Are these the best AI stocks in December? [2024]

Artificial intelligence (AI) has taken the world by storm, carving out a sector worth over $200 billion.

Analysts argue that the market could grow to over $1 trillion by 2030, making AI stocks an intriguing opportunity.

We've already covered the list of artificial intelligence stocks on the ASX. Now dive into the top 10 AI stocks from U.S. markets.

Which are the best artificial intelligence stocks to watch?

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

Apple Inc | US$237.33 | +27.84% | US$3.59t | |

NVIDIA Corp | US$138.25 | +187.00% | US$3.39t | |

Microsoft Corp | US$423.46 | +14.18% | US$3.15t | |

Alphabet Inc | US$168.95 | +22.28% | US$2.08 | |

Meta Platforms Inc | US$574.32 | +65.85% | US$1.45t | |

Tesla Inc | US$345.16 | +38.94% | US$1.11t | |

Taiwan Semiconductor Manufacturing Co | US$184.66 | +81.88% | US$793.5b | |

Advanced Micro Devices Inc | US$137.18 | -1.01% | US$222.6b | |

Palantir Technologies Inc | US$67.08 | +304.58% | US$152.7b | |

SoundHound AI Inc | US$9.31 | +347.60% | US$3.4b |

Data as of 29 November 2024. Source: Stake, Google.

*The list of artificial intelligence stocks mentioned is ranked by market capitalisation. When deciding what AI companies to feature, we analyse the financials, recent news, state of the industry, and whether or not they are actively traded on Stake.

Discover the top AI companies to consider for your investment strategy

1. Apple Inc ($AAPL)

- Market capitalisation: US$3.59t

- Stock price (as of 29/11/2024): US$237.33

- Stake investors watching $AAPL: 212,466

Apple Inc ($AAPL) is a multinational technology company headquartered in California, USA. It’s the world’s largest company by market cap and produces popular products like the iPhone, MacBook, and iPad devices.

Apple was a frontrunner in the AI assistant sector when it released Siri in 2011, a virtual assistant that can understand voices and help with a selection of simple tasks. However, the company recently rolled out Apple Intelligence, a new implementation of AI that sees Apple devices empowered with an improved version of Siri and the ability to write/summarise content or notifications, provide transcripts of calls, and generate images.

Historically, Apple has performed well. It has yielded 1-year returns of 25.68%, 47.07% over 3 years, and 244.87% across a 5-year period. The company is already a top tech stock, but with the release of Apple Intelligence, it could capture a significant portion of the AI market, which could make Apple one of the best AI stocks.

