.png&w=3840&q=100)

Under the Spotlight Wall St: Chevron (CVX)

Warren Buffett is betting big on Chevron’s cash flow gusher.

.png&w=3840&q=100)

Warren Buffett may be 95, but he’s still chasing gushers – not of oil, but of cash.

Berkshire Hathaway ($BRK.B) added over 3m Chevron ($CVX) shares in Q2, lifting its stake to 122m shares. That’s around 6% of the oil major and worth more than US$18B – placing Chevron in Berkshire’s top five bets alongside Apple ($AAPL) and Coca-Cola ($KO).

The reason is clear: rising cash flow. Chevron just closed its US$53b Hess acquisition, giving it a prized 30% share of Guyana’s giant oil fields. These barrels are cheap, long-lived and expected to supercharge production – and cash generation – for years.

The investment is already delivering. Chevron’s shares have gained 14% over the past year, while rival ExxonMobil ($XOM) is up just 2%.

Chevron’s mix of production growth, strong balance sheet and steady shareholder returns neatly fits the Buffett playbook of long-term predictable business.

Pumping up

Chevron’s Hess takeover isn’t just a trophy deal – it reshapes the company’s global footprint and boosts reserves that had hit decade lows.

The centrepiece is a 30% stake in the Stabroek block offshore Guyana. It’s one of the world’s biggest oil discoveries of the past decade with over 11b barrels found so far. But that rich bounty didn’t come without a fight. ExxonMobil owns 45% of Stabroek and unsuccessfully challenged CVX’s bid for Hess.

Production from Guyana’s fields is set to climb sharply. Multiple floating production vessels will lift output from around 900,000 barrels a day to above 1.3m by 2027 and 1.7m by 2030. With a low breakeven oil price of around US$30 a barrel, Stabroek’s rising output will deliver healthy cash flows.

But Hess brings more than Guyana, with valuable acreage in the Bakken shale in North Dakota and around 31,000 barrels a day in the Gulf of America, broadening CVX’s oil and gas production mix across both traditional and deepwater plays.

Beyond Hess, CVX has other growth engines firing: the giant Tengiz expansion in Kazakhstan, oil and gas deepwater projects in the Gulf of America such as Anchor and record-breaking oil volumes in the Permian Basin.

Billions poured into Gorgon and Wheatstone liquified natural gas facilities make the company a global LNG powerhouse, underpinning Australia’s position as a top tier exporter.

What sets these assets apart isn’t just size, but quality. Guyana barrels are some of the cheapest in the world, Permian shale offers flexibility to ramp output, and LNG provides long-term exposure to Asian demand. Together, they give Chevron a rare mix of stability and growth.

For Buffett, that combination is irresistible: decades of future production, low-cost barrels and diversified projects to keep cash flowing regardless of oil prices.

_(3).png&w=3840&q=100)

Crude numbers

Chevron’s Q2 earnings show why Buffett is pumping more into the US$324b giant.

It delivered record production of 3.4m barrels of oil equivalent per day, with the Permian Basin surpassing 1m barrels a day for the first time.

But Q2 earnings fell to US$2.5B from $US4.4B a year earlier. The culprit? A decline in upstream earnings (earnings from oil and gas production) from US$4.4B to US$2.7B as crude prices fell.

Downstream earnings – or earnings from refineries and chemicals – rose to US$737M from US$597M a year earlier.

But cash kept flowing despite lower prices as CVX continued to squeeze costs. Operating cash flow hit US$8.6B, while free cash flow reached nearly $5B. Management is targeting US$12.5B in free cash flow by 2026, powered by Guyana growth and US$1B in annual savings from integrating Hess.

