Top 10 Cybersecurity ETFs to Watch in 2024

The growing importance of cybersecurity is becoming clear with cyber threats and further advancements in AI technology. There is always a challenge in trying to choose the best individual stocks to gain exposure to these movements. Instead, cybersecurity ETFs can provide diversification to the long-term growth potential of this crucial tech sector.

Discover our cybersecurity ETFs list to add to your watchlist

Company Name | Ticker | Share Price | Year to Date | Assets Under Management |

|---|---|---|---|---|

Vanguard Information Technology ETF | US$565.61 | +20.01% | US$74b | |

Technology Select Sector SPDR Fund | US$219.17 | +16.93% | US$68b | |

Fidelity MSCI Information Technology Index ETF | US$168.22 | +20.34% | US$11b | |

First Trust NASDAQ Cybersecurity ETF | US$57.86 | +10.27% | US$6b | |

Amplify Cybersecurity ETF | US$66.56 | +12.07% | US$2b | |

iShares Cybersecurity and Tech ETF | US$47.89 | +8.08% | US$868m | |

Global X Cybersecurity ETF | US$30.20 | +5.82% | US$755m | |

Global X Defense Tech ETF | US$36.41 | +30.74% | US$535m | |

WisdomTree Cybersecurity Fund | US$24.88 | +1.01% | US$105m | |

Xtrackers Cybersecurity Select Equity ETF | US$31.84 | +3.73% | US$6m |

Data as of 18 September 2024. Source: Stake, Google Finance.

*The ETF list is ranked by assets under management (AUM). When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the fund’s holdings, and whether or not they are actively traded on Stake.

Explore these ETFs in the cybersecurity sector

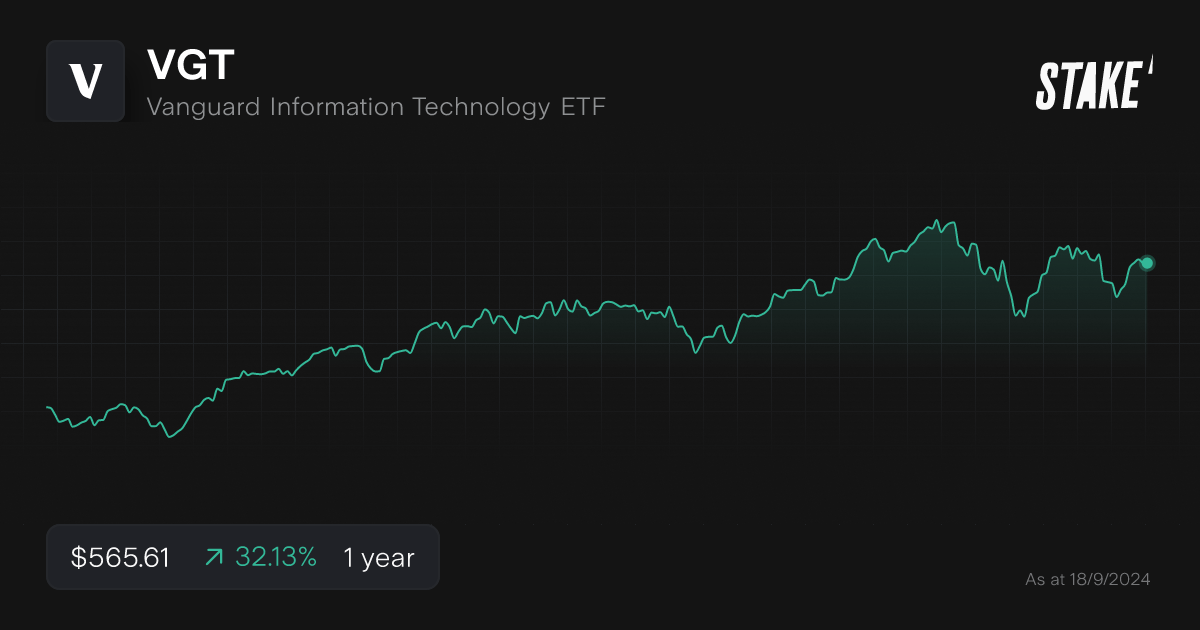

1. Vanguard Information Technology ETF ($VGT)

- Assets under management: US$74b

- Share price (as of 18/09/2024): US$565.61

- Stake investors watching $VGT: 5,957

The Vanguard Information Technology ETF ($VGT) provides exposure to the information technology sector, with 300+ companies and a portion of them from the cybersecurity industry. It offers a diversified portfolio of tech giants and innovators driving advancements in this critical area.

