Under the Spotlight Wall St: Booking Holdings (BKNG)

Established in the internet’s early years, Booking Holdings is the world’s largest travel conglomerate. Can the firm continue to soar? Let’s put it Under the Spotlight.

The amount of money spent on travel by tourists and people doing business has been rising worldwide for decades. But the days when the brick and mortar travel agency dominated are long gone. Online sales account for more than 70% of the travel and tourism industry’s total revenue, with the number expected to reach 76% by 2028.

One of the leading players responsible for this change in customer behaviour is Booking Holdings ($BKNG). Founded in 1997 as Priceline.com, the company wanted to connect travellers with hotels and airlines in an unprecedented way. Unlike any other traditional business, instead of looking up different prices from multiple vendors and providers, travellers could name their own prices, bidding in a reverse auction of sorts.

Priceline.com users would state how much they were willing to pay for a specific service and if a vendor accepted the offer, the transaction would take place. The spread between the customer’s bid and a vendor’s price would be Priceline’s revenue. Despite the unusual pricing model, the business gained popularity as use of the internet soared. In 1999, the company went public, and despite still not being profitable, it raised US$160m at a U$12.9b valuation.

Buying spree

In April 1999, one month after its IPO, Priceline’s shares jumped from US$16.00 to US$990.00, a 60x move. But as the internet bubble popped, shares plummeted to a low of US$6.38 in December 2000. The unfavourable business environment and sharp drop in valuation forced the company to tighten its belt and shut down unprofitable initiatives, such as its online groceries service. By 2001, the firm had its first profitable quarter.

As global economies started to recover after the dot-com crash, Priceline altered its proposition and expanded. In 2003, the company began to introduce regular prices for its services, while in 2005, it acquired Booking.com for US$133m.

Even 20 years ago, Booking.com was the leading hotel room booking website in Europe, a title it still holds to this day. The acquisition was arguably Priceline’s most important ever, as it allowed the company to gain a firm grip on some of the world’s most popular travel destinations.

With a significant European footprint, Priceline decided to look further east to expand, and in 2007 acquired Agoda.com, a leading travel agency business based in Bangkok and Singapore.

Diversifying

The 2010s were an important decade for Priceline, the period marking the firm’s successful entrance into different sectors of the travel industry. In 2010, the company acquired multinational vehicle rental business TravelJigsaw, which would later become known as Rentalcars.com. The acquisition marked an important shift from a business model focused on hotel rooms and accommodation, to a one-stop shop for anything related to travel. The year also marked the first time that Priceline surpassed Expedia ($EXPE) as the world’s largest hotel reservation service.

Further diversification ensued in 2013 with the US$1.8b acquisition of Kayak.com, a metasearch engine that allows users to find the best prices on flights and accommodation. In 2014, Priceline also bought restaurant booking platform OpenTable for US$2.6b, the company’s biggest ever acquisition.

Highs and lows

Due to low interest rates and strong global economic growth, the travel industry grew larger than ever. Priceline, which was renamed Booking Holdings in 2018, benefitted greatly, with the stock reaching new all-time highs throughout the late 2010s. However, in 2020, the tide quickly turned.

