Best Vanguard ETFs in Australia to Watch [May 2025]

When it comes to exchange-traded funds (ETFs), Vanguard is one of the best-known names for long-term investors, with over $10 trillion in funds under management. Out of the company’s 80+ ETFs listed on the ASX, we’ll be looking at Vanguard’s top 10 Australian funds by assets under management.

Discover our list of the best Vanguard ETFs in Australia

ETF Name | Ticker | Share Price | 1Y Return | Assets Under Management | Dividend Yield | Expense Ratio |

|---|---|---|---|---|---|---|

Vanguard Australian Shares Index ETF | $104.31 | +9.31% | $19.3B | 3.29% | 0.07% | |

Vanguard MSCI Index International Shares ETF | $139.41 | +13.39% | $10.5B | 3.38% | 0.18% | |

Vanguard US Total Market Shares Index ETF | $451.80 | +15.18% | $5.1B | 1.11% | 0.03% | |

Vanguard MSCI Index International Shares (Hedged) ETF | $107.80 | +5.41% | $4.6B | 5.57% | 0.21% | |

Vanguard Australian Shares High Yield ETF | $74.01 | +3.42% | $4.6B | 7.64% | 0.25% | |

Vanguard All-World ex-US Shares Index ETF | $101.77 | +13.52% | $3.8B | 2.39% | 0.07% | |

Vanguard Australian Property Securities Index ETF | $97.84 | +6.13% | $3.0B | 4.45% | 0.23% | |

Vanguard Diversified High Growth Index ETF | $69.05 | +8.26% | $2.8B | 4.20% | 0.27% | |

Vanguard Global Aggregate Bond Index (Hedged) ETF | $41.93 | +2.62% | $2.7B | 2.27% | 0.20% | |

Vanguard Australian Fixed Interest Index ETF | $46.40 | +3.55% | $2.6B | 2.72% | 0.10% |

Data as of 28 May 2025. Source: Stake, ASX.

*The list of funds mentioned is ranked by assets under management. When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

Compare best-performing Vanguard ETFs by return

Ticker | 1Y Total Return | 3Y Total Return (ann.) | 5Y Total Return (ann.) |

|---|---|---|---|

10.52% | 8.11% | 13.42% | |

12.11% | 14.16% | 14.02% | |

10.88% | 13.96% | 15.00% | |

8.09% | 8.69% | 12.48% | |

10.84% | 10.12% | 16.98% | |

13.16% | 11.87% | 10.55% | |

8.15% | 4.79% | 11.79% | |

9.90% | 9.14% | 11.39% | |

5.72% | 0.62% | -1.22% | |

6.94% | 2.81% | -0.30% |

Data as of 30 April 2025. Source: ASX Investment Products Report April 2025

Decide which Vanguard ETF to buy in Australia

Vanguard offers several ETFs listed on the ASX. Find out which one might be right for you below.

1. Vanguard Australian Shares Index ETF ($VAS)

One of the most popular low-cost choices for Australian investors, VAS is a total market index ETF that tracks the ASX300. VAS is largely composed of blue-chip stocks with strong brands and long operating histories, so this popularity is no surprise.

Some of the fund’s largest holdings include BHP Group Limited ($BHP), Commonwealth Bank ($CBA), and CSL Limited ($CSL).

With an expense ratio of just 0.07%, VAS is a compelling option for investors seeking low-cost exposure to some of Australia’s leading firms.

🎓Related: How to invest in the ASX 200 in Australia→

2. Vanguard MSCI Index International Shares ETF ($VGS)

VGS tracks the return of the MSCI World Index, which includes around 1,500 companies from developed countries. Notably, it excludes Australian firms, offering diversified international exposure.

International stocks can be a good way to invest in sectors like technology and healthcare, which make up a smaller portion of the Australian market.

For investors seeking a global portfolio, VGS is worth considering, especially given the fund’s 12.11% previous year performance. Its three biggest holdings are Apple ($AAPL), Microsoft ($MSFT), and Nvidia ($NVDA).

