How Extended Hours Trading works on Stake

Stake Wall St now offers additional trading sessions to give investors more opportunities to buy and sell U.S. shares. Here are some specifics about investing during pre-market and after hours on our platform.

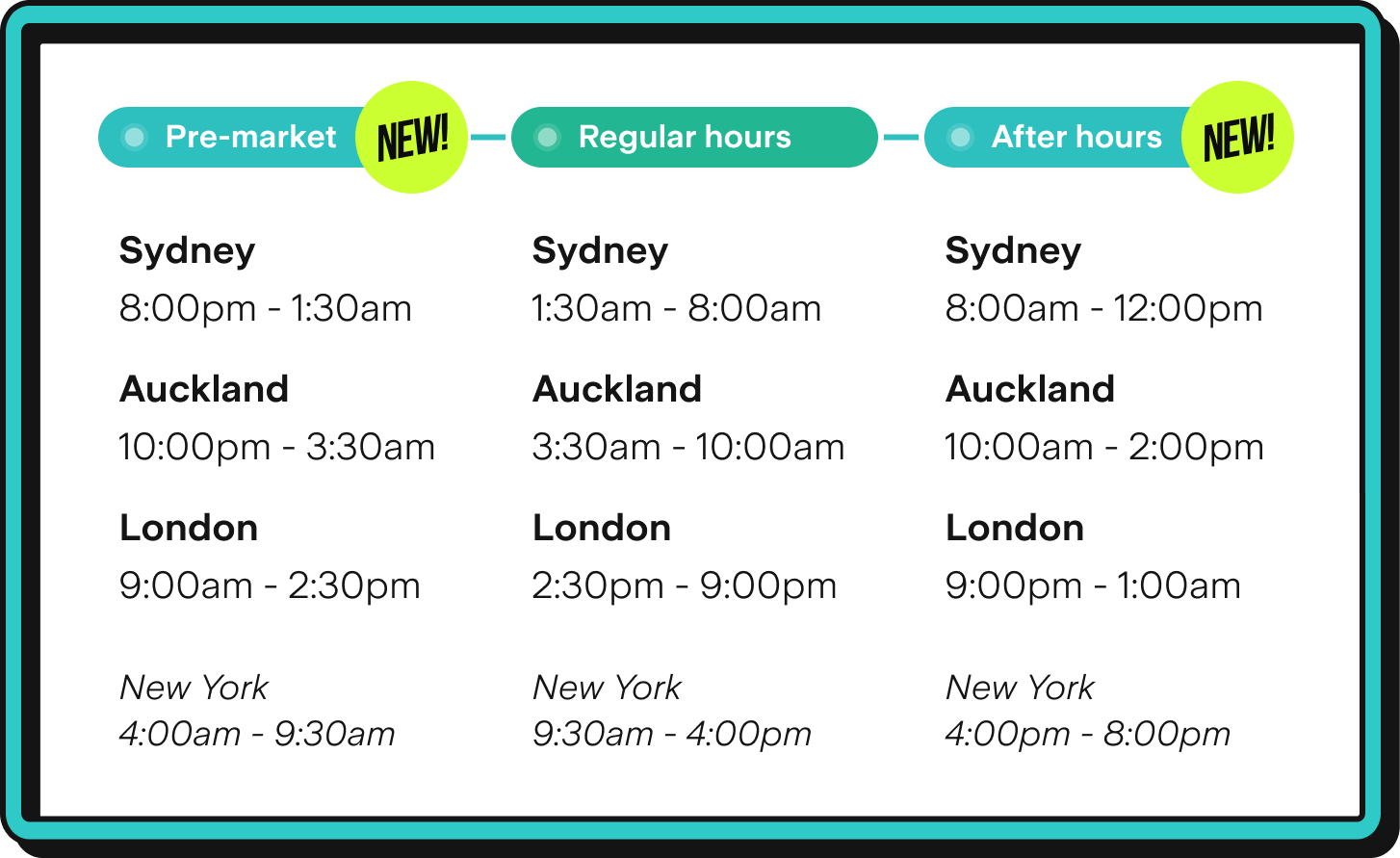

We’re excited to provide Stake investors with an additional 5.5 hours of trading before and 4 hours after the usual market opening times, so they can make more timely investment decisions and participate in the excitement of the markets at more convenient hours.

On Stake, Extended Hours are comprised of pre-market and after hours:

Buying and selling shares during these additional sessions will be very similar to the official U.S. market hours, but it’s not entirely the same process. There are some new features that can enhance the experience for investors.

Placing orders

To get started with Extended Hours trading, place an order in any session and you’ll see the option to enable it to be executed in both regular and extended trading sessions. When Extended Hours is enabled, limit orders for all shares can be filled during either regular hours, pre-market or after hours, with the usual expiry options available.

Market orders, on the other hand, are only possible during Extended Hours for around 1,000 higher-volume stocks – and they will be cancelled if they don't execute immediately as a protection in moments of high volatility. So it’s worth keeping in mind that market orders might not always get filled.

Before enabling any given order to be carried through to Extended Hours, investors should keep in mind that, due to lower levels of trading activity, those sessions can be relatively volatile.

Profit and loss calculations

Stake Wall St customers can choose whether or not they want their dashboards to show Extended Hours pricing. With the sun/moon toggle greyed out (off), all values on the platform will reflect regular hours sessions only. But when it’s on (the default), calculations for profits and losses will be updated live during the two additional sessions.

As share prices will change in the new session, the returns for stocks and overall holdings will be affected. The percentage movements during the pre-market or after hours period will be shown; these numbers will only reflect the shift during this new period rather than the whole day.

For each investor, the total return on this specific stock will also be calculated in real time. This value will always be there and can be good to look at before making any investment decisions. The figures for profit and loss will again be adjusted if the toggle setting is changed to only the usual trading hours.

Session tracker

Stake investors could previously tell whether a market is open and for how long through a countdown timer on the top of the dashboard. This has now evolved into a dynamic, interactive session tracker.

This teal banner makes it clear what session you’re currently in. It can also expand to provide more information about timings and sessions, adjusted to local times. Additional info such as notices about upcoming trading holidays is also on hand to help investors plan ahead.

So if you’re ever unsure what time it is in New York and what trading session is in progress, look no further than the top left of your dashboard to find out.

Extended Hours carries additional risk and may not be suitable for all investors. Read our Risk Disclaimers and Terms and Conditions.

Sam is a product marketing specialist at Stake with 6 years of finance experience in Australia. With a Bachelor in Business from the University of Technology, Sydney, he specialises in product marketing and communications strategy. Previously, he has worked in the home lending and retail banking sectors with experience in customer success, marketing and product at Mortgage Choice and Ubank (formerly 86 400). At Stake, Sam helps manage the launch of new products and features whilst also focusing on marketing campaigns that help improve the Stake experience.