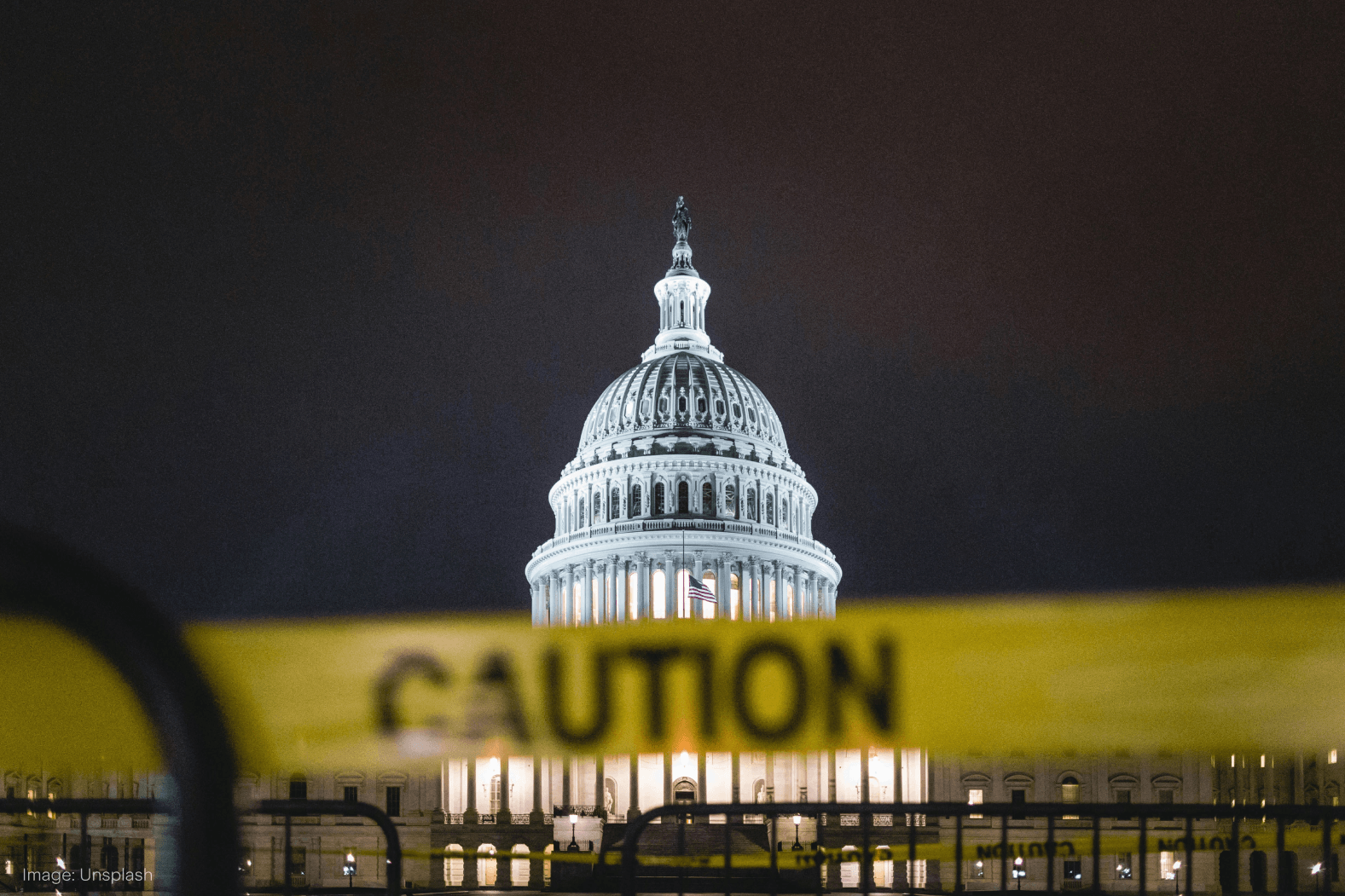

Shutdown

As Washington powered down, Wall St powered on. The question now: which stocks are still shining.

History offers a surprising narrative on U.S. government shutdowns: they often spook headlines more than they do markets. In the 22+ shutdowns since 1976, the S&P 500 has averaged a 0.3 % gain.

This time’s no different. The S&P 500, Nasdaq and the Dow Jones all surged to new highs as Wall Street shrugged off the government shutdown extending into its second week.

Instead, investors tuned into Tesla ($TSLA) CEO Elon Musk’s campaign to cancel Netflix ($NFLX) subscriptions, which sent the stock down 2.5% in the days that followed. Tesla investors also had another reason to cheer as the EV maker’s deliveries surpassed Chinese rival BYD ($BYDDY) for the first time this year.

Then came the monster chip deal. OpenAI really said it's open for business, as it began building a 10% stake in AMD ($AMD) as part of a multi-year partnership. Amongst other things, AMD will supply 6 gigawatts of AI infrastructure and enable large-scale AI deployments for the ChatGPT maker. That triggered a 38% jump in $AMD – its biggest rally in almost a decade.

AMD wasn’t the only one riding the wave. Wall Street’s fresh face Figma ($FIG) popped 16% on Monday after OpenAI CEO Sam Altman showcased the design app’s integration with ChatGPT on stage.

Corporate news might have been the catalyst for major stock moves this week, but that doesn’t mean the shutdown’s impact is off the table.

For instance, important data releases like the BLS labour market report didn’t make it out . And with no jobs data just weeks before the next Fed meeting, investors are flying blind. So it's no surprise that volatility is creeping higher.

The Volatility Index (VIX) aka Wall Street’s ‘fear gauge’ rose for five straight sessions. So did the S&P 500. It's the first time in history that both rose in tandem for a stretch this long, according to Goldman Sachs. Why does it matter? Because it’s not your textbook ‘risk-on’ move, which usually involves a falling VIX and rising stock prices.

The data suggests that investors are hedging their bets as they ride out the rally. A sign that momentum isn't what it appears to be on the surface. With the shutdown fogging key data, earnings season may be the only light Wall St can trust. Good thing it's right around the corner.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.