How to invest in S&P 500 in Australia

Investing in the S&P 500 can be a powerful strategy for Australian investors looking to tap into the growth potential of the largest companies in the US. With its long-standing track record of delivering impressive returns, the S&P 500 has become a favoured choice among smart investors seeking to grow their wealth.

This article focuses on how to buy specific securities, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

How to invest in S&P 500?

Australian investors can invest in the S&P 500 by choosing an Australian-listed ETF that tracks the index on the ASX or by opening an international stock investing account to invest in US-listed S&P 500 funds or ETFs.

If you open an account with Stake you can invest in Australian and U.S. securities, which means you can access the S&P 500 ETFs across both markets.

💡Related: Discover the 10 reasons why you should invest in U.S. shares→

Steps on how to buy S&P 500 in Australia

- Open a stock investing account (it takes just a few minutes to sign up to Stake)

- Find an S&P 500 index fund (choose from ASX and U.S. listed securities)

- Fund your account

- Choose the order type and purchase the S&P 500 fund

- Monitor your investment and assess your investment goals and strategies

S&P 500 Explained

The S&P 500, also known as the Standard & Poor's 500, is a widely followed stock market index in the United States. It is composed of 500 of the largest publicly traded companies listed on U.S. stock exchanges. The index is designed to provide a snapshot of the overall performance of the U.S. equity market and serves as a benchmark for measuring the performance of large-cap stocks.

The S&P 500 is market cap weighted, which means that the companies with the largest market values have a greater influence on the index's movements. It includes the largest U.S. listed companies, ranging through various sectors such as technology, healthcare, finance, consumer goods, and more, offering a broad representation of the U.S. economy.

The index is frequently used by investors and financial professionals as a gauge of the stock market's health and as a basis for constructing investment portfolios. Many mutual funds and exchange-traded funds (ETFs) aim to replicate the performance of the S&P 500, allowing investors to gain exposure to a diversified portfolio of U.S. large-cap companies.

Check out our article for a deeper dive into what the S&P 500 index is.

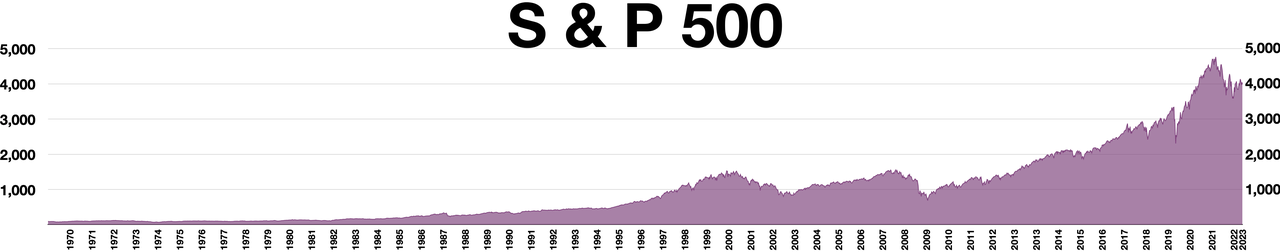

S&P 500 Index historical performance from 1970 to 2023. Source: Wikipedia

Top 10 constituents of S&P 500

As of 31 May 2023 from the S&P 500 factsheet, these were the S&P 500 top 10 holdings of the index:

Constituent | Ticker | Sector |

|---|---|---|

Apple Inc. | Information Technology | |

Microsoft Corp | Information Technology | |

Amazon.com Inc | Consumer Discretionary | |

Nvidia Corp | Information Technology | |

Aplabet Inc A | Communication Services | |

Alphabet Inc C | Communication Services | |

Meta Platforms, Inc. Class A | Communication Services | |

Berkshire Hathaway B | Financials | |

Tesla, Inc. | Consumer Discretionary | |

Unitedhealth Group Inc | Health Care |

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

Ways to buy S&P 500: ETFs vs mutual funds

When it comes to buying the S&P 500 in Australia, you have the option of investing through ETFs (Exchange-Traded Funds) or mutual funds. Both options provide exposure to the S&P 500 and both tend to be low-cost index funds, but there are some key differences between them:

- Structure: ETFs are traded on stock exchanges like individual stocks, while mutual funds are bought and sold through the fund company at the end-of-day net asset value (NAV).

