Under The Spotlight: Lynas Rare Earths ($LYC)

As AI, EVs and defence tech supercharge demand for rare earths, Lynas Rare Earths has become the West’s best bet on breaking China’s grip. But can the miner turn geopolitical momentum into profit?

ICYMI: Do your own research and make your own decisions. This article drills down on a specific company, however, it is not a recommendation to invest in the company and should not be taken as financial advice. Got a stock you want covered? Tell us here.

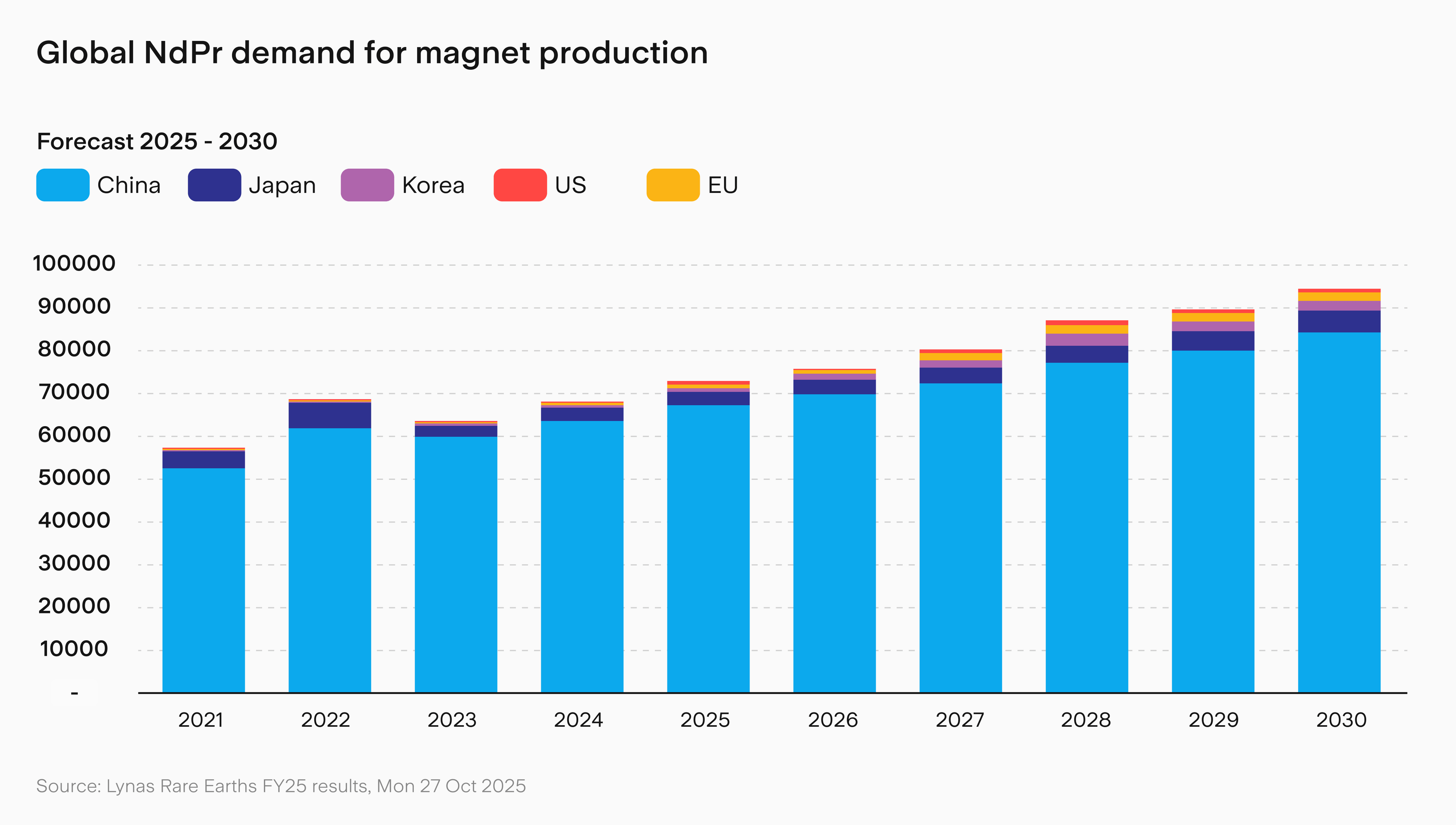

The world wants faster chips, cleaner energy and more powerful AI systems – and demand is surging for the minerals behind the machines.

Every intelligent product, from NVIDIA ($NVDA) GPUs to autonomous drones, relies on rare earth materials. Yet China controls around 70% of mining and nearly 90% of processing, giving Beijing outsized influence over global supply.

A new U.S.-Australia minerals deal aims to change that. By co-investing billions and setting price supports, Washington and Canberra want to build a non-Chinese supply chain for the materials powering tomorrow’s tech.

