Under the Spotlight Wall St: Rocket Lab (RKLB)

Once just the backdrop for sci-fi novels and movies, space exploration is a growing business today. Pushing through the final frontier is Rocket Lab, a U.S.-listed company with Kiwi roots. Let’s put it Under the Spotlight.

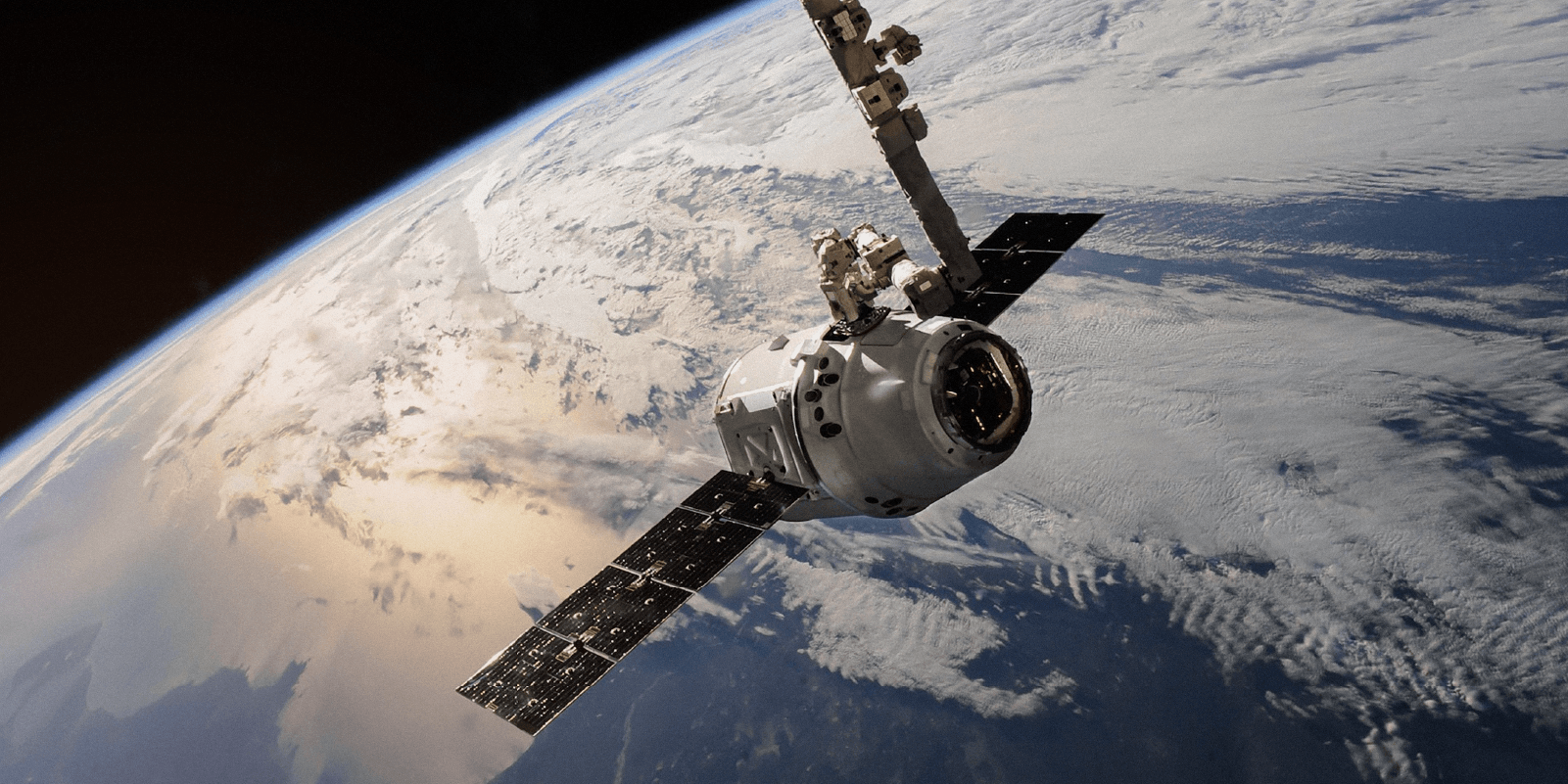

When you think of space exploration, you probably think of NASA or some space travel businesses like SpaceX, Blue Origin and Virgin Galactic ($SPCE). But space, and the companies in that space, already play a huge part in your everyday life: the internet, GPS systems, TV and even the radio wouldn’t be possible without the launch of countless satellites around the Earth’s orbit. And that’s where Rocket Lab ($RKLB) thrives.

The company is one of the biggest players in the satellite sector, with over 1,700 satellites in the atmosphere using some kind of Rocket Lab technology. They design, manufacture, test, launch and repair satellites that are used for civilian communications, defence systems and scientific expeditions. For instance, NASA’s James Webb Space Telescope, which recently made the news with amazing images of outer space, uses Rocket Lab’s technology.

A heavy load

The company is currently developing Neutron, which will be its biggest rocket capable of delivering an 13,000kg payload to low Earth orbit. The vehicle should be operational sometime in 2024 which is good news for Rocket Lab as the total addressable market is expected to grow from US$380b to over US$1t by 2030. The biggest growth should come from space applications and launch services.

Rocket Lab is also developing whole reusability systems for its rockets, be it through engineering rockets that can perform a soft landing or even by capturing them with helicopters. Considering that 72% of the company’s customers are recurrent ones, these features could lower costs and thus boost sales.

To lure new customers, Rocket Lab offers rideshare options that make launches cheaper. Customers can also choose whether to launch in the U.S. or in New Zealand, in one of the company’s three launching sites.

.png&w=3840&q=100)

Scaling up: not rocket science

The ride towards profit might still be shaky, but the company seems to be headed in the right direction. Costs of goods sold dropped from 134% of the revenue in 2020 to 91% by the end of the first semester of 2022, while administrative and R&D costs went from 68% and 54%, respectively, down to 44% and 34%. Rocket Lab would still have to halve those expenses, but they’ve definitely been tightening the belt.

In Q2 2022, revenue grew 36% to US$55.5m, with most of the growth being led by the space systems, as launching revenue practically stalled. Though sales have risen and costs have fallen relative to revenue, in absolute terms, expenses also grew almost 10% to US$38.2m. This was driven mostly by investments in the development of Neutron, their new rocket, and the reusability of their older models.

For Q3 2022, Rocket Lab expects revenue to range from US$60m to US$63m, with expenses rising to about US$43m. Gross margins are also expected to rise from 9% to between 12% and 14% due to higher average selling prices.

So with costs rising together with revenue, will Rocket Lab manage to reach infinity and beyond?

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.