- Flexibility: ETFs can be bought and sold throughout the trading day at market prices, offering more flexibility for investors to enter or exit positions. Mutual funds are typically bought or sold at the end of the trading day based on the NAV.

- Cost: ETFs tend to have lower expense ratios compared to mutual funds. ETFs are passively managed and aim to replicate the index performance, whereas mutual funds may have higher management fees due to active management.

- Minimum investments: Mutual funds often require a minimum initial investment, which can be a barrier for some investors. ETFs generally don't have such minimum investment requirements which means you can start investing in an S&P 500 ETF from as little as $10 using fractional shares.

- Tax efficiency: ETFs are generally more tax-efficient than mutual funds. ETFs typically have lower capital gains distributions since they are structured to minimise taxable events.

It's important to consider your investment goals, trading preferences, costs, and tax implications when deciding between ETFs and mutual funds to invest in the S&P 500.

What Australian ETF tracks the S&P 500 index?

If you are looking to invest in Australian ETFs that track the S&P 500 index, there are three popular options:

- iShares Core S&P 500 ETF ($IVV): This exchange-traded fund is managed by BlackRock and seeks to provide investment results that correspond to the performance of the S&P 500 index. It is traded on the Australian Securities Exchange (ASX) and aims to provide investors with exposure to 500 large-cap US companies.

- SPDR S&P 500 ETF Trust ($SPY): This ETF is managed by State Street Global Advisors and is one of the largest and most traded ETFs in the world. While it is primarily listed on US exchanges, it also has a presence on the ASX through Chess Depository Interests (CDIs). The SPY aims to track the performance of the S&P 500 index.

- BetaShares S&P 500 Yield Maximiser Fund ($UMAX): This ETF by BetaShares is designed to provide investors with exposure to the S&P 500 index while offering enhanced income potential. It aims to track the performance of a yield-optimised index based on the S&P 500 and incorporates a covered call strategy to generate additional income.

Each of these ETFs has its own unique characteristics, liquidity and expense ratios.

What U.S. ETFs track the S&P 500?

There are several ETFs in the U.S. that track the S&P 500 index. Here are three popular options:

- SPDR S&P 500 ETF Trust ($SPY): Managed by State Street Global Advisors, SPY is one of the oldest and largest ETFs tracking the S&P 500. It aims to provide investment results that correspond to the performance of the index. SPY is highly liquid and widely traded, making it a popular choice for investors seeking broad exposure to the U.S. equity market.

- iShares Core S&P 500 ETF ($IVV): Managed by BlackRock, IVV seeks to track the investment results of the S&P 500 index. It offers investors a low-cost, tax-efficient way to gain exposure to large-cap U.S. stocks. IVV is known for its tight tracking of the index and is a popular choice among long-term investors.

- Vanguard S&P 500 ETF ($VOO): Offered by Vanguard, VOO aims to track the performance of the S&P 500 index. It is known for its low expense ratio, making it an attractive option for cost-conscious investors. VOO is designed to provide broad exposure to the U.S. equity market and is widely held by both retail and institutional investors.

💡Related: 10 U.S. High Yield Bond ETFs to Watch→

How to choose an S&P 500 index fund?

Choosing an S&P 500 index fund involves considering various factors to align your investment portfolio with your investment goals. Here's a step-by-step guide to help you select an S&P 500 index fund:

- Understand your investment goals: Determine your investment objectives, such as long-term growth, income generation, or diversification, to align with the purpose of investing in the S&P 500.

- Research different index funds: Conduct thorough research on different S&P 500 index funds available in the market. Consider factors such as expense ratio, fund size, tracking error, and fund provider reputation.

- Evaluate expense ratio: Compare the expense ratios of different funds. Lower expense ratios generally indicate lower costs for investors and can have a positive impact on long-term returns.

- Assess tracking error: Review the historical tracking error of the fund. Tracking error measures the deviation of the fund's performance from the underlying index. Look for funds with lower tracking error, as it reflects closer alignment with the index's returns.

