11 Bitcoin ETFs available to invest in now [2024]

It's time to deep dive into the 11 new spot Bitcoin ETFs available on the U.S. stock market. All these ETFs have a similar goal, so what are the differences and what can you look for when deciding which could be the best Bitcoin ETF for your investment portfolio?

Bitcoin ETF list of 11 SEC-approved assets

ETF Name | Ticker | Share Price | AUM* | Expense Ratio |

|---|---|---|---|---|

Grayscale Bitcoin Trust | US$35.27 | US$22.9b | 1.50% | |

Blackrock’s iShares Bitcoin Trust | US$22.60 | US$1.4b | 0.25% | |

Fidelity Wise Origin Bitcoin Trust | US$34.60 | US$1.2b | 0.25% | |

Bitwise Bitcoin ETF | US$21.60 | US$448m | 0.20% | |

ARK 21Shares Bitcoin ETF | US$39.60 | US$396m | 0.21% | |

Invesco Galaxy Bitcoin ETF | US$39.56 | US$254m | 0.39% | |

VanEck Bitcoin Trust | US$44.84 | US$109m | 0.25% | |

Valkyrie Bitcoin Fund | US$11.23 | US$88m | 0.25% | |

Franklin Bitcoin ETF | US$22.98 | US$51m | 0.19% | |

Hashdex Bitcoin ETF | US$47.22 | US$15m | 0.90% | |

WisdomTree Bitcoin Fund | US$42.16 | US$7m | 0.30% |

Data as of 24 January 2024 for share price, AUM and expense ratio. Source: Google Finance, ETFdb.

*The list of funds mentioned is ranked by assets under management (AUM). When deciding what ETFs to feature, we analyse the financials, recent news, the state of the industry, and whether or not they are actively traded on Stake.

💡Related: Learn how to buy Bitcoin ETFs in New Zealand→

List of 11 Bitcoin ETFs available to invest in

If you are planning to add cryptocurrency exposure to your portfolio through the new Bitcoin spot ETFs, it’s important to understand they are a relatively new and volatile asset class. However, the underlying assets of these ETFs, Bitcoins, are not regulated and the usual protections associated with traditional ETFs do not apply to the underlying Bitcoins. Find out more below in our Bitcoin ETF list (in order of assets under management size):

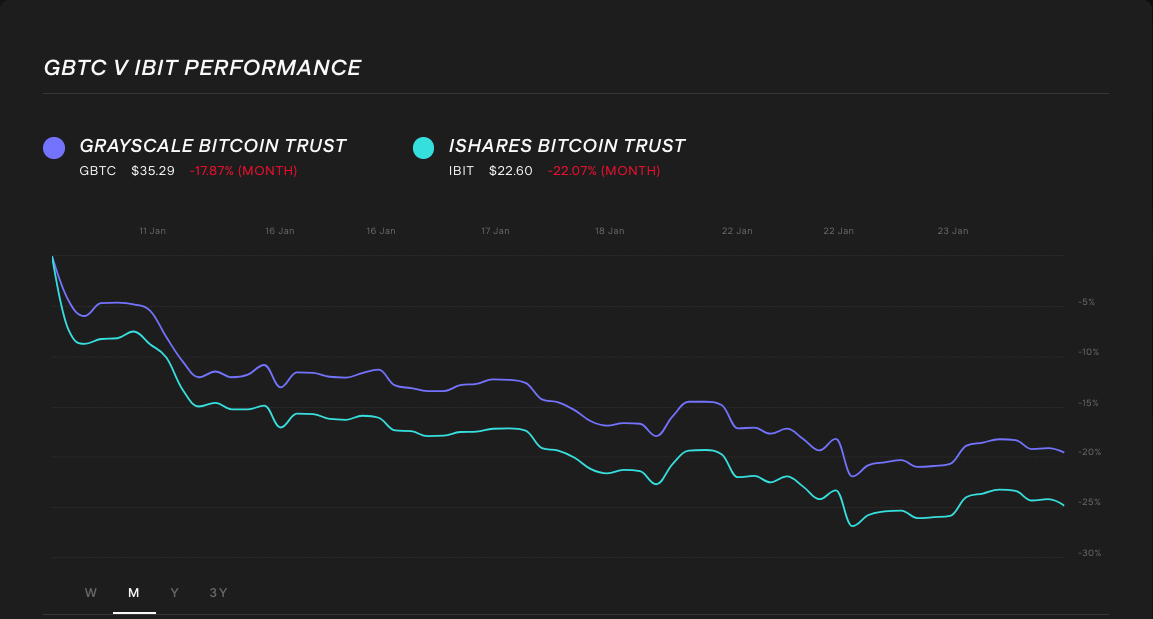

1. Grayscale Bitcoin Trust ($GBTC)

Assets under management (AUM): US$22.9b

ETF price (as of 24/01/2024): US$35.27

Stake Platform GBTC Bought / Sold (11 Jan 2024 - 24 Jan 2024): 47% / 53%

Grayscale Investments, a front-runner in digital currency investment, presents the GBTC ETF. The strategic shift by Grayscale to transform its Bitcoin trust into an ETF holds significance, as through this action it became the biggest spot Bitcoin ETF. Nevertheless, it's noteworthy that the fund comes with a relatively elevated fee structure compared to its counterparts, standing at 1.5%, the highest among the listed ETFs.

