What are the best AI ETFs to invest in? [2024]

Artificial intelligence themed exchange-traded funds (ETFs) offer investors easy access to a diverse portfolio of companies working on cutting-edge innovations that are reshaping global business and the way we live.

AI ETFs list to watch in 2024

ETF Name | Ticker | Share Price | Year to Date | Assets Under Management | Expense Ratio |

|---|---|---|---|---|---|

Global X Robotics & Artificial Intelligence ETF | US$31.67 | +11.34% | US$2.7b | 0.68% | |

Global X Artificial Intelligence & Technology ETF | US$36.51 | +18.90% | US$2.2b | 0.68% | |

ROBO Global Robotics & Automation Index ETF | US$56.91 | -1.94% | US$1.2b | 0.95% | |

ARK Autonomous Technology & Robotics ETF | US$58.36 | +2.15% | US$828m | 0.75% | |

iShares Robotics and Artificial Intelligence ETF | US$34.31 | -0.67% | US$673m | 0.47% | |

First Trust Nasdaq Artificial Intelligence & Robotics ETF | US$43.74 | -4.43% | US$527m | 0.65% | |

Global X Autonomous & Electric Vehicles ETF | US$24.67 | +0.56% | US$515m | 0.68% | |

Invesco AI and Next Gen Software ETF | US$48.90 | +28.88% | US$404m | 0.60% | |

WisdomTree Artificial Intelligence and Innovation Fund | US$21.50 | N/A | US$301m | 0.45% | |

Defiance Quantum ETF | US$65.02 | +21.66% | US$300m | 0.40% |

Data as of 12/07/2024. Sources: Stake, ETFdb.

*The list of ETFs mentioned is ranked by assets under management (AUM). When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry, fund performance, and whether or not they are actively traded on Stake.

Discover these artificial intelligence ETFs and add them to your watchlist

1. Global X Robotics & Artificial Intelligence ETF ($BOTZ)

- Assets under management: US$2.7b

- Share price (as of 12/07/2024): US$31.67

- Our customers watching and trading $BOTZ (as of 30 June 2024): 2,574 watching and 3,236 orders executed

Global X Robotics & Artificial Intelligence ETF ($BOTZ) provides investors with targeted access to companies focused on automation, robotics, and artificial intelligence technologies.

BOTZ has rallied from its October low as its largest holding Nvidia hit new highs on growing demand for its chips. The ETF has performed well against its peers YTD returns, delivering an 11.00% increase.

ABB, Intuitive Surgical ($ISGR) and Keyence are other holdings that have hit fresh highs. The ETF has higher management fees compared to broader tech index funds. This ETF is for those investors with a medium-high risk profile, seeking focused exposure to the robotics and AI sector.

2. Global X Artificial Intelligence & Technology ETF ($AIQ)

- Assets under management: US$2.2b

- Share price (as of 12/07/2024): US$36.51

- Our customers watching and trading $AIQ (as of 30 June 2024): 278 watching and 183 orders executed

The Global X Artificial Intelligence & Technology ETF ($AIQ) invests in companies involved in the development and utilisation of artificial intelligence and big data technologies.

The AIQ ETF has reached new highs in 2024, driven by rising investor interest in artificial intelligence and technological advancements. This surge is due to increased demand for AI technologies from multiple sectors, including healthcare, finance, and automotive, which are betting on AI to drive efficiency and innovation.

The ETF's portfolio has performed well. Key AI holdings include Nvidia ($NVDA), Broadcom ($AVGO) and Qualcomm ($QCOM), while tech leaders like Meta ($META), Alphabet ($GOOGL), Netflix ($NFLX) and Tesla ($TSLA) are also included. A focus on AI and tech leaders has contributed to the ETF's 19% YTD return.

With a diversified portfolio of technology leaders, AIQ appeals to investors seeking long-term growth tied to the potential of artificial intelligence.

