.jpg&w=3840&q=100)

Under the Spotlight ASX: ANZ ($ANZ)

ANZ’s sweeping shake-up and half year results has investors intrigued, despite record ASIC penalties.

ICYMI: do your own research and make your own decisions. This article drills down on a specific company, however it is not a recommendation to invest in the company and should not be taken as financial advice.

Despite the constant banking misconduct headlines, the sector hasn't lost its shine on the ASX.

Even with ANZ ($ANZ) having the dubious honour of copping ASIC's record fine, investors reacted with a shrug.

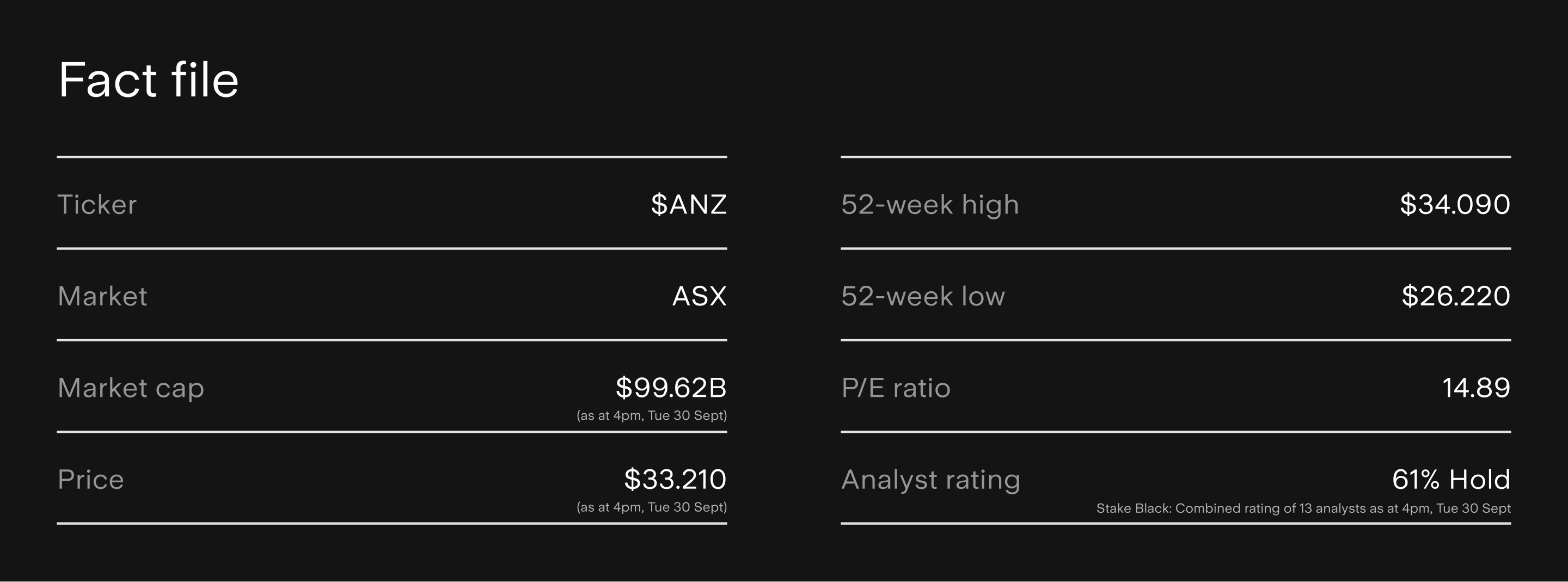

The share price dipped just 1% on the day and is only down 0.63% for the month. Year to date? ANZ is still up 9.45%.

What matters more to the market now is whether ANZ – Australia’s fourth-largest bank – can lift performance under new CEO Nuno Matos.

Can new CEO Nuno Matos lift ANZ's performance?

Since stepping in, Matos has laid out bold plans, including:

3,500 job cuts, mostly in tech and retail.

Consolidation of banking platforms.

A sharper focus on risk management.

