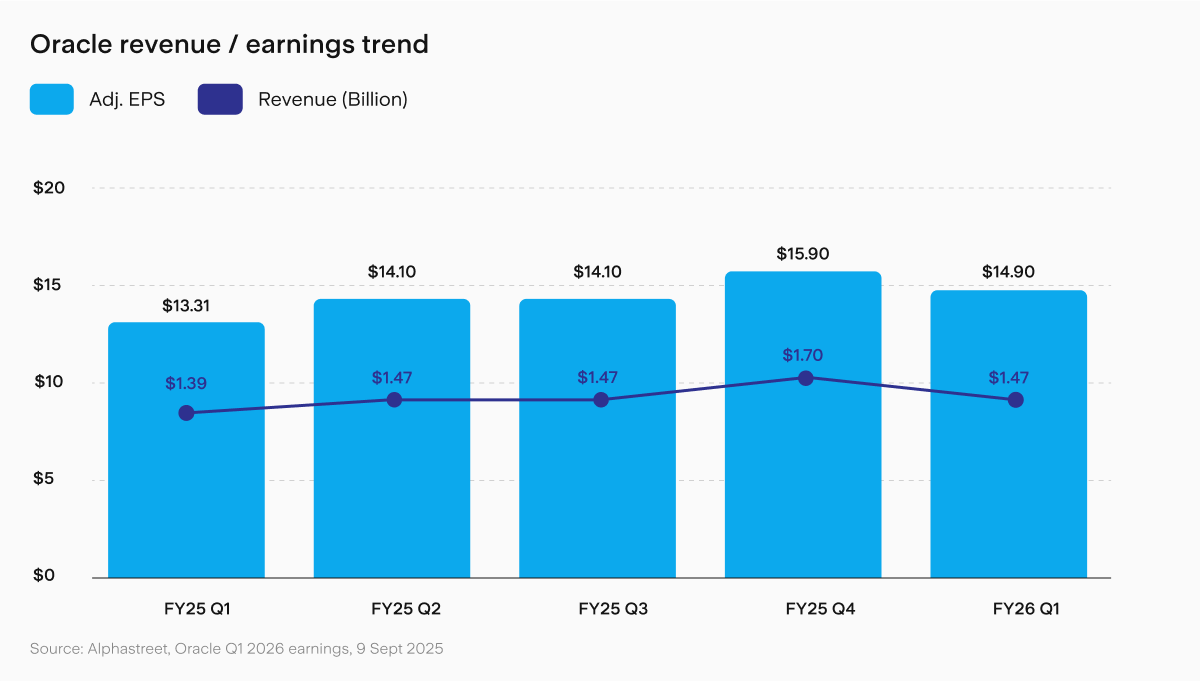

Under The Spotlight: Oracle ($ORCL)

The legacy data giant is chasing the AI boom after deals with OpenAI and TikTok. But will massive spend pay off in profits?

ICYMI: do your own research and make your own decisions. This article drills down on a specific company, however it is not a recommendation to invest in the company and should not be taken as financial advice.

Oracle ($ORCL) might be nearly 50 years old, but it’s not sitting out the next tech frontier. The software giant is going all in on AI – and with big plans comes big spending.

It’s already raised US$18B in debt to finance a fleet of data centres – it’s the second-biggest bond sale in the US this year.

Is Oracle’s US$18B debt a smart strategy or risky business?

The debt looks hefty, but Oracle’s pipeline is even heavier. It’s sitting on a US$455B cloud contract backlog. The standout? A five-year US$300B deal with OpenAI – one of the largest ever cloud contracts.

And that’s just one front. Oracle’s also one of the leading players in the consortium set to oversee TikTok’s U.S. operations.

No surprise the market’s been bullish. Share prices broke past US$328 last month, with most analysts rating the stock a Buy. But price targets vary widely – from as low as $130 to as high as $410.

So what’s the truth? Is Oracle flying too close to the AI sun? Or is it simply the newest megastar on the tech stage?

Inside Oracle’s massive cloud deals and data centre expansion

Oracle’s had a blockbuster year. Big innovations. Big contracts. Big spending.

Take the potential TikTok deal. If it goes through, Oracle will take control of the platform’s coveted algorithm. The consortium that will control TikTok in the U.S. is valued at $14B, and some analysts even think that’s conservative.

Then there’s its big-name cloud contract pipeline. OpenAI, xAI, Meta ($META), Nvidia ($NVDA) and AMD ($AMD) are all lined up. The US$18B bond raise is designed to fund the infrastructure these deals demand.

