Under the Spotlight AUS: Telix Pharmaceuticals (TLX)

As medical treatments keep evolving with new technologies, developing targeted cancer care is the focus of Telix Pharmaceuticals. Let’s put it Under the Spotlight.

The word cancer evokes fear and uncertainty about the path ahead. As an uncontrollable growth of abnormal cells, cancer can form tumours and spread through the body with devastating consequences. There are many types of cancer, each usually named after the organ or tissue where it forms. There’s no single cure, but early detection and targeted treatment help increase the odds of a healthy life.

Until the turn of this century, cancers were mostly treated by chemotherapy drugs that destroyed cells that were busy replicating. Unfortunately this includes some normal cells alongside the cancerous ones. Over time, researchers found ways to recognise the profile of cells with abnormal features related to cancer. This aligns with a shift to precision medicine, as technology enables a more personalised approach to diagnosing and treating patients.

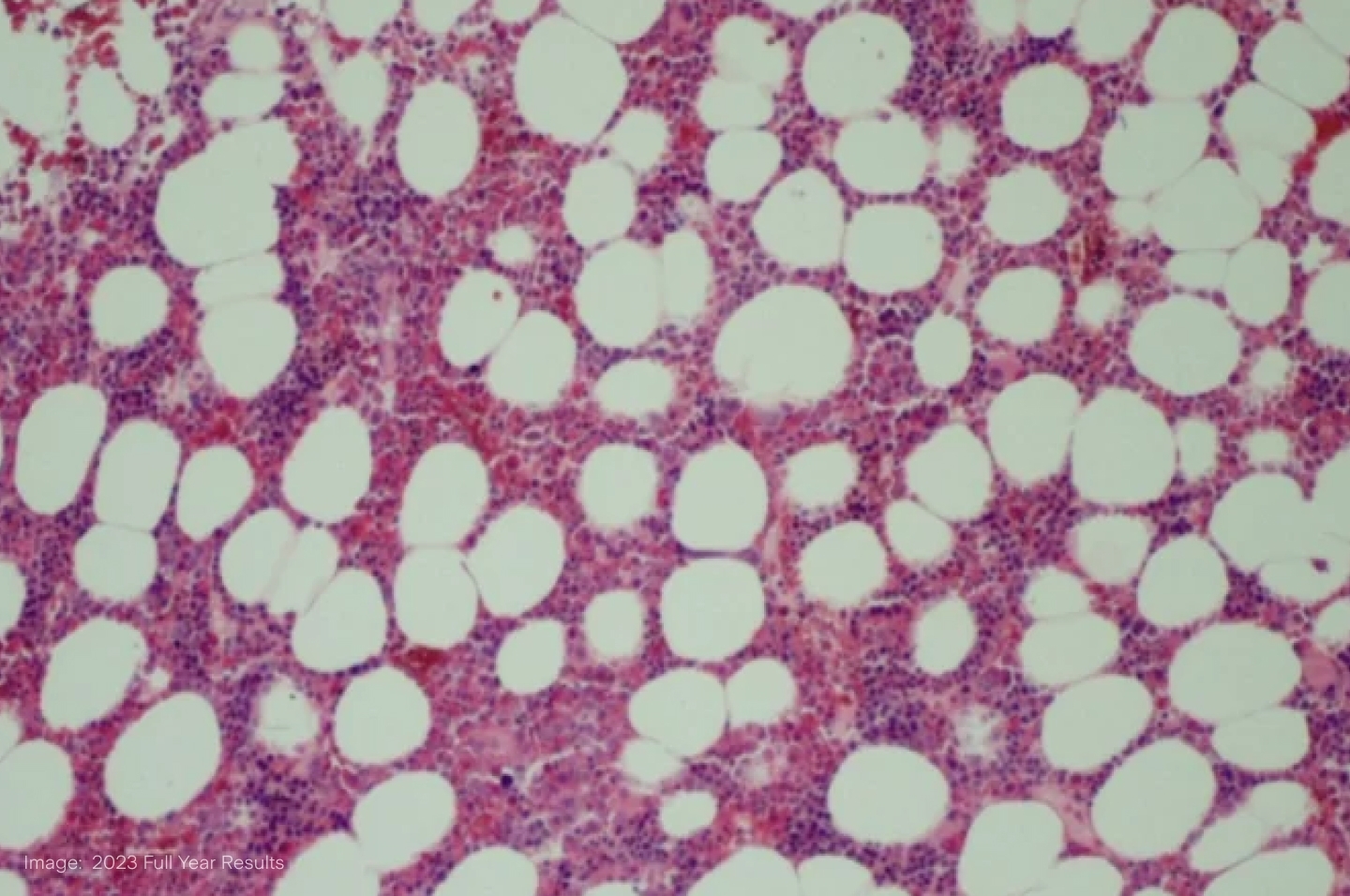

We’ve long known that radiation can both cause and cure cancer. Radiopharmaceuticals are a kind of drug that takes radioactive materials to the affected area of the body, and can be used during diagnosis as part of medical imaging systems or as a therapy. Molecularly-targeted radiation (MTR) can deliver radiation to very specific cells with certain markers that could indicate cancer – and this has been the focus of Telix Pharmaceuticals ($TLX).

Targeted growth

Telix is a rare biotech that has transitioned from a small-cap clinical stage company to a fully operational commercial entity. Their prostate cancer imaging product named Illuccix was approved for use on patients by the Australian Therapeutics Goods Administration in November 2021. One month later, approval by the FDA (Food and Drug Administration, the U.S. regulatory agency) opened up a major market. The EU decision is expected in H1 2024 and studies are underway in China.

