Stock Lending with Stake

An opportunity to earn interest on your U.S. stocks.

Stock Lending is Stake’s take on securities lending, a common practice where brokers lend out stocks to financial institutions, in return for a fee.

Securities lending has historically allowed high net worth or institutional investors, like fund managers, to earn a bit extra on their portfolios for stocks they already hold. With Stock Lending, Stake makes this possible and shares this extra income with you.

Below you’ll find more details about our Stock Lending program, including the key risks and protections, so you can understand if it's right for you.

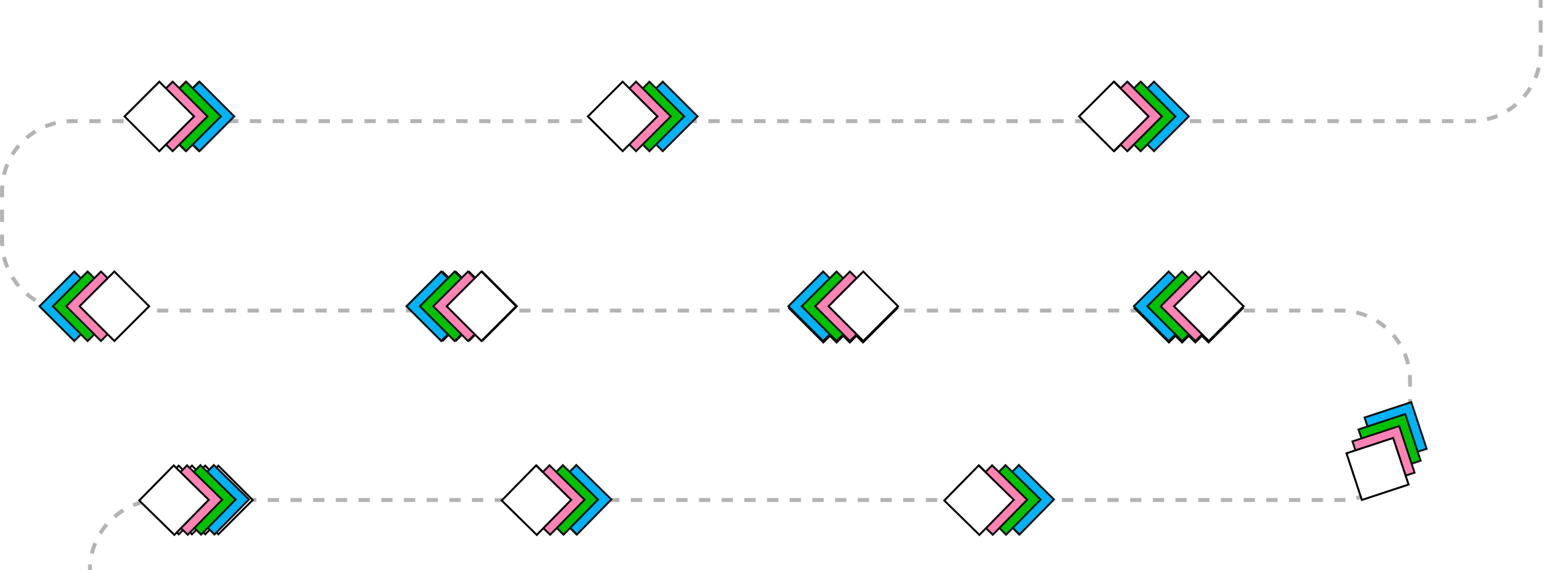

How does Stock Lending work?

If you participate in Stock Lending, your U.S. stocks are available to be lent.

Stake matches your stocks with financial institutions who want to borrow them.

In return, borrowers pay interest. We use this to cover costs, and share a payment with you.

What can I expect if my stock is lent out?

For example, say you hold $1,000 of XYZ Industries shares and are part of the Stock Lending program. There's high demand to borrow this stock, so Stake’s broker is able to lend out all $1,000 of your XYZ Industries shares to ABC Institutional Investor for a year. When the loan begins, ABC Institutional Investor puts aside $1,020 of cash collateral in a separate bank account, for your protection.

ABC Institutional Investor pays interest for the $1,000 of XYZ Industries shares they borrow. After covering the broker fees, Stake receives 10% annualised interest of $100. Most of this is used to cover the costs for Stake to run the Stock Lending program, and you keep the remaining $20 (annualised). Our share of the interest allows us to offer this opportunity to you, and provides us with some additional revenue which helps us continue to provide you with low cost and seamless access to the markets. Those low costs, combined with extra interest from Stock Lending, give Stake customers the opportunity to grow their portfolios a bit more each month.

Why lend my stocks?

Extra monthly income

If a stock you hold is lent out, you’ll receive a Stock Lending Payment in your Wall St account. This is your share of the interest, after we cover the costs of setting up and running the Stock Lending program, plus a small margin to allow us to make Stock Lending available. The interest varies based on the duration of the loan, market conditions, borrower demand, interest rates, the amount of securities borrowed and other factors.

We do the legwork

Stake and our U.S. broker DriveWealth do all the work to match your stocks with financial institutions who want to borrow them. This gives you access to the lending market typically reserved for institutional investors. We only work with established borrowers, who are experienced in Stock Lending.

Keep trading as usual

You can buy and sell your holdings at any time as normal, even if the stock is on loan. Selling a stock on loan will simply end the loan. To keep things simple, DriveWealth also ends loans whenever there’s an upcoming corporate action (like a stock split) or distribution, so you’ll still receive any dividends as normal. However, you cannot vote while your stock is on loan. If you'd like to participate in a vote, you must opt-out at least five business days prior to the record date for the vote. Simply opt back in afterwards to start earning again.