🆚 Compare AAPL vs MSFT→

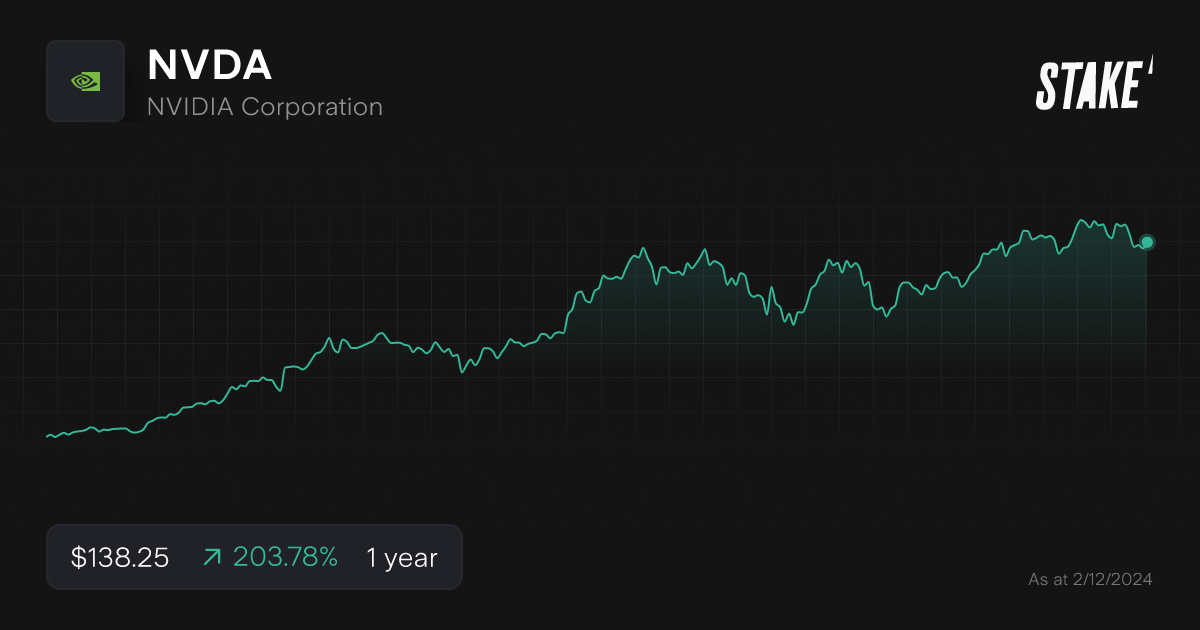

2. NVIDIA Corp ($NVDA)

- Market capitalisation: US$3.39t

- Stock price (as of 29/11/2024): US$138.25

- Stake investors watching $NVDA: 190,241

Nvidia Corporation ($NVDA) is a technology company that produces Graphics Processing Units (GPUs) for retail customers, business use, and AI applications. The company has ventured head-first into the AI sector, which has proved excellent for Nvidia’s stock price.

The company has played a vital role in the AI space. Its GPUs were perfectly fitted to AI applications, which enabled it to gain a foothold in the industry, while its DLSS technology leveraged AI to improve gaming performance. However, Nvidia has also developed AI-specific chips and technology, like the Tesla V100 and Blackwell architecture, which have become the industry standard for complex AI models and data centres.

Nvidia’s role in the AI boom has made it one of the best AI stocks, bolstered the company’s financials, and caused its stock price to surge in recent times. It has risen by 208.50% over one year, 366.89% over three, and 2,551.02% across five years, making NVDA one of the best artificial intelligence stocks in terms of growth. Its financial success has enabled Nvidia to acquire stakes in several AI firms, including TuSimple, Nano-X Imaging, and SoundHound AI.

3. Microsoft Corp ($MSFT)

- Market capitalisation: US$3.15t

- Stock price (as of 29/11/2024): US$423.46

- Stake investors watching $MSFT: 50,722

Microsoft Corporation ($MSFT) is a well-known technology company that created the Windows operating system, which commands a 73.41% market share of desktop operating systems. It’s considered one of the top AI stocks due to its blue-chip status and consistent investment in AI technologies.

The tech-titan launched an AI-powered assistant dubbed Copilot in late 2023. The tool is integrated into Bing and Windows 11. It will also be introduced to GitHub, a developer platform Microsoft acquired in 2018. Copilot can assist with various tasks, including summarising documents and interacting with plug-ins, which expand its use case dramatically.

Microsoft has invested heavily in developing its AI infrastructure and related products. For example, Microsoft invested $13 billion in OpenAI, the company responsible for creating ChatGPT and DALL-E. Moreover, Azure AI leverages ChatGPT models to offer services like text-to-speech, transcribing, image analysis, and facial recognition. Investors have been buying Microsoft shares, causing its share price to rise 16.96% over 12 months and 185.64% over five years.