Holdings in the VGT ETF from the cybersecurity sector include industry leaders like Fortinet ($FTNT) and Palo Alto Networks ($PANW). These companies are pivotal in providing advanced security solutions and safeguarding against cyber threats.

The VGT ETF expense ratio is 0.10%.

2. Technology Select Sector SPDR Fund ($XLK)

- Assets under management: US$68

- Share price (as of 18/09/2024): US$219.17

- Stake investors watching $XLK: 1,270

The Technology Select Sector SPDR Fund ($XLK) aims to track the performance of the Technology Select Sector Index. It's designed to provide exposure to technology-related companies within the S&P 500, including those in cybersecurity.

The XLK ETF includes several notable companies within the cybersecurity sector. Microsoft Corp ($MSFT) is a top holding, with a significant focus on cloud security services. Other relevant holdings include Oracle Corp ($ORCL) and Cisco Systems Inc ($CSCO), both known for their cybersecurity solutions.

The XLK ETF's expense ratio is 0.09%.

🆚 Compare these two ETFs from the list: VGT vs XLK

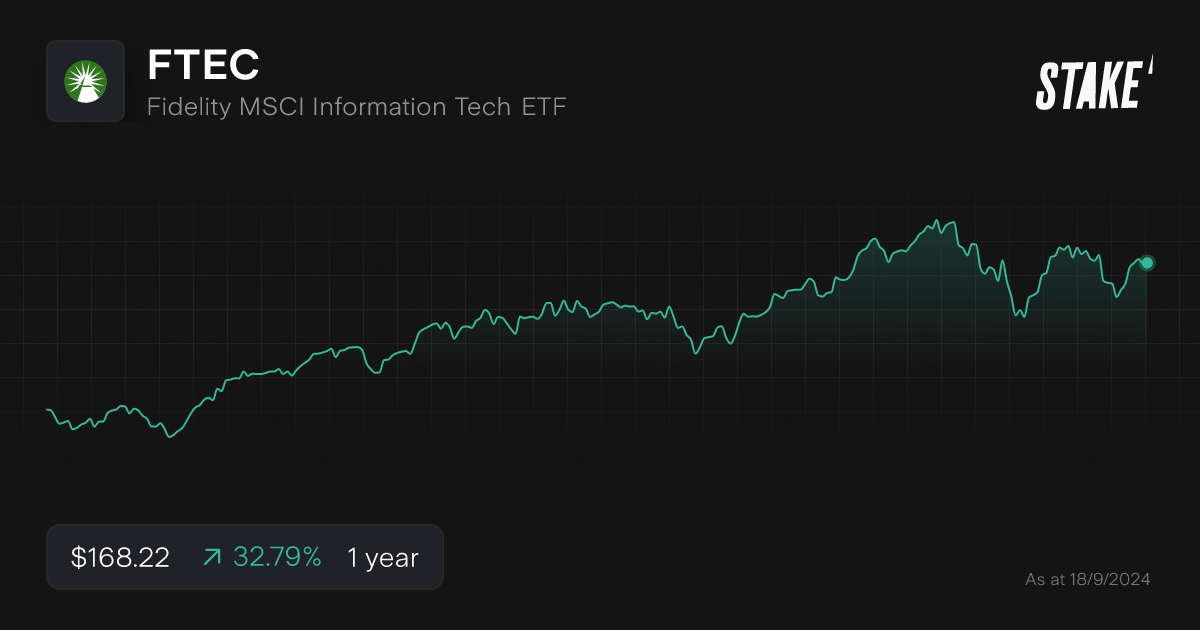

3. Fidelity MSCI Information Technology Index ETF ($FTEC)

- Assets under management: US$11b

- Share price (as of 18/09/2024): US$168.22

- Stake investors watching $FTEC: 456

Fidelity MSCI Information Technology Index ETF ($FTEC) offers exposure to the U.S. information technology sector by tracking the performance of the MSCI USA IMI Information Technology Index. The ETF includes a broad range of companies engaged in software, hardware, IT services, and semiconductors.

