Stake Ambitious Investors Report

Discover the motivations, values and strategies of 1,500 Aussie investors as they adapt to a slowing economy, interest rate hikes and high living costs.

Latest update: The 2025 Ambition Report explores what we call Investor EQ – the confidence and ambition that drive people to take control of their financial future.

Update: In July 2024, Stake released The Ambition Report, with double the respondents and covering New Zealand investors as well. Read the updated insights here.

The pandemic was a catalyst in attracting more Australians to investing – 1.2 million more since 2020, according to ASX data. But with the global economic slowdown, rising interest rates and higher living costs, some have questioned if the retail investment boom is sustainable over the long term.

The 2023 Stake Ambitious Investors Report explores the motivations, values and strategies of 1,500 non-retired Australian investors (holding at least one investment in the share market). The findings highlight how the investment boom is far from being short term, but rather a reaction to the changes we’re seeing in the Australian economy. From the research it’s clear that investing is no longer seen as a supplement to wealth creation, but a central part of it.

PART 1: INVESTOR AMBITIONS

DEFINING FINANCIAL SUCCESS: FREEDOM OVER LUXURY

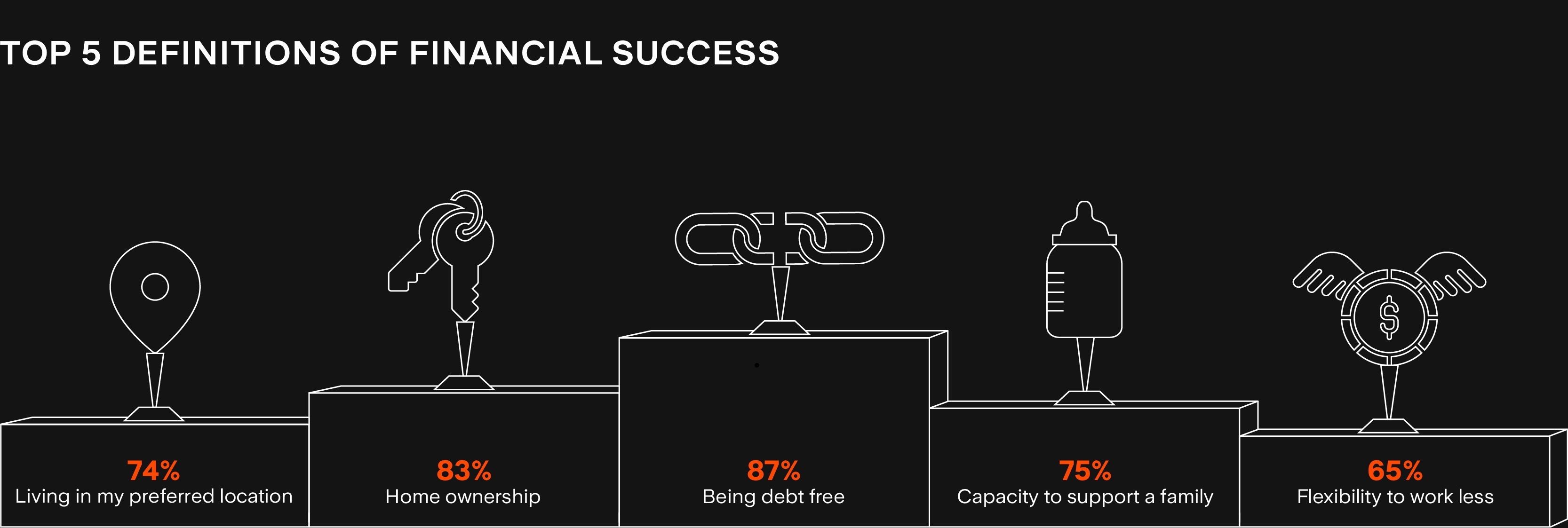

To understand what’s motivating Australian investors, it’s important to know how they define financial success. On the whole, they are ambitious but relatively modest, with a focus on balanced lifestyles rather than chasing luxury items.

Material goods and classic ‘status symbols’ ranked low. Only 13% say having an expensive car is important, and just over a fifth (21%) say that having a large or expensive home is key.

The top five answers were mostly consistent across different age groups, genders and levels of investing experience, but Gen Z has the highest percentage (81%) of those that say supporting a family is important. Investors aged over 45 begin to place more emphasis on living in the area of their choosing over the capacity to support a family.