🤖 Related: How you can invest in the company behind ChatGPT

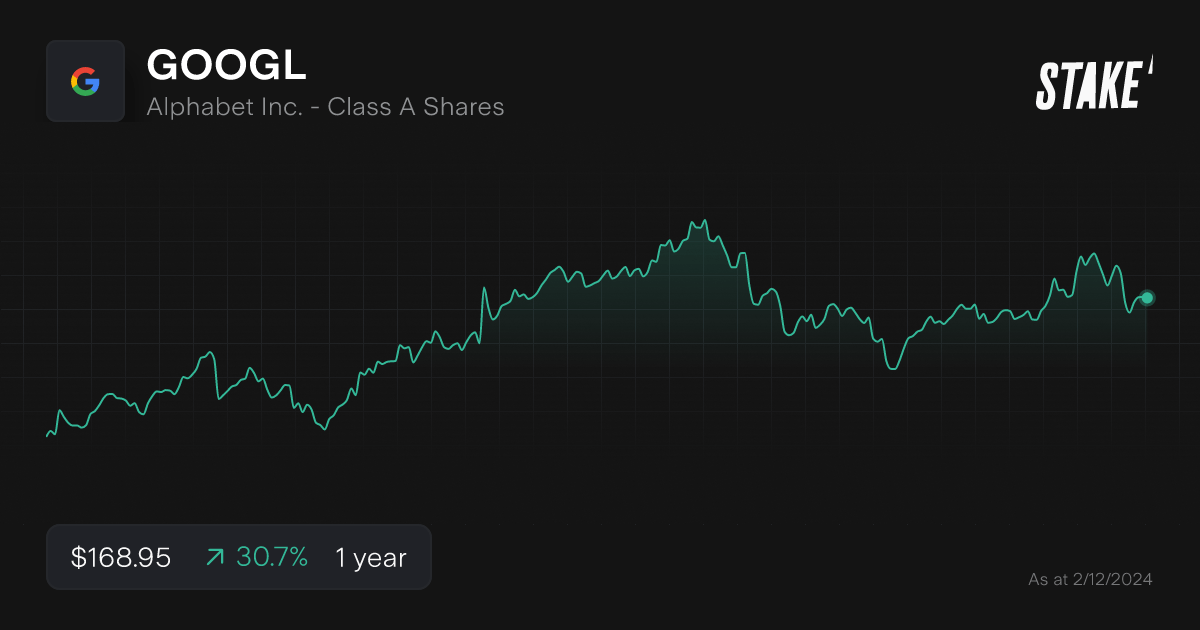

4. Alphabet Inc ($GOOGL)

- Market capitalisation: US$2.08t

- Stock price (as of 29/11/2024): US$168.95

- Stake investors watching $GOOGL: 34,107

Alphabet Inc ($GOOGL) is a technology conglomerate that operates large businesses such like the search engine Google, YouTube and Waymo. It’s considered one of the top AI companies to invest in due to its dominance in web browsing and its ventures into AI-centric cloud computing services, a segment that has grown by 35% year-on-year.

At Alphabet’s third-quarter earnings call, the company’s CEO Sundar Pichai stated that “more than a quarter of all new code at Google is generated by AI” and expressed that the company maintains a “long-term focus and investment in AI.” From these statements, it’s clear that Alphabet is committed to AI and developing its offerings in the sector.

Alphabet leverages AI across many aspects of its business, including analysing/ranking search results, powering its Google Assistant service, and optimising advertising campaigns, making it one of the best artificial intelligence stocks.

5. Meta Platforms Inc ($META)

- Market capitalisation: US$1.45t

- Stock price (as of 29/11/2024): US$574.32

- Stake investors watching $META: 183,254

Meta Platforms Inc ($META) is the technology company that owns Facebook, Instagram, and WhatsApp. The company rebranded to Meta from Facebook in 2022 after acquiring virtual reality company Oculus in 2014 and venturing into the digital world/metaverse.

To introduce AI into its applications and compete with other companies, Meta Platforms has developed the Llama (Large Language Model Meta AI) model and Meta AI assistant. Functioning similar to ChatGPT, Meta AI can answer questions, generate images, and create animations.

On November 4th, Meta Platforms revealed that it will make the Llama model available to US government agencies working on security applications. The company’s focus on AI has led to solid growth. META stock is up 80.75% over the past year, 66.90% over three, and 192.99% over five years.

6. Tesla Inc ($TLSA)

- Market capitalisation: US$1.11t

- Stock price (as of 29/11/2024): US$345.16

- Stake investors watching $TSLA: 232,965

Tesla Inc ($TSLA) is an American automotive and technology company that develops and sells electric vehicles and battery technologies. The company is pioneering Full Self Driving (FSD) capabilities using advanced AI systems. Moreover, it recently unveiled the Tesla Bot, an AI-powered robot designed for repetitive or dangerous tasks.

Tesla has long been considered one of the best AI stocks. Its aim to develop a fleet of autonomous ‘robo taxis’ has excited prominent investors like Cathie Wood about the company’s future. Over the past year, Teslashares have performed relatively well, returning 14.31%. However, it has dropped 38.28% across three years and surged by 1,088.96% across five.

✅ Related: Learn how to buy Tesla shares in Australia

7. Taiwan Semiconductor Manufacturing Co Ltd ($TSM)

- Market capitalisation: US$793.5b

- Stock price (as of 29/11/2024): US$184.66

- Stake investors watching $TSM: 14,860

Taiwan Semiconductor Manufacturing ($TSM) is the world’s largest manufacturer of semiconductors, a key component used in Central Processing Units (CPUs) and GPUs. The company plays an instrumental role in creating AI computing chips, and it has grown in value due to their increasing demand.

