How to buy Coinbase shares in New Zealand [2023]

Coinbase is a titan of the ever-evolving crypto space and the largest publicly traded cryptocurrency exchange, revolutionising how investors buy, sell, and trade crypto assets. The platform is home to over 50 million users navigating the cryptocurrency market.

This article focuses on how to buy specific securities, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

Here's what you'll learn in this article:

- How to buy Coinbase shares

- Coinbase Global, Inc. overview

- Coinbase share price performance

- Coinbase stock P/E ratio

- Coinbase EBITDA

- What are similar stocks to Coinbase?

- Which ETFs have exposure to Coinbase ($COIN)?

- Coinbase FAQs

Want to start buying COIN shares but not sure how? Learn how to buy Coinbase stock in 5 simple steps on the Stake stock investing platform below.

1. Find a stock investing platform

To buy U.S.-listed companies, you'll need to sign up to an investing platform with access to the U.S. stock market. There are a number of share trading platforms available, of which Stake is one.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Coinbase or COIN

Find the share by name or ticker symbol: COIN. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy COIN shares

Buy on any trading day with a market order or use a limit order to delay your purchase of COIN shares until it reaches your desired stock price. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how your stock and the business perform with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your stock.

Coinbase Global, Inc. overview

Coinbase is one of the most prominent crypto exchanges in the industry, founded by Brian Armstrong and Fred Ehrsam in 2012. Established as a platform for buying, selling, and managing crypto assets, Coinbase has become synonymous with the crypto trading world. It supports a wide range of digital currencies, including the two largest by market cap, Bitcoin and Ethereum, as well as 150 other assets, offering services for both individual and institutional traders.

Since its inception, Coinbase has grown significantly, adapting to the evolving landscape of cryptocurrency markets. Listing on the Nasdaq in April 2021, Coinbase is recognised as the largest publicly traded crypto company in the world.

In 2023, despite the general volatility of the crypto market, Coinbase has continued to thrive. This prominence is a testament to the company's ability to navigate the challenges and opportunities presented by the dynamic and sometimes unpredictable nature of the cryptocurrency market.

Coinbase Wallet

Coinbase Wallet is a self-custody crypto wallet, which means that, unlike a centralised exchange, users have full control over their crypto, keys, and data. This type of wallet is designed to provide increased security and autonomy, as users are responsible for managing their private keys, a critical aspect of cryptocurrency security. With the Coinbase Wallet, individuals can securely store a wide variety of digital assets, including cryptocurrencies and non-fungible tokens (NFTs).

The wallet supports the storage of thousands of tokens and decentralised applications (dApps), and providing access to the decentralised web.

The design of the Coinbase Wallet emphasises user control, safety, and an easy-to-navigate interface, making it a valuable tool for both novice and experienced cryptocurrency users who want to engage with the broader ecosystem of digital assets and decentralised applications.