That’s good news for Australia’s Lynas Rare Earth ($LYC), the world’s biggest rare earth producer outside China.

But mining is volatile. Prices swing, projects stall and global alliances shift. This week’s rare earth sell-off – following a U.S.-China deal to ease export controls – was a sharp reminder.

The question now: can Australia’s rare earth leader turn geopolitical momentum into sustainable growth?

A rare business

Mining isn’t an easy game to enter. It demands massive upfront investment and years of development before turning a profit.

Lynas’ closest ASX rivals, Iluka Resources ($ILU) and Arafura Rare Earths ($ARU), are still building their first processing plants. By contrast, $LYC has been both producing and refining rare earths at scale for over a decade.

At the heart of its operations is Mt Weld in Western Australia, considered one of the world’s richest rare earth deposits. The site supplies ore rich in neodymium (Nd) and praseodymium (Pr), the key ingredients in high-performance magnets used across EVs, wind turbines and defence technology.

But digging up ore is only one piece of the puzzle. The harder task is separating the elements – a complex, chemical-intensive process that only a few companies, mostly in China, have mastered at scale.

For Lynas, ore is shipped to its processing plant in Malaysia, where it’s refined into individual rare earth elements, which are then sold to manufacturers across Asia, Europe and the U.S.

A new processing plant in Kalgoorlie, launched last year, is designed to improve efficiency by reducing waste before ore is exported. While final processing still happens in Malaysia, the upgrade should cut shipping costs and environmental impact.

When Washington calls

Lynas’ next phase of growth is unfolding across the Pacific. New U.S. projects and partnerships have seen the $LYC share price jump over 70% in the last six months.

Among them is a heavy rare earths processing facility in Texas, part-funded by the U.S. Department of Defense. If approved, it could supply key materials for U.S. missile systems and advanced electronics from 2026.

In October, a separate deal with U.S. manufacturer Noveon Magnetics sent Lynas stock soaring to a 14-year high. The partnership aims to establish a full-scale supply chain for permanent magnets – a key component in EV motors and defence technologies.

All this momentum is being reinforced by the new U.S.-Australia critical minerals pact – a deal that could prove a game changer for Lynas, offering:

Strategic positioning as the leading non-Chinese rare earth supplier amid U.S.-China trade tensions.

Product expansion, becoming the first company outside China to produce commercial quantities of dysprosium oxide – a key input for EVs and defence tech.

U.S. market access via a partnership with Noveon Magnetics to develop a domestic magnet supply chain.

Government backing, including potential premium pricing, long-term offtakes and low-cost financing.

By securing a place in this new supply chain, Lynas gains strategic importance that few Australian companies can match. That potential hasn’t gone unnoticed by investors.