LIFE MILESTONES BEING DELAYED

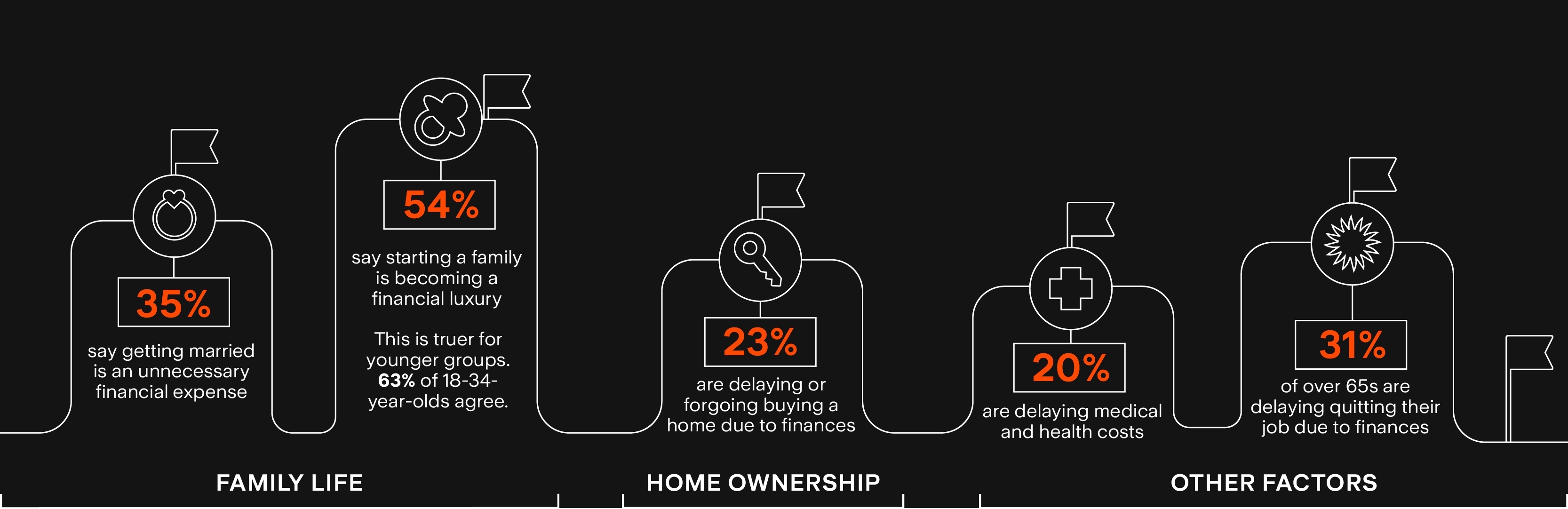

Yet even these grounded definitions of financial success are proving hard to reach for investors.

For starters, more than half (54%) – and almost two thirds of those aged 18-34 – agree that starting a family is becoming a financial luxury. With the Australian Consumer and Competition Commission reporting that childcare costs have risen quicker than both inflation and wages for the past five years, it’s no surprise that a fifth of 18 to 34-year-old investors are delaying starting a family due to financial reasons.

Housing is another classic marker of financial success, but almost a quarter (23%) of all investors are delaying or forgoing buying a home due to financial reasons. And this is much higher for younger investors – 53% of 18 to 24-year-olds and 38% of those 25-34 are significantly delaying or forgoing their home purchases.

Despite Australia’s superannuation guarantee, 31% of pre-retirement investors over 65 are delaying quitting their jobs due to financial reasons – as are 31% of those aged 55-64. And a fifth of investors say they’re even delaying health-related costs.

CONFIDENCE IN THE MARKETS OUTSTRIPS CONFIDENCE IN WAGES

Overall, 59% are confident about their financial future. Yet just 38% of investors are confident that their wages will keep pace with the cost of living throughout their working lives.

And despite some economic fears of a wage price spiral, 47% of Australian investors expect a below inflation wage increase of 1-5% over the next year, while almost a fifth (19%) expect no wage increase at all, and 7% expect wages to actually decrease.

In comparison, investors are much more positive about long-term Australian market returns. 64% have an actively positive 10-year outlook, and just 5% have a specifically negative outlook. This is similar over a 20-year time span, with 62% having an actively positive outlook and 5% having an actively negative view. Given that the S&P/ASX 200 has delivered an average annual return of around 9% over the past decade (dividends included), compared to annual nominal wage growth of less than 3%, investors are placing more faith in the markets for wealth creation.

