Market Depth: a powerful tool for navigating volatile markets

Both avid traders and part-time investors are always on the lookout for tools and techniques to get an edge in the markets. Two such tools, available on our premium offering Stake Black AUS, are Market Depth and Course of Sales. Here’s what they can help with.

Before we look further, it’s important to understand a useful indicator of general market activity and investor sentiment known as trade volume. Trade volume is a measure of the amount of a particular asset that’s being bought and sold in a given time period.

For example, a higher-than-average trade volume may indicate strong demand or increased interest in the asset. On the other hand, low trade volume may indicate a lack of interest or a lack of liquidity in the market. By tracking this data investors can gain insight into the current state of the market and make more informed decisions.

Market depth and Course of Sales

Market Depth refers to the quantity of a particular asset that’s available for purchase or sale at a given price. Therefore, it’s a measure of the liquidity of an asset, indicating how easily it can be bought or sold without significantly affecting the price.

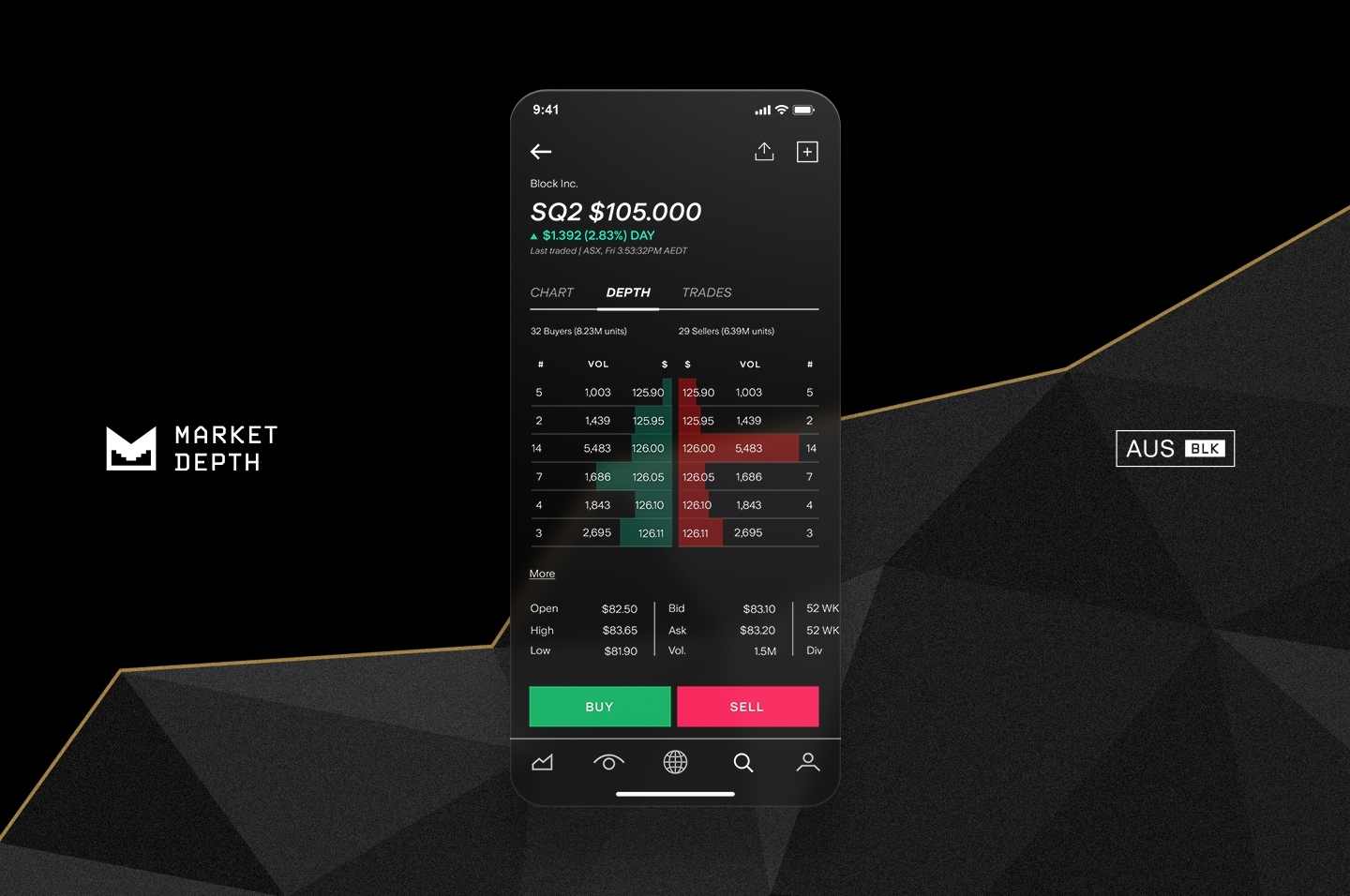

On Stake Black, this information is displayed as a list of all the open buy and sell orders of any ASX security. Investors can access it directly from each stock page under the tab ‘Depth’

.jpg&w=3840&q=100)

Next to it is the tab ‘Trades’, which gives access to the Course of Sales. Also known as the ‘order book’ or ‘trade book’, this is a list of all the buy and sell orders that have been executed for a particular asset, organised by price level. It’s a measure of the supply and demand for the asset at a given point in time.

