Under The Spotlight: Advanced Micro Devices ($AMD)

AMD’s stock has soared after OpenAI agreed to buy a huge batch of its chips – enough computing power to rival several nuclear plants. But can it deliver on the AI hype driving its rally?

ICYMI: Do your own research and make your own decisions. This article drills down on a specific company, however, it is not a recommendation to invest in the company and should not be taken as financial advice. Got a stock you want covered? Tell us here.

If you’ve been following AI stocks lately, you might need an aspirin. In the space of just a few weeks, OpenAI has inked a string of deals that’s entangled the world’s biggest chip and cloud companies and lit a fire under Wall Street’s favourite AI trades.

Take Advanced Micro Devices ($AMD). The chipmaker’s stock has surged more than 40% in October after OpenAI signed a deal to secure up to 6 GW of AMD GPUs.

For context, that’s roughly the energy output of around six nuclear power plants.

The scale is hard to grasp, but this deal is just one of several. OpenAI has been busy signing billion-dollar agreements with nearly every major chip and cloud provider, including Nvidia ($NVDA), Broadcom ($AVGO), AMD and Oracle ($ORCL).

The message is clear: OpenAI isn’t picking favourites – it’s hedging by backing the whole field.

Inside the OpenAI-AMD deal

On paper, AMD’s 6-gigawatt deal with OpenAI looks enormous. But the fine print tells a more complex story.

Under the agreement, OpenAI will receive 160 million AMD shares in exchange for deliveries of AMD’s Instinct MI450 GPUs, with the first batch expected in the second half of 2026.

It’s a unique arrangement: OpenAI will receive the shares gradually over time in line with chip deliveries, technical milestones and AMD’s share price.

Crucially, the deal hinges on both sides meeting these requirements. OpenAI must hit technical and commercial milestones needed to deploy AMD’s chips at scale.

The specifics are unclear. But if all targets are met, OpenAI could end up owning roughly 10% of AMD’s total shares.

The AI money loop

While clearly a win for AMD, OpenAI has struck even bigger deals with main rivals Nvidia and Broadcom.

Each partnership is designed to secure scarce computing power. But the financial structures vary and not all are equally lucrative.

Market leader Nvidia got the better deal. It’s investing up to US$100B in OpenAI as its systems are deployed from 2026. In exchange, OpenAI will buy 10 GW of Nvidia GPUs. That gives Nvidia both a stake in OpenAI’s success while entrenching its position as AI’s dominant hardware supplier.

Broadcom’s arrangement is less transparent but it’s described as a multi-year collaboration with OpenAI to co-develop and deploy 10 GW of custom AI accelerators from 2026.

AMD’s deal is structured more like a bet on itself. OpenAI becomes an investor, exchanging some chip spend for equity that could rise in value if AMD’s GPUs deliver on performance.

Despite AMD CEO Lisa Su calling it a ‘win-win’ the asymmetry is clear. OpenAI wins either way while AMD carries all of the risk. At any point, OpenAI could simply cancel the order by not meeting its milestones.

Deal comparison

Nvidia: Up to US $100B investment into OpenAI as it deploys 10 GW of systems from 2026. Reinforces NVIDIA’s dominance in AI hardware.

AMD: OpenAI granted up to 160 million AMD shares (~10 % of the company) as 6 GW of AMD GPUs are deployed, pending performance and delivery milestones. Elevates AMD into the AI infrastructure race, but with more conditional upside.

- Broadcom: 10 GW of custom AI accelerators (through to 2029) jointly developed with OpenAI. Positions Broadcom as a long-term custom-silicon supplier and diversifies OpenAI’s supply chain.

AMD in focus

While AMD’s share price performance is tied to AI right now, it’s not the only line of business generating revenue.

It remains a market leader in CPUs (Ryzen and EPYC), desktop GPUs (though significantly trailing Nvidia) and APUs used for gaming and portable devices. Playstation and XBox both use AMD chips.

In recent years, AMD has leaned into more energy-efficient data-centre GPUs for AI training one of the main constraints in AI development.