INVESTORS TURN TO THE MARKETS TO SECURE THEIR FUTURE

Investment goals further suggest that Australians are turning to markets to secure their future. Three of the top five most common investment goals are directly related to reducing or replacing the need to work.

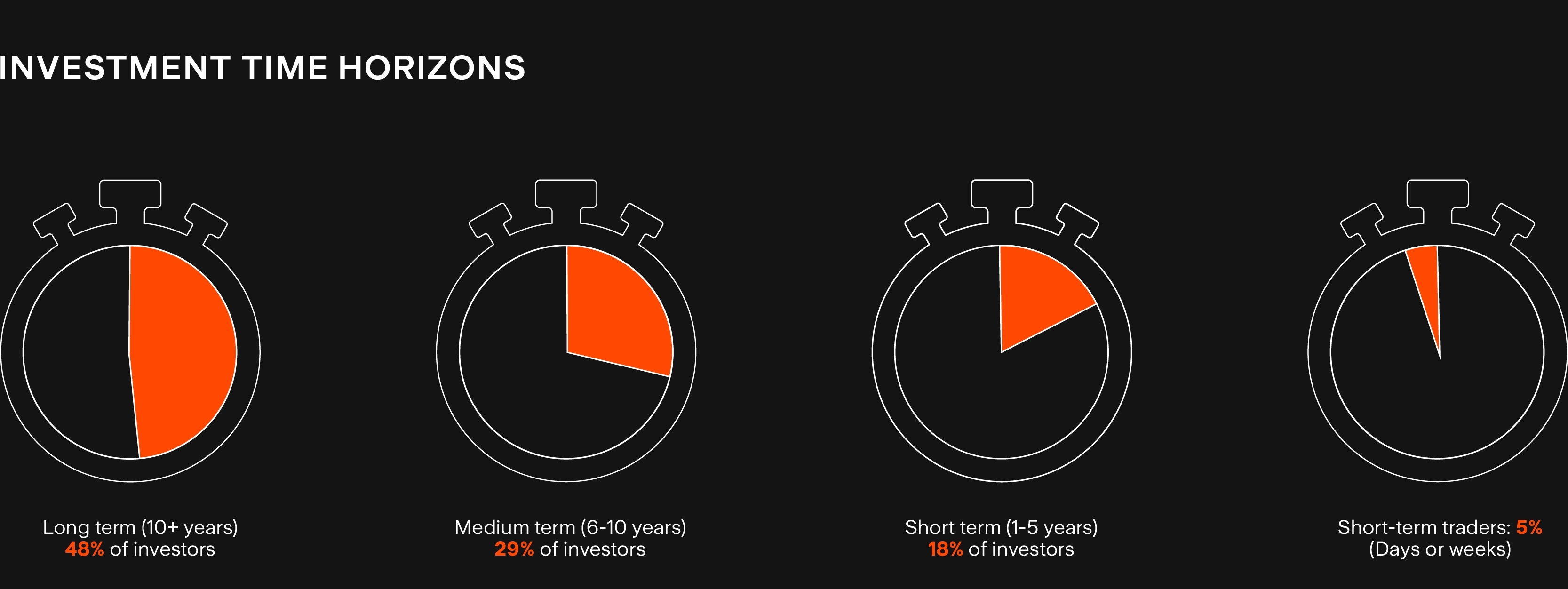

In contrast, only 12% are investing to buy more consumer goods. Given this, it’s no surprise that most investors have a multi-year time horizon. Around half (48%) expect to hold onto the average investment for over 10 years before selling, while 29% expect a timeframe of 6-10 years. Just under 5% consider themselves to be short-term traders.