3. Global X Robo Global Robotics & Automation ETF ($ROBO)

- Assets under management: US$1.2b

- Share price (as of 12/07/2024): US$56.91

- Our customers watching and trading $ROBO (as of 30 June 2024): 892 watching and 729 orders executed

The ROBO Global Robotics & Automation Index ETF provides exposure to global robotics, automation, and artificial intelligence sectors by tracking the ROBO Global Robotics and Automation Total Return Index.

The ETF has experienced a moderate performance decline this year, attributed to global economic conditions and sector-specific challenges. However, the long-term outlook remains positive, driven by continuous advancements in robotics and artificial intelligence technologies.

As automation and robotics become increasingly central to various industries, the $ROBO ETF allows investors to capitalise on the transformative impact of these technologies. Notable portfolio holdings include Intuitive Surgical ($ISRG), Harmonic Drive Systems, and Fanuc. Maintaining a diversified portfolio with exposure to such high-growth sectors could benefit long-term investment strategies.

4. ARK Autonomous Technology & Robotics ETF ($ARKQ)

- Assets under management: US$828m

- Share price (as of 12/07/2024): US$58.36

- Our customers watching and trading $ARKQ (as of 30 June 2024): 4,343 watching and 7,737 orders executed

$ARKQ, the ARK Autonomous Technology & Robotics ETF, is an actively-managed fund focusing on companies positioned to benefit from advancements in energy, automation, manufacturing, materials, and transportation.

The ETF's top 3 holdings include Tesla ($TSLA), Teradyne, Inc. ($TER) and Kratos Defense & Security Solutions Inc. ($KTOS). This positions ARKQ as an option for investors seeking exposure to future-forward technology and automation industries.

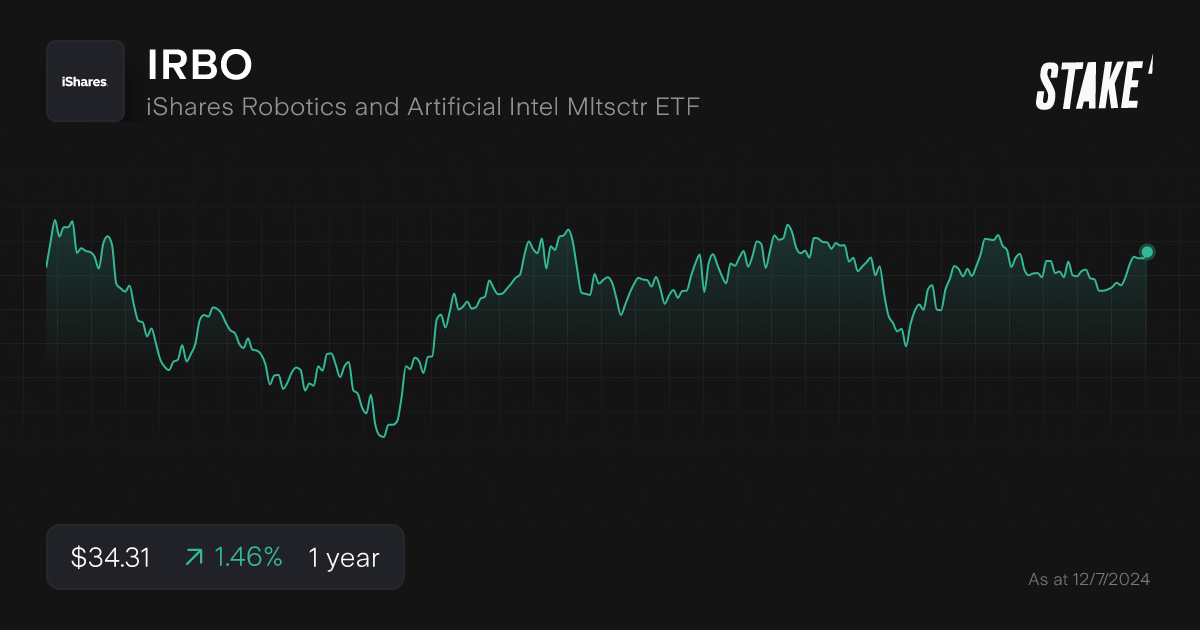

5. iShares Future AI & Tech ETF ($ARTY)

- Assets under management: US$673m

- Share price (as of 12/07/2024): US$34.31

- Our customers watching and trading $IRBO (as of 30 June 2024): 574 watching and 545 orders executed

iShares Robotics and Artificial Intelligence Multisector ETF invests in global companies that derive revenue from robotics and artificial intelligence (AI). It tracks the NYSE FactSet Global Robotics and Artificial Intelligence Index.

