Decode

Our digital devices process units of information called bits, each bit being in essence either a one or a zero. As fast as the calculations may get, they usually have a linear path to a single result. Quantum computing has the potential to revolutionise that.

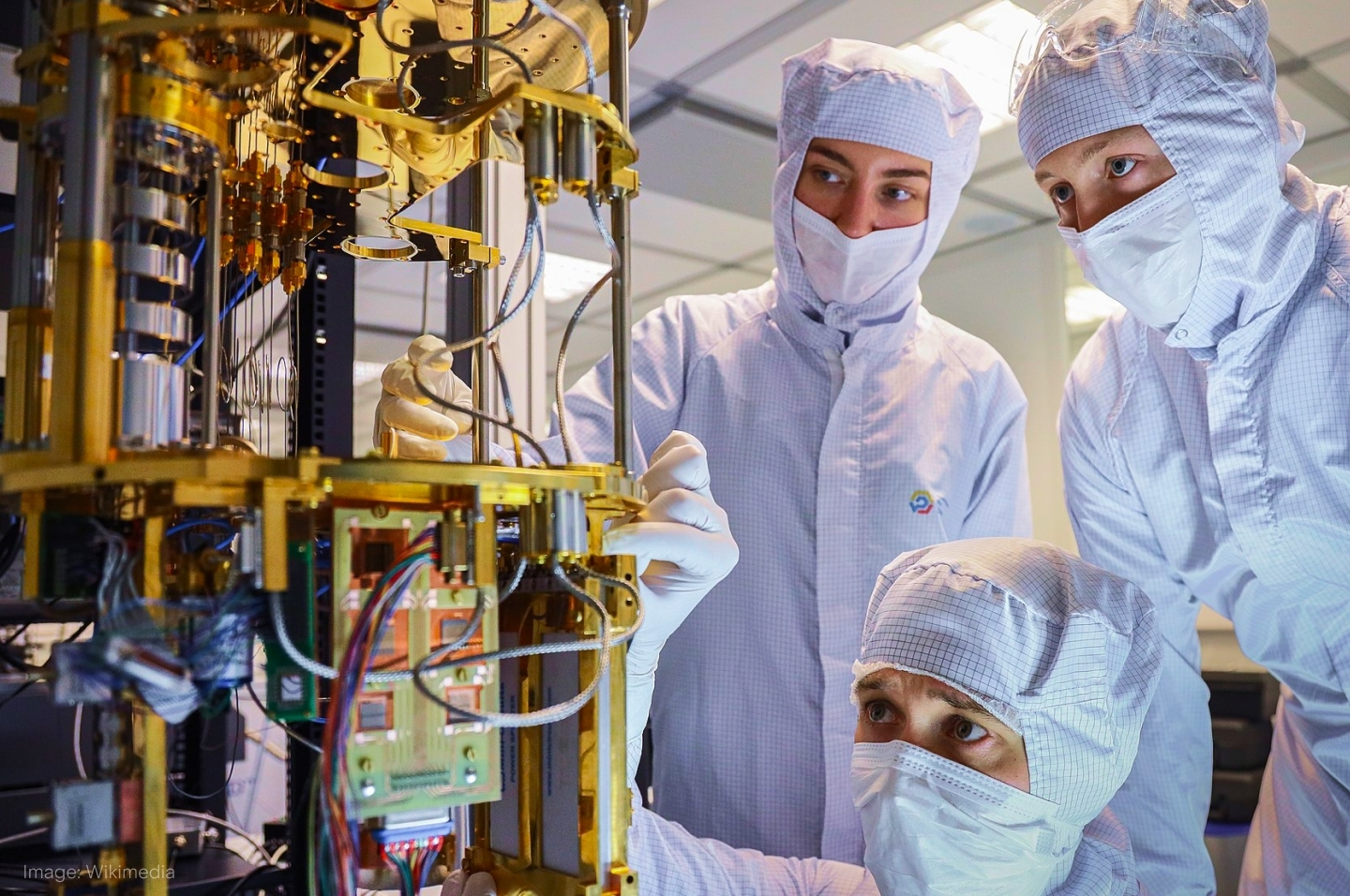

Instead of bits, the nascent quantum computing industry works with quantum bits, or qubits. These can store both zeros and ones simultaneously, which is called superposition and allows quantum computers to explore multiple paths at the same time. They deliver a range of potential answers and can save significant amounts of time when solving complex problems.

The technology could dramatically streamline tasks such as creating life-saving drugs and optimising supply chains. There’s even longer-term promise in helping with decision-making in investment portfolios and risk management. It could also be much faster to crack many encryption systems, posing an even tougher challenge to data privacy and cybersecurity.

Investors had poured US$5.4b into quantum computing startups by the end of 2022, and governments have announced funding worth US$34b to support the sector. The market could reach US$93b in value by 2040. However, quantum computing has high expectations to live up to; some are concerned it may be caught up in a hype cycle. The premise is largely theoretical and real commercial benefits could still be years away.

One major issue has been trying to reduce the number of mistakes when scaling up, as qubits are quite volatile. Due to the nature of quantum computing, scientists can’t use the usual error correction methods either. To keep qubits more stable and cut down on their information loss, quantum computers often operate in cryogenic chambers at nearly -273ºC. Businesses such as FormFactor ($FORM) offer quantum researchers testing and measuring facilities built for cold temperatures.

Firms are taking different approaches in terms of software and hardware development – for example, Alphabet ($GOOGL) uses loops of electric currents, while Honeywell ($HON) has groups of charged particles in its machines. But new listings on the stock market have mostly stumbled, with companies like IonQ ($IONQ), Arqit Quantum ($ARQQ), Rigetti Computing ($RGTI) and D-Wave Quantum ($QBTS) struggling to regain earlier stock prices.

Even industry leader IBM ($IBM) is progressing at a pace that can be considered slow. These performances, coupled with tighter funding from venture capitalists in 2023, explain concerns about a ‘quantum winter’ on the horizon. Could there be a quantum leap in time to heat things up?

Top image: Unsplash