PART 2: COST OF LIVING AND INVESTING

INVESTORS ARE CUTTING BACK BUT STAYING IN THE MARKETS

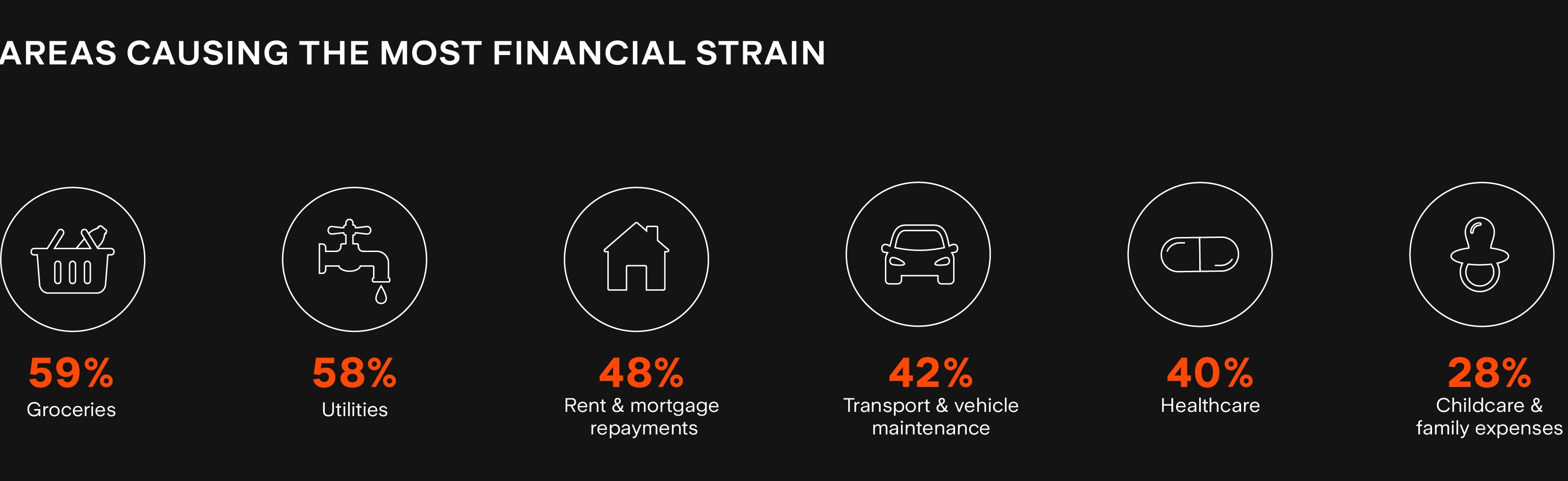

Like most people in Australia, investors have been impacted by increased living costs – 61% have been forced to cut back on their outgoings over the past six months. But they remain focused on investment goals, with cutbacks overwhelmingly focused on discretionary spending.

Some cohorts are feeling the pinch more than others. 69% of women have been forced to cut back on outgoings, compared to just 54% of men. And 18-24 is the age group most impacted, with 71% cutting back.

After experiencing Covid lockdowns in recent years, younger investors are still cutting down on their social lives. Almost half (49%) of those aged 25-34 are cutting back on out-of-home entertainment, as are 47% of those aged 18-24.

LIVING COSTS PREVENTING INVESTORS FROM INVESTING MORE

39% of investors have cut down on their allocation to savings and investments, but 51% have still made an investment in the past three months – which increases to 65% within the past six months. 67% haven’t sold any of their investments over the past 12 months and only 0.3% have sold everything.