This ETF has experienced a -0.67% YTD decline. Market volatility and investor sentiment towards the tech sector have played a role, especially due to rising interest rates and renewed scrutiny over AI developments and regulation.

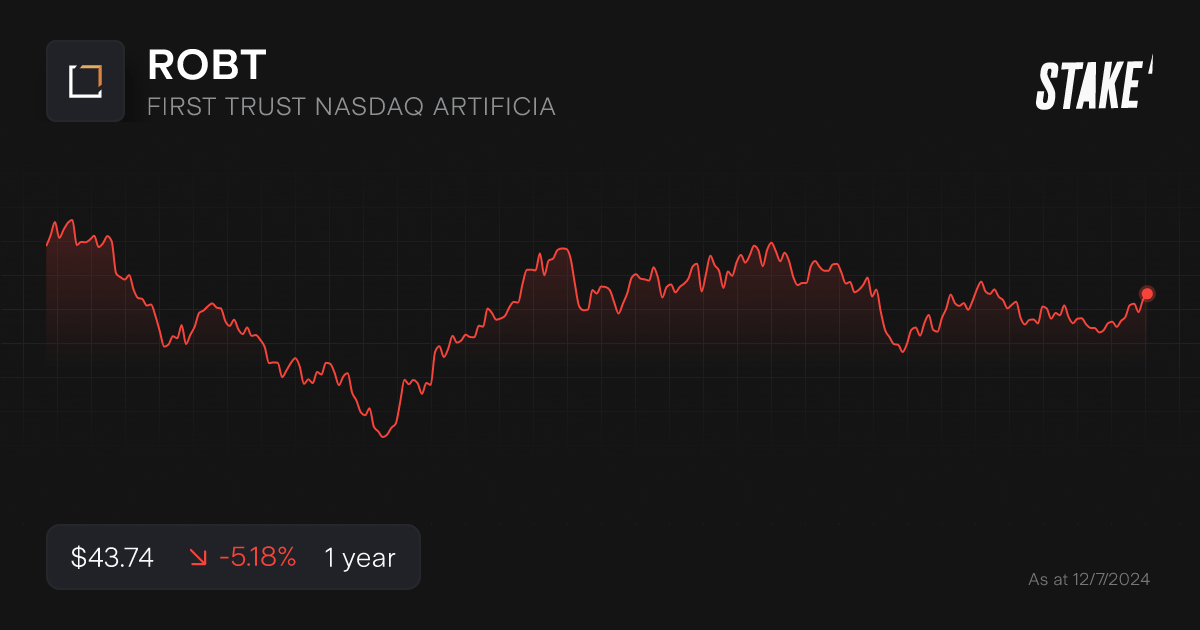

6. First Trust Nasdaq Artificial Intelligence and Robotics ETF ($ROBT)

- Assets under management: US$527

- Share price (as of 12/07/2024): US$43.74

- Our customers watching and trading $ROBT (as of 30 June 2024): 214 watching and 35 orders executed

The First Trust Nasdaq Artificial Intelligence and Robotics ETF ($ROBT) tracks the performance of companies significantly involved in the AI and robotics sectors.

Recent interest in $ROBT has been driven by the strong performance of its underlying assets and the increasing adoption of AI and robotics technologies across various industries.

The top holdings include SentinelOne, Inc. ($S), ServiceNow ($NOW), and Palantir Technologies ($PLTR), with a clear focus on key market players that are spearheading innovations in software and IoT services. Although the ETF has faced some market volatility reflecting broader market trends, its fundamentals remain strong, making it a focal point for investors seeking exposure to these high-growth sectors.