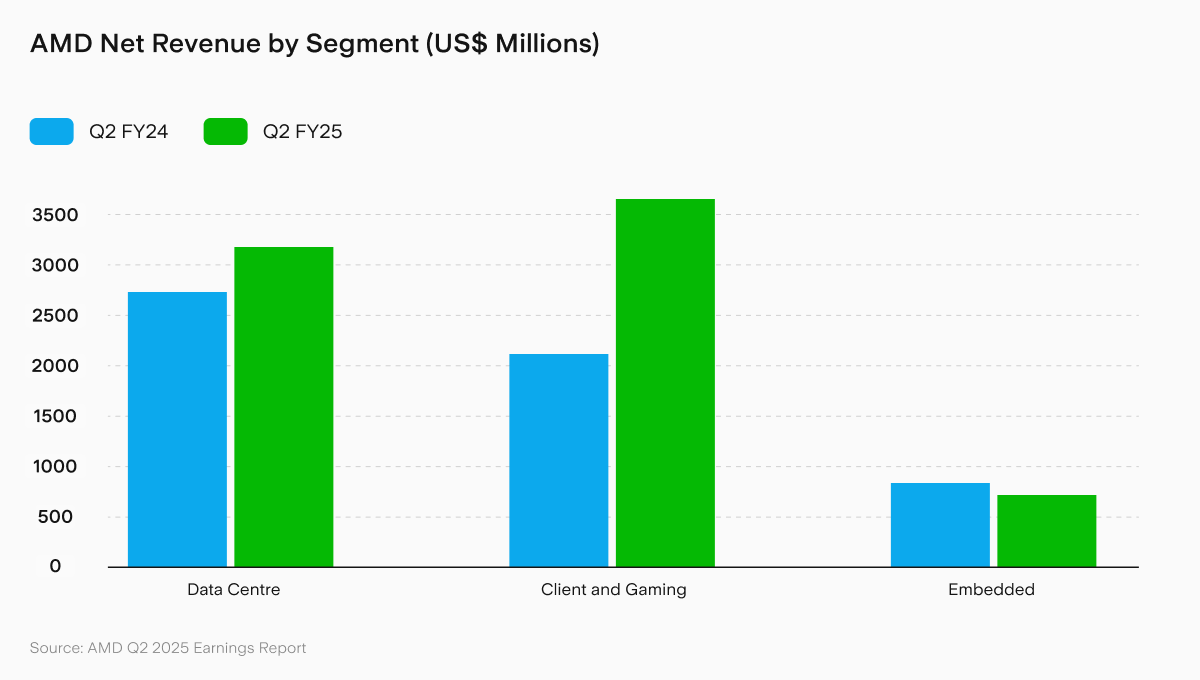

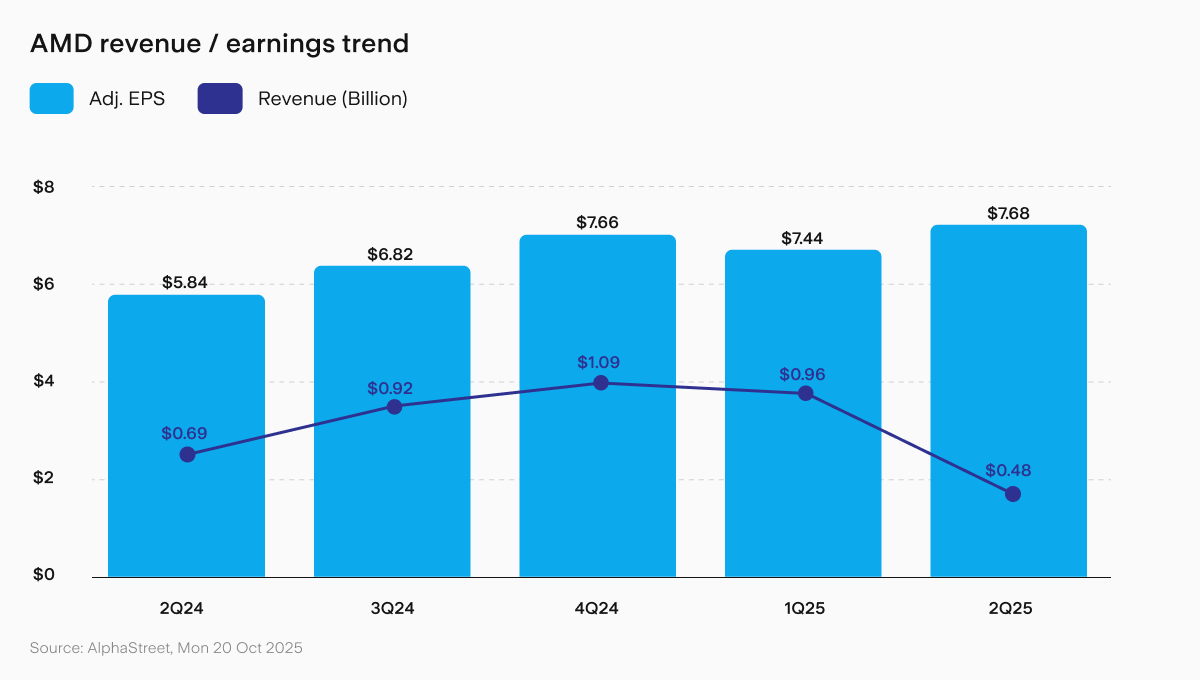

This shift is paying off. In the June quarter, AMD reported a record US$7.7B in revenue – up 32% YoY. Its data-centre segment makes up 41% of this.

Net profits jumped by an impressive 229%, although discretionary profits (non-GAAP) fell 30% thanks to the U.S. government export restrictions on AI chips to China.

With a 40% gross margin and 7% debt-to-equity ratio, AMD clearly has room to expand and invest in the R&D it needs to dominate in an AI powered world.

Nvidia holds the crown

But AMD’s future hinges, in part, on its ability to close the gap on its biggest rival, Nvidia.

