.png&w=3840&q=100)

Under the Spotlight Wall St: UnitedHealth (UNH)

Warren Buffett has given UnitedHealth shares a shot in the arm with a US$1.6b bet on the health insurance giant.

.png&w=3840&q=100)

Warren Buffett says he likes to be greedy when others are fearful. That’s exactly what he’s done with UnitedHealth ($UNH), the world’s largest private health insurer, whose shares have nearly halved over the past year.

Berkshire Hathaway’s (BRK.B) latest filing showed it snapped up more than 5m shares, investing US$1.6b in a company battered by soaring costs, regulatory probes and public outrage. The investment has jolted the stock back to life, sending UNH up 12% since the new position was revealed on 14 August.

So why would the Oracle of Omaha bet on a business under federal investigation, fresh off a CEO exit and suspended earnings guidance only months ago? Because Buffett built his reputation on buying great businesses during times of peak pessimism.

To many, the stock looks sickly. To Buffett, it looks cheap. Once a textbook example of steady compounding, UNH is now a fallen giant. The question: is Buffett’s prognosis right? Is the stock critical or curable?

Critical condition

UNH’s troubles stem from the very strategy that once made it the envy of the industry.

For years, the combination of UnitedHealthcare (insurance) and Optum (medical and pharmacy services) provided an unbeatable advantage. UNH had the scale to squeeze suppliers, snare more taxpayer-funded Medicare Advantage revenues and grow faster than rivals.

But the industry giant is creaking under its own weight. Policy changes reduced how much insurers can bill Medicare, just as medical costs started soaring.

UNH faces pressure on both sides: high claims costs and shrinking revenue. Worse still, because it not only insures but also treats patients through Optum, the squeeze is hitting both arms of the business.

UNH’s public image has also suffered. In late 2024, Brian Thompson, head of the insurance unit, was fatally shot in New York on his way to an investor day. The tragedy fuelled public anger at insurers, sparked death threats against executives and drew political scrutiny. For investors, it highlighted how toxic UNH had become.

Add in reputational damage from a cyberattack and a Department of Justice investigation into Medicare billing, and UNH went from market darling to pariah.

The stock, which once traded on a hefty multiple for its reliable revenue and earnings growth, has been stripped of its premium valuation as investors await signs of renewed health.

UNH traded at a forward PE of around 14x earlier this month - down from an excess of 20x a few years ago. This underscores the appeal for Buffett: a dominant franchise temporarily on its sickbed and trading cheaply. UNH’s forward PE has since rebounded to around 18x.

Margin headache

UNH’s latest earnings show the pain the company is going through.

