Under the Spotlight: Amazon ($AMZN)

Billions in AI investment are paying off, but the question now is whether growth can keep pace with spending.

.jpg&w=3840&q=100)

ICYMI: Do your own research and make your own decisions. This article drills down on a specific company, however, it is not a recommendation to invest in the company and should not be taken as financial advice. Got a stock you want covered? Tell us here.

Amazon might be the world’s biggest marketplace, but lately it’s the one doing all of the shopping.

The company is pouring billions into AI chips, cloud data centres and warehouse robots, spending US$120 billion on capital investments in the last 12 months alone, nearly double the year before.

Now it’s got the numbers to prove it – and a new US$38B deal with OpenAI to match. Its latest earnings beat expectations and sent the share price soaring, as revenue rose 13% YoY in the September quarter to US$180.2B and net income jumped from US$15.3B to US$21.2B.

Still, with capital expenditure in the tens of billions, Amazon’s profit margins remain slimmer than peers. And the competition is closing in fast.

AWS: The cloud behind the AI boom

While most people think of Amazon as a retailer, it’s been investing in cloud and AI infrastructure since long before ChatGPT hit the mainstream.

Amazon Web Services (AWS), its cloud division, has been building its own chips (Trainium, Inferentia) since 2015. AWS powers the internet for businesses and governments, renting out computing, storage and software so others can run apps and, crucially, AI systems.

It’s a huge market – and AWS leads the pack. As of Q2 FY25, it held around 30% of the global cloud infrastructure market, compared to Microsoft ($MSFT) Azure’s 20% and Google ($GOOGL) Cloud’s 13% (Statista).

.png&w=3840&q=100)

And it’s now Amazon’s most lucrative sector, contributing roughly 60% of operating profits.

In Q3 FY25, AWS revenue surged 20% year-on-year to US$33 billion, its fastest pace since ChatGPT launched in late 2022.

That growth isn’t just about scale. Amazon reported strong uptake of its AI developer tools, as enterprise clients rush to embed generative AI into their workflows. CEO Andy Jassy said growing demand for AI infrastructure as well as partnerships with firms like Anthropic and now OpenAI, are driving ‘strong momentum’ across the business.

But it comes at a cost. Free cash flow dropped to US$14.8B, down from nearly US$48B a year earlier, as capital spending surged by US$50.9B.

For investors, the trade-off is clear: short-term cash compression for long-term dominance in cloud-AI.

Beyond the cloud: Amazon’s retail engine

While Amazon’s cloud arm boasts the highest margins, it’s not what drives the bulk of its revenue.

For all the hype around AWS, most of Amazon’s money still comes from the things we buy, watch and click. Retail, streaming, advertising and devices together make up more than 80% of global sales.

In Q3 FY25, North American sales rose 11% to US$106B, while international revenue climbed 14% to US$40.9B, helped by faster delivery and AI-driven automation.

Advertising too is becoming a profit machine in its own right. Ad revenue jumped 24% year-on-year to US$17.7B, driven by the same AI tools behind Amazon’s broader efficiency gains.

Robotics and AI investments are also tipped to deliver big savings across retail and logistics. In July, Amazon hit its one-millionth robot and unveiled DeepFleet, a new AI model that acts as an intelligent traffic system for its global warehouse fleet.

.png&w=3840&q=100)

It’s an advancement Morgan Stanley says is often overlooked. The bank estimates that up to US$2-4B a year could be saved by 2027, with 40 next-gen robotic warehouses in the pipeline.

With up to 10% of Amazon’s global warehouses flagged for next-gen automation, costs could fall by up to 40%, according to Morgan Stanley – potentially replacing 160,000 workers.

