Conflict

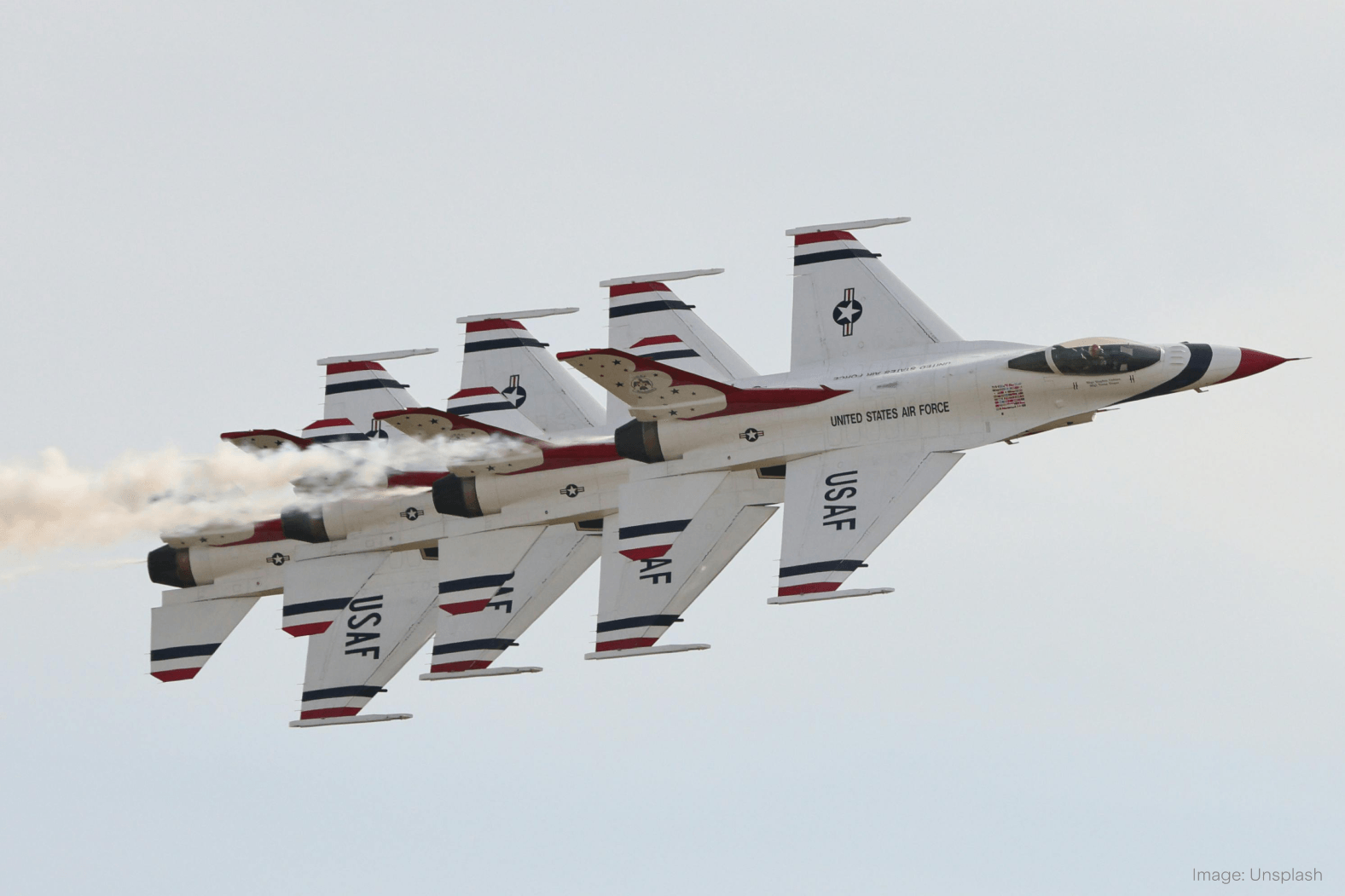

The U.S. strike on Iran adds another conflict for global markets to fret over. But amid rising tensions, defence stocks are proving popular.

There may be a fragile ceasefire in the Middle East for now, but global markets are on high alert to escalating conflicts.

The U.S. attack has investors rethinking how and where they allocate capital in an increasingly dangerous world. Wall Street’s fear gauge, the VIX Index, has inched higher over the past two weeks.

Some investors have looked to U.S. defence stocks. Stake’s platform has seen increased trading in stocks like Lockheed Martin ($LMT) and RTX Corp ($RTX).

The Dow Jones U.S. Select Aerospace & Defense Index is up 37% over the past year, outpacing the S&P 500’s 10% gain and Nasdaq’s 12%. RTX, which makes missile defence systems like Israel’s Iron Dome, is up 26% this year alone.

Why defence stocks? Because that’s where the money is. Governments are ramping up military budgets as geopolitical power shifts and global conflict increases. The U.S. strike comes as Israel fights a multi-front war, while Ukraine and Russia notch up a third year of combat.

The numbers are eye-watering. The Trump administration has requested US$1t for the Pentagon in the FY26 budget. China, which is eyeing ‘reunification’ with Taiwan, approved a 7.2% rise in military spending to US$245b in March.

Defence stocks aren’t for everyone. But when it comes to military tech, the U.S. leads. The B-2 bomber used to bomb Iran’s nuclear sites? Built by Northrop Grumman ($NOC). The engines that powered it across Iranian airspace? That’s GE Aerospace ($GE). The bunker buster bomb? Built by Boeing ($BA).

Defence ETFs are one way investors are gaining diversified exposure to military contractors. Think of them as the joint operations of defence stocks: air, sea, land, space and cyber - they offer it all in one investment. The U.S.-listed iShares U.S. Aerospace & Defense ETF ($ITA) is up 37% over the past year.

In Australia, the Betashares Global Defence ETF ($ARMR) and the VanEck Global Defence ETF ($DFND) have soared 52% and 71% respectively over the past year. Those gains have been fuelled by their largest holding being Palantir Technologies ($PLTR). We recently riffed on Palantir, which has rallied 480% over the past year as its AI-driven data analytics platform wins U.S. military contracts.

The world has become a more dangerous place. Military spending reflects this reality. As Metallica warns in Don’t Tread on Me: ‘To secure peace is to prepare for war’.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.