How to buy shares in Squarespace (SQSP)

Website building and hosting service Squarespace is set to IPO via direct listing May 19, here's how to buy shares in SQSP on Stake.

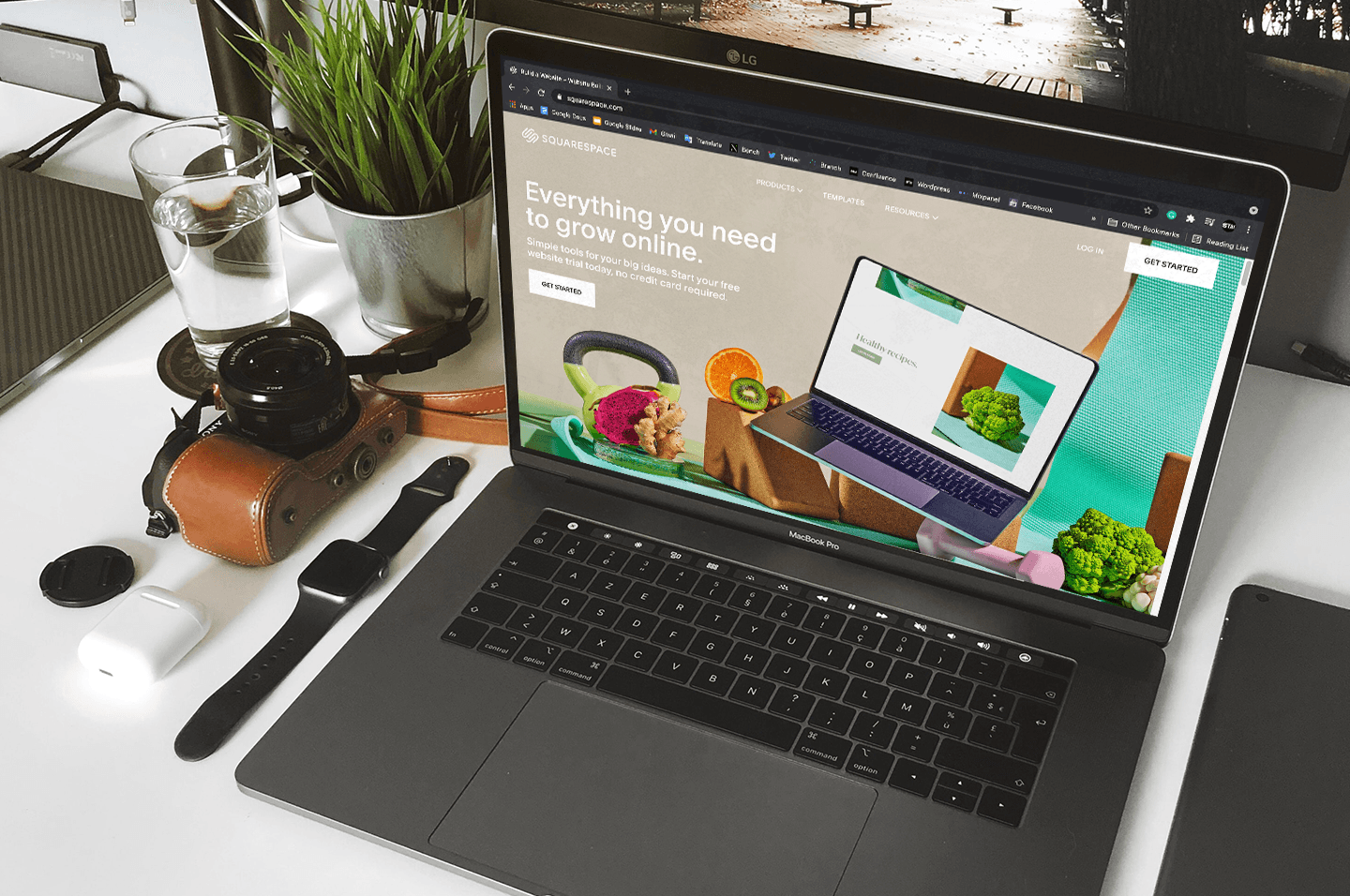

What is Squarespace?

Powering over 2.5 million sites on the internet, Squarespace is a website building and hosting service. Allowing for no-code site design, its software breaks down the barriers to producing aesthetic, quick, and cost-efficient webpages.

With revenue of US$644m and a net loss of US$267.7 in 2020, the company was valued at US$1ob during its last raise in march. It will go public via a direct listing.

How to buy shares in Squarespace (SQSP)?

During Wednesday’s session on 19 May, Squarespace (SQSP) will complete a direct listing. At some point during the session, $SQSP will become available to investors.

Here are a few things to keep in mind for those looking to invest.

Direct Listings

The stock price and value of a company are entirely determined by market supply and demand. Existing insider shareholders can sell their shares at a price they calculate as fair while traders and investors determine their bid price. The stock initially trades where the bid and the ask meet.

During a traditional IPO, a bank will predetermine the value of a company during the underwriting process. Given direct listings do not feature an underlying predetermined valuation, they can be subject to increased volatility.

Buying on Stake

Investors will only be able to submit an order for $SQSP once it is live. This is often an unknown time after the market opens once the pre-listing auction is complete. While the stock page may be visible on the website and app, no orders can be placed until the stock is officially trading.