Under the Spotlight: Taiwan Semiconductor Manufacturing (TSM)

The company powering every device in your sight. Found in iPhones and PS5s, TSM is a hidden US$600b powerhouse. Read on to find out more about the company that changed a country’s whole economic trajectory.

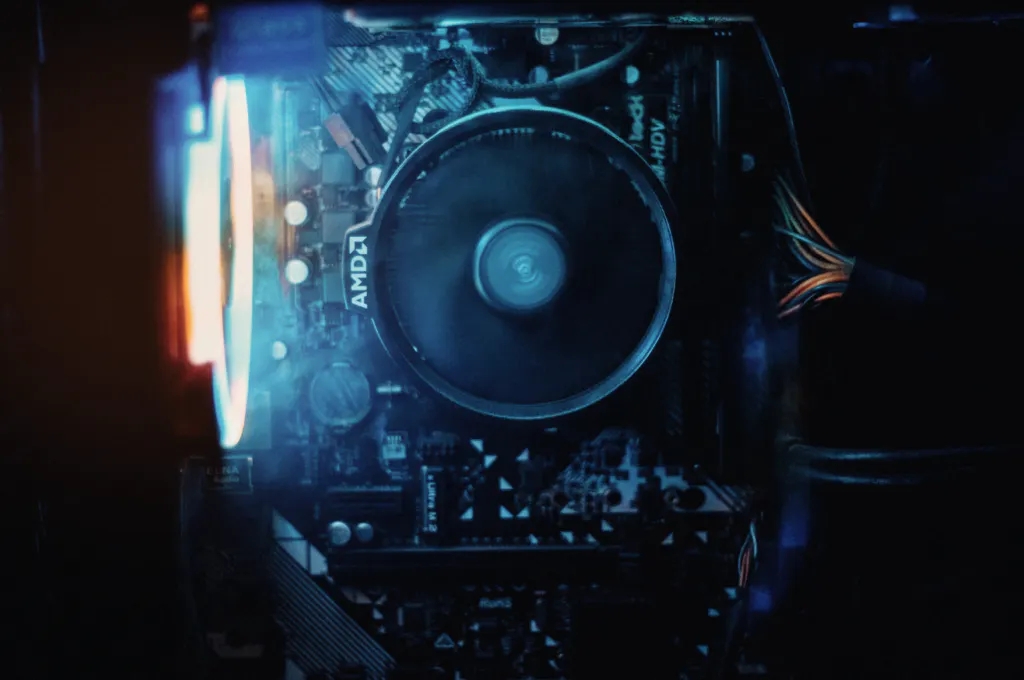

While Nvidia and AMD dominate the computing hardware conversation, they are actually some of Taiwan Semiconductor’s biggest customers. TSM is the biggest semiconductor manufacturer (known as foundry in the world). Today we’re going to talk about how TSM operates in one of the most crucial markets for economic growth around the world.

From plastic to silicon

Just a few decades ago, Taiwan’s manufacturing industry revolved around low-value goods. Plastic trinkets and toys flooded the market. Since then, the island has undergone dizzying industrialisation and low-value products had their factories moved to mainland China.

The San Francisco Bay Area carries the name Silicon Valley, but it would not be unreasonable to suggest that perhaps that moniker should be transferred to Taipei. Until the 1960s the United States was responsible for 100% of the world’s semiconductor production, today 75% of world production is concentrated in Asia, with much of it being produced by Taiwan Semiconductor Manufacturing ($TSM).

Sure, some of the biggest players in the industry like Intel, AMD, Nvidia and Texas Instruments are American companies. However, there is no mistake: much of the production of microchips used by these companies is made by TSM. If you can’t beat them, join them.

To meet the demand of giant companies, TSM has the capacity to produce more than 12 million 12-inch wafers annually, each containing more than a trillion transistors. Currently, the smallest transistor used is about 10,000 times smaller than the thickness of a strand of hair. In the simplest terms, the smaller a transistor, the more that can be packed into chips. The more transistors in a chip, the more powerful a device is. Typically, technological progress has adhered to Moore’s Law.

Growing up

Moore’s Law takes its name from one of Intel’s founders and states that the number of transistors on a chip tends to double in two years, for the same cost of production. Originally an empirical observation, Moore’s law would become a metric for the industry growth and is a goal to be achieved in the development of its products. More generally, the significance of Moore’s Law is diminishing as computing power can be measured in more ways than just transistor count, but the trend stands true.

TSM has religiously adhered to Moore’s law in the production of its integrated circuit wafers, but it has also come close to replicating it in its revenue growth. Since its IPO in 1994, the company has seen its revenues grow by an average of 17.2% per year, causing revenues to double every five years.

In the third quarter of 2021 alone, the company earned more than $18.11 billion, coming mainly from the production of circuits for smartphones, which represent 44% of revenue, and for supercomputers, which accounted for 37%. Chips for cars and other products that benefit from the internet of things account for 14% of that number, which is on the rise: for more than two years the company’s monthly revenue has not stopped growing.

The efficiency gained from being close to the entire production and logistics chain of the segment makes the production of semiconductors extremely profitable for TSM: the company currently has a gross profit margin of 51.3% and a return on equity of 30.7%, which is consistently kept above the 20% range year after year.

💡Related: Top 10 U.S. Semiconductor Stock to Watch→

Processing bottlenecks

The growing need for semiconductors around the world is making it increasingly evident how vital this industry will be for decades to come. With the pandemic crippling distribution channels around the planet, cars are not being produced for lack of semiconductors and even Apple ($AAPL) (which is a TSM customer) has revised its projections for the year downwards, as it expects to be able to deliver fewer iPhones due to a lack of processors on the market. With increasing demand, TSM has been able to raise its prices by 20% recently without impacting demand.

To try to solve this problem, several world powers are making huge investments in the sector. In the US, the Biden government is expected to invest more than $52 billion to revitalise the industry in the country. The European Union intends to allocate US$150 billion for the same purpose and South Korea alone will spend more than US$450 billion to ensure its competitiveness in the market.

The United States is unquestionably one of the largest consumer markets for semiconductors on the planet, but its geographic distance from the sector’s large production and distribution centres may hinder the resumption of this industry in the country. At least that’s what Morris Chang, founder of TSM and who criticised the US government’s plan, thinks. Nevertheless, the company is investing more than $12 billion to build a factory in Phoenix, Arizona, in an attempt to secure its supremacy in the US market.

Computing expectations

With a favourable international scenario and growing demand, the company’s medium-term vision is positive: until 2025 the company intends to maintain annual revenue growth between 10 and 15%; a gross profit margin in the range of 50% and ROE above 20%, as it had been doing in recent years.

However, if the logistical crisis that today hinders the recovery of several economies in a post-pandemic scenario worsens, it is possible that the company’s results will be impacted. The company may also suffer from environmental issues, such as lack of electricity and even water. Yes, if you think water and electronics don’t mix, you’re only relatively correct. The semiconductor polishing process is extremely intensive in the use of pure water (without the presence of microorganisms or minerals), making the entire sector susceptible to climatic risks.

TSM is the only semiconductor manufacturer to be listed on the Dow Jones Sustainability Index, which it has been a part of for more than 20 years. However, at a time when the entire world suffers from a lack of energy resources, this is a risk that cannot be ruled out. Finally, there is the risk that Samsung, one of its main competitors, may grab a good part of its market share, benefiting from the colossal investment plan of the South Korean government.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.