Taiwan Semiconductor is considered one of the best artificial intelligence stocks due to its role in the production process. Nvidia outsources much of its chip production to Taiwan Semiconductor, meaning when Nvidia performs well, Taiwan Semiconductor usually follows suit.

The company is focused solely on semiconductor production, and unlike companies like Facebook or Microsoft, it doesn’t invest directly in AI technologies. Instead, it focuses on improving the efficiency of its manufacturing process and chips. This approach has led the company to surge by 115.55% over the past year and 269.47% over five.

8. Advanced Micro Devices Inc ($AMD)

- Market capitalisation: US$222.6b

- Stock price (as of 29/11/2024): US$137.18

- Stake investors watching $AMD: 31,649

Advanced Micro Devices Inc ($AMD) is a semiconductor company and a competitor to AI-powerhouse Nvidia. AMD has had a hard time carving out a defined space for itself in the AI industry. It produces GPUs and CPUs for business and retail customers. Like Nvidia, AMD also produces AI-specific chips and GPU products for use in data centres and other applications.

Although less dominant in the AI sector than its competitor, AMD is working hard to advance the technology.

In 2023, it pledged $135 million to adaptive computing development, which could enhance and optimise AI. Capturing revenue in the AI market is crucial for any semiconductor stocks or computing chip company, and AMD’s efforts are paying off. The company is up 26.20% over a year and 291.87% over five.

🆚 Compare AMD vs NVDA→

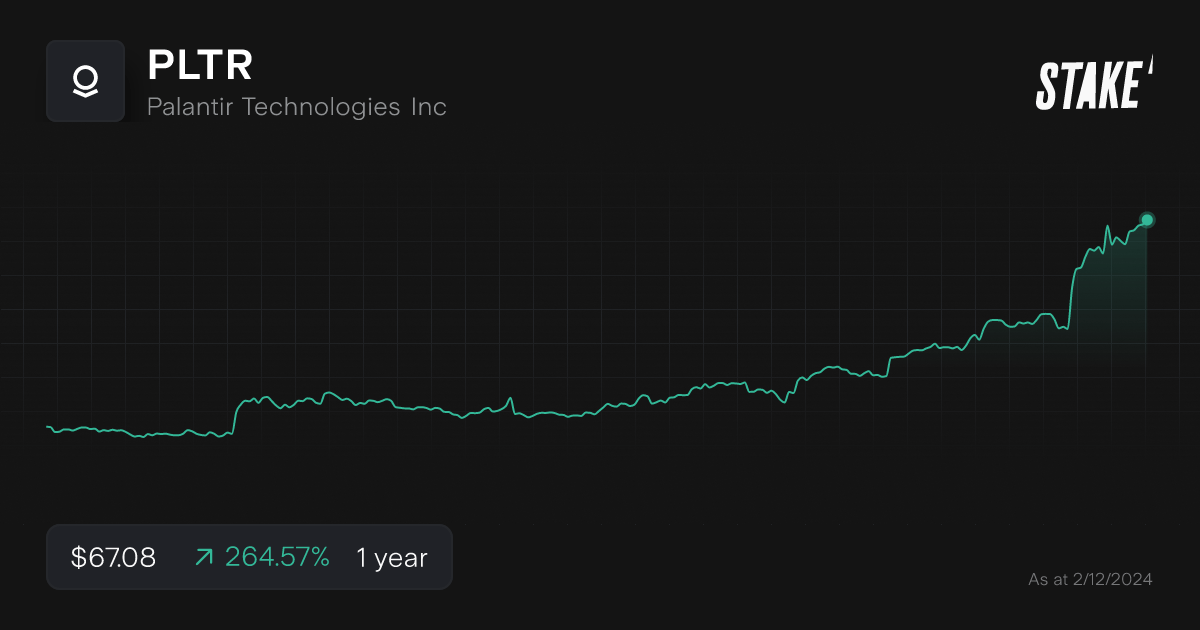

9. Palantir Technologies Inc ($PLTR)

- Market capitalisation: US$152.7b

- Stock price (as of 29/11/2024): US$67.08

- Stake investors watching $PLTR: 168,426

Palantir Technologies ($PLTR) is a US-based software and big data analytics company that operates internationally. One of its offerings is Palantir Gotham, an AI-powered tool for defence and anti-terrorism purposes, with customers including the US and UK militaries. Its efforts have cemented Palantir Technologies amongst the top AI stocks, with it rising by 170.67% in a year and 96.65% across a year three period.