Some of the world’s biggest companies are included in the ETF including Apple Inc ($AAPL) and Microsoft Corp ($MSFT). There are several holdings tied to the cybersecurity sector with smaller weightings, such as Cisco Systems, Inc. ($CSCO), Palo Alto Networks Inc ($PANW), Fortinet Inc ($FTNT) and CrowdStrike Holdings Inc ($CRWD).

The FTEC ETF expense ratio is 0.084%.

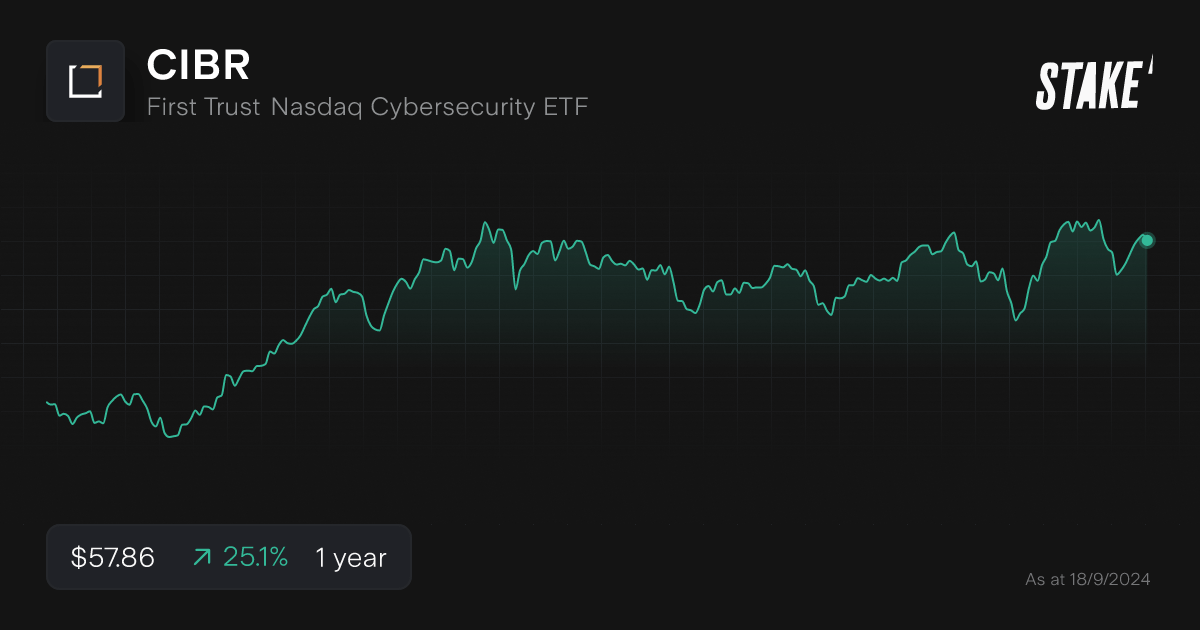

4. First Trust NASDAQ Cybersecurity ETF ($CIBR)

- Assets under management: US$6b

- Share price (as of 18/09/2024): US$57.86

- Stake investors watching $CIBR: 805

The First Trust Nasdaq Cybersecurity ETF ($CIBR) seeks to match the performance of the Nasdaq CTA Cybersecurity™ Index, focusing on companies involved in cybersecurity. These include firms involved in cybersecurity for private and public networks, computers, and mobile devices. Launched in July 2015, it offers investors tight exposure to a range of cybersecurity companies.

The CIBR ETF includes prominent cybersecurity holdings like Infosys Limited ($INFY) at 9.87%, Broadcom Inc. ($AVGO) at 8.80%, Palo Alto Networks, Inc. ($PANW) at 8.36%, and Cisco Systems, Inc. ($CSCO) at 7.82%. Other significant holdings include CrowdStrike Holdings, Inc. ($CRWD) at 6.09% and Fortinet, Inc. ($FTNT) at 4.59%. These make up nearly 50% of CIBR's weighting.

Total expense ratio of First Trust Nasdaq Cybersecurity ETF ($CIBR) is 0.59%.

