Stake vs Hatch

Our Stake vs Hatch comparison helps you decide which stock investing platform is right for you.

- Stake offers simple brokerage fees for investing in U.S. shares

- Stake Rewards on offer for signing up and referring

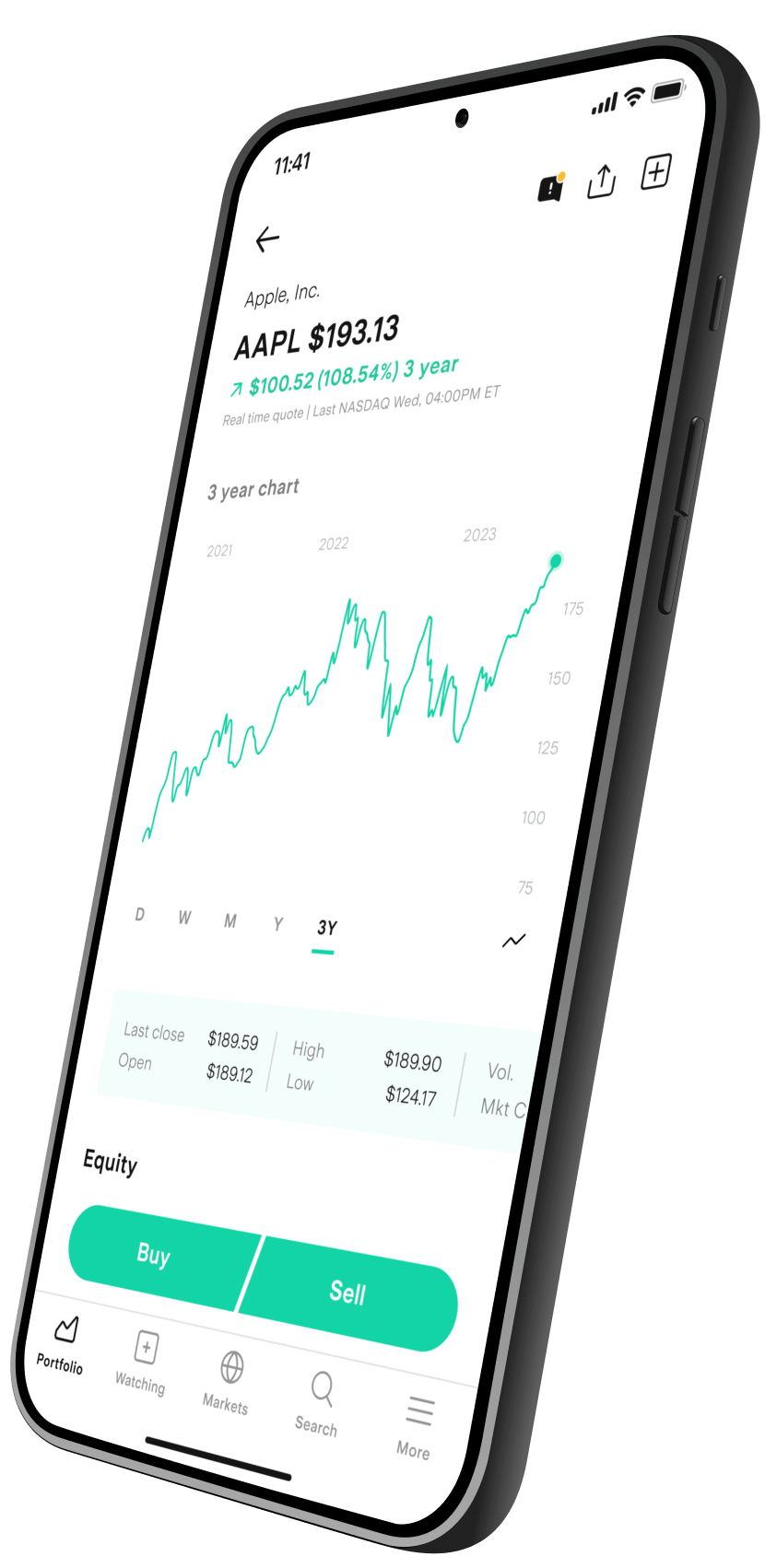

- A powerful, intuitive experience for investors of all levels, on mobile and desktop

Compare Stake vs Hatch

THIS COMPARISON WILL HELP YOU CHOOSE THE BEST STOCK INVESTING PLATFORM FOR YOUR INVESTING NEEDS

Stake provides New Zealanders with a seamless U.S. stock investing experience (Stake Wall St) with simple brokerage fees. Investors can easily jump in and trade over 9,500 stocks and ETFs on the web or through the Stake app.

