.png&w=3840&q=100)

Under the Spotlight Wall St: Berkshire Hathaway (BRK.B)

As Warren Buffett turns 95, Berkshire Hathaway investors are uneasy about life after the Oracle of Omaha.

.png&w=3840&q=100)

Warren Buffett turns 95 on 30 August but the candles on his birthday cake double as a countdown clock.

The Oracle of Omaha retires as Berkshire Hathaway’s ($BRK.B) CEO at year’s end, closing a chapter that began in 1965 when he took control of a faltering textile mill and transformed it into a US$1t powerhouse spanning insurance, railways, energy, and a legendary share portfolio.

Yet Wall Street isn’t raising a toast. BRK.B shares have fallen 7% since his retirement announcement in early May, underlining investor unease over what comes next.

Buffett’s track record as a CEO and stock picker speaks for itself – from Coca-Cola ($KO) to Apple ($AAPL), BRK.B’s shares compounded at nearly 20% annually since 1965, roughly double the S&P 500’s return over that stretch.

As Buffett blows out 95 candles, Wall Street is wishing Greg Abel – Buffett’s anointed successor – can keep the fire burning and prove Berkshire’s next chapter can burn as brightly as the last.

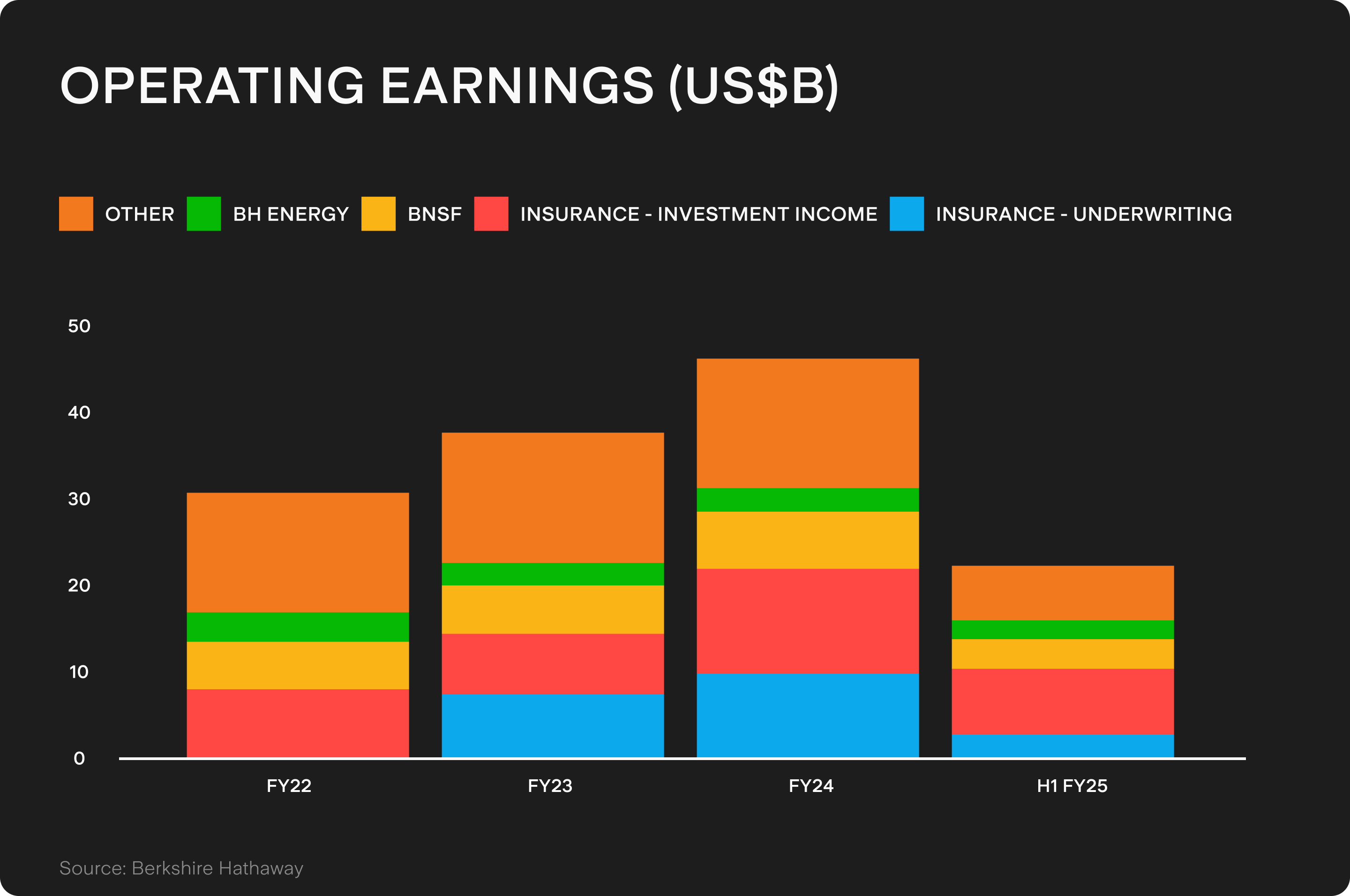

Earnings engines

Forget the high profile portfolio. Berkshire’s real muscle comes from the companies it owns outright, quietly compounding every day.

At its core, BRK.B is a global insurance giant. It writes everything from GEICO car insurance policies to billion-dollar catastrophe reinsurance. That scale gives it advantages few rivals can touch.