You’re covered

When your stocks are lent, you transfer legal and beneficial ownership of the stocks to the borrower for the duration of the loan – but you retain economic ownership and can recall your stocks at any time. Each loan is backed by the borrower with cash collateral, which you’re entitled to in the event the borrower can’t return your stocks. The cash is solely to secure the loan and is not re-invested. It is held in a separate account at BMO Harris Bank and managed by an independent collateral administrator. The amount of collateral is adjusted daily, so it remains at least 100% of the market value of the lent stocks.

What are the risks?

Borrower default and repurchase risk for stocks on loan

There is a risk that the borrower of your stocks is unable to return the stocks it has borrowed. Any lent stocks are backed by at least 102% cash collateral, adjusted every day. However, if the market value of the lent stocks increases by more than 2% during the same day the borrower defaults, the collateral may be insufficient to fully cover the market value of the unreturned stocks, resulting in a shortfall. The borrower has a contractual obligation to reimburse you if this shortfall occurs, so any potential losses in this scenario are covered. We'll step in and liaise with the borrower directly on your behalf if this happens.

Stocks on loan are protected by collateral instead of SIPC

Your U.S. brokerage account at Stake is insured for up to US$500,000 in total equity value if the broker DriveWealth becomes insolvent. When your U.S. stocks are borrowed, they move out of this brokerage account, so those stocks aren’t insured that way during the loan. Instead, the cash collateral is your source of protection. If you’re part of our Stock Lending program but your stocks are not out on loan, the stocks in your account remain insured for up to US$500,000 total equity value as usual.

Price of stocks on loan will still fluctuate

While your stocks are on loan, you still have full economic ownership of them. You have a contractual right to their return, and to sell them at any time (which will end the loan). This means that you are still exposed to market fluctuations and the value of your stocks may go up or down whilst they are on loan.

FAQs

We’ve partnered with our existing U.S. broker, DriveWealth, who has an experienced Stock Lending team. When there is demand, DriveWealth will borrow your U.S. stocks and lend them out to established banks and institutional investors, in return for interest. DriveWealth only lends to creditworthy Tier 1 and 2 borrowers, and they perform due diligence on those borrowers on an ongoing basis to ensure they remain appropriate counterparties.

There are many reasons financial institutions may want to borrow your stocks, including market making, covering failed trades, meeting margin requirements, or for short-selling and other trading and investment strategies. Our broker DriveWealth must comply with strict legislative requirements set by the U.S. Federal Reserve Board when they borrow your stocks, including for what purposes they can borrow your stocks.

Your stocks are only ever lent out to reputable borrowers, who are reassessed regularly. Stock Lending is an established practice, and borrower defaults are infrequent. In the event a borrower does not return a lent stock, DriveWealth will buy the stock from another party, in order to return it to you. All lent stocks are backed by 102% cash collateral held in a separate bank account, which is set aside to buy your stocks back for you if required. If there is any shortfall between the collateral and what the borrower owes you, they are legally required to reimburse you.

Stocks in your portfolio are assets that can earn you interest, similar to cash sitting in a bank account. Stake is giving customers access to the lending market, typically reserved for institutional investors, so you have the opportunity to make extra monthly income on the U.S. stocks you already hold, without any additional effort.

If your stocks are lent out, you’ll receive a Stock Lending Payment into your Stake account around the 15th of the following month. This is your share (20%) of the fees paid to Stake by the borrower. Our share is used to cover our costs of establishing, managing, and maintaining the Stock Lending program, plus a small margin. Our costs are covered so you can participate in Stock Lending and earn an extra income on your holdings.

Generally, the Stock Lending Payment you receive if your stocks are lent is taxed as ordinary income. This is not tax advice. Consider seeking appropriate advice from a professional tax adviser who will take into account your personal financial circumstances.

No. When you participate in Stock Lending, any U.S. stocks in your Stake Wall St portfolio can be borrowed. The loans will occur automatically – you won’t get notice or be asked to approve each loan. Whether a stock in your portfolio is lent will depend on borrower demand and other market factors. There is no guarantee that any of your stocks will be lent.

Yes. When any of your stocks are on loan, you’ll still be able to see them in your Stake portfolio as usual and trade them without restriction. You can sell your stocks at any time and realise any gains or losses as usual. If your stocks are on loan when you initiate a sell transaction, this will simply end that loan.

In your monthly Account Statement, which can be downloaded from the Stake app or web platform, you’ll be able to view a list of any stocks that were lent in the previous month.

Loans are ended prior to dividend payments, so your stocks won’t be on loan at the dividend record date, and you’ll receive dividends as normal.

You can't vote while a stock is on loan. If you'd like to participate in an upcoming vote, you should opt-out of Stock Lending at least five business days before the record date for the vote. You can opt back in to Stock Lending at any time afterwards to start earning again.

You can opt-out and opt-in to Stock Lending in your Wall St Account by clicking on Settings > Trade Settings > Stock Lending Settings > Turn off Stock Lending.

Stock Lending is currently available for all New Zealand and United Kingdom customers who hold U.S. stocks on Stake. It’s not available for Australian customers yet. If Stock Lending is available in your country, you don’t need to do anything extra to take part: we’ll do all the work to match your stocks with borrowers. You can always check and adjust your Stock Lending preferences in Settings in the Stake app or web platform.

We’ve made it simple for you to switch off Stock Lending at any time if you don’t think it’s right for you. When you’re in the Wall St section of the Stake app or web platform, go to Settings > Trade settings > Stock Lending settings.

As with all financial products, stock lending carries risk. Before making any investment decision, please ensure you understand the risks involved, consider if it’s right for you and seek appropriate advice from a licensed financial adviser. You should read our Stock Lending Explained page, Disclaimers, Financial Services Guide, Terms and Conditions, as well as DriveWealth’s Risk Disclosures and the Master Securities Lending Agreement.