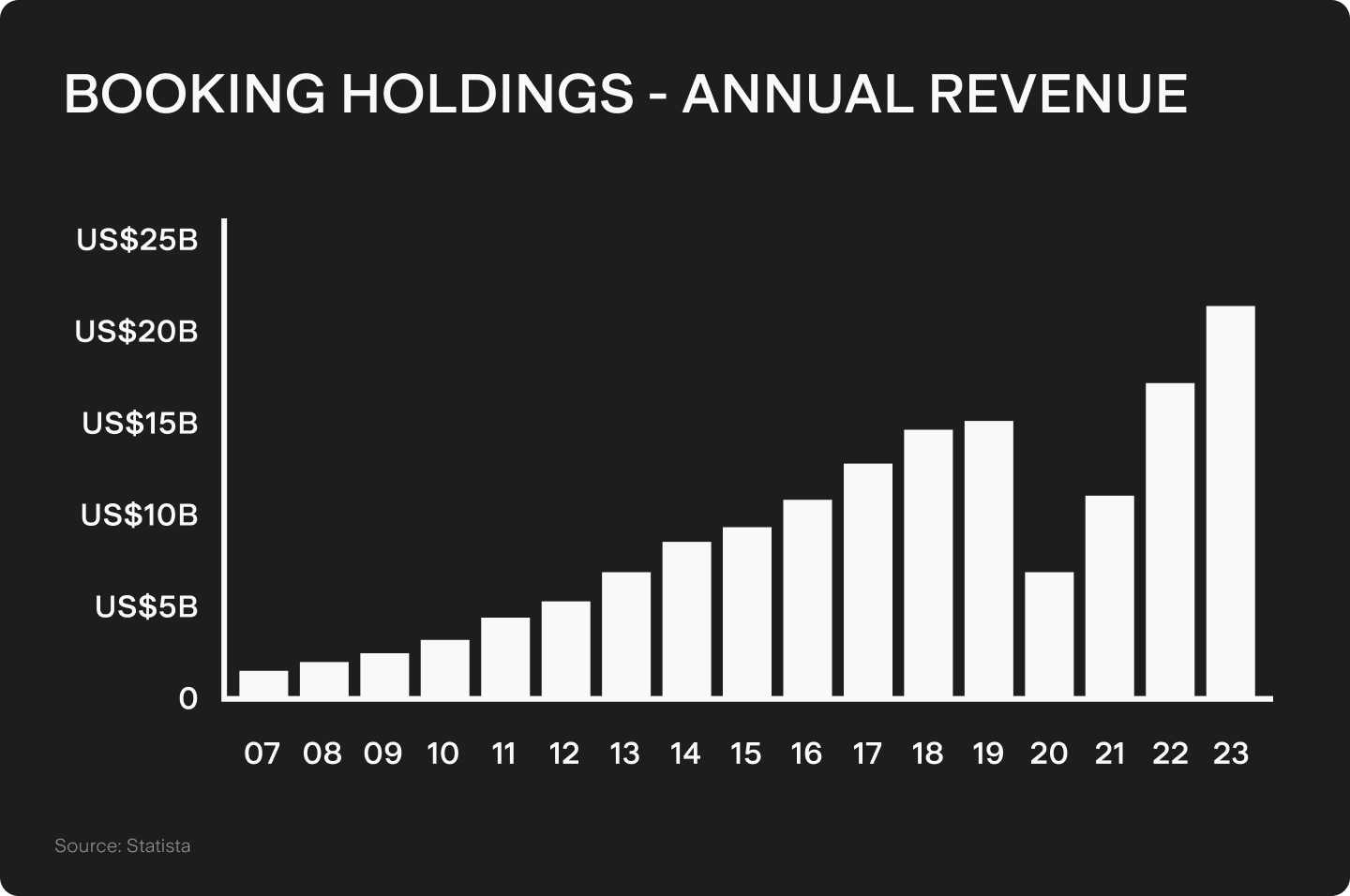

As the COVID-19 pandemic wreaked havoc on health systems and economies worldwide, the travel industry was severely affected. From 2010 to 2019, Booking had grown its revenue from US$3.08b to US$15.07b. But in 2020, sales dwindled to a level not seen since 2013, down to US$6.8b.

The travel colossus acted quickly, raising US$4b through a debt offering. The firm ultimately didn’t need to use this cash thanks to the easing of lockdowns and its cost-control measures (the company shrunk its workforce by 25%).

Steep recovery

Much of the travel industry has yet to recover from the pandemic, but that’s not the case for Booking Holdings. By as early as 2022, the company’s revenue had reached new all-time highs of US$17.09b, while in 2023 the firm reported an even bigger record of US$21.37b.

One of the main contributors to the firm’s recovery was the vast expansion of offers on flagship website Booking.com beyond just hotel rooms. As Airbnb’s ($ABNB) revenue soared during the pandemic, with travellers seeking to rent entire apartments or houses, Booking took notice and expanded its portfolio. It now boasts 29 million different listings, encompassing even boats and igloos.

As a result, the number of overnight stays booked through the group rose to an unprecedented one trillion in 2023, growing 17.1% year-on-year. Offering flights from more than 500 airlines to more than 4,500 different destinations, flight sales also improved massively, growing 57.6% compared to 2022 and totalling more than 36 billion tickets sold through the company’s ecosystem. The number of car rental days also improved, jumping from 62 billion to 74 billion, a 19.7% increase year-on-year.

Future outlook

Booking is not number one in its category on a few measures, such as brand awareness, but it has surpassed its biggest competitors in many ways. While Booking’s revenue has grown at a 17% average in the past five years, the sector median growth is 3%. And while its net income margins sit at around 20%, its peers average 4.6%. This success leads the stock to a steeper valuation, though. Booking’s forward price/earnings ratio is currently at 20x, while the travel sector trades at a more modest 15x.

As the company looks to the future, it seems the worst of interest rate rises are likely over. Yet new hikes aren’t off the table and could dampen discretionary spending in sectors like travel. Furthermore, while the IMF has lowered its concerns about a recession, the possibility of rising inflation shouldn’t be dismissed. But having risen to many challenges over the last 27 years, it’s hard to imagine Booking losing its way or checking out anytime soon.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)