What to make of Analyst Ratings and Price Targets

It can be overwhelming to navigate the market as an investor and make informed decisions about which stocks to buy and sell. Many look to the pros for guidance or inspiration, which is why it’s convenient to have Analyst Ratings and Price Targets on Stake Black Wall St.

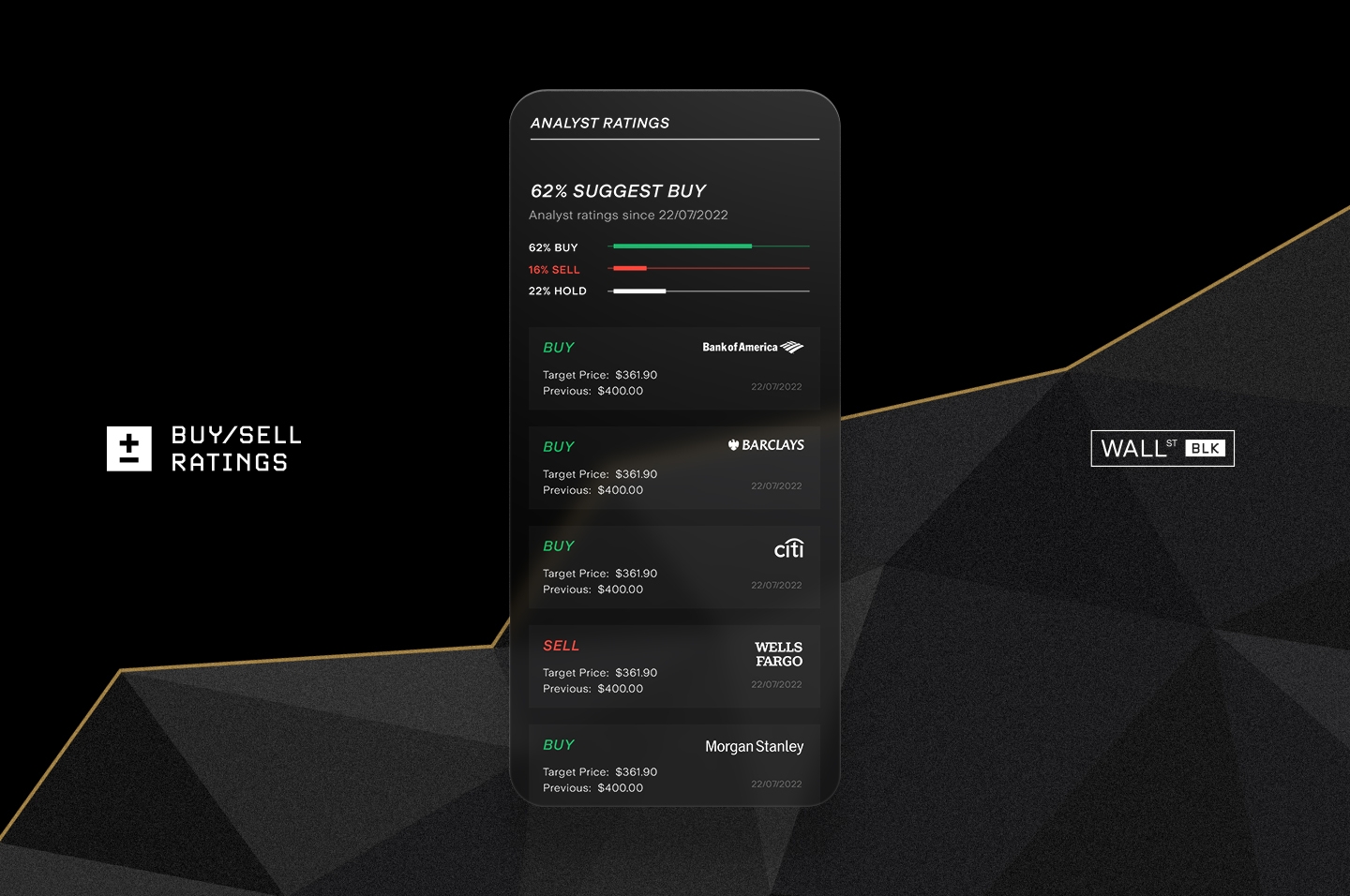

Analyst Ratings, or buy/sell ratings, are opinions issued by financial analysts on whether it’s a good idea to buy or sell a particular stock. Each rating is a snapshot of the view a particular professional, gained after completing a quantitative and qualitative analysis of the stock. These ratings can range from "strong buy" to "strong sell", with various tiers in between.

Stake Black Wall St members are able to access a library of buy, hold or sell ratings on thousands of U.S. stocks, by hundreds of different analysts from major sell-side investment banks. The ratings for a company are usually updated by analysts at regular intervals, and a change in rating can have an immediate effect on the overall sentiment around a stock.

Meanwhile Price Targets are predictions made by analysts about what a stock's price will be at a certain point in the future. The analyst may provide a single number or lower and upper levels based on their beliefs about the share. These targets can be forecast for short-term periods such as six months or have a long-term view like five years from now.

.jpg&w=3840&q=100)

How analysts rate stocks

Analysts consider multiple factors when issuing their ratings:

- Financial performance: Analysts will look at a company's past and current financial performance, including its revenue, profits and future growth potential.

- Competitive landscape: They also consider the environment of the industry in which a company operates, including the strength of its competitors and any potential disruptive threats.

- Management and leadership: The management and leadership of a company can play a significant role in its success, so analysts will review the track record and vision of a company's senior management team.

- Potential risks and opportunities: Analysts will research any potential risks or opportunities that may impact a company's future performance. They could be changes in industry regulations or the introduction of new technologies.

What’s important to note is that a rating and price target is a simple summary from the analyst after combing through all this information.

Why consider analyst ratings?

So, how can you use these ratings and targets in your investing? As with all financial information, you should be doing your own research; analyst ratings can provide another source of knowledge on which to build your own opinions.

Below are a few things to connsider when using ratings within your strategy:

- Check for outliers: If only one analyst is recommending to "buy” a particular stock, it’s best not to jump to conclusions and immediately follow through. If the majority are recommending to "sell", you may also want to explore why they’re all coming to the same view.

- Consider the analyst and their track record: Financial analysts are humans too, susceptible to their own biases and beliefs. They might not all have the same level of expertise or accuracy in their predictions. You can always research the background and track record of an analyst before making a decision based on their recommendations.

- Ratings and targets are just predictions: It's important to remember that buy/sell ratings and price targets simply represent an analyst’s future expectations, and there are no guarantees in the stock market. It's always a good idea to do your own research and make investment decisions based on your own due diligence.

Analyst Ratings and Price Targets can form a foundation for Stake Black investors looking to sharpen their trading strategy. Just remember to base you investments on a variety of factors, rather than relying solely on these opinions.