He told shareholders his aim is a ‘high-performance culture, accelerating the pace of delivery and materially improving our risk management capabilities’.

It’s ambitious, but will it pay dividends?

Brokers are largely neutral on the smallest and cheapest of the Big Four. Price targets range between $26.50-$36.70.

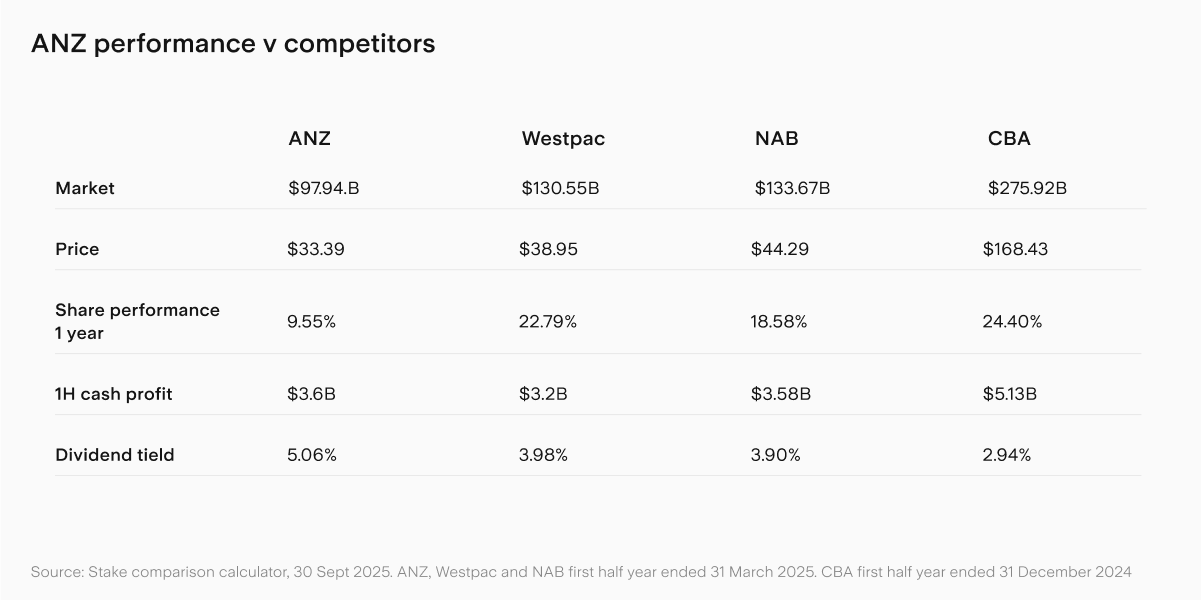

Compared to Commonwealth Bank’s ($CBA) price of $168.43, ANZ offers cheaper exposure to the sector. The key questions: is the price fair, and can ANZ turn its culture around?

Despite record fines, will ANZ cut its dividend?

In September, ANZ was fined $240M by ASIC across four separate misconduct cases, including:

In short, these included:

Misreporting bond trading data to the Australian Government while managing a $14B government bond deal over two years.

Failing to act on customer hardship notices nor having appropriate hardship procedures.

Making false or misleading statements about savings interest rates and not paying the promised rate to customers.

Charging and not refunding fees to dead customers and taking too long to respond to loved ones managing deceased estates.

This is not ANZ’s first rodeo with ASIC either. Their total penalties have hit $310M across 11 cases since 2016.

But the bank is trying to clean up its act. It’s cut the pay of current and former execs to drive accountability and earmarked $150M for cultural reform and risk fixes.

But shareholders may need to brace for dividend cuts. Morningstar analyst Nathan Zaia expects a 5% yield for the full year, ending September 2025. He expects ANZ to treat the fine as a one-off and to continue to pay out 70% of underlying profit.

Inside ANZ's strategy to integrate Suncorp and streamline tech

The fine isn’t the only headline. Structural change is Matos’ main act since he joined in May 2025.