7. Global X Autonomous & Electric Vehicles ETF ($DRIV)

- Assets under management: US$515m

- Share price (as of 12/07/2024): US$24.67

- Our customers watching and trading $DRIV (as of 30 June 2024): 676 watching and 1,120 orders executed

The Global X Autonomous & Electric Vehicles ETF ($DRIV) focuses on companies involved in the development and production of autonomous and electric vehicles, and related technology. The ETF tracks the Solactive Autonomous & Electric Vehicles Index.

Electric vehicles have attracted investor interest as they have become more popular and leading companies have embraced AI and machine learning capabilities to develop autonomous driving.

Companies in the ETF like NVIDIA ($NVDA) and Alphabet, Inc. ($GOOGL) are at the forefront of these innovations, with the portfolio also holding stakes in car manufacturers like Tesla, Inc. ($TSLA) and Toyota (7203 JP).

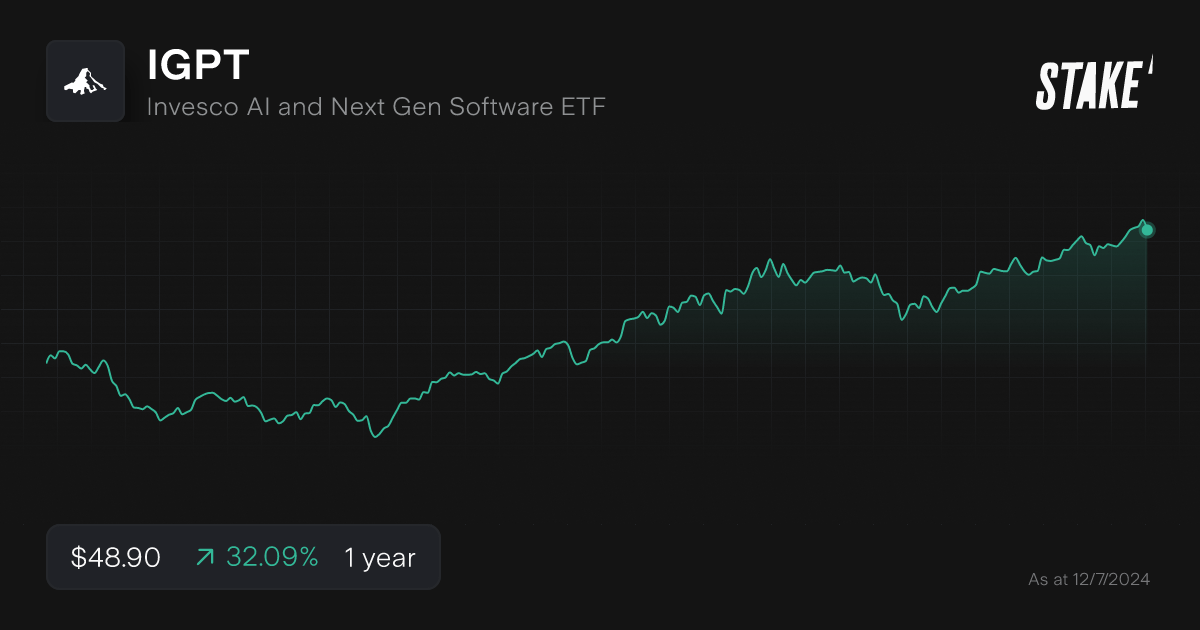

8. Invesco AI and Next Gen Software ETF ($IGPT)

- Assets under management: US$404m

- Share price (as of 12/07/2024): US$48.90

- Our customers watching and trading $IGPT (as of 30 June 2024): 88 watching and 101 orders executed

The Invesco AI and Next Gen Software ETF ($IGPT) focuses on equities of companies involved in advanced software development and artificial intelligence. It predominantly invests in large-cap tech firms and aligns with the STOXX World AC NexGen Software Development Index.