And Oracle’s cloud business is lucrative. Chair and CTO Larry Ellison claimed revenue from Microsoft, Amazon, and Google grew a massive 1,529% in Q1 FY26.

With 37 new data centres planned, Ellison is forecasting 77% revenue growth to US$18B this financial year, and eyeing US$144B in the years ahead. Investors took note: Oracle’s share price surged 30% on the news.

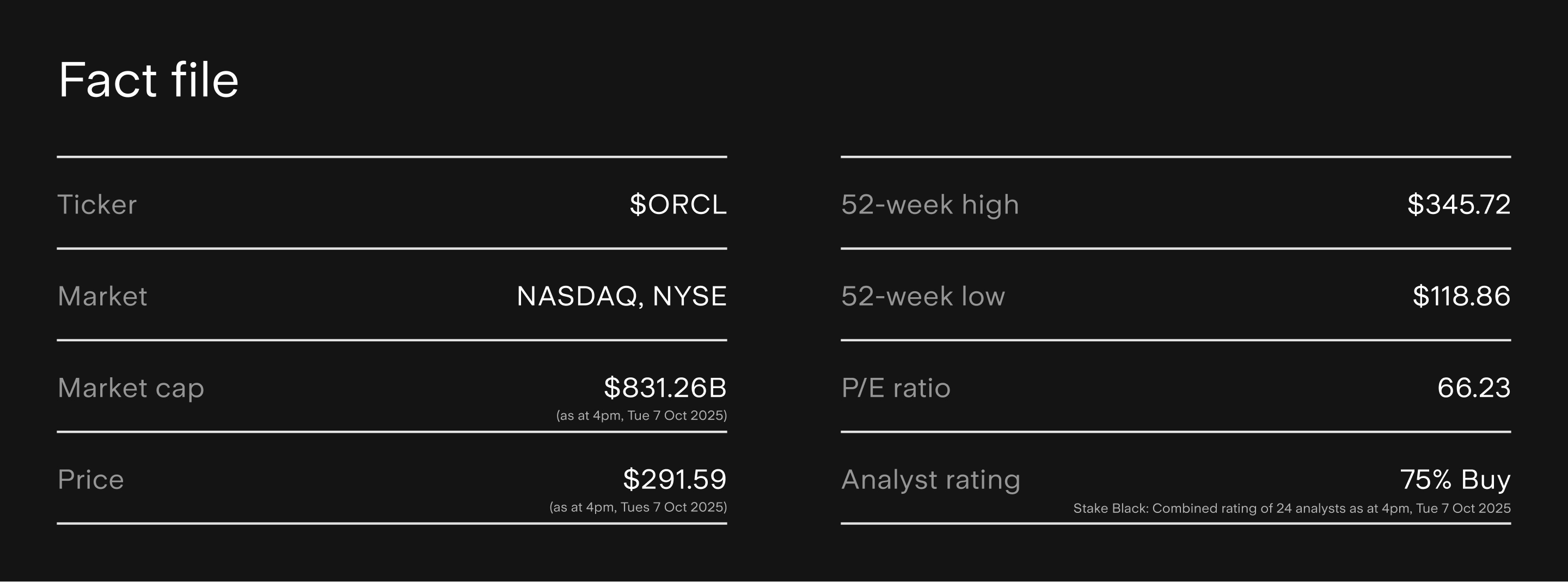

As for fundamentals:

Revenue climbed 12% to US$14.9B.

Operating cashflow rose 13% to US$21.5B.

Q1 earnings per share dipped 2% to $1.01.

Capital expenditure jumped from US$2.3B to US$8.5B YoY, with FY26’s Capex estimated to be US$35B.

It’s a big outlay – and a necessary one to deliver on its cloud pipeline – but has rung alarm bells for analysts worried about future payoffs.

Why Oracle is going all in on flexible AI solutions

Oracle’s betting on its AI stack to shake up the industry.

Its AI Database and AI Agent Platform give customers a pick of leading AI models – including Gemini, ChatGPT, Grok and Llama – to overlay and analyse data. It’s a multi-model approach that stands in contrast to competitors banking on a single AI partner.

That’s not the company’s only play.

In the past year, Oracle has:

Built a global database and infrastructure to simplify workflows and protect against outages.

Rolled out an AI tool that analyses agricultural data and crop performance to help governments create more resilient food systems.

Partnered with Nvidia to provide AI services in Oracle’s systems.

