What are the best quantum computing stocks to buy in 2025?

Quantum computers represent an entirely new way of computing, leveraging advanced physics to solve challenging problems far quicker than traditional approaches. In the race to build a universal quantum computer capable of commercial deployment, consider these ten leading stocks.

Discover these quantum computing companies to invest in

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

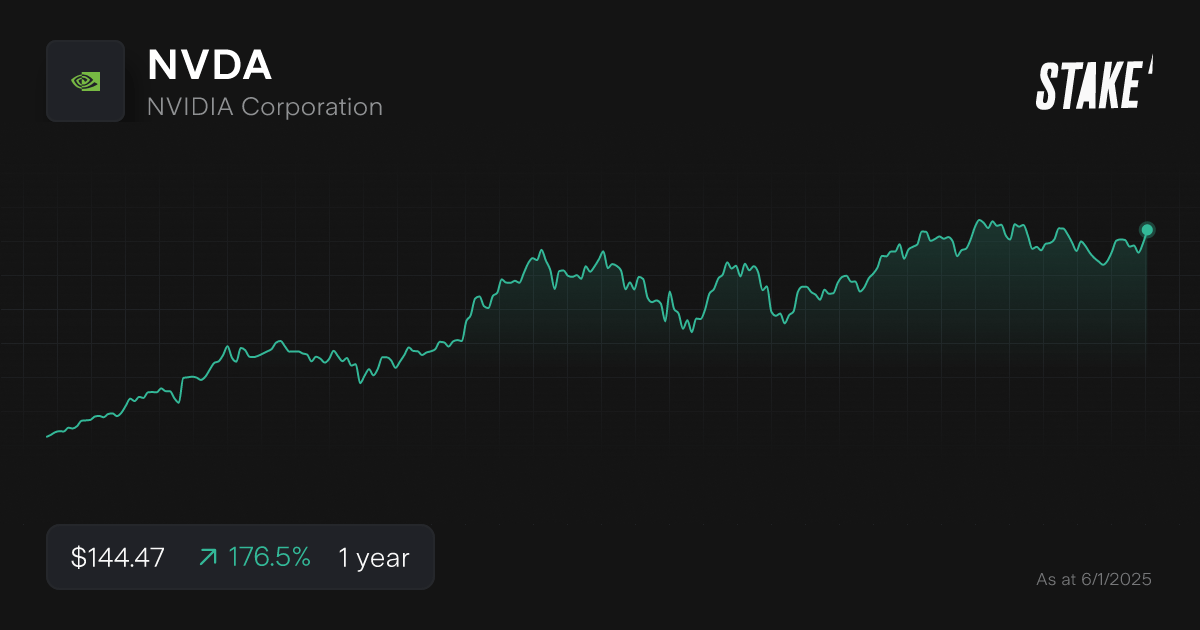

Nvidia | US$144.47 | +176.50% | US$3.54t | |

Microsoft | US$423.35 | +12.99% | US$3.15t | |

Alphabet | US$191.49 | +38.14% | US$2.35t | |

IBM | US$222.65 | +38.17% | US$205.87b | |

Honeywell | US$226.62 | +11.77% | US$147.29b | |

Intel | US$20.56 | -57.56% | US$88.68b | |

IonQ | US$47.77 | +277.93% | US$10.34b | |

Rigetti Computing | US$19.02 | +1,568.42% | US$4.61b | |

D-Wave Systems | US$9.14 | +938.64% | US$2.66b | |

Quantum Computing Inc. | US$17.50 | +1,889.09% | US$2.11b |

Data as of 3 January 2025. Source: Stake, Google.

*The list of quantum computing stocks mentioned is ranked by market capitalisation. When deciding what companies to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

Decide which is the best quantum computing stock to watch in 2025

1. Nvidia Corporation ($NVDA)

- 198,283 Stake customers watching

- 216,142 orders executed on Stake

Nvidia may be best known as the chipmaker fuelling the artificial intelligence revolution, but the company is also taking a leading role in the development of quantum computing technology. The company’s cloud architecture offers remote access to quantum computers, while its CUDA-Q architecture bridges classical and quantum programming.

Notably, Nvidia has been working closely with Alphabet to build out the latter company’s quantum architecture.[1] Although Nvidia is not building a quantum computer itself, this relationship shows how the company is still actively involved in the development of the technology.