Digging into financials

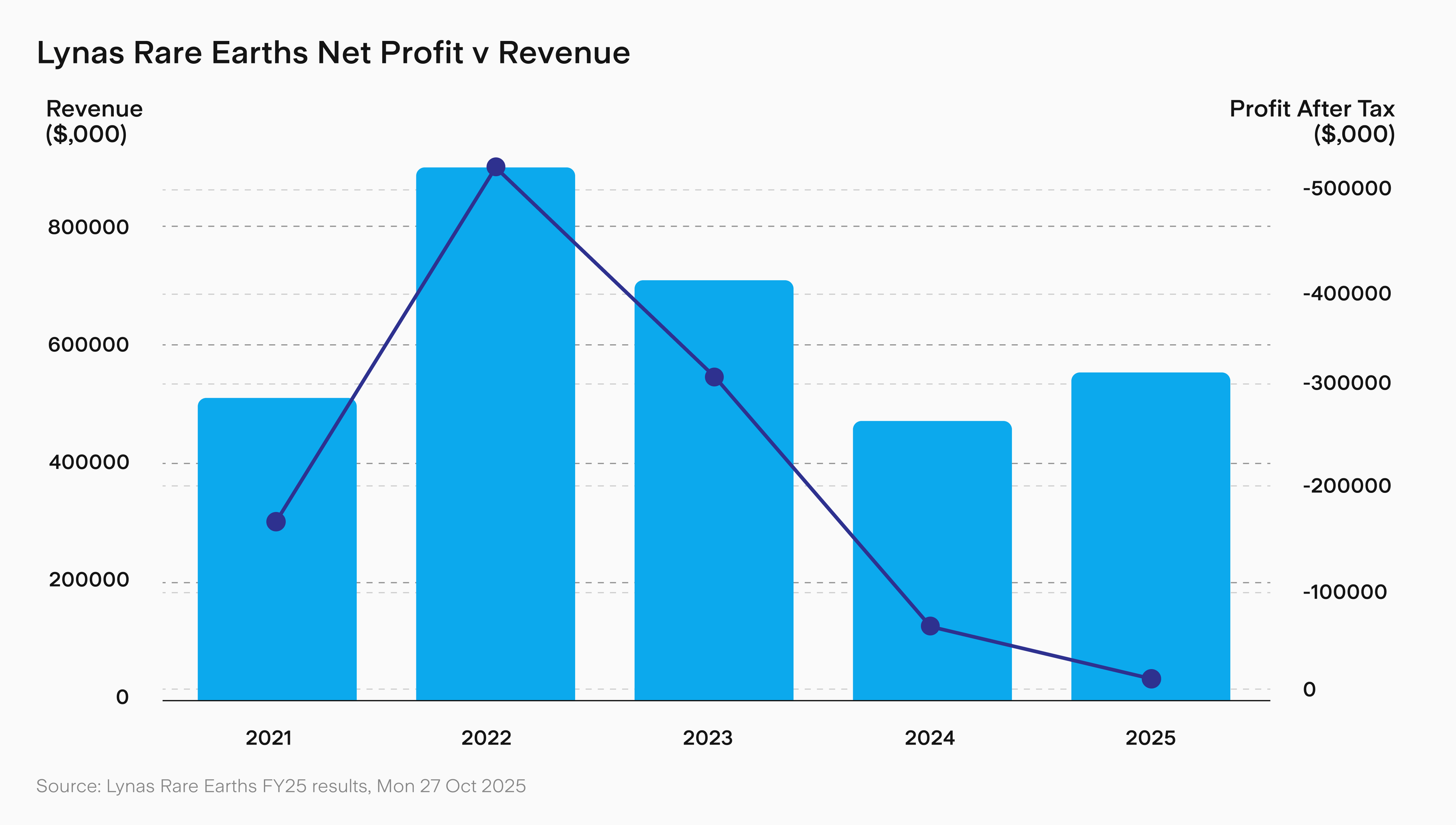

Lynas might be in the right place at the right time, but the numbers show just how challenging this business can be.

In FY25, the company reported net profit after tax (NPAT) of $7.9M – down 90% from $84.5M the previous year.

The reasons include higher costs, lower-than-expected output from the new Kalgoorlie plant and falling rare earth prices – particularly neodymium and praseodymium (NdPr), Lynas’ main products.

As a growth-focused company, Lynas doesn’t pay dividends – profits are reinvested into projects. These include a $500M expansion of its Mt Weld mine from FY22, a $180M expansion of its Malaysia processing plant and $800M to build its new Kalgoorlie processing plant.

The results so far are promising. Revenue in FY25 rose 20% to $556.5M thanks to increased NdPr production. Low debt, healthy cash reserves and a recent equity raise have bolstered the business’ balance sheet. But earnings remain tied to commodity prices – when NdPr drops, profits evaporate.

Opportunities and risks

With Lynas at the centre of Western efforts to secure future-critical materials, the opportunities are clear.

Government funding and new U.S. contracts could accelerate its Mt Weld and Kalgoorlie expansions, while proposed new Texas and Malaysia plants would bolster profit margins.

But there are also challenges that can hinder the bottom line.

Foremost, mining remains cyclical. Prices are shaped by Chinese production quotas and global demand. Policy support can help, but only up to a point.

And with the company juggling multiple capital-heavy projects, any delays or budget overruns could test investor patience.

Competition is also intensifying. Rivals like Iluka, Arafura and Hastings ($HAS) are pushing ahead with their own government-backed plans. Meanwhile, Chinese players remain dominant, leveraging scale and cost advantages that Australian miners can’t match.

Lynas’ big challenge is proving that sustainability and scale can co-exist. It has the political will and operational foundation to lead. But it still faces a bumpy road shaped by market cycles.

Is $LYC a buy?

Lynas holds a unique position: strategically vital and technically proven, but exposed to commodity swings.

After more than doubling this year, its share price reflects investor optimism. Still, analysts are cautious.

In October, Macquarie, Goldman Sachs and Morgan Stanley rated $LYC as ‘neutral’, while Ord Minnett downgraded it to ‘sell’ with a $10 target – around 30% below its current price.

While expansions to its mine and processing facilities should see production and revenue ramp up, the outlook largely depends on rare earth prices stabilising.

Geopolitics only goes so far. Chinese producers still dominate the market, and at lower cost, helped by state backing and more relaxed environmental standards.

For long-term investors betting on supply-chain independence, Lynas is a rare opportunity. For others, it may pay to wait until the story shifts from strategy to earnings.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Kylie Purcell is an investments analyst and finance journalist with over a decade of experience covering global markets, investment products and digital assets. Her commentary has been featured in publications including the Australian Financial Review, Yahoo Finance and The Motley Fool. She has a Masters Degree in International Journalism from Cardiff University and a Certificate of Securities and Managed Investments (RG146).