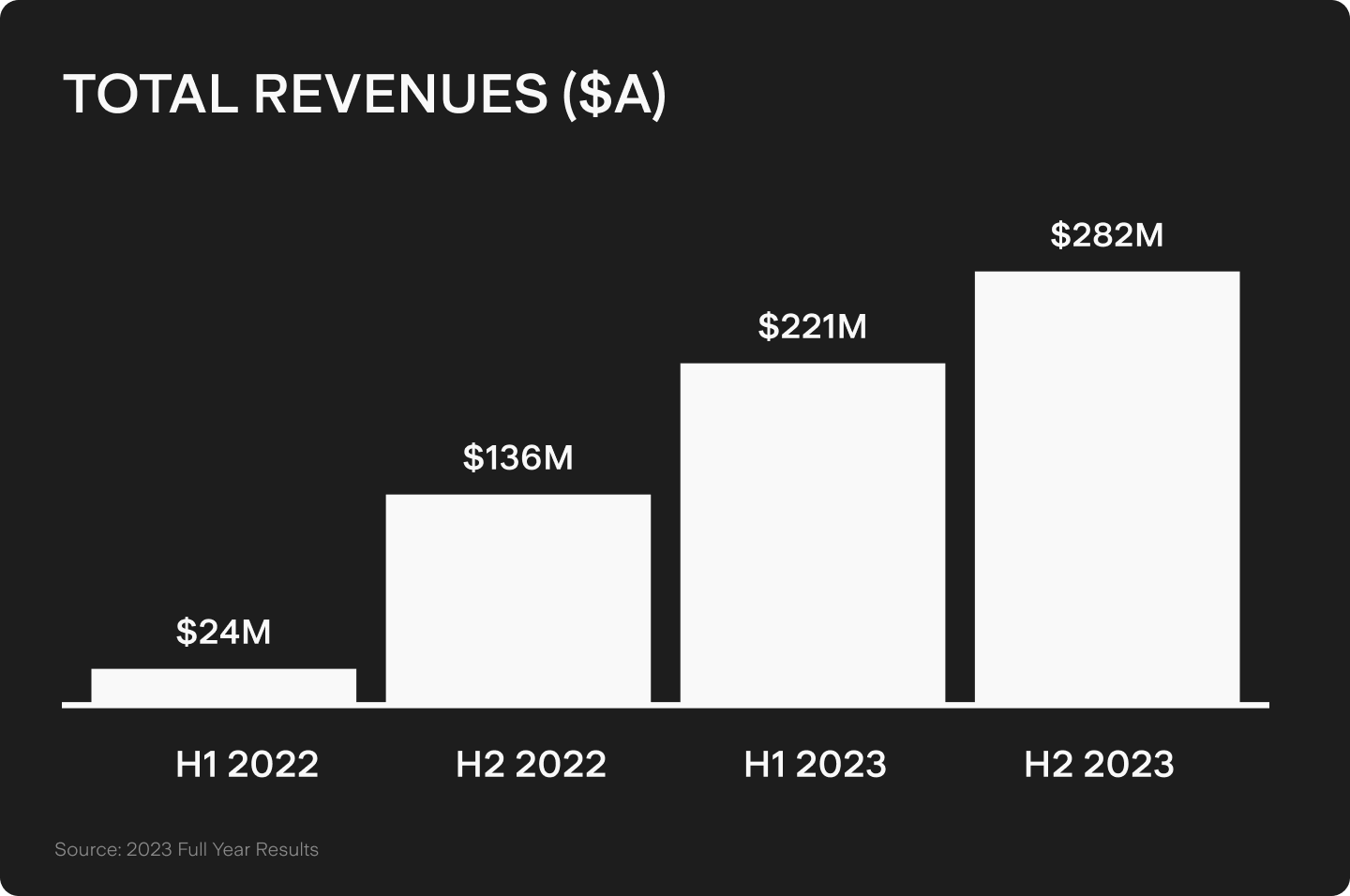

Illuccix is an agent used by medical professionals in scans to diagnose the stage and spread of the disease. Its usage widened significantly after it could be reimbursed by U.S. medical schemes, from mid-2022; revenues there grew from $19.3m in H1 2022 to $275.6m in H2 2023. The company’s positive cash flow is currently dependent on this product, which accounted for all of Telix’s $502.5m annual revenues in 2023.

Growing revenues have helped the firm scale quickly, with the 214% annual increase facilitating more spending. Yearly sales costs went from $65.2m to $188.2m, while research and development expenses climbed from $81m to $128.8m from 2022 to 2023. However, this shift also reveals the importance of getting a drug through all the development stages – failed drugs can lead to bankruptcy for biotech firms.

Telix’s balance sheet has shown major change in just one year, with the company earning $5.2m in profits after tax in 2023 after experiencing a loss of $104.1m in 2022.

Alternative treatments

Telix aims to bring additional products to market over the next few years, including more targeted radiation therapies which would match an imaging agent with a therapy. The former would detect and the latter would destroy the selected cancer cells, as well as limit damage to healthy tissue and vital organs. The drug is injected into the bloodstream and the treatment occurs alongside regular monitoring to allow for a personalised approach.

