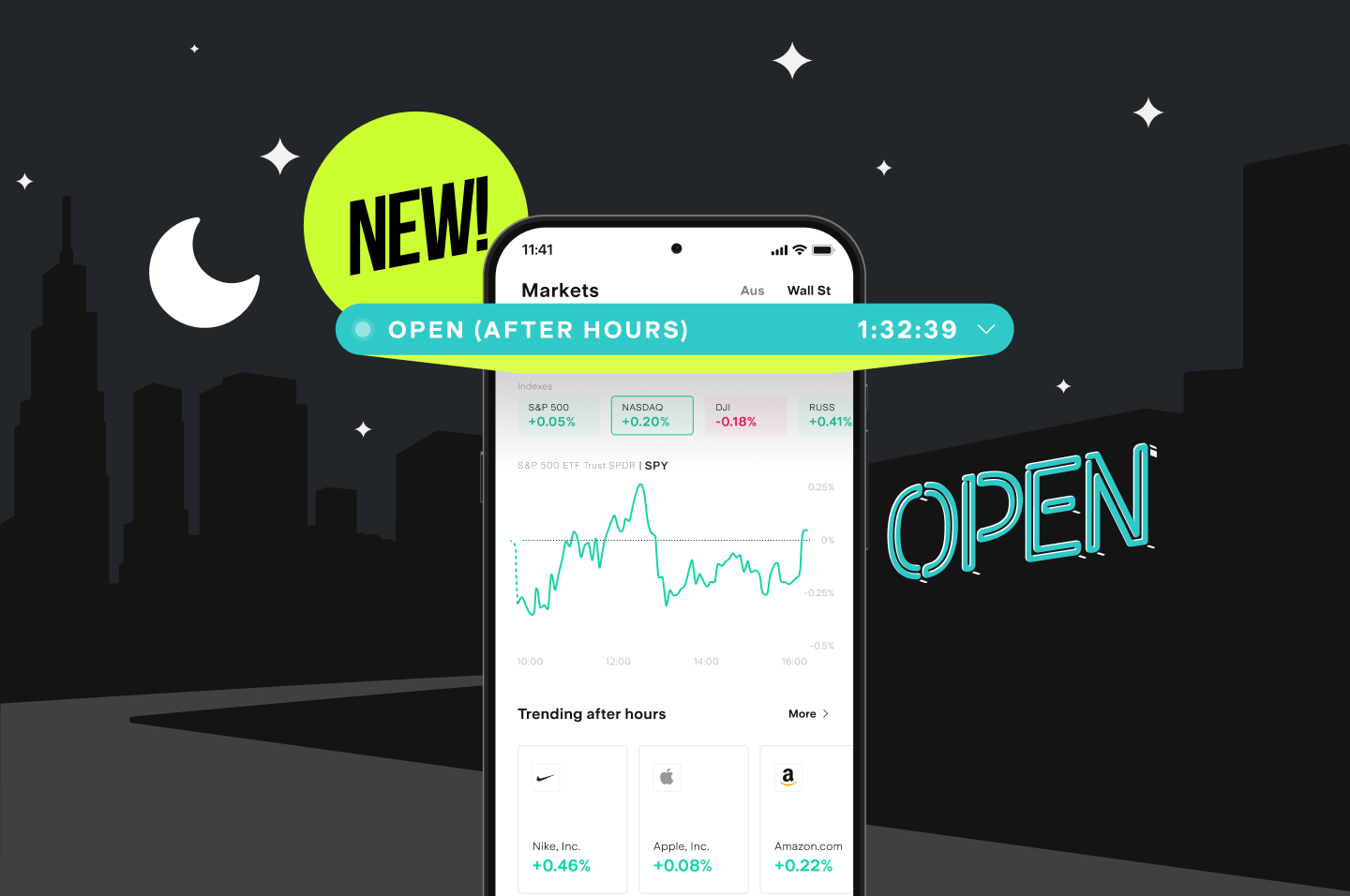

Stake Launches Extended Hours Trading for U.S. Stocks — Bringing Better Access for Investors Across Time Zones

Stake has launched Extended Hours for the U.S. markets, giving investors more flexibility to trade on their own schedule.

Sydney, Australia, 5 December 2023 - Stake, the Australian investment platform, has launched Extended Hours for the U.S. markets, giving investors more flexibility to trade on their own schedule. With over nine hours of additional access per trading day, Australians can now see U.S. orders execute without enduring late nights or early mornings.

Joel Larish, CPTO at Stake said, “The U.S. market offers unrivalled access to major global brands, but the time zones can make it difficult for Australians to take part in the action. Extended Hours gives Stake customers more flexibility to make trades when they’re most likely to have the time, such as during their morning commute or early evening.”

