Breaking down the balance sheet with Full Financials

Whether you’re already a shareholder or potential investor, a company’s financials are the greatest source of truth behind their performance. With Stake Black you receive on-platform access to the last eight quarters of cash flow, income and balance sheet statements for all U.S. stocks and ETFs.

Even experienced investors can find reading financial statements to be a daunting task. Thankfully Stake Black’s easy-to-navigate Full Financials breaks down all the data into three easy statements on the platform.

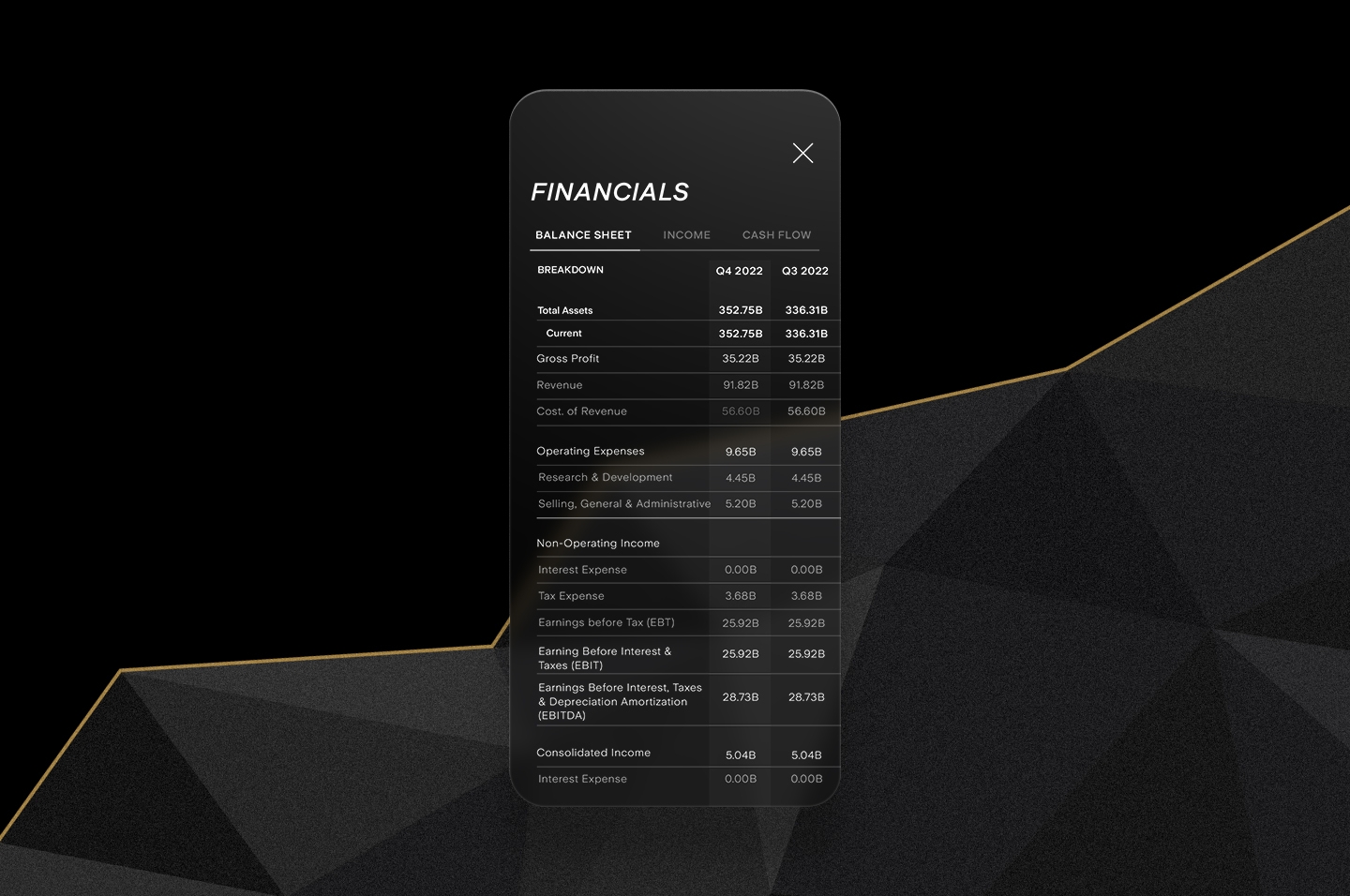

The Balance Sheet

A balance sheet is a snapshot of a company's financial position at a specific point in time. It provides valuable insights into a company's assets, liabilities and equity.