Yes, first-half insurance underwriting earnings fell 31% year-on-year (YoY) to US$3.32b due to the southern California wildfires, but insurance investment income rose 6% to US$6.26b. And GEICO remains strong: premiums earned rose 5% to US$21.8b in H1, while pre-tax underwriting earnings rose 7% to nearly US$4b.

Higher interest rates have also boosted returns on Berkshire’s US$174b float – the pool of insurance premiums it holds to invest before paying claims – reinforcing Buffett’s long-time model of collecting premiums upfront and putting that money to work.

Burlington Northern Santa Fe – the railway business Buffett bought in 2010 in what he called an ‘all-in wager’ on America – is gaining steam. H1 operating earnings were up 13% to US$2.68b as freight volumes rose.

The timing matters: rival Union Pacific ($UNP) is chasing an US$85 billion coast-to-coast merger with Norfolk Southern ($NSC), raising pressure on Buffett’s railway.

But the Oracle quashed talk of acquiring rival CSX ($CSX), instead backing a cheaper track: partnerships based on new joint services, expanding reach without stretching the balance sheet.

And then there’s Berkshire Hathaway Energy. It’s not sexy, but it is steady. It has durable cash flows that smooth the earnings cycle and anchor the balance sheet, delivering US$1.8b in H1, up 6% YoY thanks to rising customer volumes, rate hikes and higher wholesale prices.

But even after warnings that new legislation could squeeze renewables returns, with about US$10b invested annually, the energy arm remains a stable, compounding earnings engine.

