.jpg&w=3840&q=100)

Under the Spotlight AUS: Telstra Corporation (TLS)

Telecommunications is a key service that supports the modern economy. It’s gone from a monopoly to a competitive industry in Australia – with Telstra a key player. Let’s put the firm Under the Spotlight.

As Australia’s six colonies came together to form one nation in 1901, new departments were set up to provide services for the country. This included the Postmaster-General's Department, which was created to manage telephone, telegraph and postal services in Australia. Forty-five years later, a department was created to manage international telecommunications, with the establishment of the Overseas Telecommunications Commission (OTC).

Postal services and domestic telecommunications were eventually separated in 1975, with the Australian Telecommunications Commission (Telecom) gaining monopoly control over domestic telecommunications infrastructure. The sector evolved quickly thereafter, marked by rapid innovation in technology that required large investment. This progression created many potential business opportunities and a merger took place between Telecom and the OTC in 1992, with the new business taking the ‘Tel’ from ‘Telecom’ and ‘stra’ from ‘Australia’ to become Telstra ($TLS).

Competitive market

The Australian telecommunications industry had been deregulated one year earlier in 1991, and two major rivals to Telstra soon arrived on the scene. Optus sought to gain market share in national long distance and international telephone services. It went head-to-head with Telstra in other areas too, with Telstra partnering with News Corporation to launch Foxtel in 1995 as a response to Optus’ cable network venture. Vodafone also entered the fray, as the telecommunications market was opened up to ‘limited competition’, with the government seeking to provide the industry with a stable transition away from the previous monopoly.

Telstra’s competitors were given a boost in the mid-nineties when the government granted them access to Telstra’s local copper loop, allowing them to compete with Telstra in providing high-speed internet access, data and pay TV services to customers.

Telstra’s formal privatisation started in 1997 with its ASX listing, in which the government sold one-third of shares to investors for $14.2b. Around 1.8 million Australians applied for shares and Telstra is still a widely held stock today.

Another 16.6% of shares was sold off for $16b in 1999, with the final tranche of approximately 50% of the shares offloaded in 2006. The government transferred one-third of this remaining portion to its Future Fund, while it sold two-thirds for $15.4b, significantly less than the price per share that was achieved seven years before. This smaller sum reflected a falling stock price as the fixed-line telecommunications sector became more competitive. Knowing that more shares are becoming available in the future also tends to dampen demand from investors, which can lead to lower share prices.

.jpg&w=3840&q=100)

Building networks

Telecommunications networks require high fixed and upfront costs, and Telstra has always needed to spend significant sums on infrastructure to uphold its services. However, regulators were concerned with the fact that Telstra owned the copper lines that were used by its competitors to provide internet access to consumers.

As such, in 2009 the National Broadband Network (NBN) was announced, with the intention to transition customers to a fibre optic network. The plan was that Telstra would cease to provide services over the copper lines, resulting in the firm standing on the same footing as its competitors. This project to bring high speed internet to the majority of Australians did not go smoothly at all. Costs blew out massively, while the new network ultimately incorporated a mix of retrograde technologies. As for Telstra, while the company would be paid billions as its customers migrated to the new infrastructure, the eventual shift of wholesale fixed-line clients away from the firm due to the NBN did affect its bottom line. In 2018, the company produced a Telstra2022 strategy to revitalise its finances, which included streamlining its product range, reducing costs and establishing a standalone infrastructure business unit, InfraCo Fixed.

