Under the Spotlight: Formula One Group (FWONA)

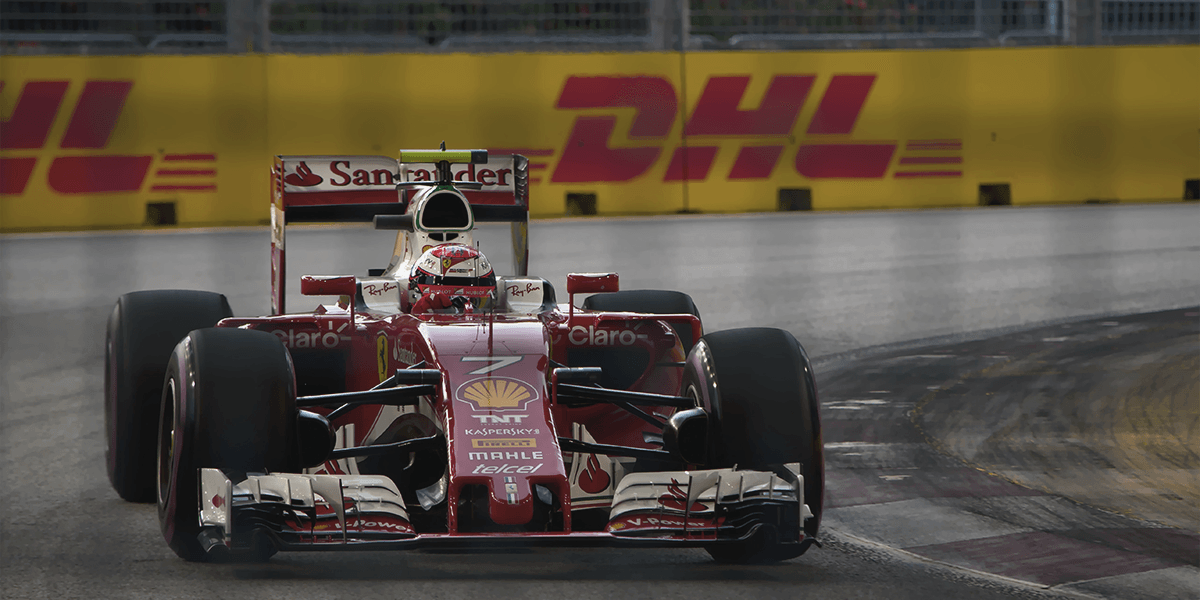

120 minutes of adrenaline and drama; that’s what Formula 1 promises its billion fans for 23 Sundays a year. Despite the complexity of DRS, porpoising and telemetry, there is no hotter sport on the planet. Up over 85% since the release of Netflix’s Drive to Survive, we put Formula One Group (FWONA) under the spotlight.

Formula 1 existed long before the publicly-traded company behind the sport came to be. Since 1950, racers have been fine-tuning four-wheeled, single rider metal chassis under the Formula 1 banner. It took Bernie Ecclestone to drive the sport into the public eye in the 1970s. Ecclestone was to F1 what Kerry Packer was to cricket or Dana White is to MMA. By negotiating TV rights, F1 went from a pastime for diehard rev-heads to a global spectacle enjoyed by millions.

TV revenues flowed through to teams allowing them to focus on R&D. Cars became faster and slicker which ultimately improved the sport. After all, the spectacle is built on speed and thrills.

In 2016, Formula One Group was acquired by Liberty Media Group and became available on the US market ($FWONA). Since the acquisition, the sport has experienced a renaissance. We have written extensively on the positive impact Netflix has had on F1. Four seasons into the show, the average viewership of each race has grown to 70m as revenue has grown to all-time highs (U$2.14b) despite the pandemic. Now, every mate is an expert on aerodynamics and has an opinion on the infamous Abu Dhabi GP last year.

Flags Of The World

Despite being seen as a sport for the elite, few sports leagues have such a diverse range of international involvement. Across the grid, there are drivers from 15 countries and teams from 6 countries.

Amazingly, F1 has found particular success in the USA, despite the country not having a local driver. The Austin event saw attendance rise from 264,000 patrons to 400,000 last year. In 2022, Miami will host its first-ever Grand Prix while Las Vegas will be added to the circuit in 2023. North America already hosts the Texas, Montreal and Mexico City Grands Prix. (yes, that’s the correct plural form of Grand Prix).

The increase in popularity is also being matched by an increase in competition. For decades, single teams enjoyed unrivalled patches of dominance. Ferrari, Red Bull and Mercedes combined to win 20 of the last 23 Constructors’ Championships, each enjoying runs of at least 4 straight wins. This was largely a product of unlimited budgets allowing the richest teams to completely dominate R&D.

This leads us to the next question, what does Formula One Group do?

Of course, car design, engineering and racing is carried out by individual teams (known as constructors). $FWONA handles pretty much everything else. From track design to setting rules to negotiating sponsorship agreements.

The Formula One Group’s strategy revolves around creating a more competitive and enjoyable viewing experience. The key to the sport’s longevity is competition. In the face of eight straight Mercedes championships, we are finally seeing some alternative outcomes in the sport as Red Bull and Ferrari take over the podium.

They promote competition in a range of ways; from setting the technical build parameters that limit disparities between cars, to allocating budgets to reward success while limiting potential edges. F1 is a sport with so many variables, it’s unbelievable that cars can finish within seconds of each other after 350km+ of racing .

A new budget cap means 2022 is the first year that cars have been designed with a roughly uniform spend of US$140m for all teams. In 2019, Mercedes were rumoured to have spent around US$500m. This is an initiative of the new F1 since its acquisition by Liberty Media.

Under The Hood

With the exception of 2020, in which about half of races were cancelled, the company’s revenue has been growing an average of 6.5% per year. For the year 2022, it is expected to reach a gross revenue of US$2.44 billion. $FWONA is hoping to capitalise on its growth in supporters and translate that to revenue. Currently, 40% of revenue comes from broadcast fees.

Considering that Formula One Group has a gross profit margin of 30.8%, one would expect the company to be extremely profitable. However, since 2017, when the company reported a net income of $255 million, the Formula One Group itself has not reported any positive earnings. The reason for this is mainly its high long-term indebtedness, with a higher cost of capital that ends up weighing on the company’s balance sheet. It is true, however, that the debt situation has been improving and that the company’s net loss is already lower than that recorded in 2019.

Sign up to Stake today and buy U.S. stocks like Formula One Group ($FWONA), Next Star Media ($NXST), News Corporation ($NWSA) and more!

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. Asalways, do your own research and consider seeking financial, legal and taxation advice before investing.