In September, he announced a $560M plan strategy to ‘eliminate duplication and complexity, stopping work that doesn’t support our priorities and sharpening our focus on improving our non-financial risk management practices across the bank.’

What that means in practice is:

A 1,000 reduction in contractors in addition to the job cuts.

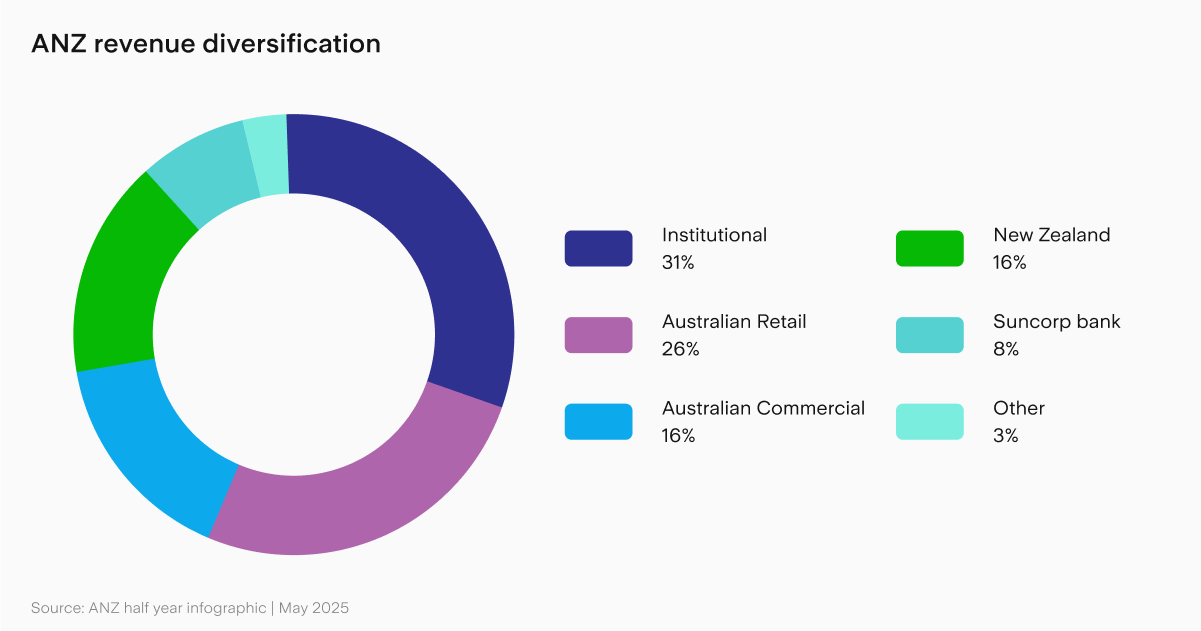

Faster integration of Suncorp into ANZ structures.

Shifting Suncorp customers to ANZ’s classic older platform.

Also potentially on the table: merging Suncorp and ANZ’s tech platforms into one, which would mean transitioning ANZ’s classic platform into its new retail platform, ANZ Plus.

It’s only the start. Matos will present his full strategy to investors on 13 October.

Morningstar’s Nathan Zaia calls this a necessary ’fresh approach’ for a bank that’s lagged its peers. He expects the changes to ‘help keep expense growth modest over the medium term’.