The ETF’s share price has gained this year amid the rally in tech stocks. The fund's investments in major technology stocks like Google ($GOOGL), Meta ($META) and NVIDIA ($NVDA) have benefited from the advancements in AI technologies and heightened corporate spending on next-generation software infrastructure.

The fund underwent a 3:1 stock split in July 2023, making it more accessible to retail investors.

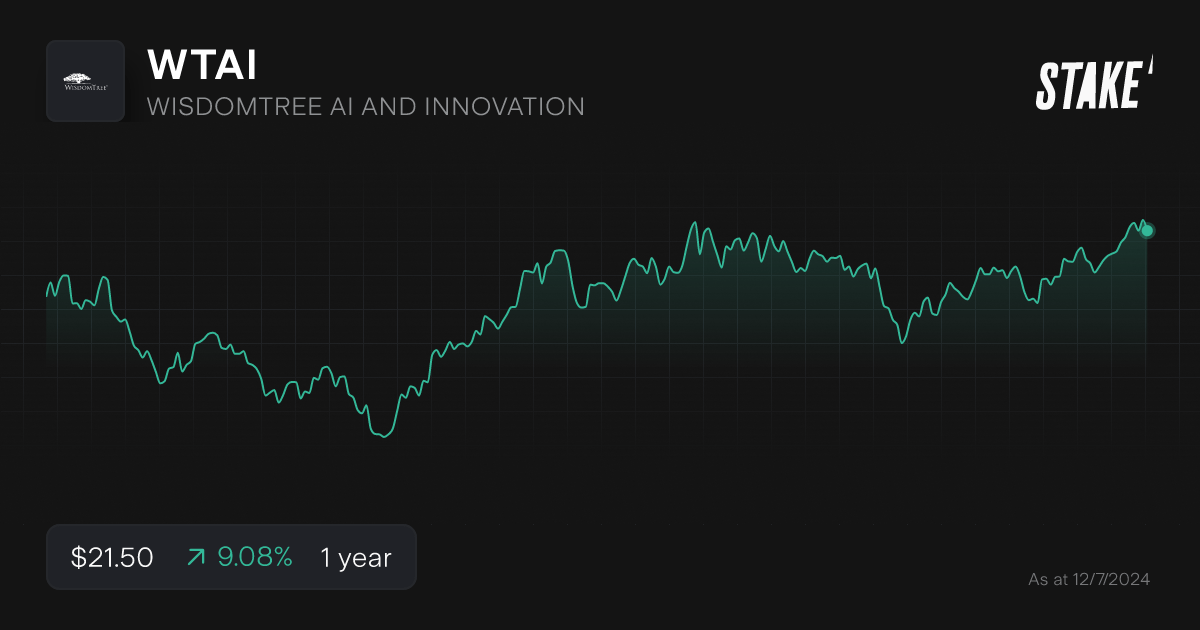

9. WisdomTree Artificial Intelligence and Innovation Fund ($WTAI)

- Assets under management: US$301m

- Share price (as of 12/07/2024): US$21.50

- Our customers watching and trading $WTAI (as of 30 June 2024): 47 watching and 39 orders executed

The WisdomTree Artificial Intelligence and Innovation Fund ($WTAI) tracks the performance of the WisdomTree Artificial Intelligence & Innovation Index, which focuses on companies in the AI and innovation space.

With a focus on companies that significantly contribute to the development and deployment of AI technologies, $WTAI has continued to attract investor interest. The fund's total assets under management are close to $300 million (as of 2 July 2024), indicating strong confidence in the AI-driven growth potential.

The portfolio’s top holdings include ARM Holding ($ARM), Nvidia ($NVDA) and SK Hynix.

10. Defiance Quantum ETF ($QTUM)

- Assets under management: US$300m

- Share price (as of 12/07/2024): US$65.02

- Our customers watching and trading $QTUM (as of 30 June 2024): 129 watching and 62 orders executed

$QTUM ETF provides exposure to companies at the forefront of quantum computing, AI, machine learning, cloud computing, and other transformative technologies. The ETF tracks the underlying BlueStar Quantum Computing and Machine Learning Index, which contains 71 globally-listed stocks. Top holdings include Advanced Micro Devices ($AMD), Wipro ($WIT), and Intel ($INTC).