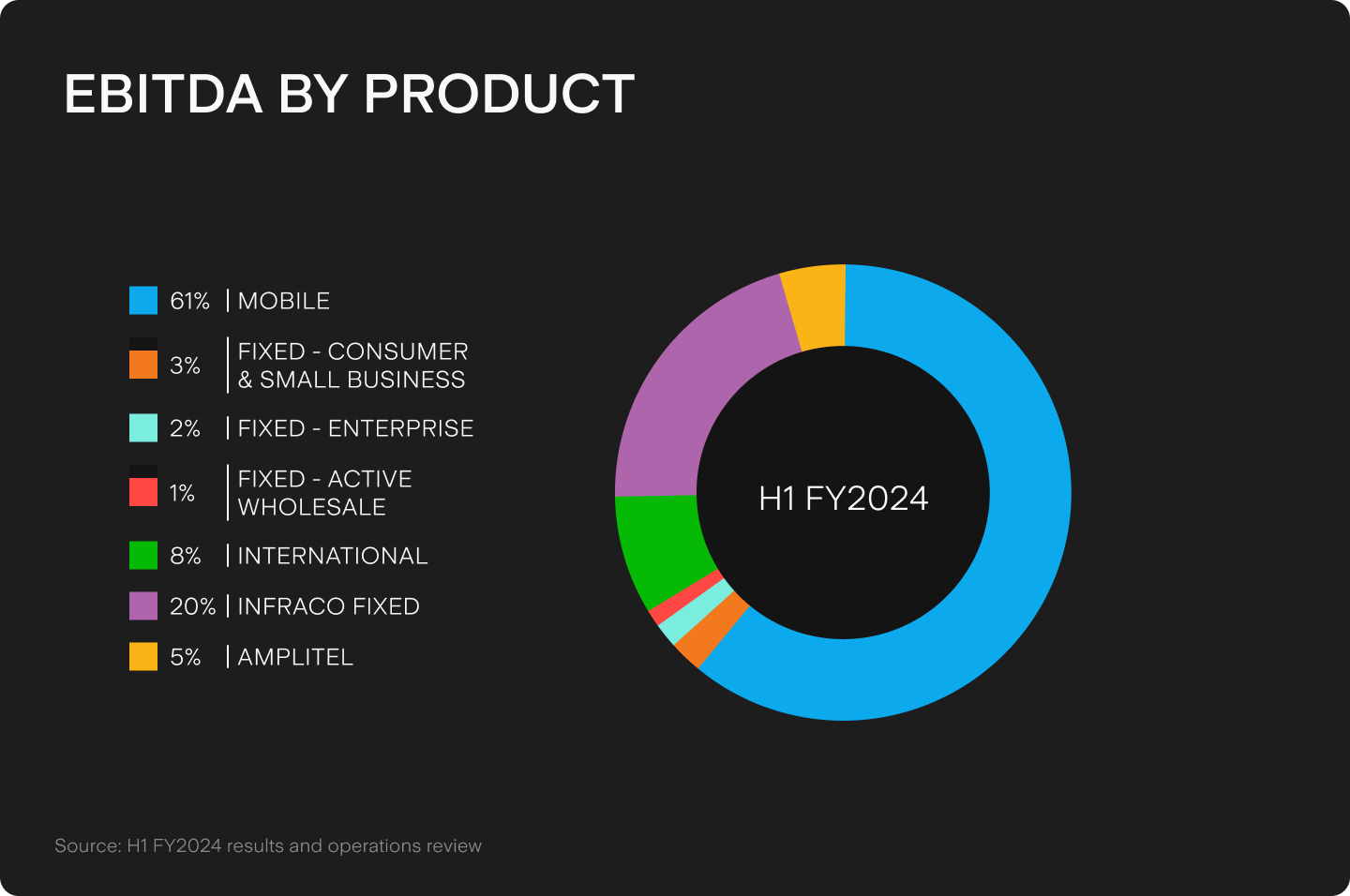

Today, mobile services are Telstra’s largest segment in terms of earnings. InfraCo comes in second and its international services, such as Digicel Pacific in the South Pacific, provide the third biggest source of earnings. Benefitting from its legacy assets, Telstra’s mobile network extends over 1 million square kilometres beyond other operators to 99.6% of Australia’s population and the company is particularly focused on its 5G rollout.

Telstra’s mobile sector accounted for $2.5b of the firm’s $4.01b total earnings before interest, taxes, depreciation and amortisation (EBITDA) for H1 FY2024. EBITDA grew 13.2% compared to the previous half-year period, with the firm’s unit that builds and manages cell towers, Amplitel, also seeing a 16.9% increase in EBITDA to $187m. The mobile and Amplitel sectors have margins of 47.1% and 81.7% respectively, which are considerably higher than any of the firm’s fixed offerings, with fixed enterprise margins at only 4.7%.

Future outlook

Telstra is concerned about a reduction in demand from businesses for use of its services, a decrease which is being driven by both a move away from voice to cloud applications and lower business confidence. Furthermore, higher interest rates have added to the company’s borrowing expenses, with net finance costs growing 25% from $252m in H1 FY2023 to $317m in the latest half year.

The uncertainty about more potential future interest rate rises or the timing of cuts has also weighed heavily on Telstra’s stock price. Despite this, the firm has maintained its reputation for paying out dividends to investors.

FY2024 guidance puts total income in the range of $22.8b to $24.8b, with underlying earnings of around $8.2b to $8.3b. These represent small potential increases to the FY2023 figures of $23.2b and $8.0b.

Telstra remains an essential part of Australia’s communications landscape. While it has met the challenges thrown its way and dialled into the future, it must continue to adapt and ensure it can answer the call of its investors for years to come.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.