One of the most important things to look at when analysing a balance sheet is a company's assets. They provide an indication of a company's liquidity, or its ability to meet its short-term financial obligations. Investors often look at the proportion of current assets which can be easily converted to cash within one year. The value of these assets is compared to current liabilities, which are debts due within one year. This measure is called the current ratio.

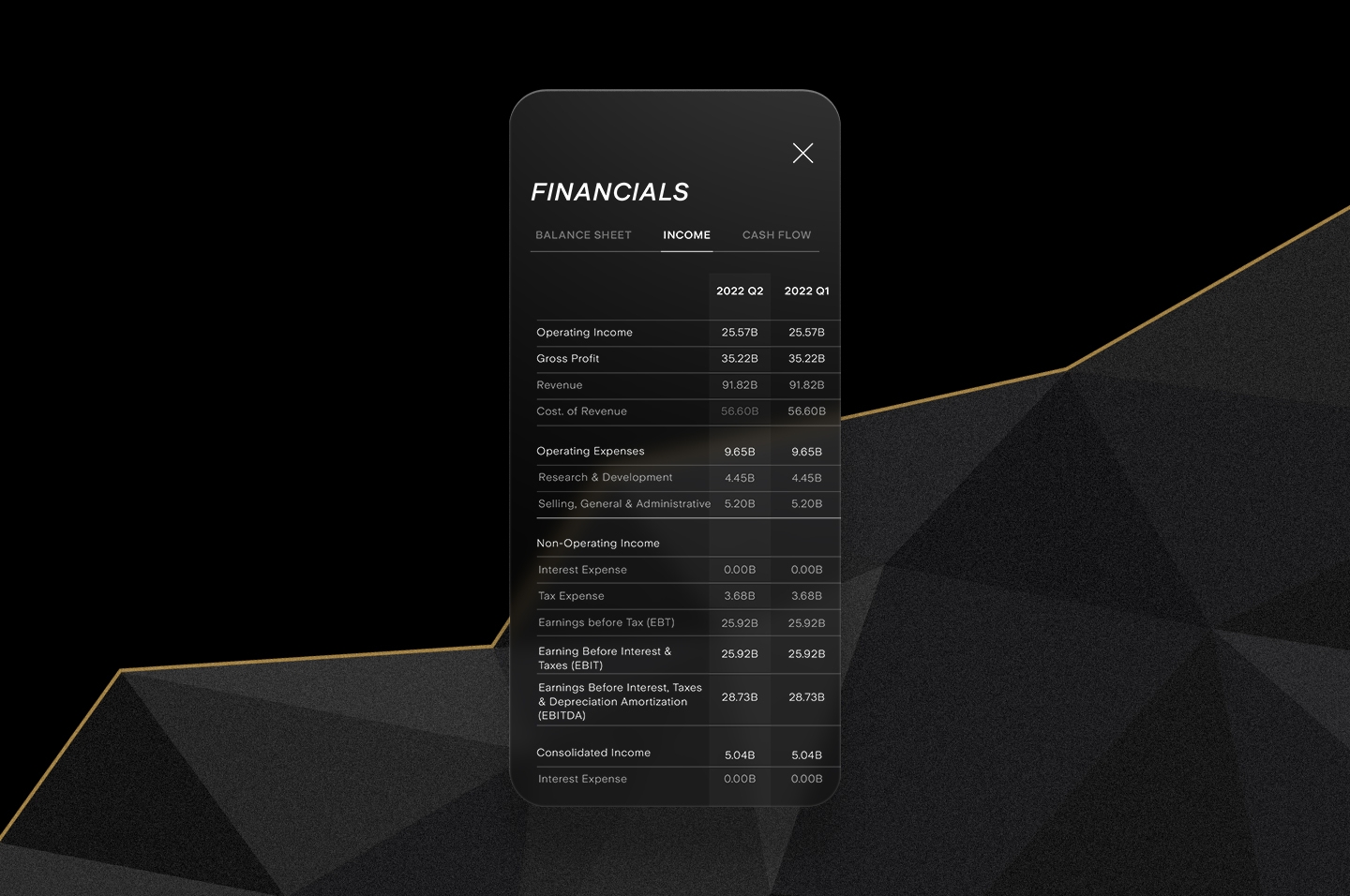

Income Statements

An income statement is a document that shows a company's revenues, expenses, and profit over a specified period of time, usually a quarter or a year. They’re also commonly known as Profit and Loss (P&L) statements.

This is relevant for investing because a company's revenue and profits are key factors in determining its value and potential for growth. The statement starts with the revenue numbers and then shows all costs that the company incurred to generate these revenues. Businesses need to account for matters such as the cost of goods sold, operating expenses and taxes. By subtracting all of the costs from revenue, we can determine a company's bottom line.