5. Amplify Cybersecurity ETF ($HACK)

- Assets under management: US$2b

- Share price (as of 18/09/2024): US$66.56

- Stake investors watching $HACK: 1,073

The Amplify Cybersecurity ETF ($HACK) focuses on companies providing cybersecurity solutions and claims to be the first cybersecurity focused exchange-traded fund launched in 2014. As the world becomes more interconnected and digital threats grow, HACK capitalises on the increased demand for robust cybersecurity measures. Thus, it offers investors exposure to a sector that's critical in today's digital age.

The HACK ETF is a small group of hyper focused cybersecurity technology companies. The top 3 holdings by weighting are Broadcom Inc. ($AVGO), Cisco Systems, Inc. ($CSCO) and Palo Alto Networks, Inc. ($PANW).

The HACK ETF's expense ratio is 0.60%.

🆚 Compare these two pure-play cybersecurity ETFs from the list: CIBR vs HACK

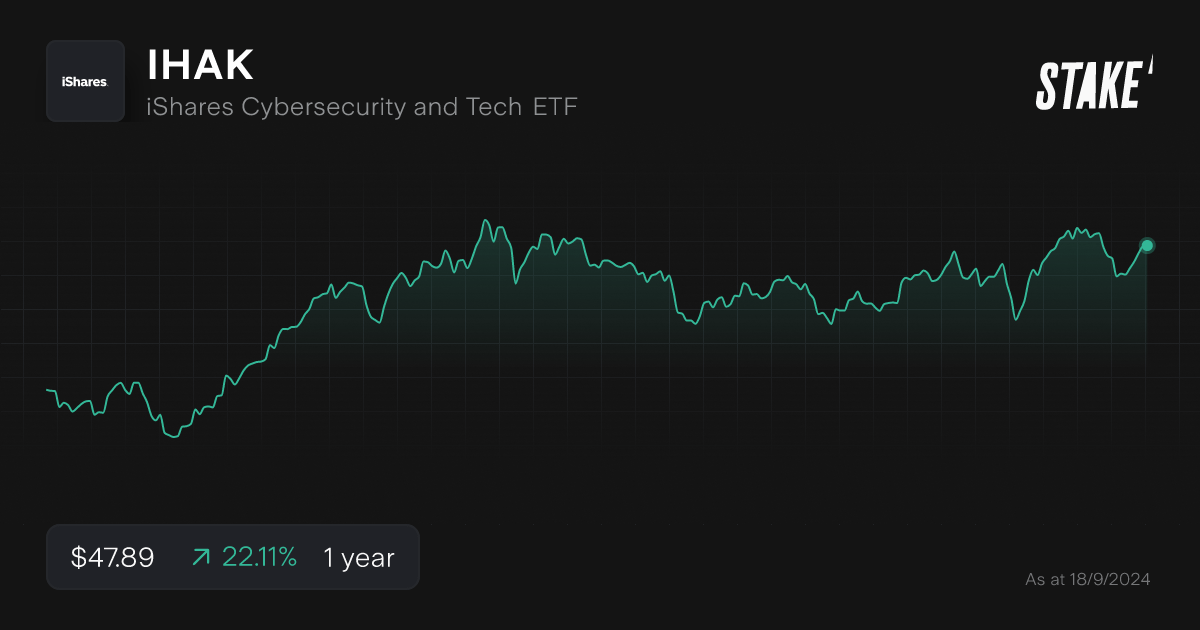

6. iShares Cybersecurity and Tech ETF ($IHAK)

- Assets under management: US$868m

- Share price (as of 18/09/2024): US$47.89

- Stake investors watching $IHAK: 292

The iShares Cybersecurity and Tech ETF ($IHAK) offers exposure to developed and emerging market companies involved in cybersecurity hardware, software, services and products through the NYSE FactSet Global Cyber Security Index. Their focus is on giving investors exposure to innovative companies that will play a crucial role in the future of AI and digital technology.

The IHAK ETF includes several key holdings in companies like CrowdStrike Holdings ($CRWD), SentinelOne Inc. ($S) and Zscaler ($ZS).

The IHAK ETFs expense ratio is 0.47%.