The ETF has been gaining attention with its focus on the ability of quantum technology to revolutionise simulations, optimisations, and sampling capabilities. The emphasis on companies involved in the commercialisation of quantum computing positions it to capture the value of this next-gen disruptive technology.

How to invest in AI ETFs

Learn how to buy artificial intelligence exchange-traded funds in five simple steps on the Stake investing platform below.

1. Find a stock investing platform

To buy AI ETFs, you'll need to sign up to an investing platform with access to U.S. markets. There are a number of share trading platforms available, of which Stake is one.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for artificial intelligence ETFs

Find the ETF by name or ticker symbol, for example, $BOTZ. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day and utilise extended hours trading to access 9.5 additional hours in the markets. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once the stocks have been purchased, you can monitor the performance. It is recommended to check all portfolios on a regular basis to ensure investments are aligned on an ongoing basis with individual financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What is the largest ETF for AI?

The largest ETF focusing on artificial intelligence is the Global X Robotics & Artificial Intelligence ETF ($BOTZ). This ETF aims to provide investment results that match the price and yield performance of the Indxx Global Robotics & Artificial Intelligence Thematic Index.

As of 12 July 2024, BOTZ manages assets worth $2.7 billion, making it the largest ETF in the AI industry by AUM.

What are the risks of investing in an AI exchange-traded fund?

The landscape of artificial intelligence is vast and rapidly evolving, which presents unique challenges and opportunities. It is essential to consider the risks below when investing in AI companies and ETFs.

Data privacy | Compliance with strict privacy laws, like the GDPR, is crucial. AI often relies on personal and potentially sensitive data that must be handled correctly to adhere to legal standards. |

Cybersecurity | AI systems must be safeguarded against unauthorised access, hacking, and other cyber threats to protect sensitive data and maintain system integrity. |

Bias | AI systems might produce biased outcomes if not properly managed, which can lead to legal and ethical issues. |

Transparent | Ensuring AI systems are transparent and their decision-making processes can be explained and audited to maintain trust and follow regulatory standards. |

Technical reliability | AI systems must be reliable and accurate. Errors, misrepresentations, or 'black-box' issues can lead to operational inefficiencies and loss of trust. |

Energy consumption | AI systems, especially complex models, may have high energy demands, raising concerns about operational costs and environmental impact. |

Competition | Companies face competition from both established tech giants and emerging startups, making it critical to maintain a competitive edge. Rapid technological advancements may render current AI solutions obsolete, requiring continuous investment in R&D. |

Litigation | The possibility of legal disputes related to data use, IP rights, or discrimination can cause significant financial liabilities. |

Innovation | High R&D costs necessary to stay ahead in the AI space can strain financial resources. |

Social Implications | Issues such as job displacement due to automation and the ethical use of AI can cause reputational and social risks. |

Governance | Strong governance frameworks to monitor AI risks and ensure ethical practices must be in place to maintain stakeholder confidence. |

By accounting for these risks, investors can make more informed decisions about AI becoming a part of their portfolio and balancing potential rewards against the inherent uncertainties in this dynamic sector.

AI ETFs FAQs

Is it a good time to invest in AI ETFs?

The decision to invest in AI ETFs depends on individual risk tolerance and investment goals. Currently, AI technologies are rapidly advancing, driving growth in related sectors and attracting significant investor interest.

However, the market can be volatile, and valuations may already reflect high expectations. Investors should conduct thorough research and remain aware of potential risks.

While AI ETFs offer exposure to a promising industry, it is still in its early stages. It is essential to evaluate your own financial situation and investment horizon before making investment decisions.

What is the best way to invest in AI?

One common approach to investing in this growing industry is through exchange-traded funds. This allows investors to diversify into various AI companies through a single asset.

Remember that there is no single solution for all investors. You must carefully consider your investment strategy before deciding which is the best way to invest in AI if you choose to.

This article was edited by Robert Guy.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.