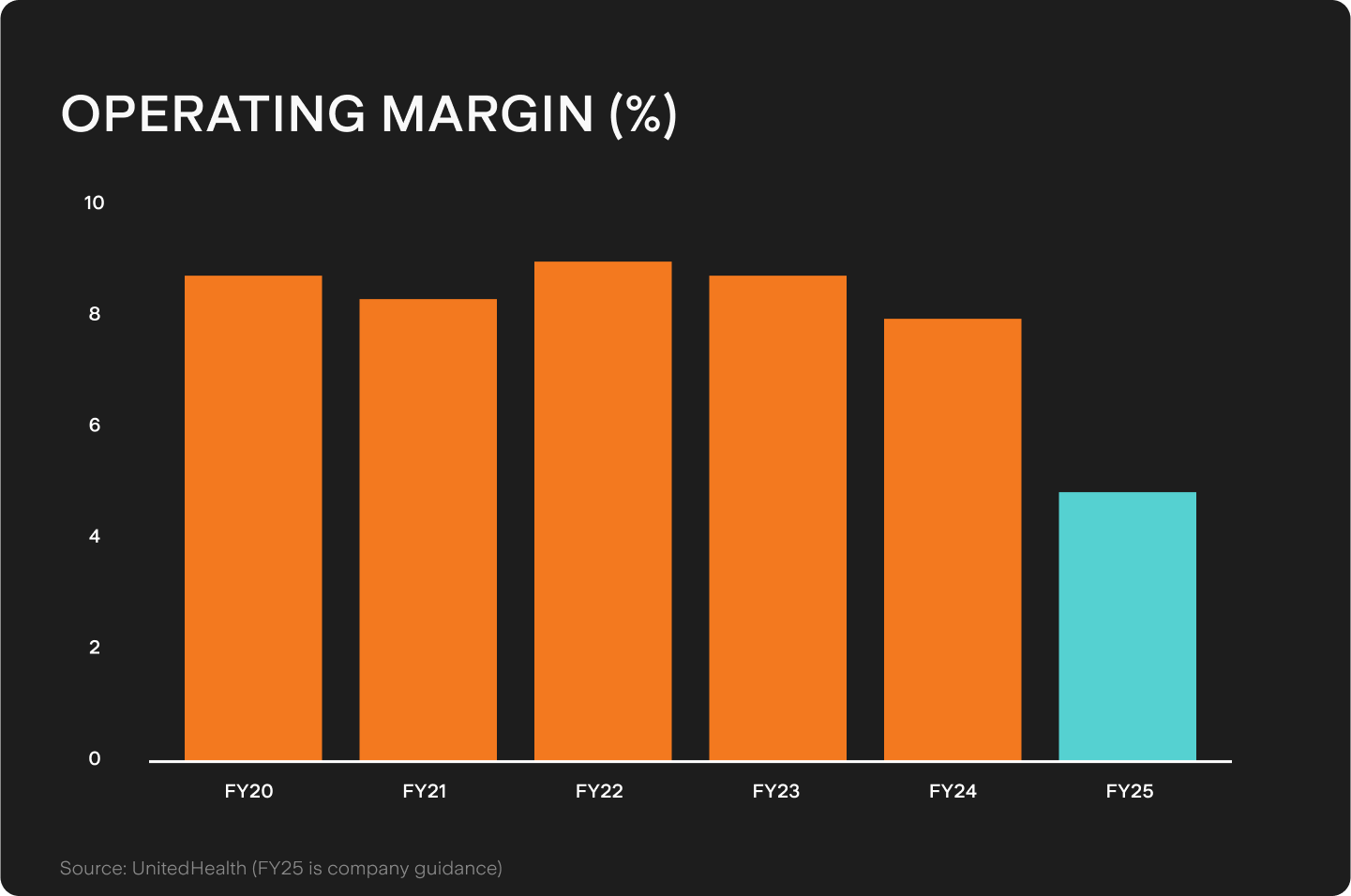

In Q2, revenues rose 13% year-on-year (YoY) to US$111.6b but operating earnings fell to US$5.2b from US$7.9b. Its operating margin shrank to just 4.6%, compared to 8% a year earlier. The culprit? Medical costs spiralling out of control.

The insurance unit’s medical care ratio – the percentage of premiums spent on patient care – rose to 89.4%, up from 85.1% last year. UNH is paying out more in claims than it budgeted for.

Its exposure to Medicare Advantage is a drag. Medical cost trends are running around 7.5% against pricing assumptions of just over 5% and are projected to accelerate toward 10% in 2026.

Optum is also struggling. Optum Health’s operating margin collapsed to 2.5% from 7.1% last year, dragged down by funding cuts and underpriced contracts. Meanwhile, pharmacy business Optum Rx faces rising costs from expensive specialty drugs. Revenues are growing but profits aren’t keeping pace.

Still, UNH hasn’t forgotten about shareholders. It raised its dividend by 5% in June and returned US$4.5b through dividends and buybacks in Q2.

Recovery plan

The good news: UNH isn’t on life support, it’s in rehab. The bad news: the recovery will be slow.