🆚 Compare VGS vs VAS→

🆚 Compare VGS vs VTS→

3. Vanguard US Total Market Shares Index ETF ($VTS)

VTS offers exposure to the U.S. stock market across various company sizes. In fact, VTS tracks the performance of 4,000 firms, making it one of the most comprehensive U.S. equity funds available.

For investors looking to participate in the dynamic American market, VTS could be a compelling option. With an expense ratio of just 0.03%, VTS is also the lowest-cost fund on the list.

Currently, the fund’s three largest holdings are Apple ($AAPL), Microsoft ($MSFT), and Nvidia ($NVDA).

4. Vanguard MSCI Index International Shares (Hedged) ETF ($VGAD)

VGAD is very similar to VGS, discussed above. Both funds track the performance of 1,500 companies from developed countries excluding Australia.

Crucially, the difference is that VGAD is currency hedged to the Australian dollar.

As a result, Australian investors in this fund will only receive exposure to underlying equity performance, not currency fluctuations. While this makes the fund slightly more expensive with an expense ratio of 0.21%, it also helps ensure that investors don’t take on unintended currency risk.

🆚 Compare VHY vs VAS→

🆚 Compare VHY vs VDHG→

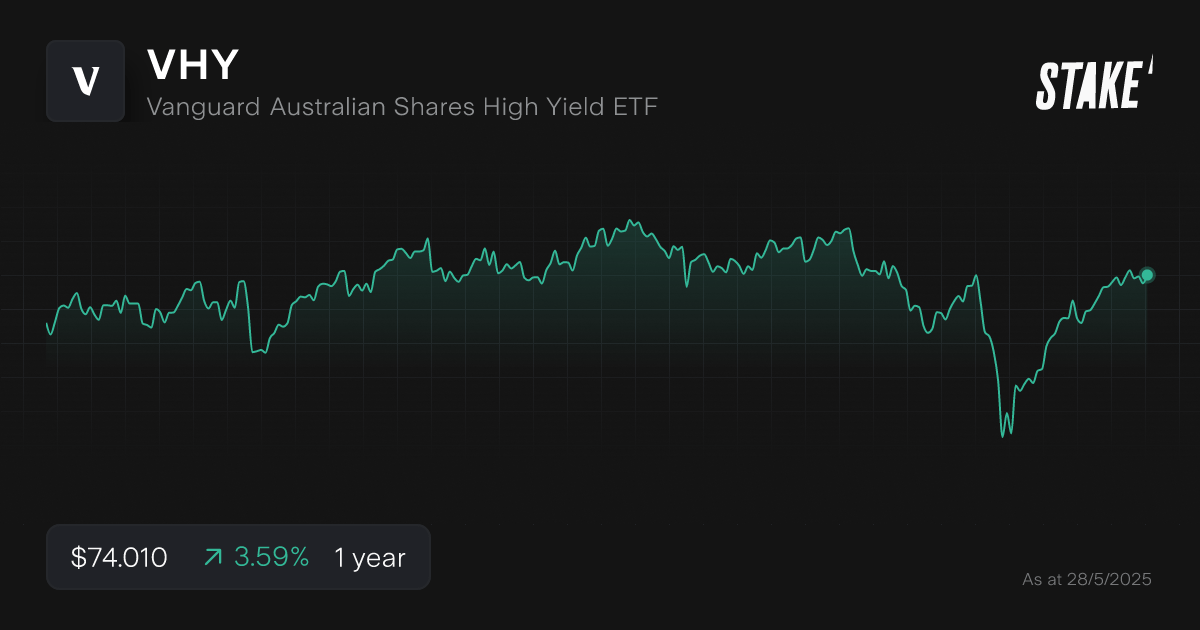

5. Vanguard Australian Shares High Yield ETF ($VHY)

Income-oriented investors will appreciate VHY – this is one of the best Vanguard ETFs when it comes to the highest dividend-paying stocks in Australia. The fund invests in firms that pay a strong dividend yield, factoring in both historical performance and future expectations.

It’s important to note that Australian Real Estate Investment Trusts (REITs) do not form part of the fund’s holdings. VHY’s three largest holdings are Commonwealth Bank ($CBA), BHP Group Limited ($BHP), and National Australia Bank ($WBC).