Palantir invested millions to create an advanced enterprise-grade system that enables AI to provide in-context suggestions and analysis for business purposes. The company has partnered with government contractors and organisations to develop AI technology for defence purposes. It also works with the UK’s National Health Service (NHS) to analyse patient data and assist in decision-making.

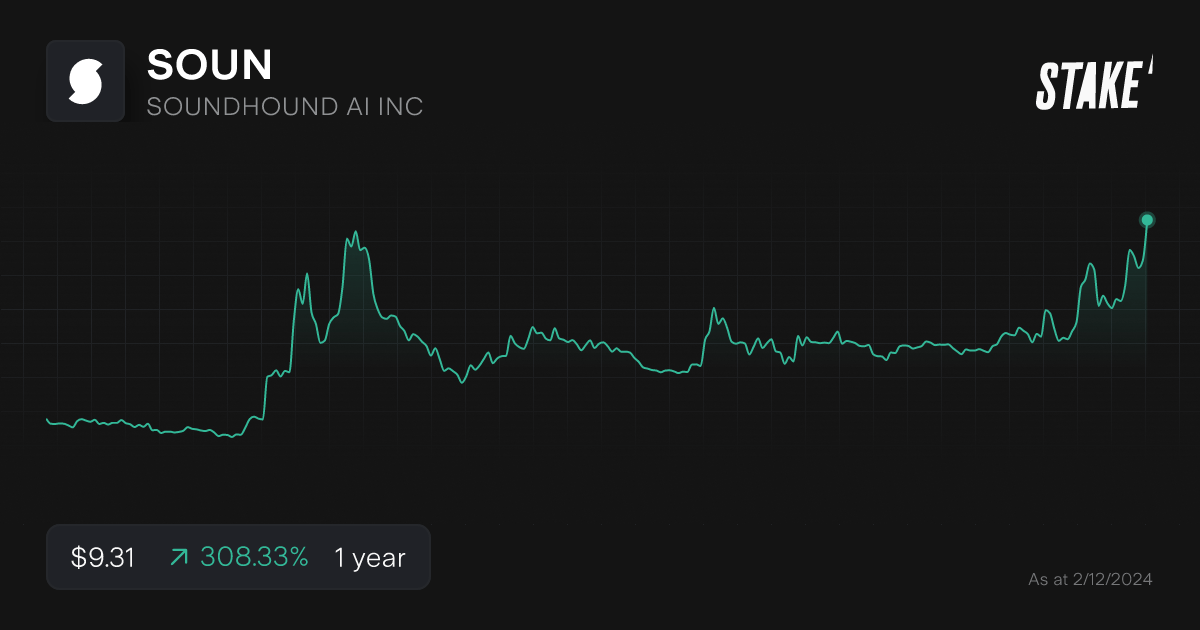

10. SoundHound AI Inc ($SOUN)

- Market capitalisation: US$3.4b

- Stock price (as of 29/11/2024): US$9.31

- Stake investors watching $SOUN: 1,758

SoundHound AI Inc ($SOUN) is one of the best artificial intelligence stocks in the AI voice sector. The company develops solutions that enable companies to implement voice control into their businesses. While Nvidia holds a significant stake in SoundHound AI, the company provides AI voice technology to other big names, including Hyundai, Snap Inc., and Qualcomm.

To expand its AI voice technologies and to reach new enterprise brands, SoundHound AI acquired conversational AI technology company Amelia on August 8th. Since going public in 2022, SOUN stock has surged, rising 191.85% over the last year and 167.30% over three years, making it one of the best AI stocks in terms of recent growth.

How to invest in artificial intelligence companies in Australia?

The main way of investing in AI companies is through shares listed on the Nasdaq and NYSE stock exchanges, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy AI stocks on the U.S. stock market, you'll need to sign up to an investing platform with access to Wall St. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Are there any artificial intelligence stocks under $10?

Although most of the most popular artificial intelligence stocks have a high cost per share, some reaching more than $500, there are options available. SoundHound AI has attracted investment from Nvidia and currently trades at just US$9.31 as of writing this article.

Could the market be in an AI bubble?

Most major companies are rushing to introduce AI features into their product lines, even if they don’t provide much value to customers. While investors typically drive up the price of a company’s stock when new AI implementations are announced, some people ignore the intrinsic value and speculate on stocks based solely on the inclusion of AI, indicating a possible bubble.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.