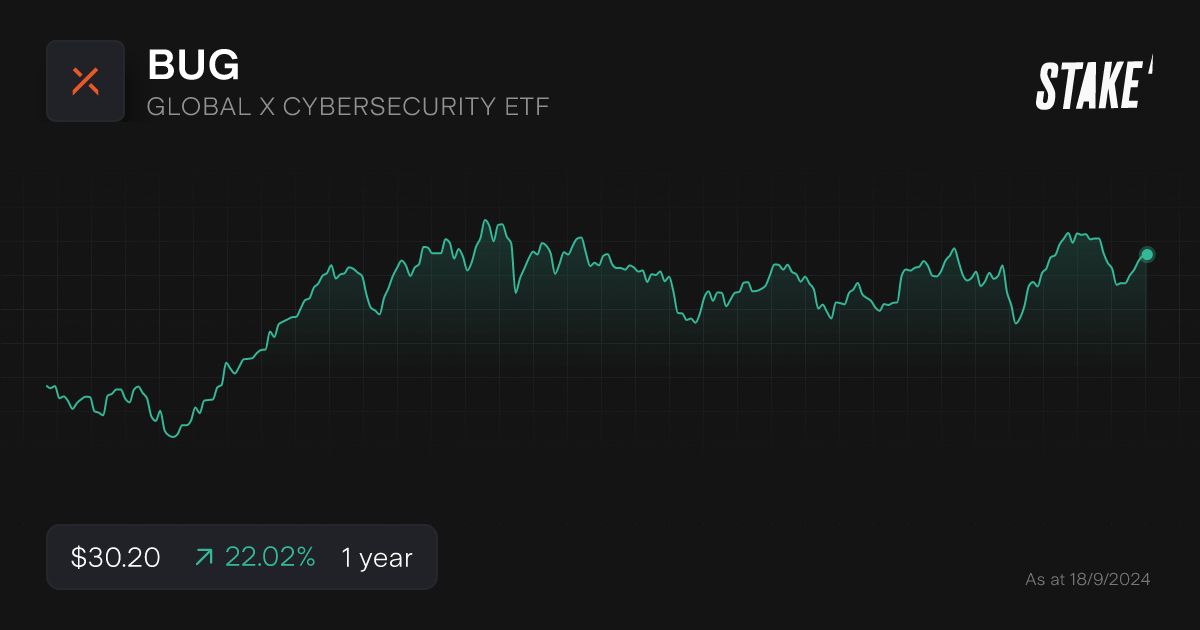

7. Global X Cybersecurity ETF ($BUG)

- Assets under management: US$755m

- Share price (as of 18/09/2024): US$30.20

- Stake investors watching $BUG: 312

The Global X Cybersecurity ETF ($BUG) focuses on the rapidly growing cybersecurity sector. It offers investors exposure to companies that are primarily involved in the development and management of security protocols for protecting networks, computers, and mobile devices. The ETF aims to leverage the increasing necessity of robust cybersecurity measures as digital threats become more sophisticated and prevalent.

The BUG ETF includes a variety of companies pivotal to the advancement of cybersecurity. These holdings are engaged in creating, managing, and implementing security solutions that protect networks and data from cyber threats. Common names in the ETF include firms specialising in cybersecurity software, hardware, and services, such as Check Point Software Technologies ($CHKP), Fortinet ($FTNT) and Palo Alto Networks ($PANW).

The expense ratio of the Global X Cybersecurity ETF ($BUG) is 0.50%.

8. Global X Defense Tech ETF ($SHLD)

- Assets under management: US$535

- Share price (as of 18/09/2024): US$36.41

- Stake investors watching $SHLD: 38

The Global X Defense Tech ETF ($SHLD) offers broad exposure to the defence technology sector, spanning cybersecurity, AR, AI and industrials. The ETF aims to track the Global X Defense Tech Index and is an opportunity for investors that seek companies that are positioned to benefit from technology, services and hardware catering to the military and defence industry.

Within the SHLD ETF, several key holdings stand out for their focus on defense tech and cybersecurity including Palantir Technologies ($PLTR) and L3Harris Technologies Inc ($LHX). These types of companies are critical in defending networks, systems, and data from cyber attacks, making them integral to the evolution of defence technology.

The SHLD ETFs expense ratio is 0.50%.