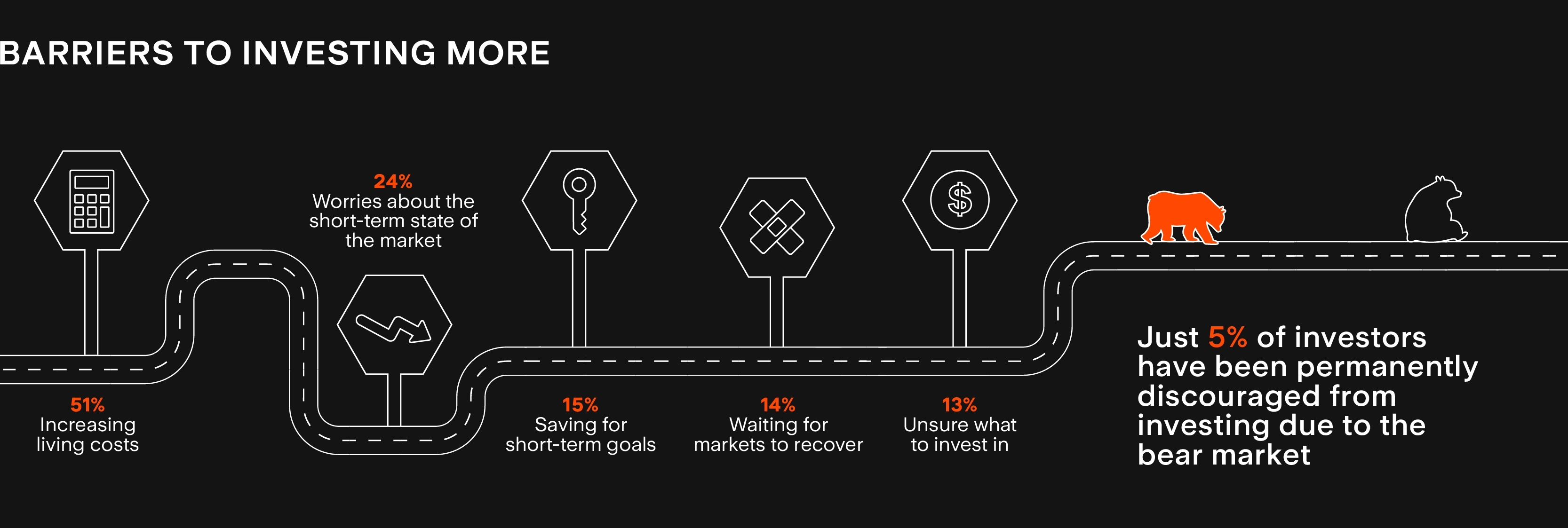

When investors were asked what stops them from investing more, the most common reasons were temporary in nature. Over half of them (51%) mentioned increasing living costs, followed by worries about the short-term state of the market (24%) and a short or medium-term goal like buying a home (15%). The 18-24 and 25-34 age groups were the most likely to point to a short-term goal, correlating to the fact that many are saving to buy their first home.

PART 3: INVESTING KNOWLEDGE AND STRATEGIES

FAMILY AND FRIENDS THE MAIN INFLUENCE ON INVESTMENT KNOWLEDGE

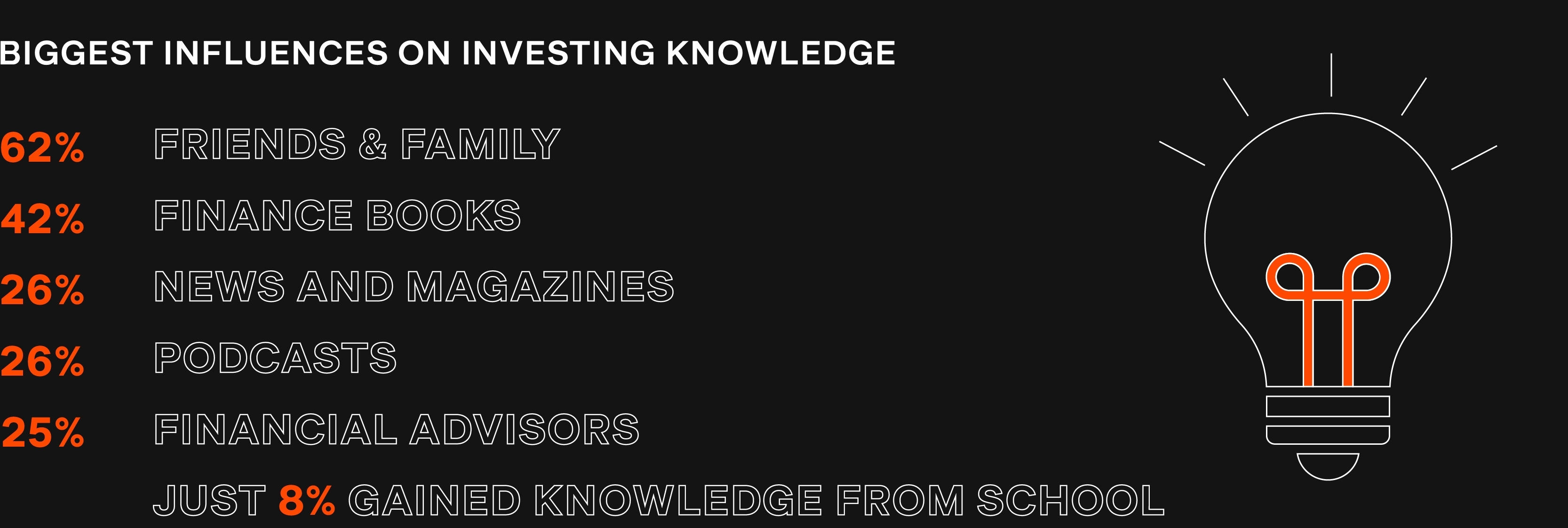

Nothing informs investors quite like their friends and family (62%). This is particularly true for those in the young cohorts of investors: 85% of 18 to 24-year-olds and 66% of those aged 25-34. Given that just 8% attributed their investment knowledge to their school education, this indicates how Australians from families that invest are at an advantage.

