.png&w=3840&q=100)

Under the Spotlight Wall St: Robinhood Markets (HOOD)

Robinhood Markets is stealing trading market share and growing its wealth business, delivering merry investors a 550% gain over the past year.

.png&w=3840&q=100)

Robinhood Markets ($HOOD) shook up Wall Street trading by putting it in everyone’s pocket. Then it got punished for it. But this one-time rebel is now staging one of the market’s most unexpected comebacks, with the stock up 550% over the past year.

It’s a stunning reversal of fortune after an ugly few years since going public in 2021 at US$38 a share. Younger traders loved its sleek, commission-free platform, but HOOD came under fire from Wall Street, customers and regulators for its role in the GameStop short squeeze in 2021. When the meme stock bubble burst, its trading volumes slumped.

Then the hits kept coming. The 2022 collapse of crypto giant FTX – which owned a 7.6% stake – rocked the company. HOOD bought back FTX’s stake in 2023. The brutal crypto winter of 2022 sent a chill through HOOD’s trading volumes. The stock slumped to a low of US$6.89 in 2022.

But Robinhood didn’t sit still. Costs were slashed as it refocused on active traders. New products encouraged clients to invest more of their wealth on the platform. Fast forward to today and their pivot has delivered strong revenue, higher trading volumes, customer growth and shares that trade above US$110.

With record share and options volumes in Q2, Stake customers have been watching - HOOD has been among the most traded U.S. stocks on the platform this year.

Crypto gambit

The boldest play in HOOD’s comeback is its big bet on crypto. The passing of the GENIUS Act paves the way for the regulation of stablecoins and the development of the wider crypto industry.

HOOD has added new tokens, products, and even its own blockchain: Robinhood Chain. CEO Vlad Tenev says crypto is no longer a speculative asset and that it could become the ‘backbone of the global financial system.’

At June’s To Catch a Token event in Cannes HOOD launched tokenised shares of OpenAI and SpaceX for European customers, plus perpetual futures, staking for U.S. users and access to crypto on its Robinhood Legend desktop platform. Tenev says ‘tokenisation is the biggest innovation in capital markets in over a decade.’

Hood is also inking deals to advance its crypto ambitions. It snapped up crypto exchange Bitstamp for US$200m in June, after buying Canadian digital assets platform WonderFi for CAD$250m in May.