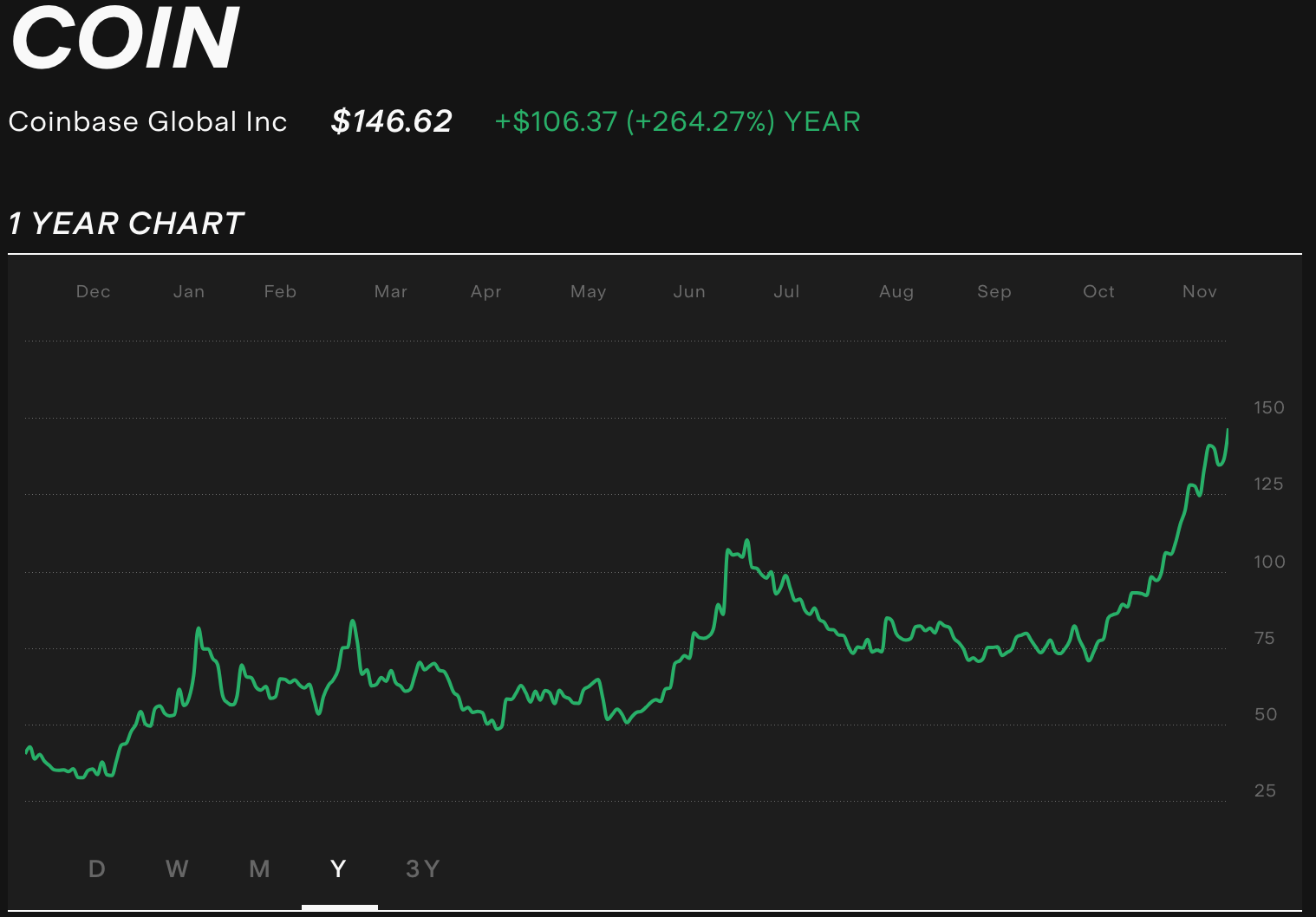

Since its inception, Coinbase's stock ($COIN) has experienced significant fluctuations, indicative of the volatile nature of the cryptocurrency market it operates in. The stock reached its all-time high in November 2021, with a closing price of $357.39. However, it's important to note that this period also saw heightened interest in cryptocurrencies globally.

Following this peak, Coinbase's stock experienced variability, reflecting the broader trends and uncertainties in the cryptocurrency market. This period was marked by fluctuations in investor confidence, regulatory developments, and changes in the overall economic environment.

In 2023, Coinbase's stock has seen remarkable growth, with an increase of approximately 330%. This impressive rise indicates a robust recovery and growing investor confidence in the company's prospects. Despite the challenges faced in the previous years, such as fluctuating cryptocurrency prices and market dynamics, Coinbase's stock performance in 2023 suggests a positive shift in market sentiment and the company's strategic positioning within the industry.

Coinbase stock P/E ratio

As of December 2023, the most recent price-to-earnings ratio for Coinbase ($COIN) stock is reported to be -24.2. This figure indicates that the company's current market price is lower relative to its earnings, reflecting a negative P/E ratio.

Coinbase EBITDA

For the nine months ending September 30, 2023, the adjusted EBITDA for Coinbase was $658.5 million, according to their third quarterly earnings report. This is up from $247.3 million for the same period in 2022.

