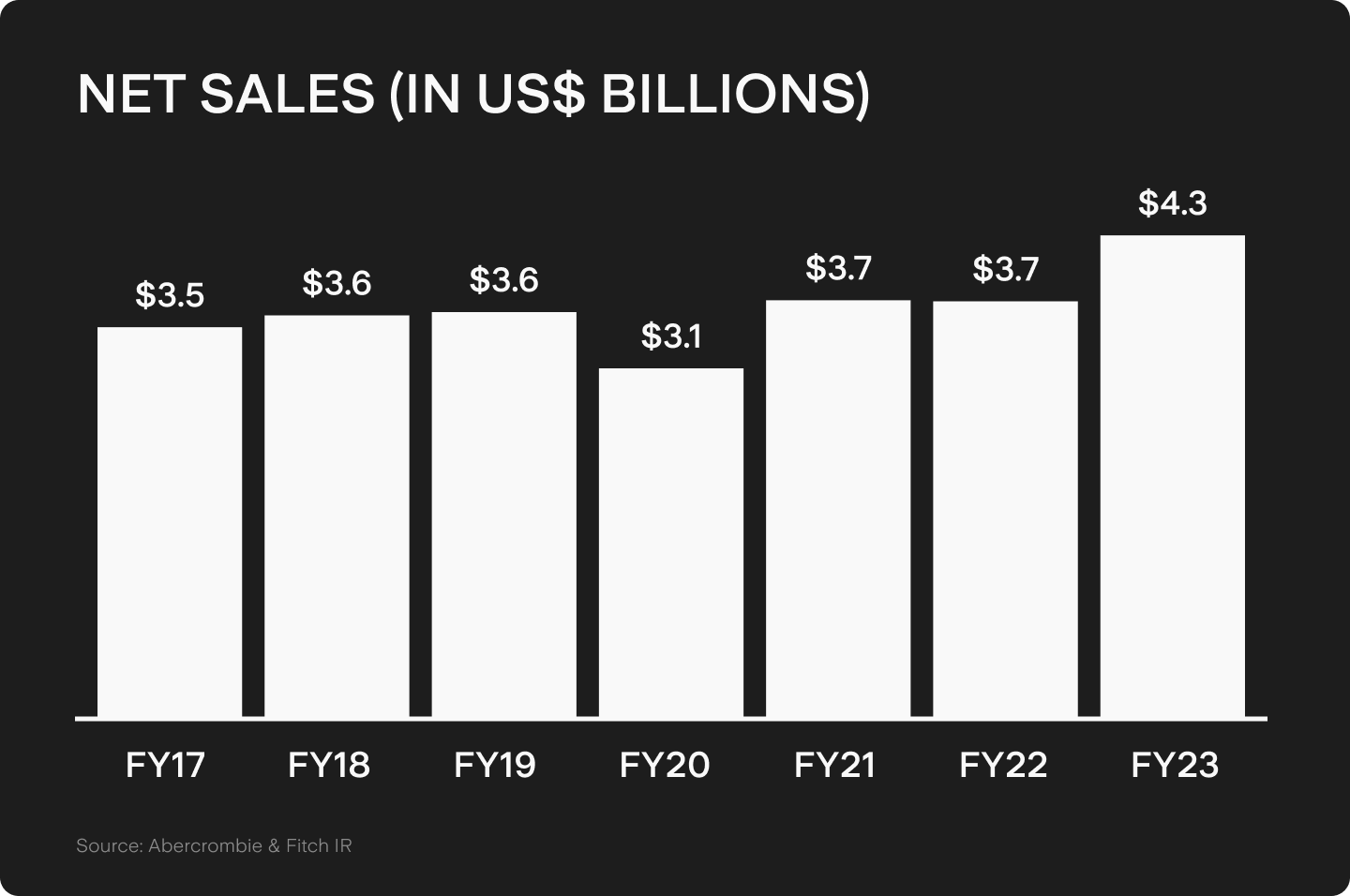

Currently, the Abercrombie & Fitch brand has 247 stores globally, while Hollister is a more capital intensive business, with 518 stores worldwide. If that was originally offset by Hollister’s bigger growth and higher revenue, that is no longer the case. While in FY2023 the teen-focused retailer had revenue of US$2.08b, down from 2019’s US$2.16b, the Abercrombie & Fitch brand made US$2.20b, up from US$1.46b five years ago. Overall, the parent company totalled about US$4.3b in sales in FY2023, a large uptick on the US$3.7b it achieved in both FY2021 and FY2022. The company aims to reach more than $US5b in sales after 2025.

Future outlook

On the back of improvements in revenue and profitability, Abercombie & Fitch’s share price has soared. Since 2019, its stock has risen more than 300%, while the S&P 500 Apparel & Accessories index has actually fallen during the same period. The company’s higher growth rate comes at a price, though, and while shares in the apparel sector trade at around 15x price to earnings, Abercombie & Fitch’s shares currently trade at around 17x, somewhat pricier than its counterparts.

In a fast-paced industry like fashion retail, liquidity risks can present a real threat to a company, but Abercombie & Fitch seems well prepared to face any challenging times ahead. The firm currently has US$901m in cash and equivalents and has also lowered its inventories, down from US$506m in Q4 2022 to US$469m in Q4 2023. With currently no short-term borrowings and US$299m of credit available in an asset based lending facility, the firm has US$1.2b in available liquidity.

One of the biggest risks to the company could also be one of its biggest opportunities: international expansion. Nowadays, more than 80% of Abercrombie and Fitch’s revenue comes from the Americas, with Europe, Middle East and Africa (EMEA) accounting for 16% and the Asia-Pacific (APAC) region making up 4%. But while growth in the EMEA regions has been steady, with sales growing 13% YoY, APAC sales are growing quicker at 21% YoY.

With only 50 stores in APAC, there could be plenty of room for expansion, especially considering it is the only region where Abercrombie & Fitch had no store closures in FY2023. And much like venturing into smart-casual business clothing was the company’s lifesaver, an unprecedented international expansion could be what it takes to make the brand’s iconic moose achieve even bigger popularity and bring it completely back into fashion.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)