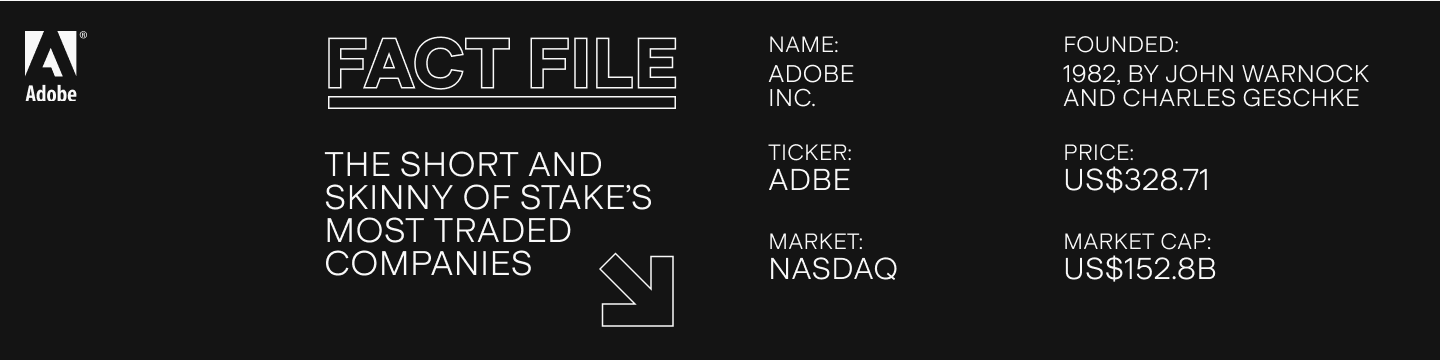

Under the Spotlight Wall St: Adobe Inc. (ADBE)

Starting with the development of a language for printers and documents, Adobe has become one of the most important companies for modern day internet. Let’s put it under the spotlight.

Despite not being one of the members of the FAANG acronym, Adobe ($ADBE) is one of the world’s biggest tech companies, transforming the way we interact with computers and the web. Adobe's software is used by professionals and individuals globally to create and edit digital media, as well as to manage and publish content online, but the company’s roots run deeper than that.

In fact, Adobe’s first product dealt with the world’s most hated devices: printers. PostScript, as it was called, was a programming language that used a set of commands and data structures to describe the layout and appearance of a document. It included support for text, graphics, and images, and could be used to create complex documents with a high degree of formatting control, thus revolutionising the printing industry.

Like Amazon ($AMZN), Apple ($APPL) and many other Silicon Valley companies, Adobe was founded in a garage, but the success of PostScript quickly allowed Adobe to scale up. Its success was so big indeed, that Steve Jobs tried to acquire the company, though he’d eventually settle to own 19% of Adobe’s shares.

Building the suite

During the 80s, the software giant begun to develop what would become one of its flagship products: Adobe Illustrator and Adobe Photoshop, a vector-based illustration software and an image editor, used by millions of designers all around the globe. Eventually Premiere, InDesign, After Effects, Lightroom and other apps would join the much beloved Adobe suite, helping thousands of businesses improve the performance of their creative teams.

One key factor that has contributed to Adobe's financial success is its focus on the subscription model. In 2013, Adobe made the decision to move its Creative Cloud products to a subscription-based model, which has allowed the company to generate a more predictable and recurring stream of revenue. This model has also allowed Adobe to continually update its products and offer new features to customers, which has helped drive customer loyalty and retention.

Another factor that has contributed to Adobe's financial success is the expansion into new markets and customer segments. In recent years, Adobe has made significant investments in acquisitions and partnerships to enter new markets and expand its product offerings. For example, in 2018, Adobe acquired Magento, a leading e-commerce platform, which has helped the company expand its presence in the digital marketing space for US$1.68b, and in September 2022 it announced the acquisition of Figma, a software development startup focused on design tools for US$20b.

Creative money-making

Adobe has had strong financial performance in recent years. In 2022, it reported revenue of US$17.6b, which represents a year-over-year growth of 15%. This growth was driven by strong demand for the company's Digital Media products, which allow users to make online ads. The segment had record revenues of US$12.84b in the period, making up for most of its income.

Adobe's financial performance has also been supported by its ability to generate consistent and growing levels of profit. In 2022, Adobe's net income was US$4.7b, which represents a margin of 27%. This strong profitability has allowed the company to consistently realise shares buybacks while also investing in research and development (R&D) to drive future growth.

Despite its strong financial performance, Adobe does face some challenges and risks. One key risk it faces is the potential for disruption from new technologies and competitors. The software industry is constantly evolving, and there is always the risk that new technologies or competitors could emerge and pose a threat to Adobe's business. However, considering the company’s creative nature, it might be hard to believe they will not continue to surprise us.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.jpg&w=3840&q=100)