6. Vanguard All-World ex US Shares Index ETF ($VEU)

VEU seeks to track the return of the FTSE Global ex-U.S. Index. This is a broad index of around 3,500 companies from developed countries. Notably, unlike other international equity ETFs on the list, VEU excludes U.S. companies.

VEU is worth considering for investors seeking diversified global equity exposure without U.S. concentration. The ETF’s largest holdings are TSMC ($TSM), Tencent ($TCEHY), and SAP ($SAP).

💡Related: Are these the best emerging markets ETFs on the ASX?→

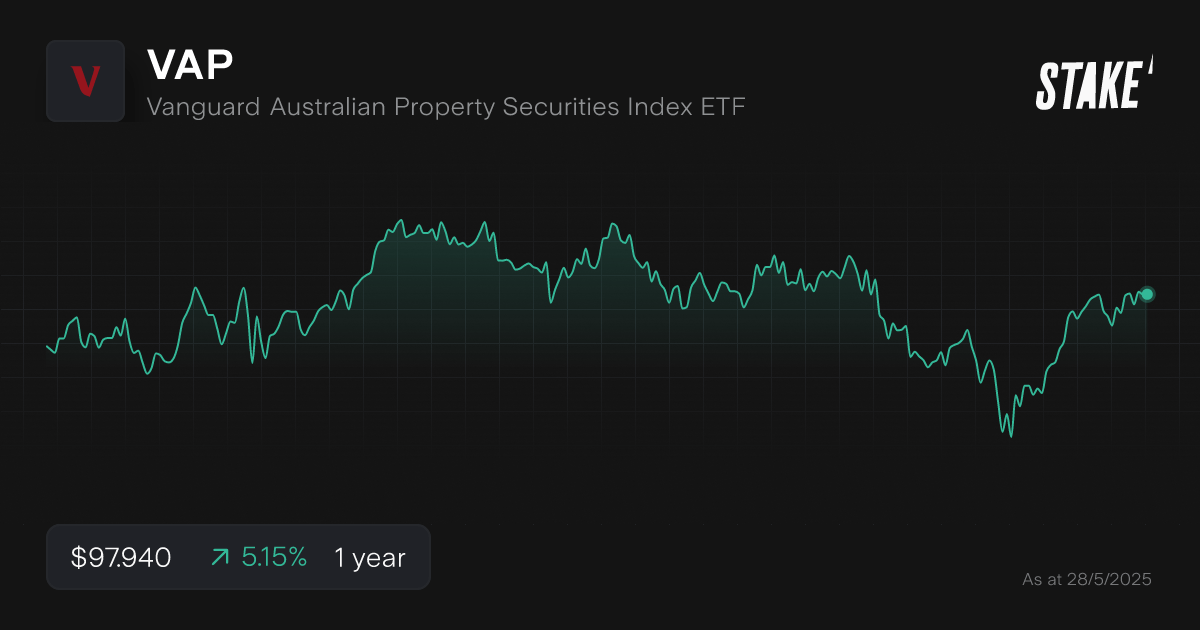

7. Vanguard Australian Property Securities Index ETF ($VAP)

VAP is an Australian real estate ETF, tracking the ASX-300's A-REIT index. This index is notable for its diversified exposure across the real estate industry, including residential, office, and industrial assets.

For investors seeking exposure to Australian property stocks, VAP could be an attractive opportunity.

It's important to note that sector-specific ETFs are less diversified than broader funds. Currently, VAP’s top holdings are Goodman Group ($GMG), Scentre Group ($SCG), and Stockland ($SGP).

💡Related: Discover these Top 10 REITs in Australia→

8. Vanguard Diversified High Growth Index ETF ($VDHG)

To put it simply, VDHG is an ETF of funds. Rather than invest in companies directly, VDHG tracks a portfolio of other Vanguard ETFs. These include international stock funds, Australian stock funds, as well as smaller allocations to bond funds.

As an all-in-one investment solution, VDHG is often compared to DHHF, a Betashares fund that is also made up of cost-effective ETFs.