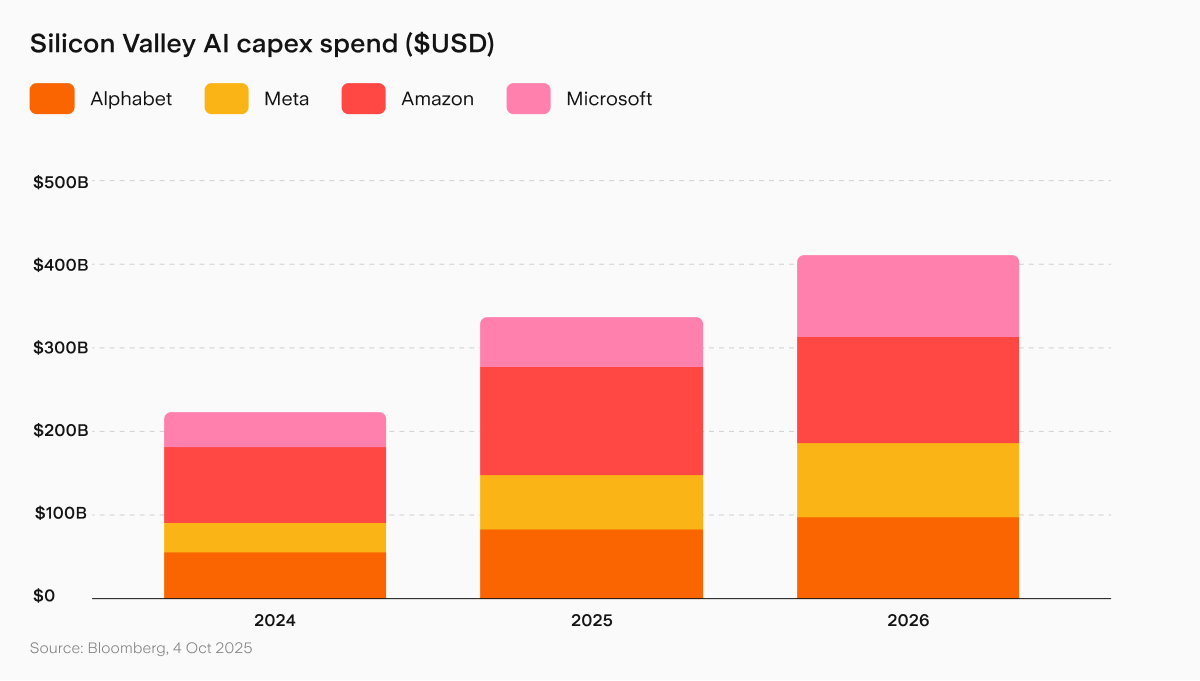

With tech giants hungry to spend on AI, Oracle is aiming to get ahead of competitors.

Is Oracle’s AI bet sustainable? Risks and red flags to watch

Oracle’s aggressive AI strategy has come with a growing debt load that may grow even further.

According to Bain, the tech sector needs to generate US$2T in revenue by 2030 to recoup the cost of building data centres. Bain expects the sector to fall short by US$800B.

Oracle’s strategy also leans heavily on the AI players helping fund it. A downturn for Microsoft ($MSFT), Amazon ($AMZN) or Alphabet ($GOOGL) would hit Oracle’s revenue.

And while OpenAI is Oracle’s largest contract, Moody’s ($MCO) doesn’t expect it to turn a profit for another five years. That could mean an extended period of high leverage and negative cashflow.

The most pointed criticism? Rothschild and Redburn’s Alex Haissl put a Sell rating and a $175 price target on Oracle. That’s a massive 40% drop from current levels. He believes the contract values are overstated and the AI outlook is more hype than reality.

That call alone triggered a rare 5.6% dip in the share price.

Is Oracle stock a buy, sell or hold?

Oracle has long been a quiet force behind the world’s biggest businesses. Now it’s making a lot of noise around AI opportunities.

Investors have already pocketed US$163B in cash via dividends and buybacks over the past decade. This year alone, shares have risen by a remarkable 74%.

With long-time CEO Safra Catz stepping down, new Co-CEOs Clay Magouyrk and Mike Sicilia come with deep cloud engineering and applied AI experience.

That sector knowledge could play a big part in determining if Oracle’s current strategic focus will pay dividends. But one thing’s clear. Big Red isn’t afraid to go all in.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Sara is a passionate finance writer with more than 15 years’ experience in the Australian finance industry. She has worked in marketing and content with Macquarie Group, Westpac, ETF Securities (now Global X ETFs) and Livewire Markets across investments, insurance, financial advice and superannuation.

.png&w=3840&q=100)