.png&w=3840&q=100)

Under the Spotlight Wall St: Circle Internet Group (CRCL)

Circle Internet Group has surged since its IPO as stablecoins look to shake up the world of money and bring crypto into the finance mainstream.

.png&w=3840&q=100)

Circle Internet Group ($CRCL) has made its mark on Wall Street in the most impressive way possible: up 550% since its June IPO.

The company behind the USDC stablecoin isn’t just chasing headlines. It wants a significant slice of the financial system.

Stablecoins like USDC are pegged 1:1 to the U.S. dollar, offering a faster, cheaper way to move money compared to old-school options like banks and credit cards.

If you haven’t heard of stablecoins, then brace yourself. This isn’t a fringe corner of the crypto world: Circle’s USDC and stablecoin leader Tether (aka USDT) have US$220b of coins on issue. Circle claims USDC has a 29% share of the stablecoin market.

Interest in stablecoins has surged since the U.S. Senate approved the GENIUS Act, laying rules for U.S. dollar-backed stablecoins. And this coming week has been dubbed ‘crypto week’ as the U.S. House of Representatives considers the GENIUS Act and other pieces of crypto legislation.

Circle has been the fifth most traded stock on Stake since its IPO – above Apple ($AAPL), Alphabet ($GOOG) and Amazon ($AMZN).

Stablewhat?

Stablecoins serve as a bridge between traditional finance and the world of crypto. Unlike volatile crypto flagbearers like Bitcoin and Ethereum, stablecoins are known for being… well, stable.

USDC achieves stability by investing in U.S. government bonds on a 1:1 basis for every coin minted. As of May 31, it had around US$61b in Treasuries, repurchase agreements and cash to back US$61b of USDC. Circle also offers EURC, a Euro-backed stablecoin.

Here’s how it works. Users open an account with Circle, transfer U.S. dollars and receive USDC stablecoins in return. Circle invests the deposit in reserves. Users can redeem USDC’s through their account, benefitting from lower fees due to peer-to-peer transfers on the blockchain being cheaper than traditional payment systems like credit card networks.

Importantly, Circle releases an audited account of its reserves every month. That’s helped it build trust, unlike its rival Tether, who’ve been dogged by questions about the value of its reserves.

.png&w=3840&q=100)

Digital dollars

Despite its blockchain creds, Circle’s revenue source is more traditional. It comes from interest paid (in fiat currency) by the U.S. government on treasuries held in its reserve.

In 2024, reserve income accounted for US$1.66b of its US$1.67b total revenue. In the three months to 31 March, reserve income comprised US$557.91m out of US$578.57m in total revenue.