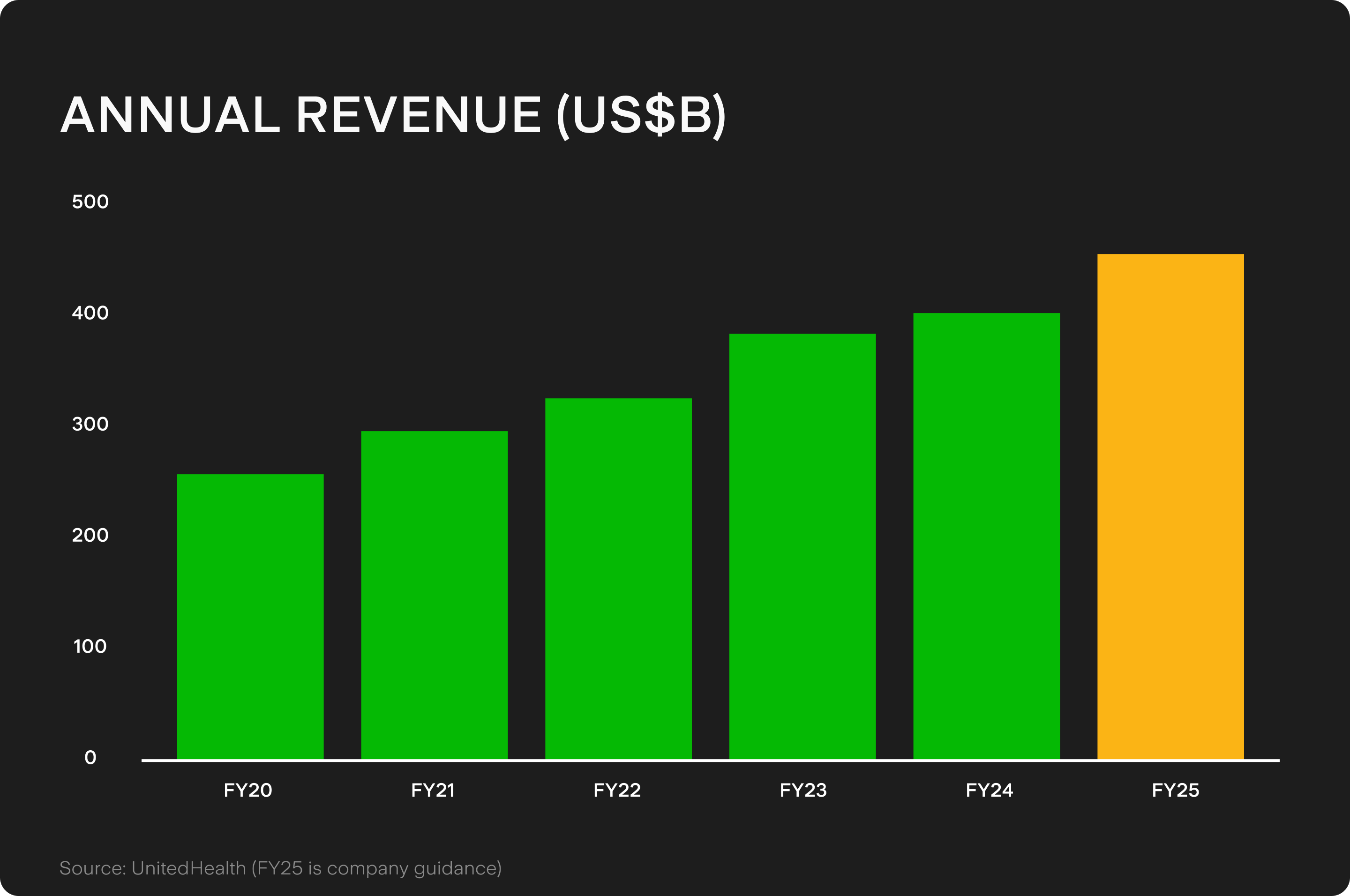

The company re-established its 2025 outlook after suspending it earlier this year. It’s guided for full-year revenues of between US$445.5b and US$448b, up from US$400.3b in FY24. Its operating margin is expected to be between 4.8% and 5%, down from 8.1% last year. Management has admitted earnings growth won’t resume until 2026.

Enter Stephen Hemsley. The former CEO, who built UNH into an industry titan, has returned to the top job after Andrew Witty’s resignation in May. His mandate is clear: reset pricing, restore cost discipline and regain investor trust.

That means slowing Optum Health’s expansion, focusing on high-performing clinics and locations, and reining in unprofitable Medicare Advantage contracts.

It also means designing 2026 benefit plans to price for higher medical cost trends, a move that should restore margins even if growth temporarily stalls.

Politically, UNH needs to win back trust. Relaxing prior-authorisation rules (where an insurer determines whether a treatment is covered by a plan) may soften public scrutiny, even if it risks higher costs. Hemsley is focused on streamlining operations, prioritising patient care and rebuilding credibility with regulators.

Second opinion

UNH's outlook looks challenging, but Buffett’s backing suggests the patient isn’t beyond saving.

With a veteran CEO back in charge and pricing power slowly resetting, recovery is possible. Buffett’s contrarian prescription is clear: sometimes the best bargains come from buying stocks with the sickest looking price charts.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.