Hatch is a digital investment platform and the retail arm of FNZ, another Wellington success story. FNZ is a leading global wealth management business and provides backend technology that powers wealth building platforms like Hatch.

Stake vs Hatch comparison

Overview | Hatch | |

|---|---|---|

Platform | Web, Android, iOS | Web |

Regulator | FMA | FMA |

Referral bonus | ||

Signup bonus |

| |

Minimum deposit | $0 | $0 |

Instant Funding | ||

Bank transfer | ||

Credit/debit card funding | ||

Apple Pay / Google Pay funding | ||

Fees | ||

U.S. brokerage | US$3 brokerage for all trades up to US$30,000. Or 0.01% for trades above US$30,000. | Flat fee of US$3 to buy or sell up to 300 shares + 1c USD for every additional share after that per transaction. |

Minimum trade (U.S.) | US$10 | No minimum |

FX fee | 1% ($2 minimum) | 0.5% |

Transferring U.S. shares (incoming) | Fees may apply (learn more) | Fees may apply (refer to Hatc website) |

Securities | ||

International shares | ||

ETFs | ||

Extended Hours trading | ||

Fractional shares | ||

OTC stocks | ||

Tradable markets | NASDAQ, NYSE | NASDAQ, NYSE |

Last updated 25 March 2024. Some incorrect information was displayed prior to this. The information displayed in the investing platform comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

A great alternative to Hatch

Join Stake and get started with a starter U.S. stock, on us.

How we compare

| Sharesies | ASB | Hatch | |

|---|---|---|---|---|

Trades up to US$30,000 | US$3 | Capped at US$5 per order | 0.6% ($50 min) | US$3 to buy or sell up to 300 shares + 1c USD for every additional share after that per transaction. |

Trades over US$30,000 | 0.01% | Capped at US$5 per order | 0.60% | US$3 to buy or sell up to 300 shares + 1c USD for every additional share after that per transaction. |

FX Fee | 1% | 0.5% | 0.4% ($40 min) | 0.5% |

U.S. securities offered | Stocks, ETFs and OTC securities | Stocks and ETFs only | Stocks, ETFs and OTC securities | Stocks and ETFs only |

U.S. portfolio transfers in/out |  |  |  | |

Fractional shares offered |  |  |  |  |

Last updated 20 Oct 2023. Some incorrect information was displayed prior to this. The information displayed in the investing platform comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

Stake vs Hatch Comparison FAQs

If you’ve currently got shares held with Hatch, you can easily bring them across to Stake:

- Download the app, sign up to Stake and log in.

- Tap the 'More' icon on the bottom right.

- Tap 'Portfolio transfers' and then select Wall St portfolio transfer for U.S. shares. Then follow the prompts.

Transfer a U.S. portfolio worth over US$500 to Stake and get a free Dropbox stock. Terms and conditions apply.

There are plenty of reasons to start investing with Stake over Hatch, here are just a few:

- A seamless, powerful mobile experience tailored for the modern investor.

- Stake users can get Stake Black, our premium membership that gives investors a host of advanced tools and features to take their trading to the next level.

- By joining Stake and funding within 24 hours, investors can earn a free stock in one of Nike, Dropbox or GoPro.

- Stake offer fast and secure ways to top up your Stake Wall St account. Choose from credit/debit card, Google or Apple Pay, POLi, bank transfer and Instant Funding (fees apply).

When buying stocks in New Zealand, every broker has its pros and cons. If you are still unsure which investing platform is right for you, refer to the alternatives to Hatch below and see how Stake stacks up.

Stakeshop Pty Ltd is registered as an overseas company in New Zealand (NZBN: 9429047452152), and is registered as a Financial Service Provider under the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (No. FSP774414). We hold a full licence issued by the Financial Markets Authority (“FMA”) to provide a financial advice service.

On Stake Wall St, your U.S. shares are covered under SIPC insurance for up to $500,000 (including $250,000 for claims for cash).

Download directly from the Apple App Store and Google Play Store.