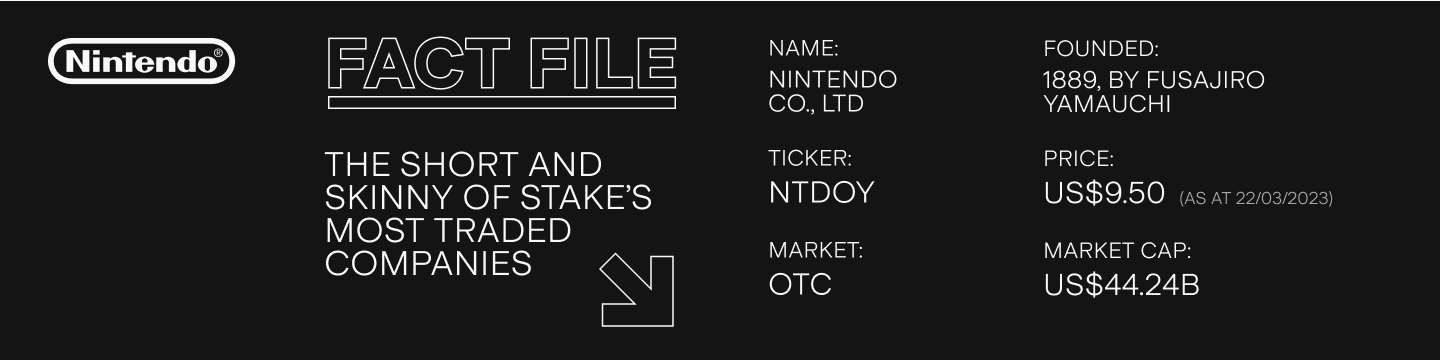

Under the Spotlight Wall St (OTC): Nintendo (NTDOY)

The company behind some of the world’s most iconic video games ever, Nintendo was once the king of the gaming industry. Can it reclaim its throne? Let’s put it Under the Spotlight.

This is an OTC edition of Under the Spotlight. OTC stocks (over-the-counter stocks), are securities that are not listed on a major U.S. exchange but instead listed elsewhere in the world. They can be traded in the U.S. via a broker-dealer network. If you want to learn more, check out our guide to OTC stocks.

Super Mario Bros., The Legend of Zelda, Pokémon. These are just some of the classic gaming titles Nintendo ($NTDOY) has released in the last four decades. But as a business that’s centuries old, video games weren’t actually the way Nintendo got started. Originally making card and board games, the company managed to stay afloat through groundbreaking events such as the Meiji Restoration, the Russo-Japanese war and WW2 before finally blossoming into a video game giant in the 1980s.

The experimentation with electronic gaming began in the 1960s. The firm developed a series of arcade games, eventually culminating with the launch of the legendary Donkey Kong in 1981. But the gaming colossus only hit it big in 1983, when the Nintendo Entertainment System (NES) entered the market. It became an instant favourite with the Super Mario Bros. franchise and sold more than 60 million units of the console across the world.

Stepping up their game

Nintendo was already the world’s leading gaming company by the end of the 1980s and it still managed to extend its winning streak. In 1989 it released the first version of the Game Boy, and the handheld gaming classic sold over 118 million units worldwide. The gadget helped to diversify the company’s revenues and become less dependent on console revenues.

Despite the rising popularity of handheld games, console sales still held up and the NES would continue to sell well into the mid 1990s. Their next version, the Super Nintendo (SNES) sold 67 million consoles across the globe, surpassing its predecessor. However, the tide would soon change.

Losing its throne

Despite facing competitors like Sega’s Mega Drive, Nintendo had been able to crush the competition up to the mid 1990s. Their games were more family friendly, and the company had bigger quality control and greater third-party support. In 1995 though, as the Sony Playstation ($SONY) came onto the market, Nintendo would no longer be the king of gaming; and it hasn’t been able to reclaim its post to this day.

The Nintendo 64 was launched in 1996 as an answer to the Playstation While in some respects it went on to become a cult classic, it failed to meet this task. It was pricier than its competitor and used cartridges instead of CDs that ultimately made games more expensive. This would eventually lead to the loss of third-party support. Nintendo took a big hit, and in 1997 its net income shrank by 38%. The loss taught the team a valuable lesson: that the video game industry is extremely volatile. They began to deleverage operations and build a war chest that now amounts to ¥1.2t, roughly US$10b.

Going casual

Since the 64, Nintendo’s been unable to regain its industry leading position. The Playstation 2 would sell 155 million units. This was seven times the amount of Nintendo’s 64 successor, the GameCube, and cemented the downfall of the company among hardcore gamers. Their solution would be to focus on casual gamers, and the GameCube’s replacement, the Wii would be a tremendous success. It sold more than 100 million consoles due to its unique motion-controlled gameplay and family friendly focus that helped to attract a wider audience beyond the traditional gaming demographic.

Even if Nintendo had lost the console battle, its handheld devices did more than fine. The Nintendo DS surpassed the Game Boy’s sales, with over 154m units sold. From there, the Japanese gaming behemoth decided to focus on hybrids: gaming devices that could be played both with handheld devices and on TVs. However, its first mixed product, the Wii U, didn’t gain traction and sold just 13 million units yet the following Nintendo Switch would be a stellar success, with over 100 million units sold between 2018 and 2023.

Popularly casual

Nintendo might have expanded its customer base with the Wii and Switch, but perhaps the biggest move to transform its income streams happened more recently. In March 2021, the company opened an amusement park called Super Nintendo World in Osaka, Japan, in partnership with Universal Studios. New parks should be opening soon in the U.S. in Hollywood and Orlando. Another in Singapore should draw even more families to the Nintendo universe. This scope’s likely to broaden further with the expected premiere of The Super Mario Bros. Movie in April 2023.

Looking ahead, Nintendo will need to continue adapting to new trends and changing consumer preferences. The rise of mobile gaming and free-to-play games pose a threat to traditional console gaming, but Nintendo's unique approach and commitment to innovation might allow it to remain a leading player in the industry. For FY23, the company expects to record sales of ¥1.65t, just shy of 2022’s ¥1.69t, a fall mostly due to exchange rates, as the Yen weakens against the dollar. Only time will tell whether Nintendo can complete this challenge or will remain at the current level.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.