A kidney cancer imaging agent called Zircaix is currently in stage three trials and may face the FDA approval hurdle in the second half of the year. Another imaging product for brain cancer named Pixclara is at a similar phase. Being able to commercialise two additional drugs would help diversify Telix’s revenues, but it’s estimated that only 25 to 30% of products move onto the next stage of the process.

Alongside other earlier stage products, the company has radiopharmaceuticals for brain cancer and bone marrow conditioning in the pipeline. Telix is also using its cash to expand across the supply chain: in June 2023 it opened a major facility in Belgium to manufacture the radioisotopes and other products used in its treatments. They also acquired advanced technologies through acquisitions, such as the takeovers of isotope production platform ARTMS Inc and radio-guided surgery business Lightpoint Medical.

Future prospects

Telix’s achievements with Illuccix have attracted the attention of many investors and there are high expectations for its other therapies. It’s worth noting they’re not the only company targeting the field, with American firm Lantheus ($LNTH) earning US$258.9m in Q1 2024 alone from Pylarify, Illuccix’s major competitor. But if Zircaix and Pixclara succeed with the approval process in the planned time frame, Telix expects full-year revenues for 2024 to grow 35-40% in a range of $675m to $705m. This would also depend on increasing R&D costs by 40-50%.

As it aims to develop into a larger pharmaceutical player, Telix has signalled its ambitions to expand in the U.S., recently registering plans for an IPO on the Nasdaq.

The company and its investors have seen some payoffs after years of trials, but some of their biggest tests might still be ahead.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)