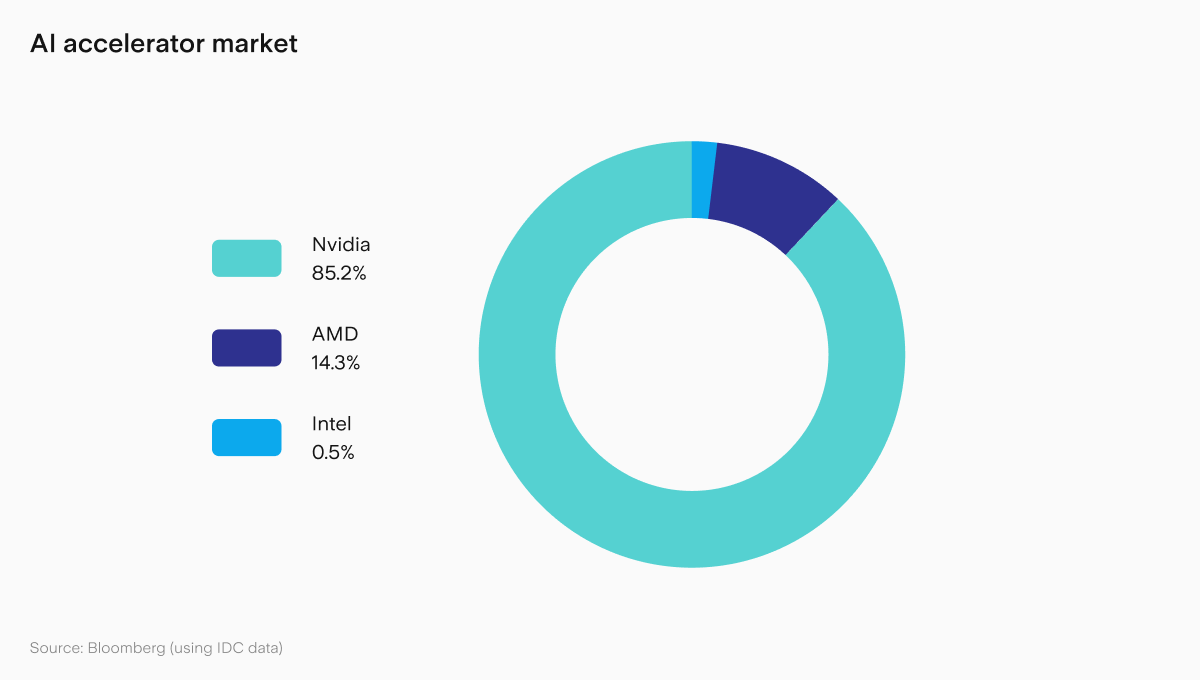

Nvidia dominates the advanced GPU market, with share price up 1,200% in the last five years. It holds a record 92% market share of the desktop GPU market compared to AMD’s 8%, and at least 80% of the data-centre segment, depending on the estimate.

Last quarter, Nvidia reported in data-centre revenue, fuelled by the AI boom. AMD’s equivalent for the June quarter was . But supply shortages are leveling the playing field. Nvidia for AI data-centres fast enough, and OpenAI’s move to add AMD chips to the mix reflects that pressure – and AMD’s potential.