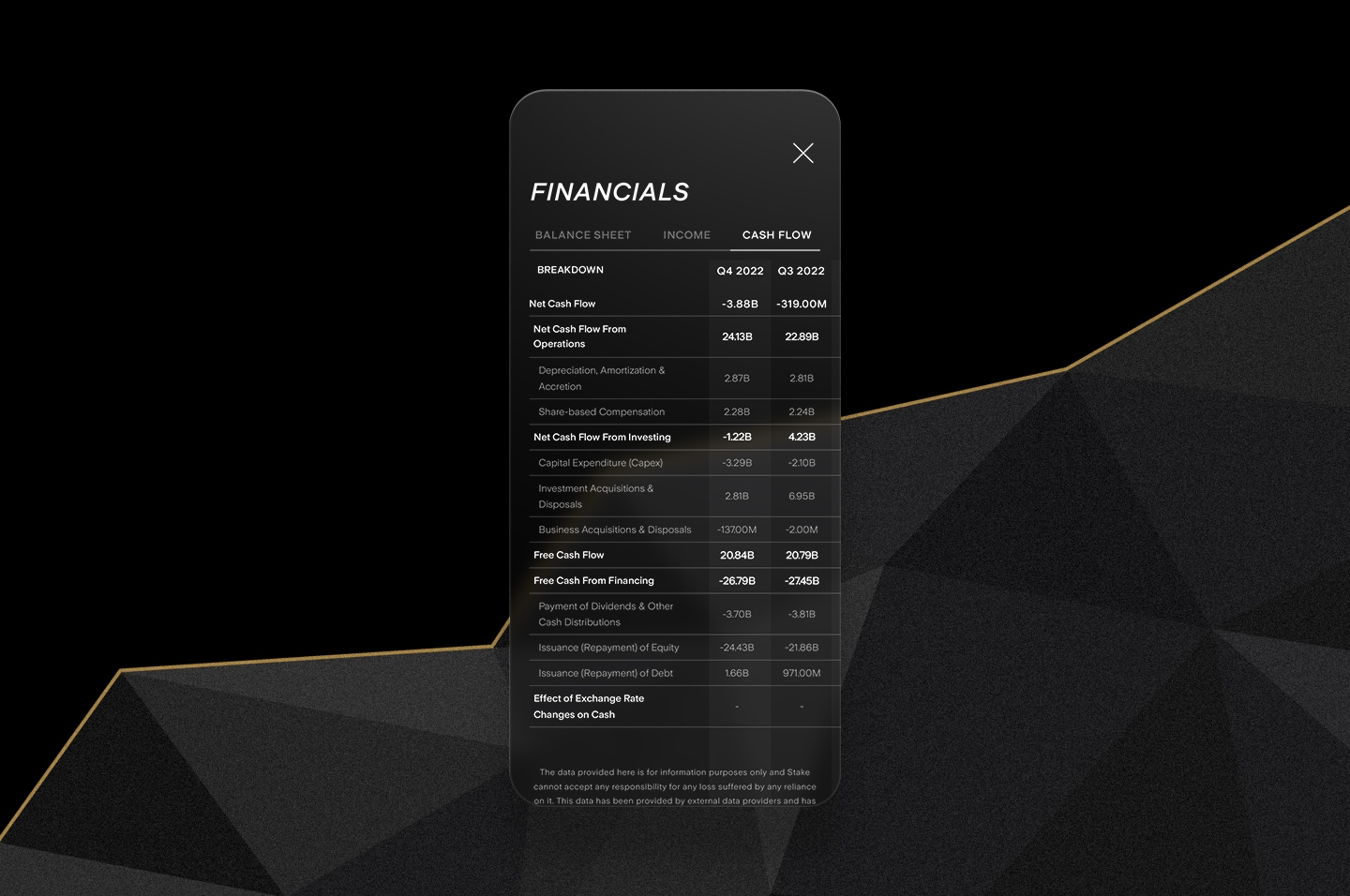

Cash Flow

A cash flow statement shows the inflow and outflow of cash, as well as cash equivalents, for a company over a specific period of time like a quarter or a year. It reveals a lot about a company's overall cash position, including how much cash it has generated from its operations, the amount used for investments, and what was distributed to shareholders.

Cash flow statements provide important information about a company's liquidity and financial flexibility. The document divides cash flow by its source into three main sections, which includes operating activities, investing activities and financing activities.

Now you know more about what Full Financials can reveal, why not give it a go on Stake Black? Activate a 30-day free trial for a limited time only and lift the curtain on the figures that matter.

The free trial promotion runs until 11:59 pm on 28 February 2023, promotion terms and conditions apply. If you use Stake Black, the Stake Black terms and conditions apply. Stocks used in images for demonstrative purposes only. This does not constitute financial advice.