Extended hours trading

Pre-market and after hours sessions now available on Stake, so you can make moves in sync with the market.

Seize more opportunities during pre-market and after hours

React faster to news and reports

Respond to price movements without waiting for the next regular session.

9.5 additional hours

Enjoy the convenience of 16 total hours of market access per trading day.

Experience Wall St in real time

Watch the price movements and know the current session at a glance.

Learn the details

Our Stake Academy content explains the risks as well as benefits.

Why trade during Extended Hours

Here’s a fact: Wall St keeps moving outside the regular market hours. Prices keep changing, as people keep trading. Now you can join them.

Extended Hours trading puts you in the front-row seat to follow the action and react quickly to price-sensitive news and reports. It’s a chance to capture gains and prevent losses without waiting for the next regular session. You also get more time to interact with the market at more convenient parts of your day.

The dynamics of Extended Hours trading – particularly the lower volumes and liquidity – involve additional risks you should be mindful of. Please refer to our article on Extended Hours risks & benefits.

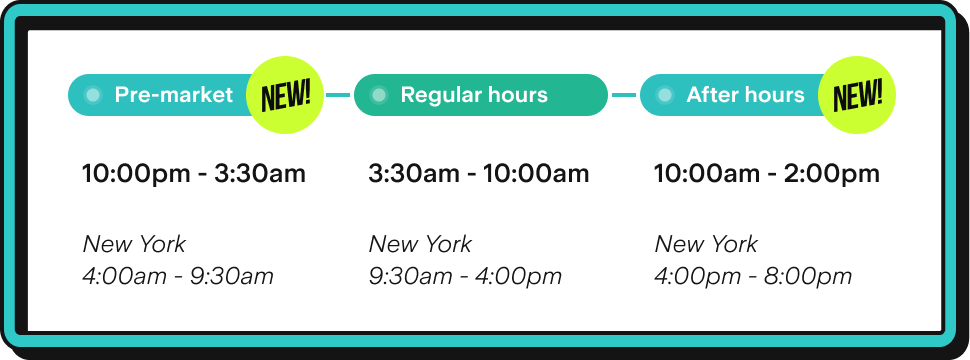

What time is pre-market and after hours?

Pre-market is the 5.5 hours before the regular trading session in New York, and after hours means the 4 hours after.

This table is an indicative guide – time differences change according to daylight savings in different markets. To make things easier, your Stake dashboard will always show exactly what session you’re in. That session tracker also expands to provide more info, adjusted to your device’s time zone.

How to trade pre-market or after hours

- Sign up in minutes

- Activate your Stake Wall St account

- Fund your account and find the company you want to trade

- Place an order and toggle on Extended Hours if applicable

Learn more about Extended Hours

Visit the blogExtended Hours FAQs

During these extra hours, buy and sell orders are matched electronically on an alternative trading system rather than a national exchange like the NYSE or Nasdaq. We’ve gone into more detail in this Stake Academy article.

When Extended Hours is enabled, limit orders for all shares can be filled during either regular hours, pre-market or after hours, with the usual expiry options available. Market orders, on the other hand, are only possible during Extended Hours for around 1,000 higher trading volume stocks. Read more about how Extended Hours works on Stake.

Extended Hours brokerage fees are the same as during regular market hours.

Since investors tend to be less active during Extended Hours, this leads to lower trading volumes, less liquidity and wider spreads between bid and ask prices for stocks. Volatility levels can be higher. Please read more about the risks involved with Extended Hours here and more on the disclaimers page.