.png&w=3840&q=100)

Under the Spotlight Wall St: ARK Innovation ETF (ARKK)

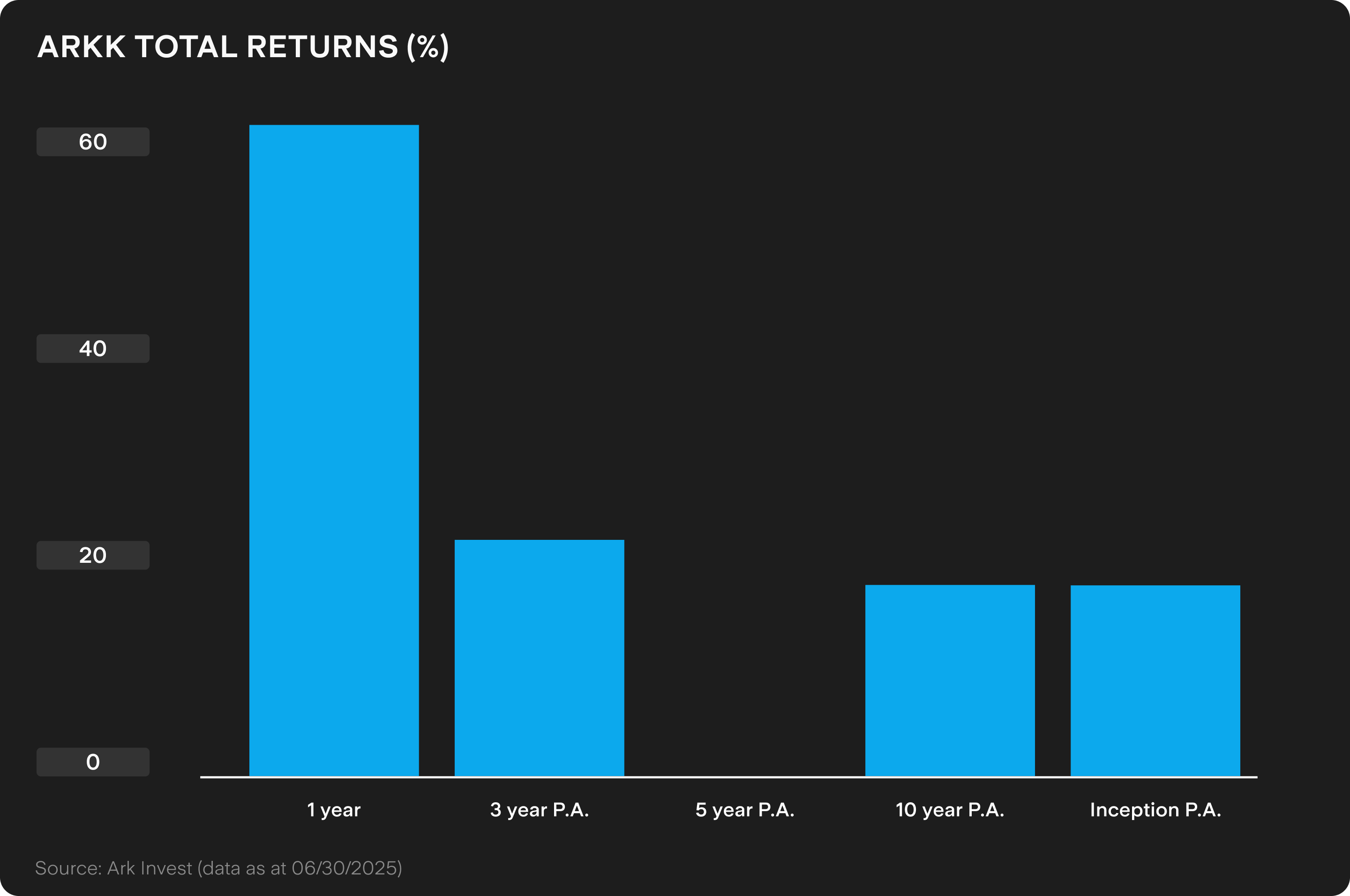

Cathie Wood’s ARK Innovation ETF has soared 87% since April as top holdings like Coinbase, Robinhood and Roblox hit new highs.

.png&w=3840&q=100)

The stars have aligned for the ARK Innovation ETF ($ARKK). U.S. tech stocks and crypto are on a tear, the Nasdaq’s hit record highs this week, and one high-profile fund manager’s flagship fund is riding the wave.

After an 80% slump from its 2021 highs, Cathie Wood’s fund is running hot, delivering a gain of 87% since April as bets on disruptive technologies pay off.

ARK Investment Management is known for its big calls on the future of crypto, autonomous vehicles, AI and genetic medicine. In ARKK, that plays out through chunky positions in Coinbase Global ($COIN), Circle Internet Group ($CRCL), Tesla ($TSLA), Palantir Technologies ($PLTR) and CRISPR Therapeutics ($CRSP).