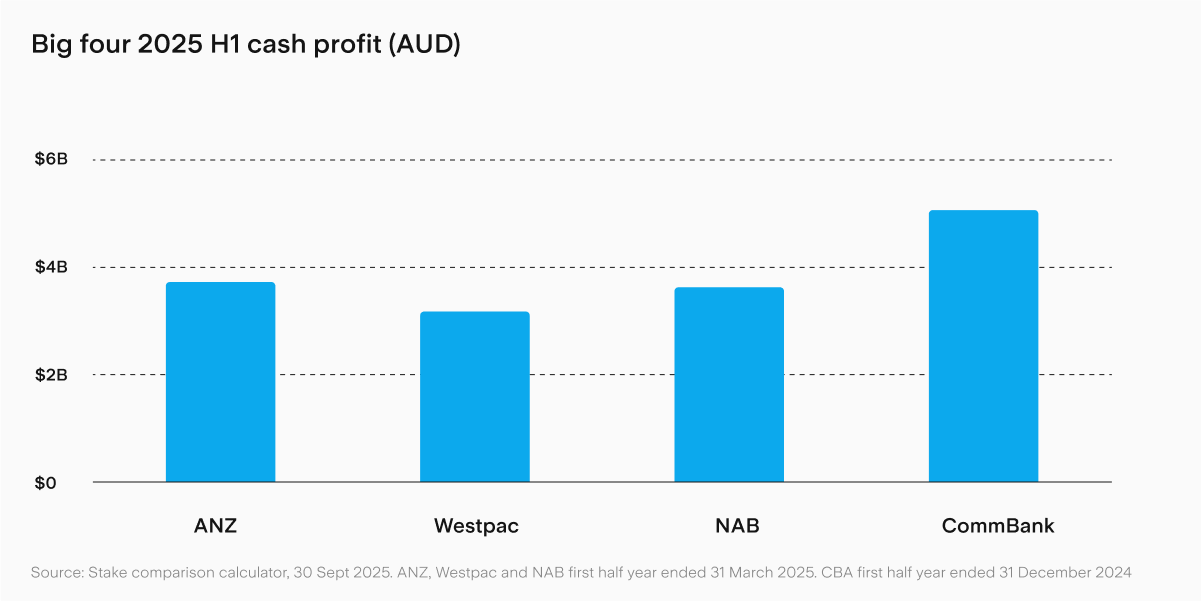

Beyond the fines: ANZ posts record $3.6B half-year profit

The headlines have focused on scandals. ANZ’s balance sheet tells a different story, with the bank delivering record half-year results.

Profit jumped 12% to $3.6B. Revenue rose 5% to $11B. Suncorp Bank was a highlight. It delivered a record cash profit of $286M in its first full half-year inclusion following its acquisition in July 2024.

It boosted ANZ’s scale in commercial and retail banking, adding 1.3M customers and growing ANZ’s market share in home lending to third.

Morningstar’s Nathan Zaia sees the bank in ‘good financial health’ and describes the balance sheet as ‘sound’. He assumes ‘low-single digit loan growth, modest net interest margin improvement, reasonable cost control and a relatively benign outlook for bad debts over the medium term.’

ANZ is also pushing innovation. It has also delivered on significant projects such as Digital Padlock, where customers can instantly secure their accounts to prevent scams.

It’s also secured a $2B government guarantee for its Pacific operations for the next 10 years and plans to invest a further $50M into Pacific banking systems.

Plus, ANZ already has digital innovation in its DNA. It led the charge on offering Apple Pay and launched A$DC, Australia’s first bank-backed stablecoin.

It also has two major long-term plays:

It’s part of the RBA’s Project Acacia research program to test using digital currency and tokenised fixed-income assets in the Australian finance system.

It’s rolling out its ‘Fuelling the Fire’ First Nations strategy, designed to boost financial inclusion and wellbeing with an aim of becoming the bank of choice for the First Nations Economy.

Is ANZ stock a buy after its strategic reset and ASIC fines?

The question for ANZ’s investors is whether upside outweighs the damage.

ANZ’s missteps are serious, and trust takes time to rebuild. But between a solid balance sheet, tech investment and a CEO with a plan, it’s positioning itself for a reset.

Its 8.8% market share is not insignificant, and some investors may see opportunity. But closing the gap on the rest of the Big Four is no small task, and the pressure is on Matos to deliver on his plan.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Sara is a passionate finance writer with more than 15 years’ experience in the Australian finance industry. She has worked in marketing and content with Macquarie Group, Westpac, ETF Securities (now Global X ETFs) and Livewire Markets across investments, insurance, financial advice and superannuation.

.png&w=3840&q=100)

.png&w=3840&q=100)