While VDHG is notable for offering easy access to a diversified portfolio, it may not be suitable for investors seeking customised exposure.

9. Vanguard Global Aggregate Bond Index (Hedged) ETF ($VBND)

VBND is Vanguard’s flagship global bond product, featuring exposure to over 10,000 high-quality bonds from nearly 60 countries. This ETF provides a defensive allocation within fixed-income, with an average credit rating of AA-.

VBND is hedged to Australian dollars, meaning Australian investors will not be exposed to foreign exchange risk. While VBND is unlikely to appreciate as strongly as equity funds, it could provide greater stability.

The fund’s top holdings include U.S. Treasury Bonds and French government bonds.

10. Vanguard Australian Fixed Interest Index ETF ($VAF)

Like VBND, VAF is a fixed-income fund focused on bond exposure. However, this fund exclusively tracks Australian bonds, with exposure to around 200 issuers, including both corporations and governments.

With an average credit rating of AA+, VAF features high-quality bond holdings. This fund could be a strong choice for investors seeking a diversified domestic fixed-income portfolio with a low expense ratio.

Currently, VAF’s largest holdings are Australian government bonds.

How to invest in Vanguard ETFs in Australia?

The main way of investing in Vanguard exchange-traded funds is using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy Vanguard ETFs on the Australian Securities Exchange (ASX), you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the ETF name

Find the ETF by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the ETF, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What Vanguard fund to invest in Australia?

Several of Vanguard's ASX-listed ETFs invest directly in Australia. These include the Vanguard Australian Shares Index ETF ($VAS), which invests in a diversified portfolio of domestic equities, as well as the Vanguard Australian Fixed Interest Index ETF ($VAF), which offers exposure to domestic fixed-income assets.

For Australian investors seeking domestic asset exposure, Vanguard’s low-cost ETFs are worth considering.

Which Vanguard ETF is best to buy?

There is no specific best Vanguard fund to buy in Australia. When choosing an ETF, it's essential to consider your investment goals, risk tolerance, and time horizon.

Based on assets under management, the most popular Vanguard ETFs on the ASX are $VAS, $VGS, and $VTS.

For investors considering which fund to buy, these ETFs are a good place to begin researching. Consider reviewing the most traded Australian shares list, which gets updated at the beginning of every month to see what has been popular recently with Stake investors.

🎓Related: Guide on how to invest in ETFs for beginners→

Which Vanguard exchange-traded fund has performed the best in the last five years?

Over the past five years, the best-performing Vanguard ETF on the ASX has been $VHY, with an impressive total return of 16.98% annualised. This performance helps show why investing in companies with a high dividend yield can potentially be beneficial.

💡Related: Are these the best performing ETFs in Australia?→

💡Related: 10 High Growth ETFs to Watch in 2023→

Vanguard ETFs FAQs

Vanguard Australia is the Australian subsidiary of the Vanguard Group, a global asset management company that provides mutual funds and ETFs to investors. Other services provided by the Vanguard Group include financial advisory and brokerage services.

The founder of Vanguard, John C. Bogle, has been credited with creating the first index fund for investors. His philosophy was to provide investors with a low-cost way of owning a diversified portfolio. With Vanguard Australia, both sophisticated and retail investors can invest across several asset classes without breaking the bank.

For investors seeking a growth-focused Vanguard ETF, consider the Vanguard Diversified High Growth Index ETF ($VDHG).

This fund invests in a portfolio of underlying ETFs with a focus on capital appreciation.

For more direct global equity exposure, the Vanguard MSCI Index International Shares ETF ($VGS) could also be a good option.

Over the past year, the Vanguard All-World ex-US Shares Index ETF ($VEU) has delivered the highest total return at 13.16%. As always, remember that past performance may not be indicative of future results.

Expense ratios are the cost of owning a fund – it is the percentage that fund managers like Vanguard charge to cover their operating costs.

As Vanguard prides itself as a low-cost manager, its funds often feature low expense ratios of around 0.10%, although some funds charge 0.20% or more.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

.png&w=3840&q=100)