Market Depth in practice

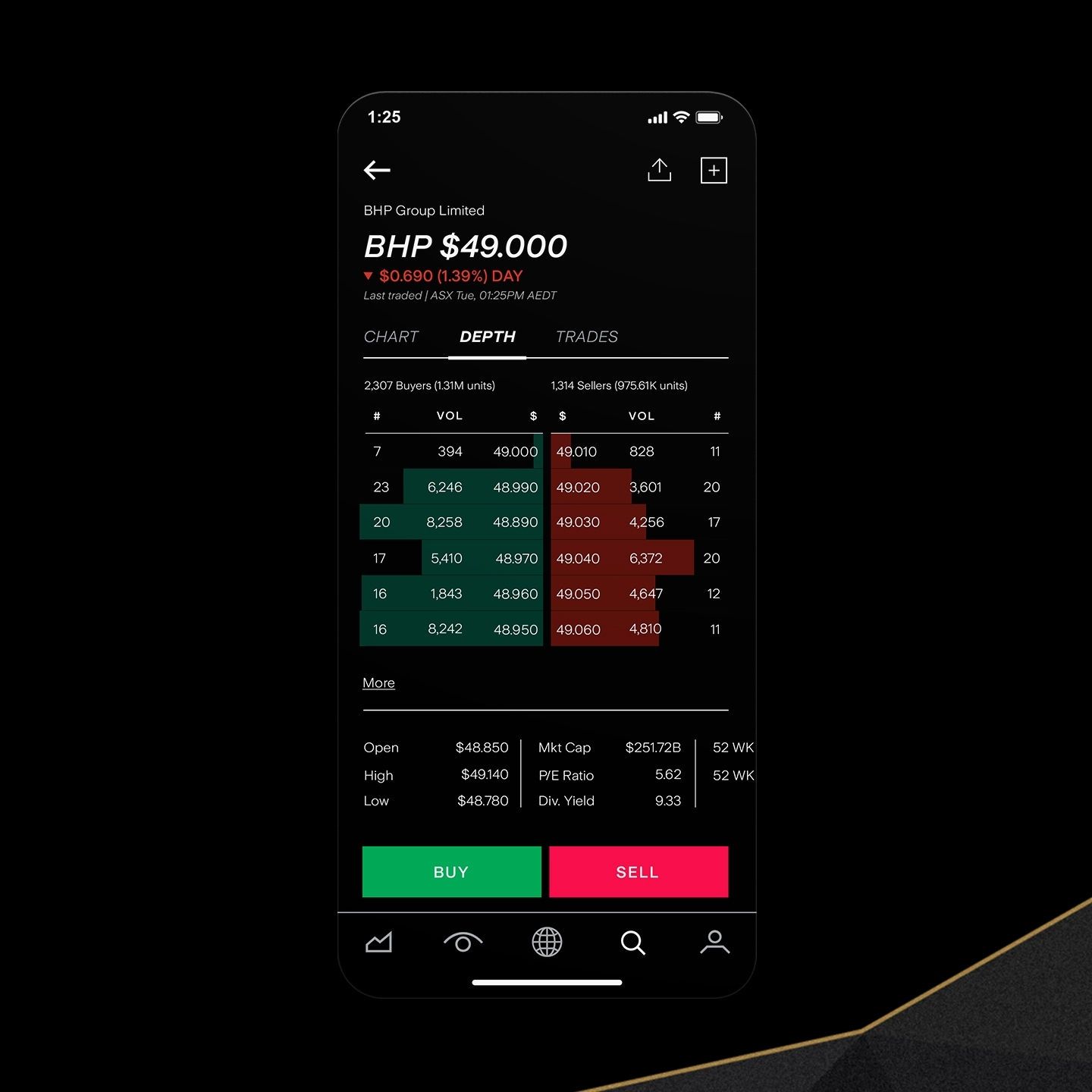

Let’s imagine you’re interested in purchasing shares of $BHP. You fire up Stake Black and toggle to the Market Depth screen. The order book shows the following data:

From this information you can see there’s decent liquidity in the market for $BHP shares, with both buyers and sellers at multiple price levels. The market depth means any trades placed could quickly get fulfilled.

This liquidity allows you to purchase the shares at a price that’s relatively close to the current market price. In this case placing a buy order for $49.01 would see your order get matched with a seller instantly.

Incorporating to your strategy

Once you understand how Market Depth trading works, let's take a look at how you can use it to help your trading performance.

Use Market Depth data to set limit orders: By analysing the order book, you can get a sense of the amount of liquidity at different prices. If you set your limit order at a price with low liquidity, you may end up selling your asset at a much lower price than anticipated. Alternatively, if you set your limit order at a price with high liquidity measures, you may be able to sell your asset closer to its true market value.

Look for market imbalances: If you see that the market is imbalanced in favour of buyers or sellers, it may be a good opportunity to enter or exit a trade. For example, seeing a given price level with significantly more buy than sell orders could indicate that the asset is in high demand and the asset’s value could rise in the near future. On the other hand, if there are significantly more sell than buy orders, it may reveal that there’s an oversupply of the asset and the price could fall.

Market Depth and Course of Sales are available on Stake Black AUS, including complete ASX market coverage. A full-depth electronic order book, plus market trade data, straight from the source, on all 2,000+ ASX stocks and ETFs.

For the avoidance of doubt, when we refer to Live Data as part of the Stake Black AUS product, it includes;

- Live CHI-X data on each page in your product

- Live ASX data on the share detail page and the order pad (there is no longer a 20 minute delay, click to refresh the data). This includes on Market Depth and Course of Sales.

We do not provide streaming data as a data delivery type for all sources of data, where streaming data is defined as data updates pushed to the customer side application as they occur.

Stake Black T&Cs apply. Stocks used in images for demonstrative purposes only. This does not constitute financial advice.