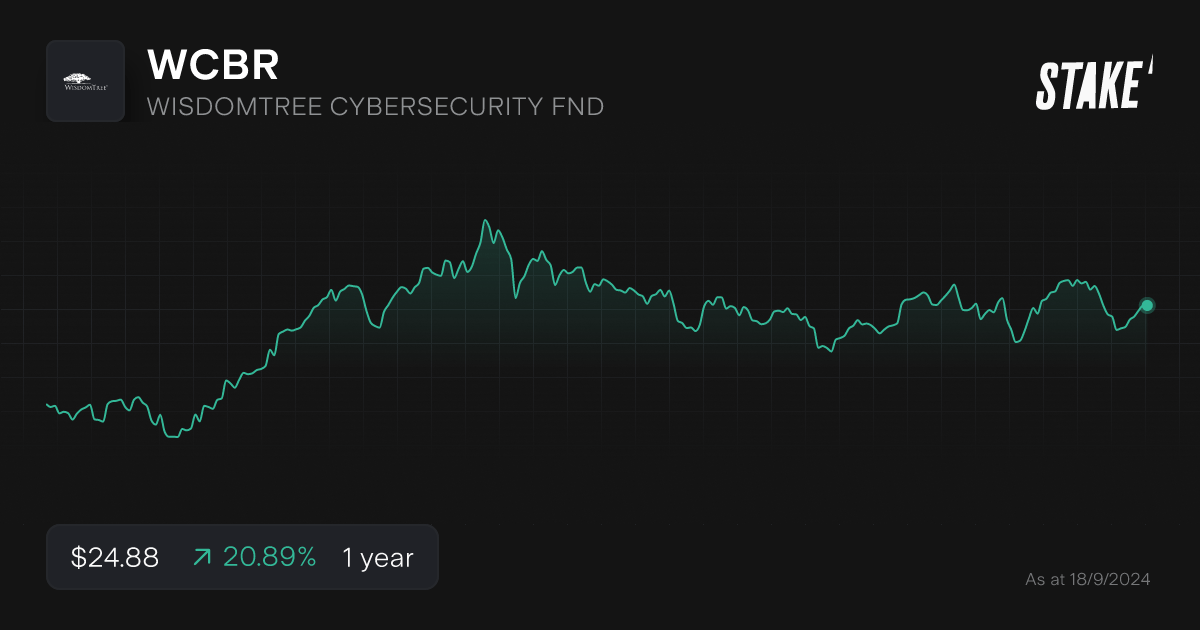

9. WisdomTree Cybersecurity Fund ($WCBR)

- Assets under management: US$105m

- Share price (as of 18/09/2024): US$24.88

- Stake investors watching $WCBR: 101

The WisdomTree Cybersecurity Fund ($WCBR) is an ETF focused on the performance of companies primarily involved in providing cyber security-oriented products – including security software, hardware, and services. The ETF is tailored for investors who want to replace or complement their existing portfolio with growth and technology holdings.

The fund features a portfolio densely packed with leading cybersecurity companies, with prominent names like HashiCorp ($HSCP), CommVault Systems, Inc. ($CVLT) and Palo Alto Networks ($PANW). The ETF diversifies across various sub-sectors including network security, endpoint protection, and identity management, providing comprehensive access to this critical industry.

The expense ratio of WisdomTree Cybersecurity Fund ($WCBR) is 0.45%.

10. Xtrackers Cybersecurity Select Equity ETF ($PSWD)

- Assets under management: US$31.84

- Share price (as of 18/09/2024): US$6m

- Stake investors watching $PSWD: 0

The Xtrackers Cybersecurity Select Equity ETF ($PSWD) offers investors exposure to cybersecurity companies by tracking the Solactive Cyber Security ESG Screened Index. This ETF provides focused investment in industry giants and emerging players across various countries including U.S., Japan, Israel, United Kingdom, Australia and Malaysia.

The PSWD ETF includes a range of holdings specialising in software security, network protection, and data defence. The portfolio aims to represent a broad spectrum of the cybersecurity landscape, from established leaders like Palo Alto Networks ($PANW) and Fortinet ($FTNT) to innovative smaller firms like NextDC ($NXT) and Applied Digital Corp ($APLD).

