Overheating

Nvidia reported yet another blowout quarter. So why does Wall Street react like the AI party is starting to fade?

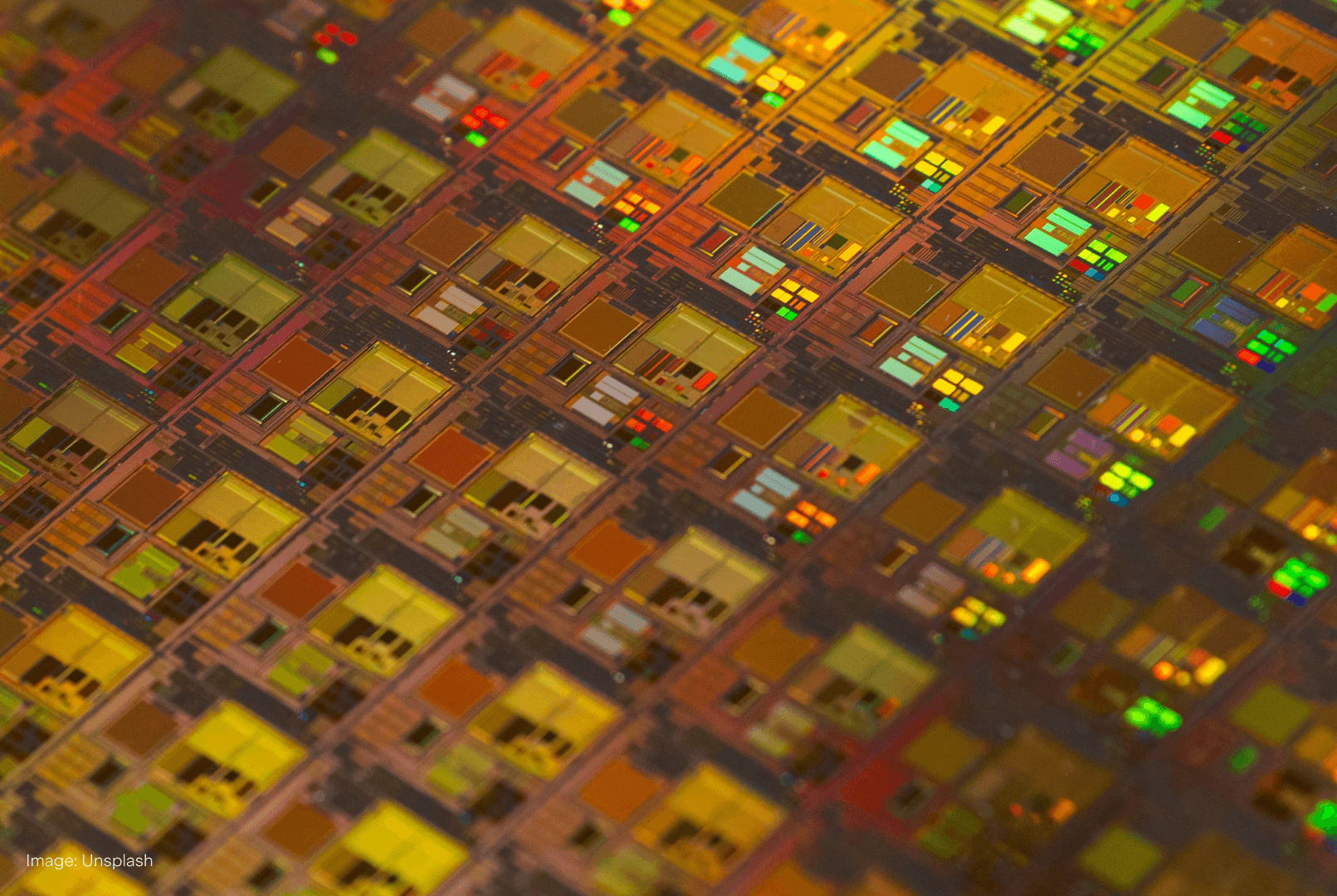

Nvidia ($NVDA) reported an EPS of US$0.81 vs the expected US$0.75. Its Q3 revenue grew 94% YoY to US$35.08b vs $33.16b expected. Naturally, data centre revenue accounted for the bulk of it, fuelled by red hot chip demand and growing 112% YoY to $30.8 billion.

In an earnings call after the bell, CEO Jensen Huang and CFO Colette Kress described a ‘staggering’ demand for the firm’s current generation of Hopper GPUs and the next generation of Blackwell GPUs.

That demand comes from the likes of Microsoft ($MSFT), Amazon ($AMZN), Meta ($META), Apple ($AAPL) and Alphabet ($GOOGL) – these clients make up 40% of Nvidia’s revenue. They’ve all upped capex spending on AI infrastructure and are lining up to receive Blackwell shipments. As Huang put it, ‘the age of AI is upon us.’

And then there was Nvidia’s Q4 revenue guidance of US$37.5b – also slightly ahead of the expected US$37b. Blackwell is an important part of that picture, and Nvidia execs say that demand for these units will exceed supply for several quarters. A good problem to have, right?

The thing is, Blackwell hasn’t been shipped yet, so there’s a lot riding on future revenue estimates. A media report earlier in the week about Blackwell AI servers overheating sent Nvidia shares down 2.9% pre-market. Shares were also down roughly 2% after hours on results day, even though Nvidia delivered another perfect score in Q3.

That kind of market reaction makes you wonder if the AI servers are the only things overheating. Could Nvidia’s share price be a little too hot right now? Nvidia has become the most valuable company in the world, with a market cap of US$3.48t. Its P/E sits at 55.21 – roughly double the P/E for the S&P 500, but potentially justified for a company of this calibre.

Nvidia has proved time and again that it can still post explosive growth. It's likely that this time around, investors anticipated another beat well in advance, bidding up the price in the lead-up to earnings, so that a dip after the event was almost inevitable.

Or maybe there’s a segment of the market with genuine doubts about Nvidia’s long-term outlook. If so, this wouldn’t include Barclays, Goldman Sachs ($GS), Citi ($C), JPMorgan ($JPM) and Bernstein. These elite brokers all increased their Nvidia price targets after last week’s earnings report. Even PhillipCapital – a firm that downgraded Nvidia from a ‘buy’ to ‘accumulate’ – couldn’t help but increase their price target in the process.

Wedbush Securities MD Dan Ives describes Nvidia’s trajectory as ‘this is LeBron in high school in terms of where this story is ultimately going.’ And if we go by what he’s saying, ‘it’s still 9:30-10pm in this AI party that goes to 4am.’