But this week will be a test of that strong performance. Some of ARKK’s biggest positions – including Robinhood Markets ($HOOD) and Roblox ($RBLX) – report Q2 earnings.

And investing in disruptive innovation doesn’t come cheaply. ARKK charges an annual fee of 0.75%.

Bumpy road

It’s been a bumpy ride for ARKK’s largest position: Tesla, which makes up 9.85% of its portfolio.

Backlash over Elon Musk’s role in the Trump administration has dented global sales, while Chinese rivals like BYD ($BYDDY) have stolen market share with a range of cheaper EVs. Tesla shares plunged 53% between December and April.

Tesla’s Q2 earnings this week contained more pain. Automotive revenue fell for a second straight quarter, down 16% year-on-year (YoY) to $16.66b. Net income fell to US$1.17b from US$1.4b a year ago.

But Musk is back in the driver’s seat at Tesla, having given up his work at DOGE after an acrimonious split with President Trump. He claims to be back sleeping in his office to show investors he’s focused on managing the company.

In June, Tesla began producing a cheaper EV to revive sales. But Musk told the Q2 earnings call that ‘it’s just a Model Y’. Mass production ramps up later this year, with the model being allegedly ‘widely available’ in Q4.

While Musk continues to talk up full self-driving, despite many missed deadlines over the years, the company has started to roll out robotaxis across the U.S. Musk claims these will be available to half the U.S. population by the end of the year.

Now the pressure’s on Musk to start delivering and build on the stock’s 37% rally since April.

.png&w=3840&q=100)

New money

ARKK has been a long-time bull on crypto and that’s reflected in its portfolio. The passing of the GENIUS Act that brings stablecoins closer to the mainstream has boosted the fund’s crypto-related stocks.

Coinbase Global, ARKK’s second-largest holding at 7.56%, clocked nearly US$393b in trading volume in Q1. And it’s now branching out. Coinbase Payments launched last month as a stablecoin ecommerce platform, alongside Coinbase Business for small businesses and startups.

Coinbase is also in M&A mode to add scale. In June, it announced its fifth deal of the year – acquiring token management platform Liquifi. It’s also looking to bed down its US$2.9b acquisition of crypto derivatives exchange Deribit by the end of the year. Coinbase reports Q2 earnings on 31 July.

Part of Coinbase’s success is linked to the growing use of the USDC stablecoin, issued by Circle Internet Group – ARKK’s seventh largest position. The fund manager reckons stablecoin supply may increase 5x-10x over the next five years.

We focused on Circle recently, highlighting its revenue sharing agreement with Coinbase. Circle pays Coinbase for the USDC that gets distributed on its platform and – with US$60b of USDC in circulation – these payments could increase given Coinbase holds more USDC than Circle.

Robinhood Markets is another ARKK crypto play. It has grown the trading platform and has rapidly expanded its crypto business, including offering tokens of OpenAI and SpaceX. The stock has been on fire – it’s up 158% this year.

User growth has followed. Funded accounts increased 7% YoY to 25.9m in May, while total platform assets rose 89% to US$255.3b. Daily average revenue trades (DARTS) in equities grew 15% YoY in May, while crypto DARTS rose 67% YoY.

Robinhood’s crypto push includes acquisitions. It snapped up crypto exchange Bitstamp for US$200m and acquired Canada’s WonderFi for US$180m. Robinhood reports on 30 July.

Roblox may be better known as a user-generated games platform, but it also offers a play on emerging forms of money. It generates revenue through its virtual currency called Robux, which is spent within the platform. It’s ARKK’s fifth largest holding.

The numbers are big. Average daily active users grew 26% YoY in Q1, with hours engaged increasing 30% YoY to an astonishing 21.7b. This translated into a 31% YoY increase in Bookings (aka buying Robux), reaching US$1.26b in Q1. Roblox shares are up 101% this year and they report on 31 July.

Health cheque

ARKK’s gene-editing bets are also paying off.

CRISPR Therapeutics, ARKK’s fourth-largest holding, has surged 111% since April. It co-developed the first gene therapy for sickle cell disease with Vertex Pharmaceuticals ($VRTX), and is now targeting cardiovascular and autoimmune conditions.

A position in Tempus AI ($TEM) offers exposure to precision medicine through a combination of genomics and AI-powered data analytics. The company generates revenue by selling its technology and data to medical researchers. It has over 300 petabytes of data based on the sequencing of 3m samples.

Tempus AI works with major companies like AstraZeneca on oncology research. The US$600m acquisition of Ambry Genetics expanded its testing capabilities to include hereditary cancer risk screening. The company made revenue of around US$1,600 per cancer test in Q1.

High flyer

After several tough years, ARKK’s big bets on disruptive technologies are finally paying off.

Crypto, AI and genetic medicine are attracting large capital flows, meaning many stocks are priced for perfection. But with plenty of its positions set to report Q2 earnings this week, there’s pressure to keep delivering the huge growth priced into some of ARKK’s high-flyers.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)