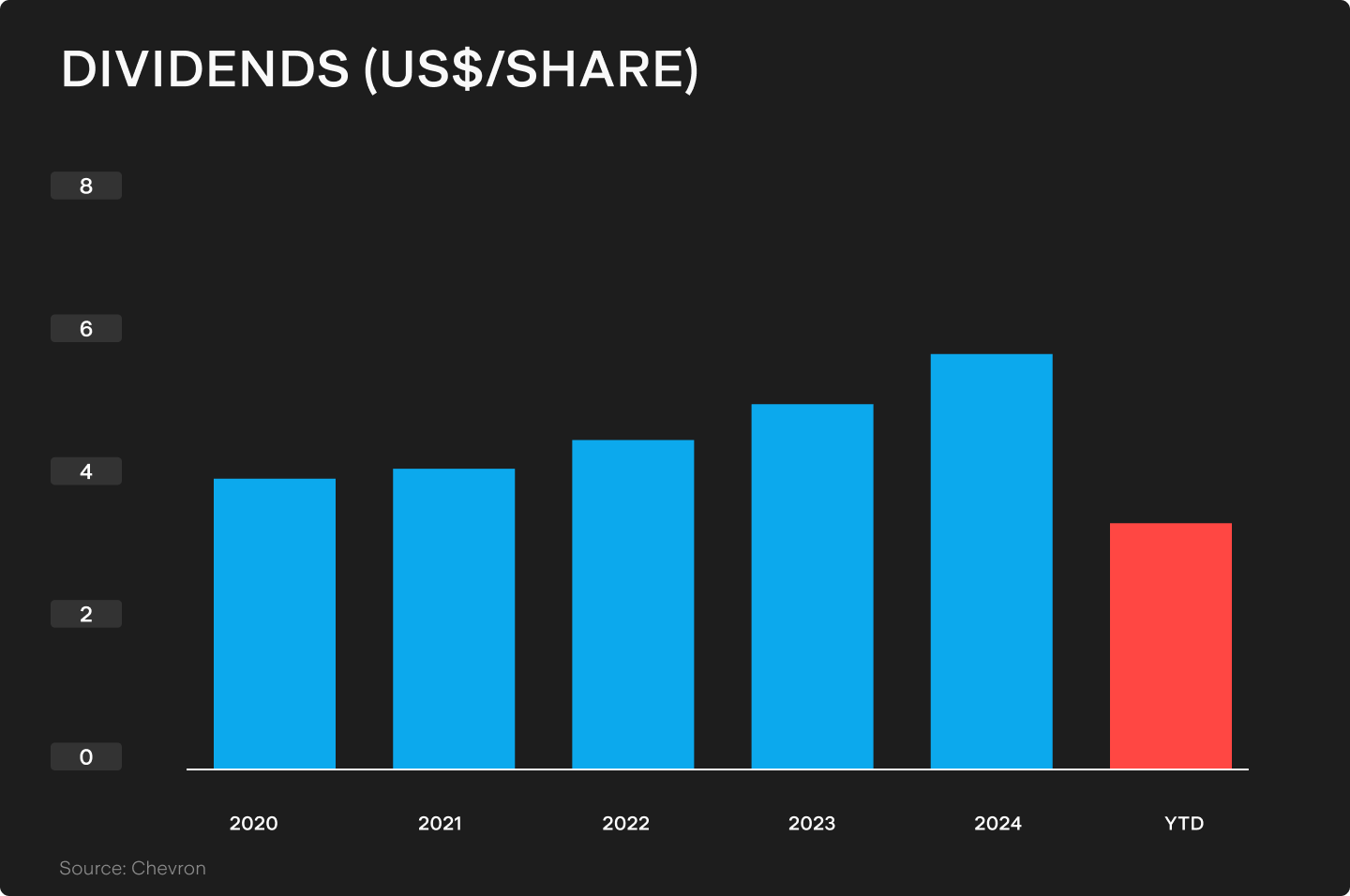

Shareholders are the big winners. Chevron paid out US$5.5B in dividends and buybacks in Q2 – the 13th straight quarter returning at least US$5B to investors. It’s also a dividend aristocrat, lifting its annual payout for 38 consecutive years – the kind of steady income stream Buffett prizes.

But the real story isn’t earnings – it’s cash flow consistency. Even in a softer price environment as OPEC+ adds more supply, CVX kept delivering cash, funded projects, and returned billions to shareholders.

Slick picks

It’s not just the Oracle of Omaha bullish on barrels – Wall Street is catching on.

Morgan Stanley rates Chevron overweight with a US$174 target, arguing Hess boosts production and cranks up free cash flow growth between 2025 and 2030.

Goldman Sachs nudged its target from US$175 to US$177 and stuck with a buy. The kicker? A ‘step-change’ in free cash flow from 2026 as Guyana gushes, the Permian powers on and US$1B of synergies start dropping to the bottom line.

And Evercore ISI set the high bar at US$180, calling Chevron one of Big Oil’s clearest ‘cash-flow inflection’ stories. It forecasts more than 14% compound annual growth in free cash flow per share between 2024 and 2027, compared with mid-to-high single-digit growth among its major rivals.

The message is clear: Buffett’s bet isn’t a lone voice. The Street now sees the same cash flow gusher he does.

Drill down

Oil prices swing up and down but Buffett’s bigger Chevron stake says the cash will keep flowing long through bumpy commodity cycles.

Chevron’s numbers confirm what Buffett already knows: the world runs on energy, but fortunes are built on cash flow.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)