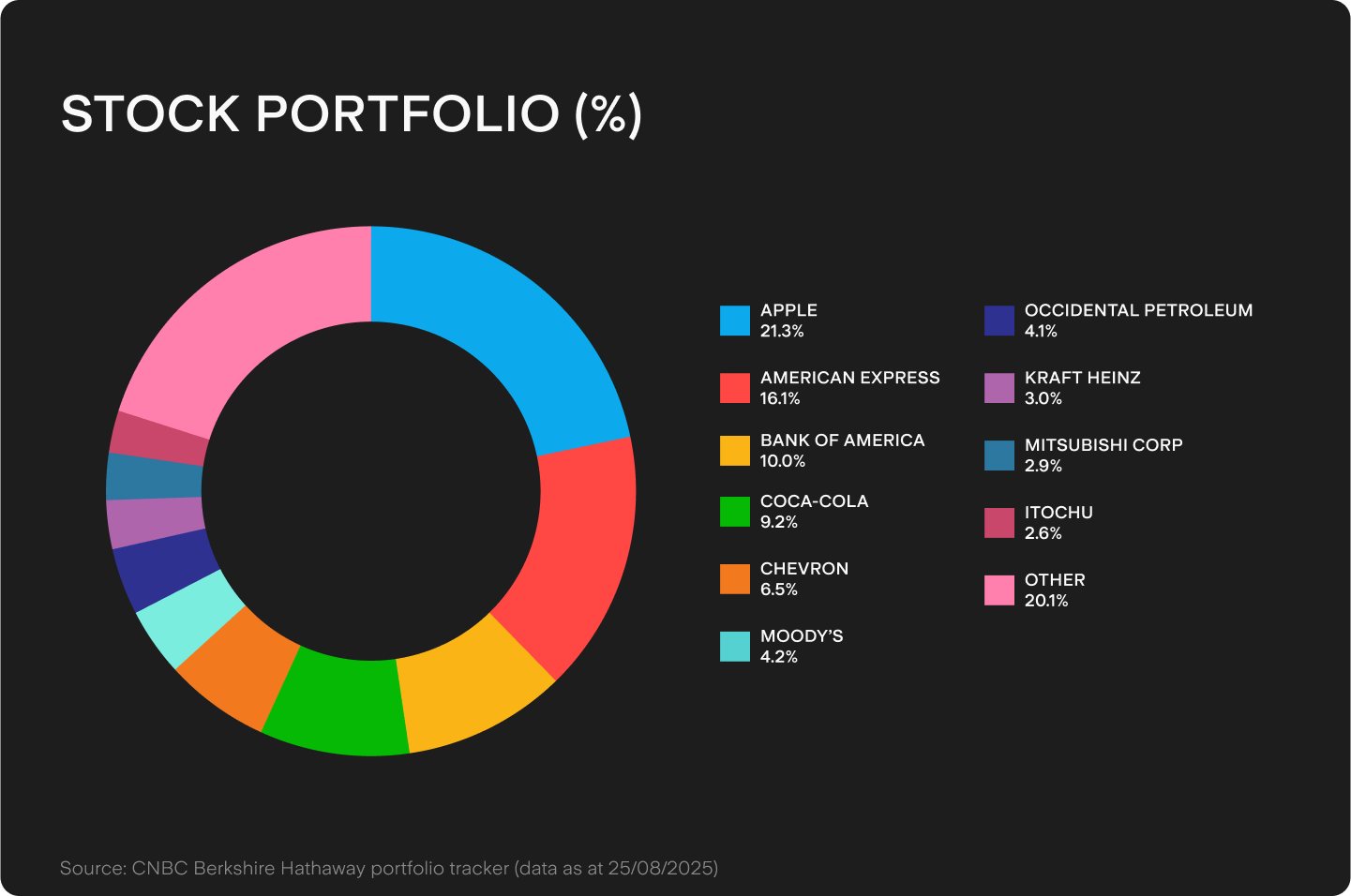

Portfolio pivots

Berkshire’s equity portfolio has long been a study in patience, anchored by a handful of giant long-term positions that reflect Buffett’s approach.

Apple, at 280m shares, remains BRK.B’s largest stake, worth US$64b. American Express ($AXP) and Coca-Cola still deliver dividends and compound value decades later. Bank of America ($BAC), a crisis-era rescue turned top-tier holding, is another pillar.

But no stock is sacred. The latest 13F filing showed Apple trimmed by about 7% and Bank of America pared back. Citigroup ($C) was jettisoned earlier this year.

Still, Buffett has always had an eye for beaten-up bargains. BRK.B doubled its bet on Constellation Brands ($STZ) this year to about US$2.1b, signalling faith in the Modelo and Corona juggernaut.

And a new US$1.6b position in UnitedHealth ($UNH) is a contrarian play on a stock dragged down by regulatory probes, costs and C-suite churn.

Energy giant Chevron ($CVX) remains a core holding with Berkshire even adding, showing renewed appetite for cash-generating resource plays.

The result is a portfolio that looks familiar at first glance but shows a willingness to pivot at the edges. The message is classic Buffett: let the winners compound, prune when prudent, and buy quality franchises when they stumble.

Willing and Abel

Now Greg Abel, the longtime leader of Berkshire Hathaway Energy, is about to step into corporate America’s hottest seat.

Abel has proven himself under Buffett’s watchful eye. But analysts say his true test isn’t running businesses, it’s deploying Berkshire’s vast cash hoard and setting the strategic tone for the post-Buffett era.

Berkshire now sits on nearly US$340b in cash. Buffett resisted paying dividends, preferring to reinvest or repurchase shares. Some analysts expect Abel may eventually shift that stance, introducing a dividend as early as 2026.

Others tip a transformative acquisition, with Occidental Petroleum ($OXY) often floated as a potential target. OXY CEO Vicki Hollub said a Berkshire buyout would be a ‘dream come true’, though Buffett wrote in his 2023 shareholder letter that Berkshire wasn’t interested in purchasing or managing Occidental.

Analysts generally remain upbeat on BRK.B despite concerns about the future. Morningstar sees the stock as fairly valued with a price target of US$487 a share. UBS is more bullish, with a thesis that GEICO’s ongoing growth and high margins justify a buy rating and a US$597 target.

Abel’s challenge will be proving there’s more to Berkshire than Buffett. The spotlight will be on his ability to allocate capital boldly and keep compounding to ensure BRK.B retains the status earned under the Oracle’s leadership.

Passing the baton

Warren Buffett’s 95th birthday is both a milestone and a turning point.

BRK.B remains one of the U.S.’s biggest and strongest companies, but its shares have fallen as investors face a future without him.

The irony is fitting: as Buffett bows out, Berkshire itself may be the kind of bargain he spent a lifetime teaching others to buy.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)