Nvidia’s net income has risen by 92.1% over the past five years and analysts expect robust sales growth in the near future.

🤖 Related: Deep dive into the most popular AI stocks moving into 2025

2. Microsoft Corporation ($MSFT)

- 51,209 Stake customers watching

- 170,081 orders executed on Stake

Microsoft, one of the world’s most valuable companies, has been aggressively pursuing quantum computing as a growth strategy. On the R&D side, Microsoft has been pioneering topological qubit technology, which the company believes is the most feasible path to a scalable quantum computer.

On the practical side, Microsoft has been leveraging the firm’s existing cloud computing architecture to facilitate hybrid solutions that blend classical and quantum approaches.[2] Notably, Microsoft plans to unveil a commercial quantum computer in 2025.

Microsoft’s net income has risen by 17.1% annualised over the past five years and analysts expect double-digit sales growth through 2026.

3. Alphabet Inc. ($GOOGL)

- 34,819 Stake customers watching

- 104,366 orders executed on Stake

Alphabet, Google’s parent company, needs no introduction. Long one of Silicon Valley’s most innovative companies, Alphabet has achieved significant breakthroughs in the company’s quest to build a general-purpose quantum computer.[3]

Recently, Alphabet unveiled the company’s ‘Willow’ quantum computing chip, capable of solving a benchmark problem in mere minutes that would take classical supercomputers longer than the age of the universe.[4] Investors should note, however, that Alphabet’s legacy operations in search and software will continue dominating the bottom line for years to come.

Over the past five years, Alphabet’s net income has risen by 23.7% on an annualised basis, and analysts are forecasting 10-15% revenue growth for the next few years.

4. IBM ($IBM)

- 6,073 Stake customers watching

- 8,380 orders executed on Stake

While IBM is widely perceived as having fallen behind Silicon Valley peers in the modern era, the company is at the forefront of quantum computing. In fact, in 2019, IBM unveiled the first commercially available circuit-based quantum computer (IBM Q System One).

The company has also been a market leader in developing practical applications for quantum computing, working with European energy companies to model weather risk in a way not feasible with classical computers.[5] In addition, IBM says its Q System Two will be operational in 2025.

IBM’s net income has dipped by 3.7% annualised over the past five years, but analysts are forecasting a modest rebound in sales growth by 2026.

5. Honeywell International Inc. ($HON)

- 1,134 Stake customers watching

- 1,464 orders executed on Stake

Honeywell is a multinational tech conglomerate based in North Carolina. In the quantum computing space, the company is notable for launching and founding Quantinuum, whose machines recently broke records for high-fidelity quantum volumes.[6]

Last year, Quantinuum’s latest funding round valued the company at more than $5 billion, with participation from companies like JPMorgan Chase and Amgen. Early reports indicate that Honeywell, which holds more than 50% of the company, could be exploring an IPO of the company in 2025. Honeywell investors would likely receive shares in the newly spun-off public company.

6. Intel Corporation ($INTC)

- 16,738 Stake customers watching

- 44,611 orders executed on Stake

Intel is best known for designing and manufacturing classical computer chips, a skill that the company is now translating into the quantum realm. Intel is focused on a technology known as silicon spin qubits, which Intel can deploy more rapidly due to their similarity to existing chip architecture.[7]

While Intel has made significant strides in quantum computing, investors should note that the company may continue to be held back by their struggles in AI. Intel’s sales have dipped by 5% annualised over the past five years, although analysts expect this trend to stabilise in the near future.

7. IonQ ($IONQ)

- 3,436 Stake customers watching

- 18,328 orders executed on Stake

IonQ is a quantum computing firm based in Maryland that specialises in trapped-ion technology. Unlike superconducting qubit technology (the industry standard approach), trapped-ion quantum computers can operate at room temperature, making them potentially more scalable.

In addition to the firm’s proprietary technology, IonQ recently unveiled America’s first quantum computer manufacturing plant, which houses the company’s R&D and production teams.[8] Recently, IonQ collaborated with Nvidia to develop a cutting-edge quantum approach to molecular modelling.[9] IonQ’s revenue is still in the early stages of growth, but analysts expect sales to rise to $147M by 2026.