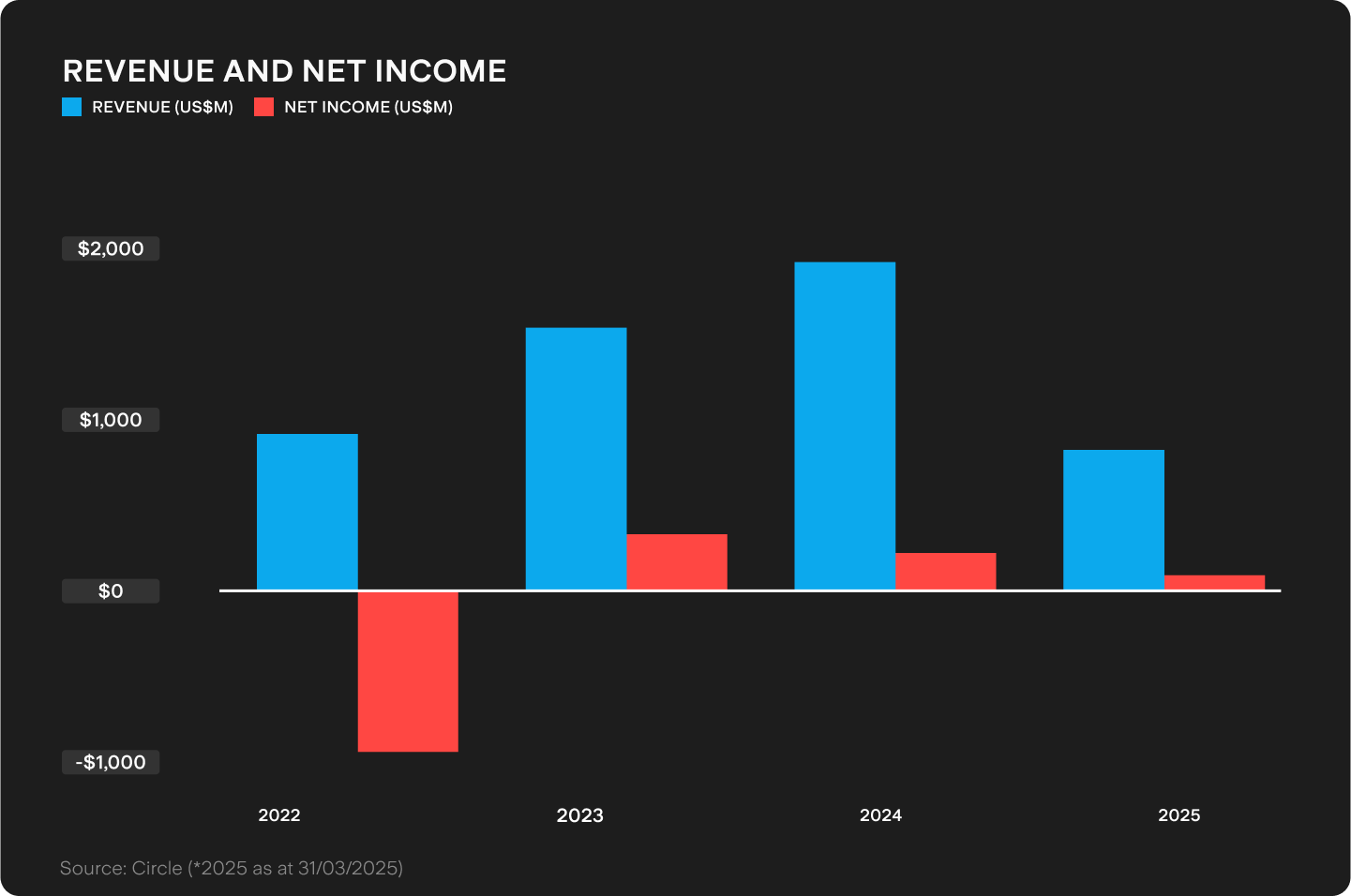

That’s partly thanks to the Federal Reserve’s aggressive interest rate rises. The reserve return rate exploded from a low of 0.14% in Q1 2022 to a high of 5.19% in Q4 2023. Little wonder Circle’s reserve income more than doubled from US$772.05m in 2022 to US$1.67b in 2024.

But the tide may be turning. Falling rates mean Circle will need more USDC in circulation – and more reserves – to offset lower yields.

But scaling USDC isn’t cheap. Distribution and transaction costs have grown from US$286.95m in 2022 to US$1.01b in 2024. In Q1 2025 they totalled US$347.31m.

A big chunk goes to Coinbase ($COIN), which earns a cut based on the USDC held on its platform – 22% in Q1, compared to 6% for Circle itself. Circle’s IPO prospectus flagged that if share keeps rising, costs could outpace income growth.

Scaling up

Circle is focused on growing USDC’s use across different blockchains to increase adoption.

It’s looking to expand across multiple blockchains by growing developer services. Customisable wallets for businesses and faster, more secure payments are part of this playbook. It’s also targeting the heart of the global payments system by working on stablecoin-enabled solutions with payment tech firm Fiserv ($FI).

Circle has applied for a national trust bank charter. If approved, this would allow it to offer custodial services to institutional clients. This is a key, though unglamorous, piece of banking infrastructure that securely hosts client assets.

It’s this type of infrastructure that’s needed if businesses are bullish on stablecoins. Walmart ($WMT) and Amazon, for example, are exploring stablecoin use as a way to lower cash handling costs and credit card fees.

USDC is also saving on remittance speed and costs. Fees for overseas workers sending money back to families – typically in less developed countries – are notoriously high. Some companies use USDC to make U.S. dollar payments to countries, often those with unstable currencies.

Divided opinions

Circle is a stock that has divided analysts.

Bulls like Seaport Securities rate the stock a buy with a US$235 price target, based on its forecast that stablecoins could grow to a US$2t market.

Bernstein rates Circle as a ‘must hold’ for investors bullish on the development of digital U.S. dollar networks. Its US$230 price target is based on the stablecoin market growing to US$4t over the next decade.

But at a US$80 price target, JPMorgan ($JPM) takes a more sceptical view. The broker cites industry competition and believes trillion dollar forecasts for the market are ‘far too optimistic’.

Mizuho also has a bearish take. It worries the GENIUS Act will attract more competitors as well as lower U.S. interest rates hitting Circle’s reserve returns. Mizuho has a US$85 price target.

Squaring the Circle

Circle’s red-hot rally has placed it and USDC firmly on investors’ radars. The buzz around stablecoins sees Circle trading on a hefty valuation.

Stablecoins are the new frontier in digital finance, offering the allure of faster and cheaper payments. Circle’s challenge is to keep delivering in the currencies that count on Wall Street: earnings and the share price.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)