Big profits, bigger pressure

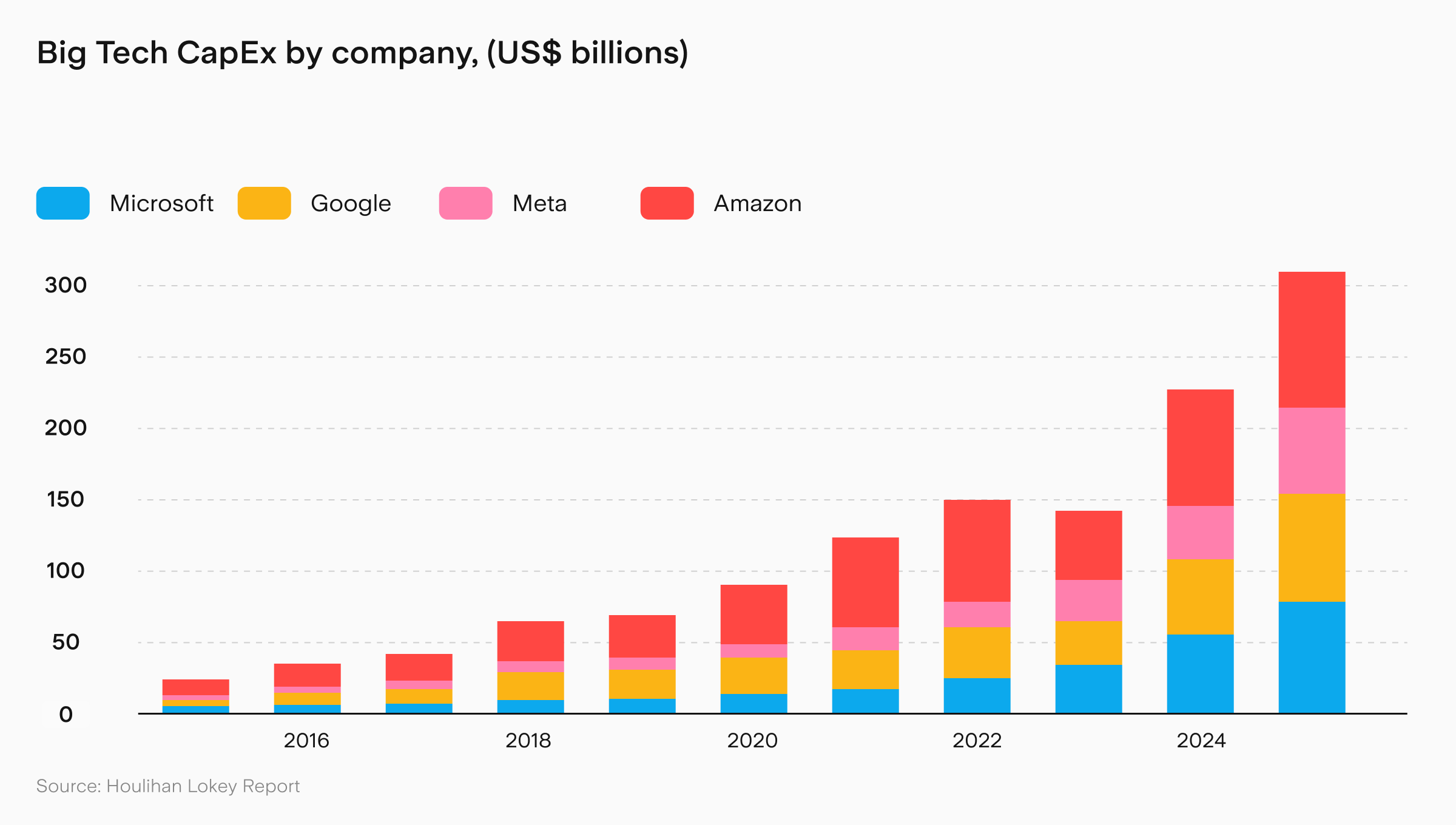

Amazon’s AI-and-cloud push is working, but the risks are real. Massive outlays on data centres and chip development have pushed capital expenditure to record highs, squeezing cash flow and leaving little room for error if AI demand dips.

And the rivals aren’t standing still. Microsoft Azure and Google Cloud are growing faster, thanks to high-profile enterprise wins and new AI integrations.

In the same quarter, Google Cloud posted 34% revenue growth, and Microsoft Azure rose 39%, compared to AWS’ 20%.

With AWS delivering most of Amazon’s profit, any slowdown would hit hard – and rattle the share price.

On the retail side, low-cost rivals like Temu, Shein and TikTok Shop are also chipping away at market share. Trade tensions and tariffs are adding further pressure to Amazon’s global supply chain.

And regulators aren’t easing off, with antitrust scrutiny in the U.S. and Europe still looming over its marketplace and ad businesses.

Amazon’s cloud lead is clear. But defending it will take smart execution and serious capital.

Where to next for Amazon?

The company isn’t slowing down. It expects Q4 revenue to rise 10–13% year-on-year, with operating income between US$21B and US$26B.

That’s healthy growth by big-tech standards, but it comes with a reminder that AI dominance isn’t cheap.

Amazon forecasts 2025 capital expenditure at US$125B – set to rise again in 2026, according to CFO Brian Olsavsky. For comparison, Google expects to spend US$91–93B and Microsoft just US$34.9B.

Still, analysts remain bullish. All 24 analysts covering the stock on Stake rate Amazon a ‘buy’, with an average price target of US$300 – around 20% above its current level.

Shares have already climbed more than 30% in the past six months, hitting record highs. It’s a strong sign the market believes Amazon’s backing the right horse.

But the real test is whether it can sustain that lead. If Amazon can continue to prove that its AI strategy translates into lasting profits rather than just hype, it could cement its place as one of the biggest winners of the AI boom.

If not, the company that built the cloud might find itself chasing the next one.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Kylie Purcell is an investments analyst and finance journalist with over a decade of experience covering global markets, investment products and digital assets. Her commentary has been featured in publications including the Australian Financial Review, Yahoo Finance and The Motley Fool. She has a Masters Degree in International Journalism from Cardiff University and a Certificate of Securities and Managed Investments (RG146).