🆚 Compare IONQ vs RGTI→

8. Rigetti Computing ($RGTI)

- 1,460 Stake customers watching

- 4,311 orders executed on Stake

Rigetti Computing is a California-based startup focused on building quantum processors and full-scale quantum systems. The company went public via SPAC in 2021 and serves prestigious customers like MIT, NASA, and Oxford Instruments.

Rigetti stock has soared toward the end of 2024, in part due to the company’s rollout of their latest Ankaa-3 system.[10] Still, Rigetti is a more speculative quantum computing play than established tech firms. Rigetti has yet to turn a profit, but analysts are expecting substantial sales growth over the next few years.

9. D-Wave Systems ($QBTS)

- 1,460 Stake customers watching

- 4,311 orders executed on Stake

D-Wave was one of the earliest innovators in quantum computing, signing contracts with customers like Lockheed Martin back in 2010. D-Wave leverages a technique called quantum annealing in its systems, which is designed to solve optimisation problems more rapidly than classical approaches.

While D-Wave’s decision to focus on quantum annealing has enabled it to pursue commercialisation before many other firms, this approach may have less flexibility than the gate-based systems that firms like Microsoft and Alphabet are pursuing. While D-Wave has yet to turn a profit, analysts are expecting sales to nearly double in each of the next two years.

10. Quantum Computing Inc. ($QUBT)

- 993 Stake customers watching

- 2,084 orders executed on Stake

Quantum Computing Inc. is a New Jersey-based company that specialises in photonic quantum computing, a technology that can operate at room temperature and potentially offers superior energy efficiency. Due to the concept of ‘photon loss,’ however, this approach may also be more susceptible to errors.

Quantum Computing Inc. is notable for being both a designer and manufacturer, having one of the few quantum foundries in the world. Their new facility in Arizona, which is set to produce high-performance photonic chips, is scheduled to open in 2025.[11] While the company has yet to turn a profit, analysts are forecasting sales to climb to $1.5M by next year.

🆚 Compare QBTS vs QUBT→

How to invest in quantum computing stocks?

The main way to invest in quantum computing is through shares listed on the Nasdaq and NYSE stock exchanges, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy quantum computing stocks on the U.S. stock market, you'll need to sign up to an investing platform with access to Wall St. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What quantum computing ETFs can I invest in?

Due to the novelty of the technology, there are limited options to invest in quantum computing ETFs. Today, the Defiance Quantum ETF ($QTUM) is the only fund exclusively focused on this sector.

This fund tracks a diversified portfolio of quantum-exposed stocks, with top holdings of Rigetti, D-Wave, and IonQ. $QTUM currently has $664M in assets and an expense ratio of 0.4%. For investors looking to back quantum computing technology as a whole, rather than the fortunes of any particular company, QTUM could be a compelling option.

🤖 Related: Discover the top 10 data centre companies on the ASX

Which company is leading quantum technology?

Unfortunately, because quantum computing technology comprises many different approaches, it’s not really possible to determine which company is the market leader today. The coming years will help determine which approach is the most commercially viable, meaning the leaders will only be obvious in retrospect.

In the traditional superconducting quantum computing vertical, companies like IBM ($IBM) and Alphabet ($GOOGL) are well ahead of the competition. Smaller firms like IonQ ($IONQ) and D-Wave ($QBTS), however, appear to be making significant strides in technologies like trapped-ion quantum and quantum annealing.

Before backing any one company, investors should conduct careful research into the underlying technology and what benefits it might offer over alternative approaches. Ultimately, a diversified portfolio of quantum computing stocks could be a smarter approach, given the uncertainty inherent in how the technology will play out in practice.

Disclaimer

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.

Article sources

[1] NVIDIA Accelerates Google Quantum AI Processor Design With Simulation of Quantum Device Physics

[2] Microsoft unveils new quantum computing hybrid solution in Azure

[4] Google Unveils New Quantum Computer With Mind-Boggling Speed - Bloomberg

[5] The Age of Quantum Software Has Already Started - WSJ

[6] Quantinuum Notches Milestones For Hardware Fidelity And Quantum Volume

[7] Quantum Computing and Systems with Intel Labs

[8] Nation’s first quantum computing manufacturing plant opens in Bothell

[9] IonQ to Advance Hybrid Quantum Computing with New Chemistry Application and NVIDIA CUDA-Q