So, is AMD a buy?

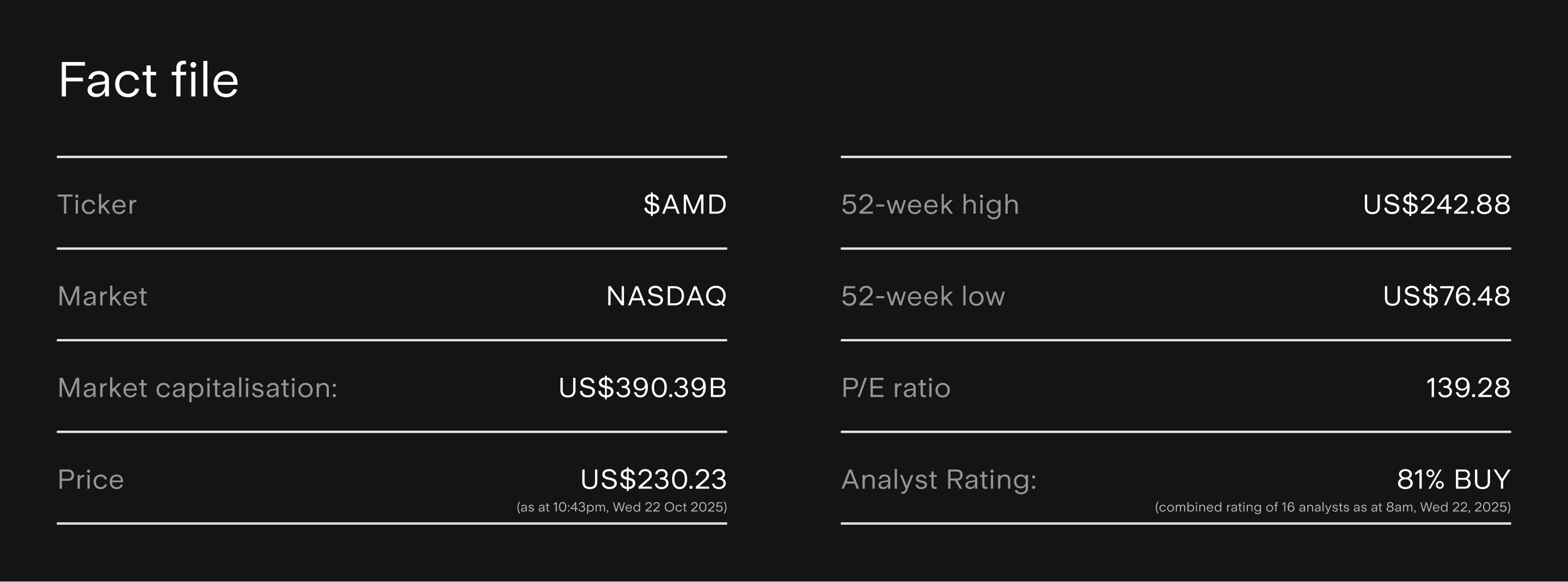

Analysts are mostly bullish. Of the 16 featured on Stake Black, 81% rate AMD a ‘buy’ with an average price target of US$268.69. That presents growth of 12% from its current price.

But AMD’s recent rally reflects optimism more than fundamentals. The OpenAI partnership puts it firmly in the AI conversation, but its payout hinges on future performance and isn’t guaranteed.

If AMD can deliver – both on roadmap and proof its GPUs can compete at scale – the reward could be enormous both in revenue and credibility. If not, the stock’s momentum may fade as fast as it rose.

Either way, one thing’s clear: the AI boom isn’t a zero-sum game anymore. Fierce rivals, are now bound together by mutual dependence, each supplying a different piece of the world’s most powerful computing puzzle.

For now, AMD is riding AI’s momentum. Whether it can convert that hype into lasting profits depends on what happens when its first next-gen GPUs start rolling off the TSMC ($TSM) lines in 2026.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Kylie Purcell is an investments analyst and finance journalist with over a decade of experience covering global markets, investment products and digital assets. Her commentary has been featured in publications including the Australian Financial Review, Yahoo Finance and The Motley Fool. She has a Masters Degree in International Journalism from Cardiff University and a Certificate of Securities and Managed Investments (RG146).