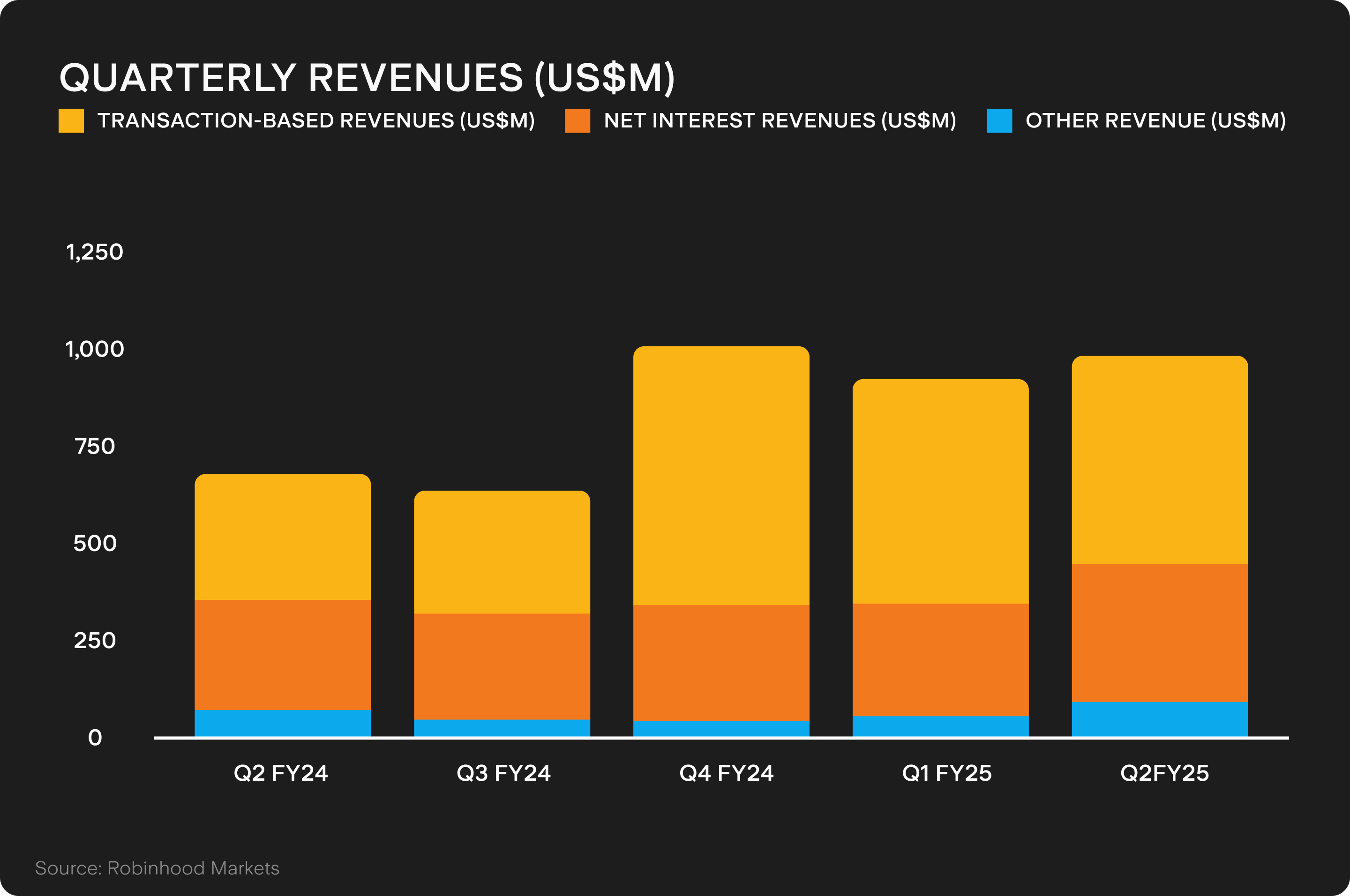

And it’s delivering results. Q2 crypto trading revenue nearly doubled year-on-year to US$160m, making up 30% of HOOD’s transaction revenue.

Diversified portfolio

But Robinhood isn’t just riding the crypto wave. It’s building a full-service financial platform spanning stocks, options, futures, banking and wealth management.

Its options business is booming, with Q2 transaction revenue up 46% YoY to US$265m. In October, it launched its advanced desktop platform Robinhood Legend, and futures and options trading on mobile. It rolled out options trading for U.K. customers this year - part of a broader international push.

But HOOD isn’t pinning its future on trading volumes alone. It launched everyday banking and wealth management products for its 3.5m Robinhood Gold members as part of a push to keep clients’ wealth on the platform.

Robinhood Banking – which includes a cheque and savings account as well as a credit card – and digital wealth adviser service Robinhood Strategies were launched in March.

Its Gold Card is now used by over 300,000 customers. Retirement assets under custody grew 118% YoY to a record US$19b in Q2. And the $300m TradePMR acquisition in February is accelerating its move into wealth management.

