Under the Spotlight Wall St: Airbus SE (EADSY)

Aircraft are crucial for today’s globalised economy, with Airbus a key player in the aerospace industry. But are its shares poised to skyrocket or set to stall? Let’s put it Under the Spotlight.

Despite not being part of prominent acronyms like FAANG, Airbus ($EADSY) is an extremely high-tech company at the forefront of today’s modern economies. One of the world's leading aerospace companies, it shapes the future of aviation. From its humble beginnings as a collaborative effort between European nations to its present-day status, Airbus has demonstrated remarkable innovation, strategic partnerships and a commitment to excellence.

Back in the 1960s, European aircraft manufacturers faced fierce competition from the United States. In response, the French, German and British governments initiated discussions to explore the feasibility of a collaborative effort. The result was the signing of the "Protocol of Intent" in May 1969, officially launching Airbus Industrie.

In December 1970, Airbus's first aircraft, the A300B, made its maiden flight. The A300B was the world's first twin-aisle, wide-body commercial aircraft, able to carry 247 passengers, while boasting advanced technologies and fuel efficiency. The successful launch of the A300B marked a significant milestone for Airbus, demonstrating its commitment to innovation and setting the stage for future developments.

In fact, up to this day, the A300 frame is still in use as it is the base for the original Beluga (Airbus A300-600ST Super Transporter), one of the world’s biggest cargo planes. Able to carry 47 metric tons of weight, the Beluga was designed in 1994 and is still in operation, being key to moving oversized cargo around the globe.

Taking off

In 1988, Airbus launched its next-generation aircraft, the A320. This narrow-body aircraft incorporated advanced technologies, including fly-by-wire flight controls, which offered enhanced safety, improved fuel efficiency and reduced maintenance costs. The A320 quickly gained popularity among airlines, becoming one of the world’s best-selling aeroplanes ever, with more than 10,800 units being produced over the decades.

In 2000, the program to build the A380 was launched, a double-decker plane that is the world's largest passenger aircraft, able to carry 850 people. The A380 showcased Airbus’ commitment to pushing technological boundaries, offering unprecedented capacity, fuel efficiency and passenger comfort. But it failed to gain market demand and struggled with production costs, as a single unit cost more than US$300m (over US$550m adjusted for inflation today). Airlines were also only able to book it for high-demand, long-distance flights like London to New York and Sydney to L.A.

Eco friendly

In recent years, Airbus has also focused on developing more fuel-efficient and environmentally-friendly aircraft. The A320neo (new engine option) is a prime example of this commitment. By incorporating new engine technology and aerodynamic improvements, the A320neo offers reduced fuel consumption, lower emissions and enhanced operational efficiency. This has attracted significant interest from airlines seeking to improve their environmental footprint and reduce operating costs as it allows companies to save up to 15% of fuel compared to the older A320s.

The A320neo was an astonishing success, and Airbus’ biggest competitor, Boeing ($BA), responded with the creation of the 737 MAX, marketed as saving even more fuel than its European counterpart. The 737 MAX had serious design and software issues, however, and after two tragic accidents in Indonesia and Ethiopia, the plane was grounded by authorities worldwide.

Boeing then conducted thorough revisions on the 737 MAX to get it flying once again, and considering the serious scrutiny it went under, it might just become one of the safest planes on the planet. At least that’s what happened with the Boeing 777, which had parts redesigned after accidents and became a favourite of both pilots and airlines alike. If the 737 MAX follows a similar destiny, A320neo sales could be severely harmed.

Frontier use

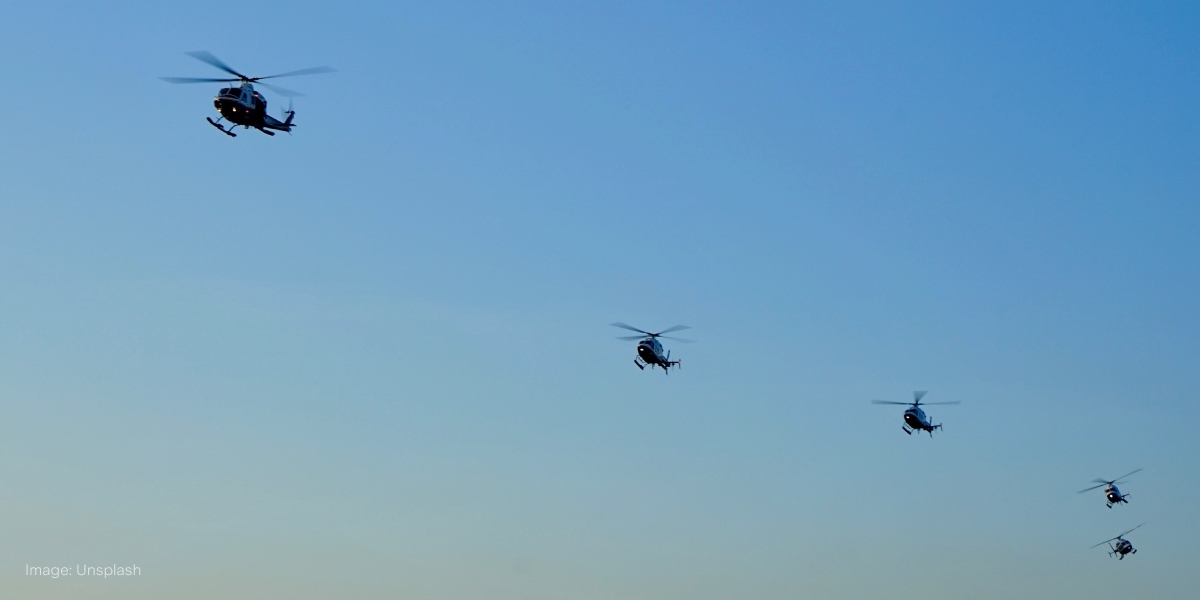

Airbus has also established a strong presence in the defence and space sectors. The company delivers a wide range of military aircraft, helicopters and defence systems to customers around the world. It has also been involved in significant space projects, including the development and deployment of satellites for communication, observation and scientific purposes.

Even though Airbus’ main focus is on civilian aircraft, the defence and space division is big business too: in Q1 2023, it generated €2.29b in revenue, 57% of which came from military equipment. Another smaller sector that Airbus completely dominates is helicopter production. Holding 48% market share, the company is the industry’s leader by a large margin. However, being a significantly smaller market, helicopter sales account for a small amount of Airbus’ total revenue, only 13.5% of the company’s €11.76b revenue in this year’s first quarter.

Headwinds and tailwinds

The COVID-19 pandemic wreaked havoc on airlines, but unlike its competitor Boeing, Airbus didn’t suffer a gigantic drop in demand. While Boeing’s backlog plummeted from 4,223 to 425 units, Airbus’ backlog fell by only 102, remaining above the 7,000 units mark. Most of this was directly attributable to the 737 MAX grounding, as many of Boeing customers switched their orders for Airbus planes. However, in 2022, Boeing’s backlog rose sharply to 4,578 units, as the plane was allowed to fly once again.

Airbus’ rival’s bounce may seem a point of concern, but the company’s deliveries are still going strong: in 2022 it produced 661 units, and in 2023 it hopes to manufacture 720 new aircraft, hoping to cash in on the growing demand to fly after two years of sanitary and macroeconomic turbulence. As a result, the aircraft giant estimates EBIT growth from €5.3b to €6b, just shy of its 15% yearly growth average. Whether new highs will be hit or this growth will stall is still to be seen, but one thing is for sure: Airbus’ rivalry with Boeing is far from over, and neither of them seem likely to lose their position as a key player in the aviation sector in years to come.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.