What are similar stocks to Coinbase?

Here are a few similar stocks to Coinbase that are positioned in the crypto stocks space:

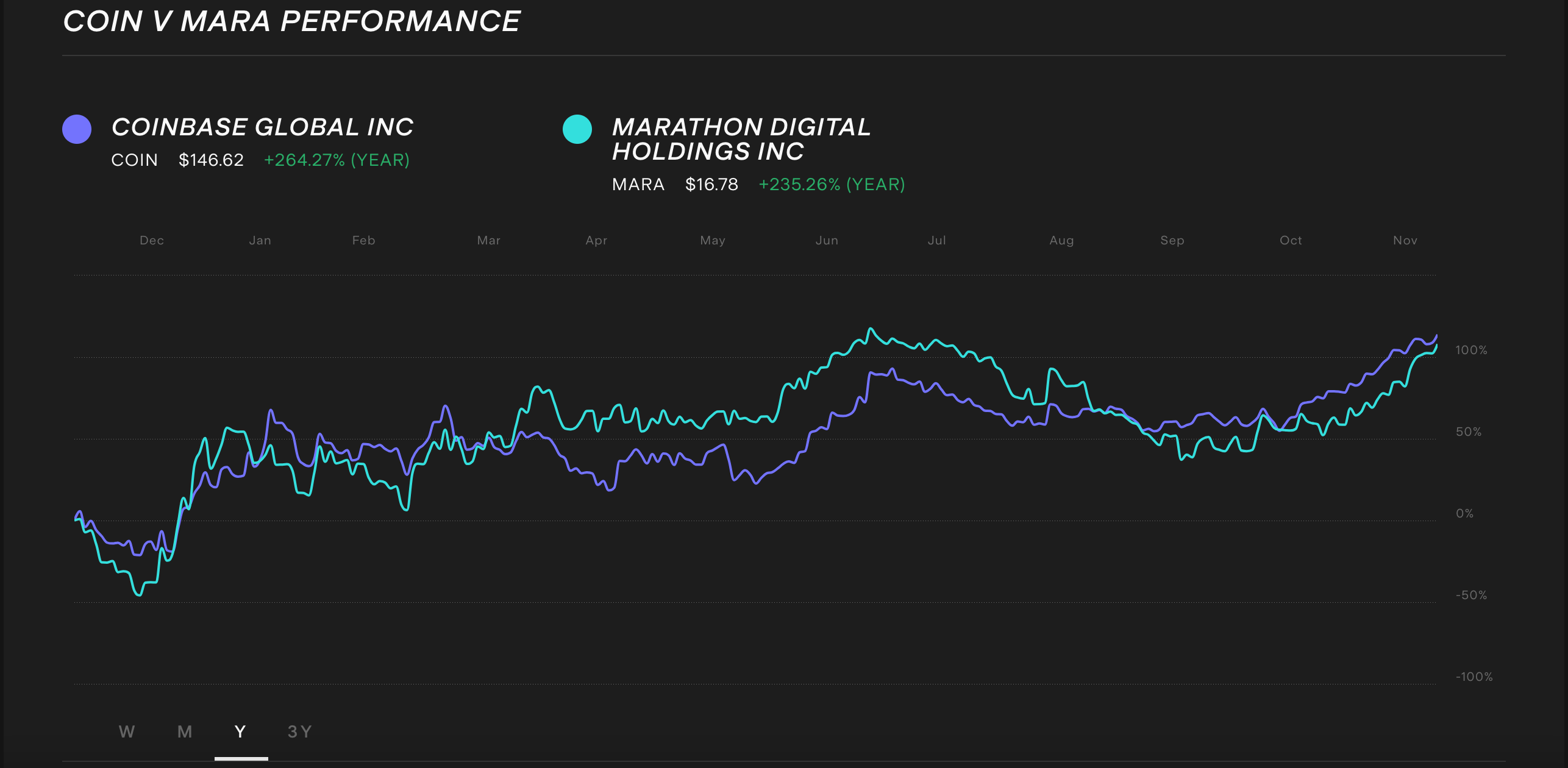

Marathon Digital Holdings ($MARA): MARA is a digital asset technology company that mines cryptocurrencies, focusing on the blockchain ecosystem. Its similarity to Coinbase (COIN) lies in its direct involvement in the cryptocurrency market, particularly in mining operations, making it sensitive to the dynamics of the crypto industry.