2. BlackRock’s iShares Bitcoin Trust ($IBIT)

Assets under management (AUM): US$1.4b

ETF price (as of 24/01/2024): US$22.60

Stake Platform IBIT Bought / Sold (11 Jan 2024 - 24 Jan 2024): 91% / 9%

The iShares Bitcoin Trust ($IBIT) by BlackRock signifies the financial giant's entry into the Bitcoin ETF market. As a prominent figure in asset management, BlackRock's involvement carries substantial weight, providing investors with a fund featuring a competitive fee structure supported by a well-established investment firm. Fees are initially set at 0.25%, and subsequently reduced to 0.2% for the first $5 billion in assets for a duration of 12 months.

3. Fidelity Wise Origin Bitcoin Trust ($FBTC)

Assets under management (AUM): US$1.2b

ETF price (as of 24/01/2024): US$34.60

Stake Platform FBTC Bought / Sold (11 Jan 2024 - 24 Jan 2024): 96% / 4%

Fidelity Investments, a well-established participant in the investment industry, has introduced the FBTC, offering indirect exposure to Bitcoin. This fund seeks to streamline Bitcoin investment by enabling investors to purchase and sell the ETF with standard tax reporting. Fidelity, recognised for its robust investment platform and recent ventures into cryptocurrency, has waived fees until August 1, 2024. Subsequently, fees will be 0.25%.

4. Bitwise Bitcoin ETF ($BITB)

Assets under management (AUM): US$448m

ETF price (as of 24/01/2024): US$21.60

Stake Platform BITB Bought / Sold (11 Jan 2024 - 24 Jan 2024): 91% / 9%

Bitwise Asset Management, recognised for its specialisation in cryptocurrency index funds, presents the BITB ETF. This fund distinguishes itself with a competitive fee arrangement, featuring an initial waiver. During the initial six months or until the first $1 billion in assets, there is a fee waiver, followed by a 0.2% fee thereafter.

5. ARK 21Shares Bitcoin ETF ($ARKB)

Assets under management (AUM): US$396m

ETF price (as of 24/01/2024): US$39.60

Stake Platform ARKB Bought / Sold (11 Jan 2024 - 24 Jan 2024): 93% / 7%

In partnership with 21Shares, ARK Invest launched the ARKB ETF, designed to monitor the performance of Bitcoin. ARK Invest's foray into the Bitcoin ETF arena stands out for its proficiency in disruptive technologies. The fund provides regulated exposure to Bitcoin and emphasises an attractively low-fee structure to entice investors. The management fee is exempted until July 10, 2024, or until assets reach $1 billion, whichever comes first. The expense ratio will then be 0.21%.

6. Invesco Galaxy Bitcoin ETF ($BTCO)

Assets under management (AUM): US$254m

ETF price (as of 24/01/2024): US$39.56

Stake Platform BTCO Bought / Sold (11 Jan 2024 - 24 Jan 2024): 100% / 0%

In partnership with Galaxy Digital, Invesco has launched the BTCO ETF, combining Invesco's ETF proficiency with Galaxy Digital's cryptocurrency expertise. The fund presents an initial fee waiver, showcasing its competitive strategy to allure investments. For the initial six months or until the first $5 billion in assets, fee waiver applies, thereafter a 0.39% expense ratio.

7. VanEck Bitcoin Trust ($HODL)

Assets under management (AUM): US$109m

ETF price (as of 24/01/2024): US$44.84

Stake Platform HODL Bought / Sold (11 Jan 2024 - 24 Jan 2024): 89% / 11%

The introduction of VanEck's HODL ETF marks a noteworthy addition to the Bitcoin ETF landscape. VanEck's strategy for Bitcoin investment via this ETF is defined by a simple fee structure and its well-established reputation in ETF markets. The fee for the fund is set at 0.25%.

8. Valkyrie Bitcoin Fund ($BRRR)

Assets under management (AUM): US$88m

ETF price (as of 24/01/2024): US$11.23

Stake Platform BRRR Bought / Sold (11 Jan 2024 - 24 Jan 2024): 100% / 0%

The BRRR ETF by Valkyrie Digital Assets marks its entry into the Bitcoin ETF arena. Despite being relatively new, Valkyrie has achieved noteworthy progress in the realm of digital asset investment products. The fund stands out with its initial fee waiver and a subsequent competitive fee rate. Fees are waived for the first 3 months, followed by a 0.25% rate thereafter.

9. Franklin Bitcoin ETF ($EZBC)

Assets under management (AUM): US$51m

ETF price (as of 24/01/2024): US$22.98

Stake Platform EZBC Bought / Sold (11 Jan 2024 - 24 Jan 2024): Not available

Global investment firm Franklin Templeton offers the EZBC ETF, signalling its foray into digital assets. This fund serves as a regulated avenue for investors to access Bitcoin exposure, embodying Franklin Templeton's strategic move into the digital asset space. Notably, the fund boasts a moderate fee structure, with fees set at 0.29%.