- Consider fund size and liquidity: Look for index funds with larger assets under management (AUM) as they tend to have better liquidity, tighter bid-ask spreads, and lower trading costs.

- Review historical performance: Evaluate the historical performance of the index funds. While past performance does not guarantee future results, it can provide insights into the fund's ability to track the index effectively.

- Understand the fund provider: Research the reputation and track record of the fund provider. Consider their experience, expertise, and commitment to the index fund managers.

- Check fund structure: Determine whether you prefer an ETF or a mutual fund structure. Consider factors such as trading flexibility, minimum investment requirements, and tax efficiency.

- Read the prospectus: Carefully read the prospectus and fund documentation to understand the fund's investment strategy, risk profile, and any additional features or limitations.

Remember that investing involves risk, and it's essential to conduct your due diligence and consider your risk tolerance before making any investment decisions.

🆚 Which S&P 500 index fund to choose: SPY vs IVV→

🆚 Which S&P 500 index fund to choose: SPY vs VOO→

Pros and cons of investing in the S&P 500

Pros | Cons |

|---|---|

Broad market exposure: The S&P 500 represents a diverse range of 500 large-cap U.S. companies, providing investors with broad market exposure. | Lack of small-cap exposure: The S&P 500 focuses on large-cap companies, potentially missing out on opportunities presented by smaller or mid-sized companies. |

Historical performance: The S&P 500 has historically delivered strong long-term returns, outperforming many other investment options. | Single-country risk: Investing solely in the U.S. market through the S&P 500 exposes investors to risks associated with the domestic economy and regulatory changes. |

Passive investing: Investing in the S&P 500 allows for a passive investing approach, as it seeks to replicate the index's performance. | Concentration risk: The index is market-cap weighted, meaning larger companies have a greater impact, potentially leading to concentration risk. |

Liquidity: S&P 500 ETFs are usually highly liquid, making it easy to buy or sell shares. | Currency risk (for non-U.S. investors): Non-U.S. investors face currency exchange rate risk when investing in the U.S.-based S&P 500. |

Investing in S&P 500 FAQs

Yes, Australians can invest in the S&P 500.

The most common method is to invest in an ETF that tracks the S&P 500 index. You can set this up in just minutes through the Stake app. Sign up now.

Investing solely in the S&P 500 may provide exposure to a diversified portfolio of large-cap U.S. companies. However, it is important to consider your risk tolerance, investment goals, and overall portfolio diversification. Diversifying across various asset classes and regions can help mitigate risk and optimise long-term returns.

Yes, it is possible to invest AU$100 in the S&P 500. There are fractional shares and low-cost investment options like ETFs that allow investors to buy small amounts of the S&P 500 or its equivalent instruments. If you have more capital to start with, check out our article on how to invest $5,000 in Australia.

You will need a minimum of AU$500 to start investing in an exchange-traded fund that tracks the S&P 500 on the ASX due to the minimum marketable parcel (MMP) rule.

However, when investing in the U.S. stock market, the minimum is US$10 to place your first trade in an S&P 500 ETF using fractional shares.

The S&P/ASX 200 is usually considered the equivalent of the S&P 500 in Australia. The S&P/ASX 200 is a market-capitalisation-weighted index that represents the performance of the top 200 companies listed on the Australian Securities Exchange (ASX). It is designed to measure the performance of the Australian equity market and is widely used as a benchmark for the Australian stock market.

Vanguard Australia does not offer an S&P 500 ETF. The closest alternative is the Vanguard U.S. Total Market Shares Index ETF ($VTS) which tracks the performance of the CRSP US Total Market Index. This index has over 3,500+ constituents and covers 100% of the U.S. investable equity market, making it a much broader exposure asset than one that just follows the top 500 companies.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Stella is a markets analyst and writer with almost a decade of investing experience. With a Masters in Accounting from the University of Sydney, she specialises in financial statement analysis and financial modelling. Previously, she worked as an equity analyst at Australian finance start-up, Simply Wall St, where she took charge of the market insights newsletter sent out to over a million subscribers. At Stake, Stella has been key to producing the weekly Wrap articles and social media content.