The lack of a formal financial education also means investors are taking things into their own hands. Finance and investing books were the second most important source of information for investment knowledge, followed by news websites and magazines at 26%.

Social media platforms such as YouTube were mentioned by 23% of investors, but are more popular with younger cohorts, with 51% of 18 to 24-year-olds using them for information. That said, this is one of many sources – young investors are as likely to read finance and investing books as their older peers.

MOST POPULAR ASSETS

For Australian investors, local shares are the most popular asset type. Over the past 12 months, investors primarily bought Australian stocks (42%) followed by index funds (33%).

Commodities and listed investment companies were bought by 8% and 6% respectively.

For those with less than five years of experience, ETFs were the most popular type of equity. It’s only after 6-10 years of investing that individual shares start to overtake ETFs, suggesting that people become more confident in picking stocks as they expand their knowledge.

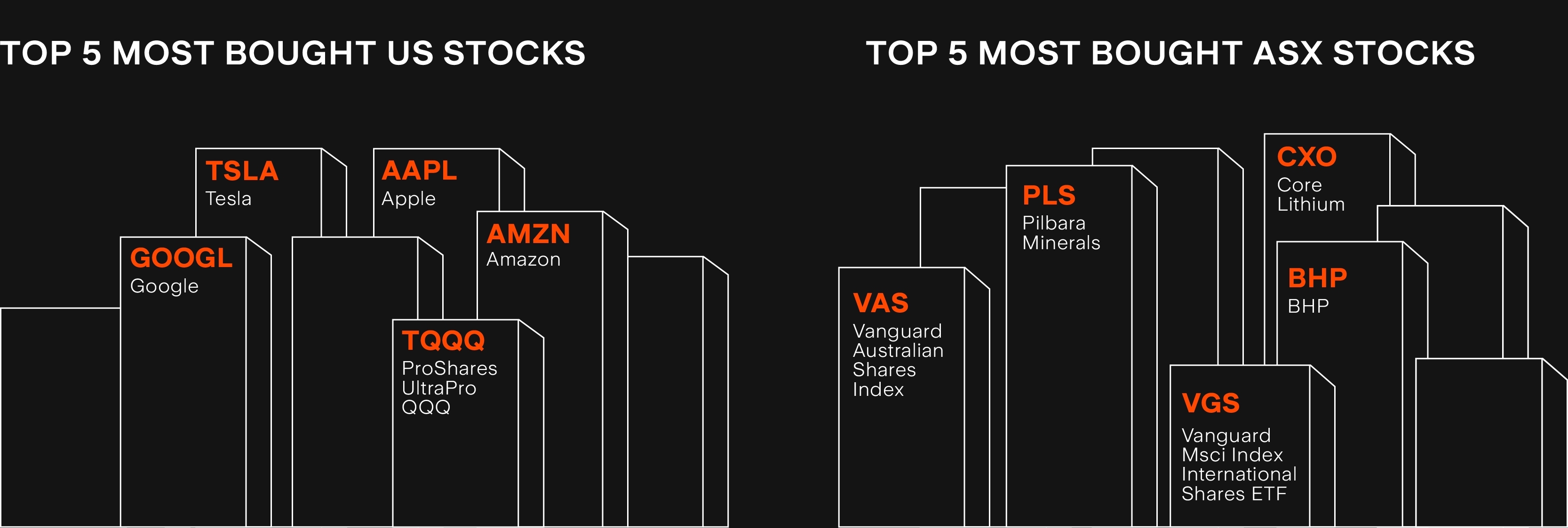

These insights also line up with the trading data that we’ve seen on Stake over the last financial year.

Index funds are popular on Stake AUS, with the Vanguard Australian Shares Index (VAS) and the Vanguard Msci Index International Shares ETF (VGS) proving popular for those seeking diversified passive returns at the core of their portfolio. However, investors were often bolstering this by seeking exposure to high profile trends, including large U.S. technology stocks and Australian resources stocks.

By having a mix of both active and passive investments, retail investors can have the long-term simplicity of broad ETFs, balanced with the flexibility to invest in companies and themes that they believe in. They can hone in on specific areas within their circle of competence, while also benefiting from the diversification in the passive part of their portfolios.

About the Research

The Stake Ambitious Investors report was conducted in partnership with Pureprofile from 22-26 May 2023. It featured 1,510 investors in Australia that do not consider themselves retired.