10. Hashdex Bitcoin ETF ($DEFI)

Assets under management (AUM): US$15m

ETF price (as of 24/01/2024): US$47.22

Stake Platform DEFI Bought / Sold (11 Jan 2024 - 24 Jan 2024): Not available

Introducing the DEFI ETF by Hashdex, renowned for its comparatively higher fee structure among approved ETFs. Hashdex, a trailblazer in cryptocurrency investment products, seeks to harness its proficiency in digital assets to provide a regulated Bitcoin investment option. Prior to the SEC approval of spot Bitcoin ETFs, this used to be a Bitcoin futures ETF that invested in Bitcoin futures contracts. The fund will charge annual fees of 0.9%.

11. WisdomTree Bitcoin Fund ($BTCW)

Assets under management (AUM): US$7m

ETF price (as of 24/01/2024): US$42.16

Stake Platform BTCW Bought / Sold (11 Jan 2024 - 24 Jan 2024): Not available

WisdomTree has introduced its BTCW ETF, offering investors regulated exposure to Bitcoin. Widely recognised for its diverse ETF offerings, WisdomTree extends its expertise into the digital asset domain with this fund. The fee structure includes a waiver for the initial 6 months or until the first $1 billion in assets, followed by a 0.39% fee.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What’s the difference between buying Bitcoin ETFs vs Bitcoin?

Investing in a Bitcoin ETF is not the same as owning Bitcoin. Investing in Bitcoin ETFs, akin to purchasing shares in traditional ETFs on U.S. markets, simplifies Bitcoin exposure for investors. This approach bypasses the complexities associated with direct Bitcoin ownership, such as handling secure storage and cryptographic key management. It provides a straightforward route for those interested in Bitcoin's market dynamics without the technical intricacies of acquiring and securing the actual Bitcoin asset. It’s also important to note that although spot Bitcoin ETFs attempt to track the price of the underlying asset, Bitcoin, they may still trade at a premium or discount to the actual Bitcoin price.

The choice between the two depends on individual preferences and risk tolerance.

It’s important to understand how both products operate and line up with your own risk appetite and investing goals. Higher potential rewards tend to come with higher risk levels when investing. This means that certain products can present more downsides than benefits for the average investor.

Are Bitcoin ETFs regulated?

Yes, the new Bitcoin ETFs are regulated. They are, like all exchange-listed ETFs, subject to oversight by regulatory bodies like the U.S. Securities and Exchange Commission (SEC). SEC regulations are intended to protect investors, maintain fair markets and facilitate capital formation. Importantly, this does not mean the underlying assets of these ETFs, Bitcoins, are being regulated. The risks and benefits of investing in a Bitcoin ETF vs buying the actual asset are quite different. It’s important to note that while regulation provides some level of protection, it does not eliminate all risk associated with investing in Bitcoin ETFs. Investors should understand how both Bitcoin and Bitcoin ETFs operate and whether they line up with your own risk appetite and investing goals. Higher potential rewards tend to come with higher risk levels when investing.

Frequently asked questions about Bitcoin ETFs

When choosing a spot Bitcoin ETF, some relevant factors to consider include the expense ratio, the size of the fund (AUM), the reputation of the fund sponsor, the underlying index that the ETF tracks, and the past performance of the ETF.

Remember, past performance is not indicative of future results, and it’s crucial to do your own research and consider your individual investment goals and risk tolerance before investing.

As of 21 November 2024, BlackRock’s iShares Bitcoin Trust ($IBIT) is the biggest Bitcoin ETF, with over US$45b AUM.

The 11 spot Bitcoin ETFs approved by the SEC are:

- ARK 21Shares Bitcoin ETF ($ARKB)

- Bitwise Bitcoin ETF ($BITB)

- Blackrock’s iShares Bitcoin Trust ($IBIT)

- Franklin Bitcoin ETF ($EZBC)

- Fidelity Wise Origin Bitcoin Trust ($FBTC)

- Grayscale Bitcoin Trust ($GBTC)

- Hashdex Bitcoin ETF ($DEFI)

- Invesco Galaxy Bitcoin ETF ($BTCO)

- VanEck Bitcoin Trust ($HODL)

- Valkyrie Bitcoin Fund ($BRRR)

- WisdomTree Bitcoin Fund ($BTCW)

- Grayscale Mini Trust ETF ($BTC)

Bitcoin ETFs can be a good investment for some, but not for everyone. For those who are interested in the growth and risk exposure of the underlying asset, Bitcoin, Bitcoin ETFs offer a simpler alternative to direct ownership of Bitcoin.

Comparative to direct Bitcoin ownership, they offer ease of access, some form of regulatory oversight, some level of diversification, liquidity and tax efficiency through the scale of the ETF and its demand on the listed market.

However, they also come with notable downsides and are primarily suited for risk-tolerant investors. Bitcoin ETFs can provide potential gains, but they also present investors with a wide range of outcomes that will test their tolerance for risk. As with all investing, when you invest your capital is at risk, It’s generally recommended to maintain a balanced portfolio with a diversified list of assets that cater to your risk tolerance.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.