Riot Platforms, Inc. ($RIOT): RIOT is a company specialising in cryptocurrency mining, with a significant focus on Bitcoin mining operations. Like Coinbase, RIOT is heavily integrated into the cryptocurrency space, with its performance often linked to the fluctuations and trends in the crypto industry.

MicroStrategy Inc. ($MSTR): MicroStrategy is a business intelligence company that has made substantial investments in Bitcoin, aligning a large part of its business strategy with cryptocurrency. Its stock is similar to Coinbase's in that both companies' valuations are influenced significantly by the cryptocurrency market, especially Bitcoin's price movements.

🆚 Which stock has been performing better: COIN vs MARA→

Which ETFs have exposure to Coinbase ($COIN)?

The number of exchange-traded funds that hold Coinbase is growing steadily. You will find similar technology-focused companies at the forefront of innovation inside these ETFs:

ARK Innovation ETF ($ARKK): An actively managed ETF focusing on long-term growth of capital by investing in disruptive innovation companies across sectors like DNA technologies, industrial innovation, and energy storage.

ARK Next Generation Internet ETF ($ARKW): This ETF primarily invests in domestic and international equity securities of companies focused on internet-based products and services such as cloud computing, AI, e-commerce, and media innovation.

ARK Fintech Innovation ETF ($ARKF): An actively managed exchange-traded fund that holds companies at the forefront of financial technological innovation, including blockchain technology, frictionless funding platforms, and e-commerce.

Amplify Transformational Data Sharing ETF (Blockchain) ($BLOK): Another ETF with an active management approach, BLOK professionally selects blockchain companies to invest in. 79% of holdings are from North America, with the remaining 21% located in Asia Pacific.

Please note that ETF holdings can change over time due to rebalancing and changes in the composition of the underlying index. Always review the ETF's prospectus and holdings to ensure that it meets your investment objectives and provides the desired exposure to Coinbase or other specific companies.

Coinbase FAQs

Do Coinbase shares pay dividends?

Coinbase shares do not pay dividends. This decision aligns with many technology and growth-oriented companies, especially in the evolving cryptocurrency sector. Companies like Coinbase often prefer to reinvest their earnings back into the business to fuel growth, innovation, and expansion.

In the case of Coinbase, this strategy might involve developing new products, enhancing their platform, expanding into new markets, or investing in technology to maintain their competitive edge in the dynamic crypto market. Dividend payments are typically more common in mature, stable companies with predictable earnings, whereas Coinbase, operating in a relatively new and rapidly changing industry, prioritises reinvestment over dividend distribution to shareholders.

How much does it cost to buy shares in Coinbase?

One Coinbase share was worth US$1146.62 as of 8 December 2023, but some platforms make it possible to trade fractional shares. This means you can buy and sell shares for a portion of one share, for example, you could become a Coinbase shareholder by investing as little as US$10 in the stock on Stake Wall St.

Is Coinbase undervalued or overvalued?

There needs to be analysis of various financial metrics and market sentiments to determine if Coinbase is undervalued or overvalued in the market.

As of December 2023, Coinbase's market capitalisation is around $35b. The company experienced significant growth in its stock value, with shares increasing by 330% in 2023. This surge in stock value could be attributed to the company's resilience amidst the volatile cryptocurrency market and investor confidence in its business model.

However, assessing whether Coinbase is undervalued or overvalued is not straightforward. It involves considering factors like the P/E ratio, market trends, the company's financial performance, and the overall sentiment in the crypto sector. While the company's stock has shown impressive growth, this alone does not conclusively indicate whether it is undervalued or overvalued. Investors typically weigh these factors against market conditions and future growth prospects to make such determinations.

🎓Learn more: How to tell if a stock is under or overvalued?

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.