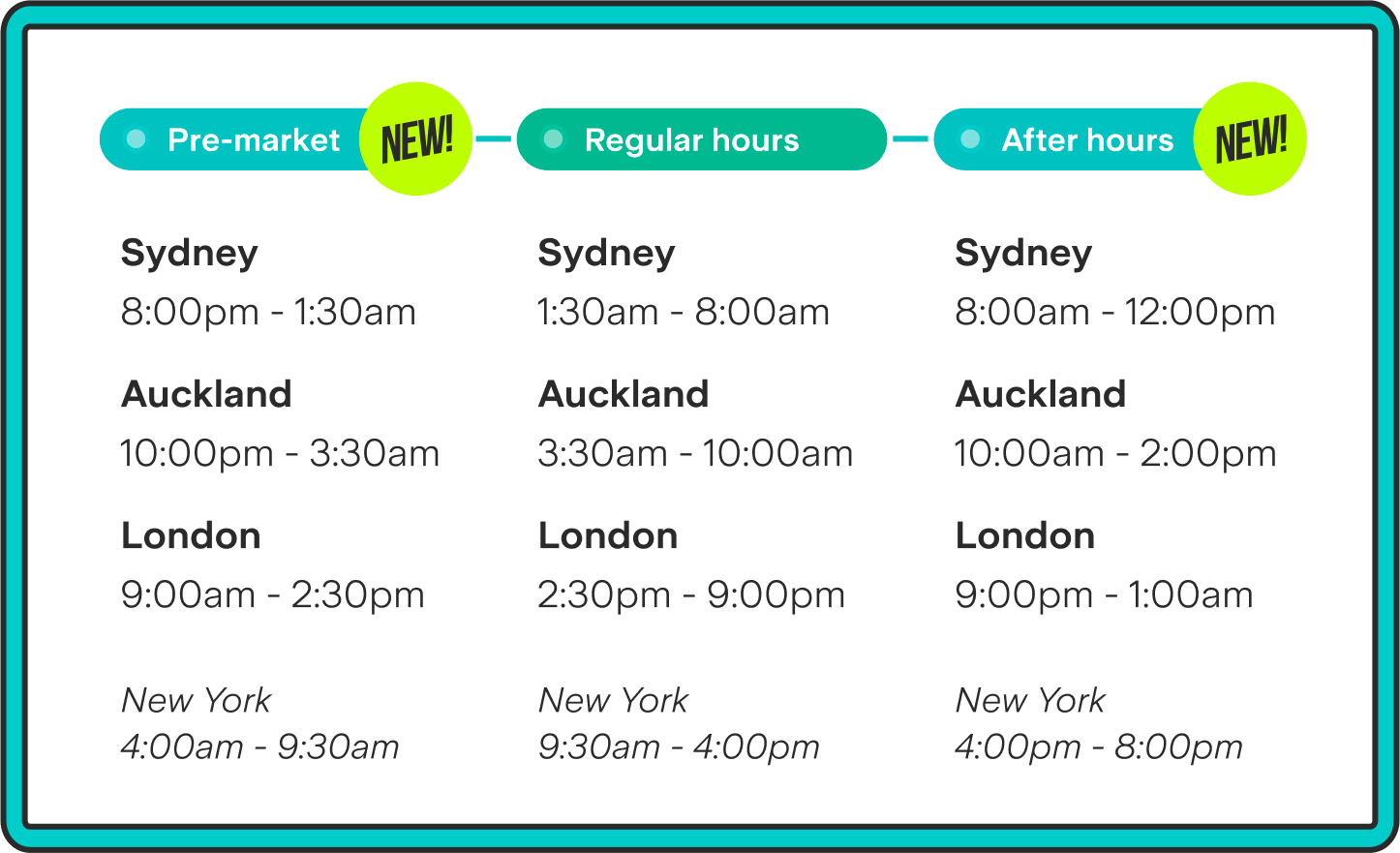

Pre-market trading opens 5.5 hours before the regular Wall St session, while after hours trading is available for four hours after close. Customers can easily toggle Extended Hours on when placing a trade to let it be executed during those two additional sessions.

Larish continued, “Unlike the Australian market, Wall St sees high volumes of trading activity outside regular hours and companies often report earnings after close, which sometimes leads to substantial price changes before the next session. Stake investors can now take part in these important periods of market activity.”

Key features of Extended Hours include:

Convenient Access to U.S. Markets: pre-market runs from 8pm to 1:30am AEDT and after hours runs from 8am to 12pm AEDT every U.S. trading day, giving Australian investors more flexibility to access opportunities. Extended Hours pricing can be toggled on or off throughout the Stake Wall St experience, allowing investors to see price movements in real time.

Session Calendar: Stake’slive calendar shows which session is active, including information on holidays and early closes that make it easy to stay on track.

Market Orders for High-Volume Stocks: during Extended Hours, investors can place market orders for over 900 high-volume equities, while limit orders can be placed for all U.S. stocks on Stake. Market orders will only execute within a range of 2.5% during these sessions to protect customers from large price swings.

Stake Academy Extended Hours Hub: educational articles and bite-sized videos are integrated into the experience to help customers better understand the new features, including the differences that change the risk profile of investing during Extended Hours.

Joel Larish adds, “Extended Hours has been meticulously designed to make the investing experience as intuitive as possible, enabling investors to access opportunities without unnecessary complexity. This is just the first of many new features we have on the horizon, and we’re excited to announce more in the coming months.”

At the time of writing, Extended Hours is available during the following windows:

ENDS

About Stake

Stake was founded in Australia in 2017 with a mission to break barriers for ambitious investors. Since its launch, Stake has attracted over 500,000 customers by providing seamless access to the U.S. markets, $3 CHESS-sponsored ASX trades, and Stake Super — an intuitive, hassle-free SMSF platform. Stake completed a $90 million Series A funding round in May 2022 and is backed by major investors including Tiger Global and DST Global. It is the largest online broker for international shares in Australia, and the third largest overall, according to the Investment Trends H1 2023 Online Investing Report.