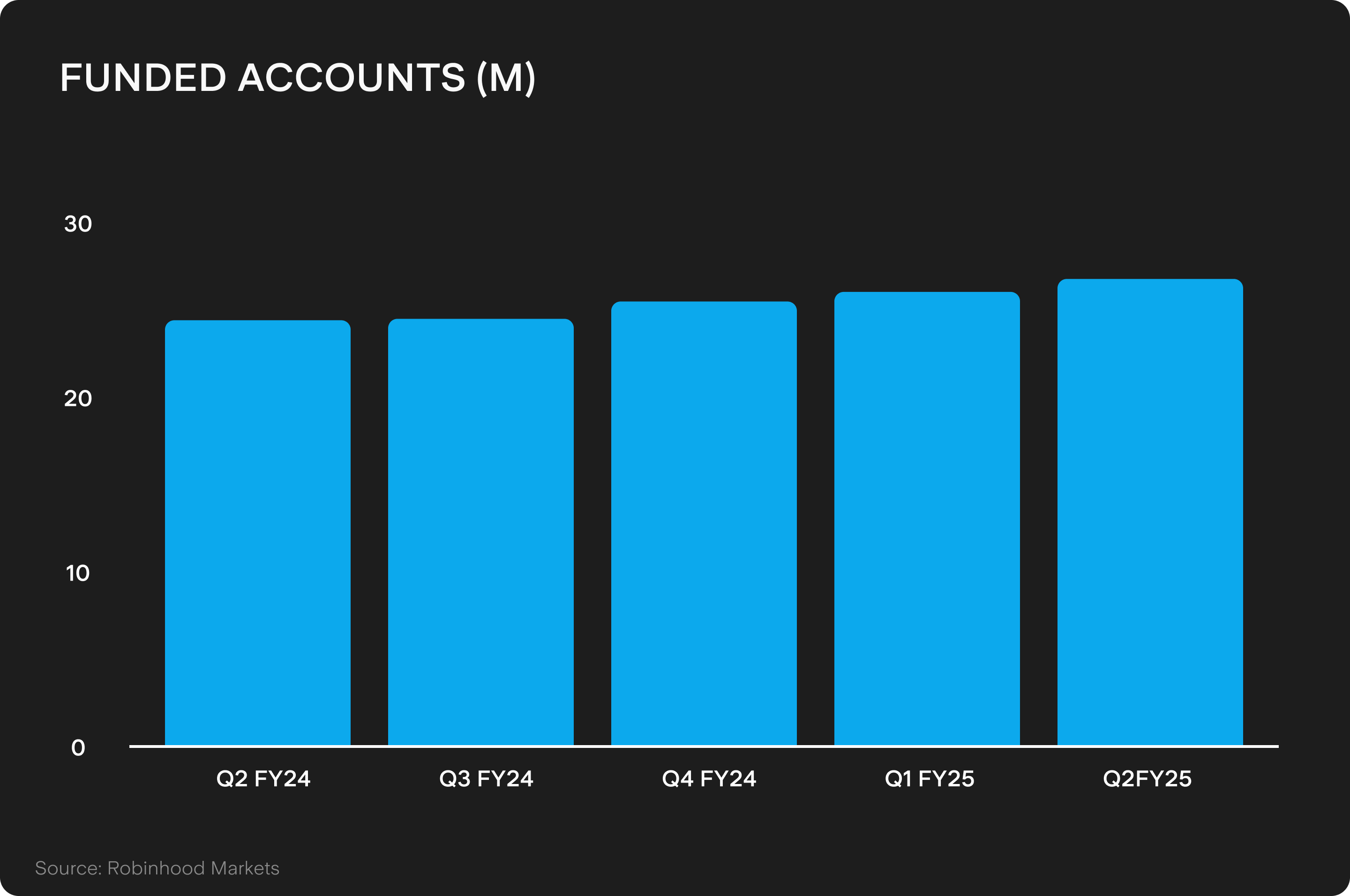

The expanded range of financial products has fuelled growth. Funded customers grew 10% YoY to 26.5m in Q2 and more deposits on the platform lifted net interest revenue 25% YoY to US$357m in Q2. Better still, average revenue per user climbed 34% YoY to US$151 in the same period.

Street cred

With the stock up more than sixfold in a year, it’s no surprise analysts are raising eyebrows at Robinhood’s valuation. The stock now trades at a lofty 73x forecast earnings - a multiple that’s hard to ignore.

Its market cap has swelled to US$98.85b. That still trails legacy brokers like Interactive Brokers ($IBKR US$109b) and Charles Schwab ($SCHW US$174b), but puts it ahead of the leading listed crypto exchange, Coinbase ($COIN US$80b).

After Q2, many analysts raised earnings forecasts and price targets, but most still rate HOOD as a hold. Citi warns that much of Robinhood’s growth is already priced in, while JPMorgan says the company has benefitted from a ‘near perfect’ setup: volatile markets, rising engagement and steady customer growth.

CantorFitzgerald is more bullish, setting a price target of US$118 on the belief HOOD can keep growing revenues from crypto, options trading and margin interest.

Aiming high

From meme stock pariah to a reinvigorated challenger taking on legacy brokers and wealth managers, HOOD has staged a comeback worthy of legend.

But with sky-high expectations and a valuation to match, HOOD needs to prove it's more than a lucky shot to deliver the growth targets investors expect.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)