The PSWD ETFs expense ratio is 0.20%. This ETF has a much smaller amount of trading volume and minimal assets under management, do your research and make sure this is the right investment for you.

How to invest in cybersecurity in Australia?

You’ll need to follow these steps if you wish to invest in cybersecurity companies and ETFs in Australia:

1. Find a stock investing platform

To buy cybersecurity ETFs, you'll need to sign up to an investing platform with access to the Aussie and U.S. stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the stock, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

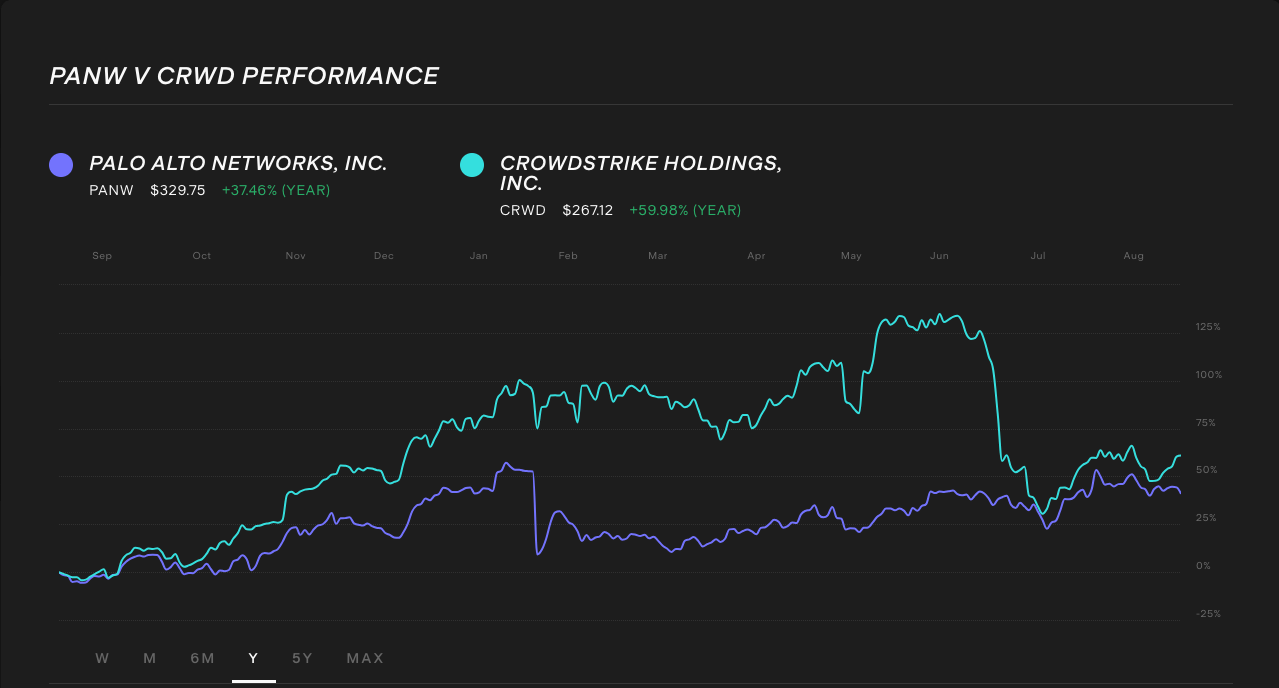

What is the best cybersecurity stock?

The best cybersecurity stock is subjective based on each investor's outlook on different factors, however, Palo Alto Networks ($PANW) has the largest market cap out of the pure-play cybersecurity stocks at $109b. Their market cap has more than doubled since early 2023.

Explore two of the largest cybersecurity stocks by market cap, PANW vs CRWD, using our stock comparison tool.

Are cybersecurity ETFs a good investment?

Cybersecurity ETFs can be a good investment due to the rising demand for digital security amid increasing cyber threats. These funds provide diversification, reduce individual stock risk, and offer exposure to other technologies like AI and cloud security. However, risks include high valuations, sector volatility, and competition from the big tech giants. While they have shown strong past performance, the sector's volatility may not suit risk-averse investors. Long-term investors looking to capitalise on cybersecurity's growth may find these ETFs attractive.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.